Stocks

Surge on Hopes for Stronger Economy, Weaker Inflation

By Victor

Sperandeo with the Curmudgeon

Introduction:

We assess the markets, economy, and inflation in this

post with selected quotes from BofA Global Research, Sentiment Trader, and

Jeremy Grantham.

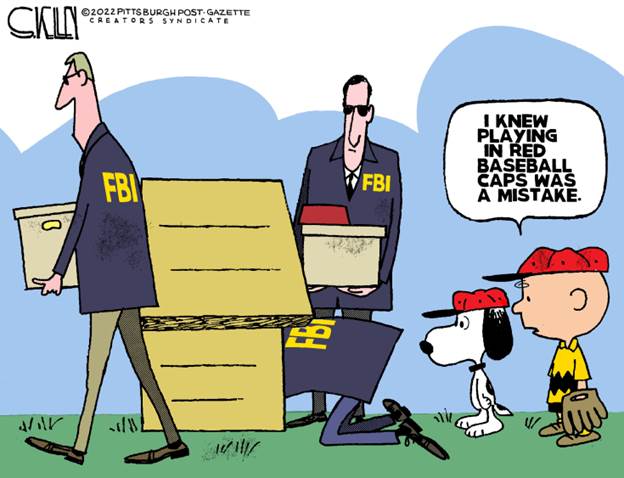

Victor opines on the negative implications of the

DoJ/FBI raid on x-President Trump’s home.

The Curmudgeon agrees that the resulting political tension and divisiveness

will be very bad for the U.S. in every conceivable way.

Market Comments:

The U.S. stock market has rallied four weeks in a row

and is now overbought. Here’s a quick

recap:

- The

rally off the June lows has been the S&P 500’s longest such run since

November 2021. The index has now

recouped more than 50% of its losses this year.

- The

NASDAQ 100 pushed further beyond its “technical bull-market” threshold,

following a surge of over 20% from its 2022 lows. The QQQ ETF up nearly 23% since the June

16 lows.

- The

Russell 2000 index of small caps broke out above its 200-day average as

the S&P nears that threshold.

Based on historical precedents, we are now due for a

pause and profit taking. The volume last week was low to moderate, which

implies that we’re experiencing a bear market rally (volume has not confirmed

price action), rather than a new bull market.

However, this remains an open question for now. We assume it’s a bear market secondary

correction, i.e., a counter trend rally, primarily due to short covering.

One of the reason stocks did well, while bonds were

sold (bond prices fall as yields rise), was due to the (bogus) BLS non- farm

payroll employment report. [We explained

that in last week’s column.]

The markets have assumed that the U.S. economy is not

in recession. Time will tell if that’s

true.

Curmudgeon Follow-on Comments:

The U.S. stock market is still overvalued. The P/E ratio of the NASDAQ 100 has soared

back to levels that put the index back into expensive territory on a historical

basis. That ratio is now 24.9 times 2022 earnings estimates, which is one

standard deviation above its historical average since the middle of 2009

and the average of 20.2. Also, many like

BofA Global Research, believe that 2022 earnings estimates are way too

high.

Jason Goepfert of Sentiment Trader

wrote:

·

Some models have cycled back

into optimistic, or greedy, territory.

·

Small options traders are

betting on a rally again.

·

The Fear & Greed model

has cycled from maximum fear to extreme Greed!

·

Dumb Money Confidence is

extremely optimistic and Smart Money Confidence is neutral. This suggests an

excess return of

-1.1% over the next 2 months.

Meanwhile, the earnings yield for the NASDAQ 100 has

risen to around 4%, which means that the spread between real yields and the

NASDAQ 100 earnings yield has narrowed to just 3.65%. That spread between the

NASDAQ 100 and real yields has narrowed to its lowest point since the fall of

2018.

Also, the Fed’s Quantitative Tightening (QT)

will be increased in September which will tighten financial conditions as the

money supply will decline due to the runoff.

Finally, Long term bear Jeremy Grantham,

co-founder and investment chief at asset management firm Grantham, Mayo, &

van Otterloo, says “In terms of the entire bear market, it would be unusual for

it to bottom out anywhere near this high. I would expect that by the low, the S&P

would have declined by 50% from the peak in real terms."

U.S. Economy and Inflation:

The Atlanta Fed GDPNow “running estimate” for

the 3rd Quarter 2022 increased to 2.5% – up from 1.4%. That’s probably due to last week’s misleading

BLS jobs report.

It will be interesting to see how the BLS will

reconcile the 1 million extra “seasonally adjusted” jobs (or the made-up number

to smooth the real data) from the real jobs numbers (which are not

seasonally adjusted) by the end of this year.

At that time, the two numbers must balance. What finagling will the BLS

do to make that happen?

The basic economic news is what investors and traders

should focus on leading up to the Fed’s annual Jackson Hole pow-wow

(boondoggle?) in late August. Till then the Fed will likely be talking the

markets down with threats of raising rates. Again, the reason for that talk

the talk is to lower inflation via a “reverse wealth effect.”

My view is that the economy will be very weak, while

the CPI continues to decline. This is critical to the Fed’s actions before the

election.

BofA Global Research Expects Lower Inflation:

BofA’s

Global Proprietary Signals, a compendium of proprietary indicators that range

across different economies, strategies, and markets, make a strong case for lower

global inflation. This report, which monitors 37 proprietary growth

indicators, ranging from US trucking to Japan factory automation, came out the

same week US inflation dipped.

The

leading indicators we observe provide support for moderation with easing supply

pressures, weakening demand, collapsing money supply, declining prices, and

falling expectations. Supply side pressures show evidence of easing with the

Global Supply Chain Pressure Index declining and the Global Manufacturing PMI

Suppliers' Delivery Times improving. Key components of headline inflation,

including food and energy are also at an inflection point. Both Wall Street and

Main Street now expect inflation to moderate, with BofA expecting CPI to

slow to 5.4% in 1Q23. Fed Funds

futures imply Fed rate hikes will end this year and with a steady downtrend

in growth indicators, we remain defensive.

Implications of the DoJ/FBI Search of Trump’s Home:

The raid by the DoJ/FBI on Donald Trump’s Mar-a-Lago

home in Florida (looking for some classified and secret documents) has created

a tipping point problem between the people and a U.S. political system in which

the state has substantial centralized control over social and economic affairs.

Former President Trump is under federal investigation

for possible violations of obstruction of justice and the Espionage Act, which

makes it unlawful to spy for another country or mishandle U.S. defense

information, including sharing it with people not authorized to receive it, a

search warrant shows. In a statement on

his social media platform, Trump said the records were "all

declassified" and placed in "secure storage.”

Source: The Week

Like the tort of abuse of process, its elements

include intentionally instituting and pursuing a legal action that is brought

without probable cause and dismissed in favor of the victim of the malicious

prosecution. In some jurisdictions, the term "malicious prosecution"

denotes the wrongful initiation of criminal proceedings, while the term

"malicious use of process" denotes the wrongful initiation of civil

proceedings.

This raid can lead to some big problems. A raid on an

x-President’s home has never been done before in U.S. history.

A person close to Mr. Trump reached out to a Justice

Department official to pass along a message from the former president to the

U.S. attorney general. Mr. Trump wanted

Mr. Garland to know that he had been checking in with people around the country

and found them to be enraged by the search.

His message was, “The country is on fire. What can I do to reduce the

heat?”

The Curmudgeon (no fan of Trump) equates this

incident to the DoJ/FBI being oblivious to the contentious, violent climate in

the U.S. today.

Indeed, the resulting political tension and

divisiveness will only make things worse for the U.S., which is already in

a steep decline. The country will

continue to deteriorate, and that will adversely affect the economy and

financial markets.

Victor’s Opinions:

This incident smacks of incipient fascism, teetering

on the edge of totalitarianism. That is what we are experiencing now. Was it

really a raid on Donald Trump? No, it

was a raid on you, me, and everybody who likes freedom. It was a message like

this: "We can get you, and we will get you if you dare stand up to the

garbage establishment of incompetent, corrupt losers who failed at literally

everything they've done."

End Quotes:

With respect to the creeping fascism in the U.S.,

here is a famous poem by a Lutheran pastor in Germany

during the Nazi’s rise to power:

“First they came for the socialists, and I did not

speak out—because I was not a socialist.

Then they came for the trade unionists, and I did not speak out—because

I was not a trade unionist. Then they came for the Jews, and I did not speak

out—because I was not a Jew. Then they came for me—and there was no one left to

speak for me.”

—Martin Niemöller

Here’s a quote on the abuse of judicial power

by Patrick Henry:

“Power is the great evil with which we are

contending. We have divided power between three branches of government and

erected checks and balances to prevent abuse of power. However, WHERE is the

check on the power of the judiciary? If we fail to check the power of the

judiciary, I predict that we will eventually live under judicial tyranny.” --→

Henry called the future like he was Nostradamus.

Thomas Kidd wrote about

why Patrick Henry did not sign the Constitution:

“Patrick Henry thought that a national government

invested with the unlimited power to tax and spend would inexorably transform

into a monstrosity, one that the Founders—even Madison—never intended. Most

Americans believe that the Constitution, at least as originally designed,

fostered a wise system of checks and balances that divided power between the

states and national government (he was thinking here of the Articles of

Confederation). But when you consider the titanic government we have today, and

the struggles to contain our mind-boggling rates of federal debt and spending,

Henry’s warnings about what the government under the (new created US

Constitution mainly influenced by Hamilton) could eventually become seem more

and more reasonable.”

In terms of history and the markets, Patrick Henry

said it perfectly in his predictions as an avid student of history:

“I have but one lamp by which my feet are guided, and

that is the lamp of experience. I know no way of judging of the future but by

the past.” ...Patrick Henry

…………………………………………………………………………………………………

Be well, stay healthy, try to find diversions to

uplift your spirits. Wishing you peace of mind, and till next time………

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2022 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).