“Goldilocks”

August Jobs Report Not That Hot Up Close

By Victor

Sperandeo with the Curmudgeon

Introduction:

We examine the BLS August jobs report in light of “the tooth

fairy” and the dichotomy of many jobs added without any IPOs. Is the U.S. economy as strong as pundits

claim?

Next is a stark analysis of what a serious recession would

mean for the U.S. government and employment.

We conclude with an analysis of the G7’s Russian oil price cap, which

could result in shortages and a decline in the U.S. dollar.

We thank readers for their comments last week. Please let us

know what you think of our work (email the Curmudgeon: ajwdct@gmail.com).

“Goldilocks” Jobs Report:

Friday’s BLS

Non-Farm Payroll/Unemployment report for August was initially

greeted with a chorus of “Goldilocks” accolades. That’s because the

report was not too hot (many jobs created) and not too cold (unemployment

rising strongly). Investors evidently forgot that “Goldilocks and the Three

Bears” didn’t really have a happy ending.

Neither did Friday’s equity markets!

The rally after the jobs report fizzled with all major averages closing

lower. For the week, the DJI was down

964.96 points or 3%, while the S&P 500 fell 3.3%, and the NASDAQ Composite

dropped 4.2%.

While the U.S. economy added 315,000 jobs in August, a bit

more than the 300,000 economists forecast, the unemployment rate ticked up and

the number of people in the labor force both increased, while wages grew at a

slower-than-expected pace. The U.S.

economy has now added jobs for 20 consecutive months.

The Morning Brew wrote: “Stocks suffered

their third weekly loss in a row because, despite August’s “Goldilocks” jobs

report, investors still believe the Fed will crank interest rates much higher

at its next meeting.”

Goldilocks job report? Well, that’s a far cry from true!

Friday’s BLS report subtracted -105,000 jobs from June (poof gone!). And the

Birth/Death Model (BDM) added +109,000 jobs for August to make the total jobs

added to 315,000. Do you believe

in the tooth fairy?

Analysis: The total

number of “seasonally adjusted” jobs reported is 2,790,000 this year, but “not

seasonally adjusted” minus the added BDM made up jobs are only 1,120,000, or 140K

per month versus the 349K reported. So, the average number of jobs added per

month is 2.5 times the “not seasonally adjusted number without the BDM made up

jobs added. Perception vs reality is

a great marketing trick!

IPO Hiatus:

If the economy has been doing so well, why has there been a

drought of IPOs? As of Friday, it’s been over 100 days since

Wall Street’s last IPO for over $25 million. This surpasses the previous

longest stretch on record since 2008.

Yet in the last three months 482,000 jobs were “created,” just

from the BDM formula created in the early 1980’s. One would assume many of those new jobs would

be at start-ups that wanted to go public to provide an exit for their private

investors. But that didn’t happen due to

“unfavorable market conditions” which is not characteristic of a strong

economy with many jobs added!

Also on Friday, U.S. bond prices increased, but Corporate

Bonds were flat. That’s likely due to cautiousness over default risk which is

yet another sign that the U.S. economy is not as strong as cheerleaders say it

is!

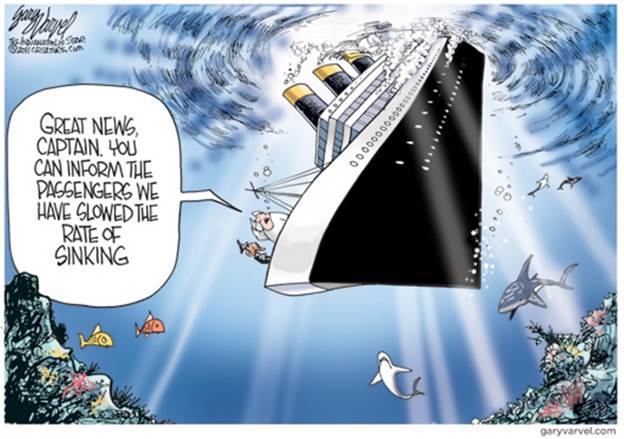

Recession Will Cause U.S. Deficits and Debt to Skyrocket:

“The door is still wide open for the Fed to keep moving, and

we also think this keeps the potential for a 75-basis-point [0.75%] rate

hike at the September meeting still on the table,” writes Rick Rieder,

BlackRock’s chief investment officer of global fixed income.

In his Jackson Hole keynote speech, Fed Chairman Jerome

Powell indicated he does not care about a recession. “Pain will be the price of bringing down

inflation,” he said. Yet the costs of

that pain will be enormous for the U.S. government.

In the last real recession – from December 2007-to- June 2009

– the federal government deficits were $1.870 trillion on tax receipts of 4.627

trillion, or 40% of total U.S. government revenues. For 2022 and 2023, revenue is estimated at a

bit more than $8.0 trillion. So, 40%

today would be $3.3 trillion added to $30.75 trillion stated debt. That makes

for a +10.7% increase in the federal debt!

And that is a conservative estimate!

Therefore, a recession will not only bring about higher

deficits, but significantly higher unemployment. That will result in less tax receipts and

more Fed debt financing by printing/monetizing the increased debt. Of course, such monetary inflation is

perfectly OK to Modern Monetary Theorists [1.], until it causes price

rises like the U.S. (and rest of the world) had just experienced!

Note 1. We’ve previously

explained that the result of all this QE/MMT will be hyperinflation. Please refer to:

End Game for U.S. Debt Spiral: Hyperinflation, MMT.

In this scenario, lower inflation (price increases) from a recession

will cause more monetary inflation which will result in higher prices across

the board. This appears to be the logic

of an Abbott

and Costello “comedy routine.”

What if the Fed Raises Rates to 4+ %?

Because the U.S. is already in recession, additional raising

of the Fed Funds rate to 4 +%, combined with planned QT of $2 trillion

(reducing the Fed’s balance sheet) could result in a 1937 like economy which

was the third worst downturn in the 20th century. From May 1937 to June 1938 real GDP was

minus 10% and unemployment hit 20%.

To use Jeremy Grantham’s view on where the S&P goes -

back to the March 2020 lows or -43% from here!

-->Yet the Fed does not seem to be concerned at all about

any of this?

I look for an economic collapse throughout the world if the

Fed raises rates as planned and executes QT. Good luck!

Russian Oil Cap/Discounts and the U.S. Dollar:

On Friday, the G-7 nations voted to cap the price of Russian Oil

in an attempt to reduce Moscow's ability to fund its war in Ukraine without

further stoking global inflation. Finance ministers from the G7 group of

countries — the United States, Japan, Canada, Germany, France, Italy, and the

United Kingdom — said they would ban the provision of "services which

enable maritime transportation of Russian-origin crude oil and petroleum

products globally" above the price cap. That could block insurance cover

or finance for oil shipments.

The maximum price for Russian oil would be set by "a

broad coalition" of countries, the G7 said in a joint statement.

What is a price cap? Price controls which create

shortages. Shortages invariably drive up

the price of the commodity in scarce supply!

Putin (who is said to be a master chess player) is said to

give buyers a 30% discount for Russian oil.

On August 24th, Bloomberg wrote:

“Russia has approached several Asian countries to discuss

possible long-term oil contracts at steep discounts, according to a Western

official. The tentative conversations to

offer some Asian buyers discounts of up to 30%.”

Indonesia’s minister of tourism, Sandiaga Uno, said in

remarks he posted on Instagram over the weekend that Russia has offered to sell

it oil “at a price that’s 30% lower than international market price.”

Source: Bloomberg Vessel Tracking

Also, there are rumors that Putin will permit Russian oil to

be purchased with gold! If true, that implies the U.S. dollar will be

substantially weakened as nations can buy gold and exchange it for oil at

-30% discount. The U.S. dollar -the

world’s reserve currency- would not have to be used to buy Russian oil which

could be paid for with rubles or gold.

Russia’s central bank recently fixed the price of

5,000 rubles to a gram of gold. Few Western investors or executives

noticed. Jack Bouroudjian, former

president of Commerce Bank in Chicago and now chairman of the Global Smart

Commodity Group explained, “It forces people to go to the Russian central

bank and pay gold to get rubles to make the transactions (for oil and other

Russian exports).”

While we need more information and confirmation of the

details, this looks like a master chess move by Putin to counter The G7 oil

price cap.

This chess game of geopolitics is between Ursula Von der Leyen,

a German physician who is President of the European Commission vs. Vladimir

Putin. Whom do you think will win?

Victor’s Market Comments:

Considering the above scenario, oil and gold look like

a buy and the U.S. dollar a sale!

When (and if) the Fed lowers its balance sheet via QT it

should help U.S. bonds but hurt stocks.

However, the U.S. Treasury will continue to raise the money

needed to finance U.S. government spending which will increase the money

supply. So, a great deal of what we’ll

see is psychological, as the money supply will stay the same.

Curmudgeon’s Market Comments:

This year has been a brutal one for both investors and

intermediate term traders. The average

U.S.-stock mutual fund or exchange-traded fund is down 17.3% for 2022,

through the end of August, according to Refinitiv Lipper data (down more

than that through September 2nd). That includes a 3.5% average decline in

August, reflecting the stock market’s negative reaction to Fed Chairman Jerome

Powell’s Jackson Hole speech noting that the U.S. central bank will keep

raising interest rates to fight inflation, despite risk of a serious recession.

Playing the short side as a market

timing opportunistic play or as a hedging strategy has been extremely difficult

this year. That’s partially due to two sharp and swift bear market rallies of

17% to 20%. Most recently, from June 16th

when the S&P 500 hit a low of 3,639.77 through August 16th when

that index reached 4,325.28 and touched its 200-day moving average. A

disciplined investor or intermediate trader would cover their short positions

on such rallies, resulting in a loss.

What makes it even worse is that inverse stock index ETFs

only match their index for one day.

There is considerable market price-to-net asset value (NAV) drift over

longer time periods. Compounding risk

is one of several negatives of inverse ETFs.

Since an inverse ETF has a single-day investment objective of providing

investment results that are one times the inverse of its underlying index, the

fund's performance likely differs from its investment objective for periods

greater than one day where compounding is present. Investors who wish to hold inverse ETFs for

periods exceeding one day must actively manage and rebalance their positions to

mitigate compounding risk.

Also, the fund’s management fees, and expenses (typically

low) are deducted from the ETF’s market price.

Active ETFs that short individual stocks are even a worse choice for bearish investors and

speculators. The two popular one’s-- HDGE and DWSH-- do

not use leverage, but they have huge expense ratios of 5.2% and 3.68%,

respectively. They trade at a premium to

NAV when the market is falling and at a discount when it’s rising. Their bid/ask spreads are on the order of 2%

to 4%, depending on market conditions and daily volume trends.

Shorting individual stocks is by far the riskiest bearish

strategy as there are often unexpected shocks or short squeezes which catapults

the stock price higher, so you have to cover your short position at the worst

possible price!

And as we’ve noted in many Curmudgeon posts this year, a

balanced portfolio hasn’t worked at all with stocks, bonds, gold, REITs,

foreign currencies, Bitcoin/crypto’s all falling in lockstep.

That is why the only “safe bet” is to hold a lot of cash,

ideally in U.S. Treasury bills and notes which pay higher interest rates than

CD’s or money market funds. The

Curmudgeon has been buying 2-year T-notes and 1 year T-bills for himself and

the accounts he manages.

End Quote:

It seems Fed Chairman Powell is saying something like this:

”Numbing the pain for awhile will make it worse when you

finally feel it.” ― J.K. Rowling, Harry Potter

……………………………………………………………………………………………….

Be well, stay healthy, try to find diversions to uplift your

spirits. Wishing you peace of mind, and till next time………

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2022 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).