Worst Year for Bond Market Since 1842 and the Fed Still Isn’t

Finished

By Victor

Sperandeo with the Curmudgeon

Introduction:

The markets have become very volatile lately, which I

attribute to Fed monetary policies to “fight inflation.” We examine the unprecedented flip from bullish

to bearish this past week, followed by my belief that the Fed wants the markets

down to create a “reverse wealth effect,” which would likely cause a recession.

It’s also important to note that bonds, especially U.S.

Treasuries, have not been the stock market hedge that many new investors

believed they would be. In fact, this

has been the worst year in the bond market since 1842 as we explain later in

this article. Hope you find it

informative and provocative. Please let

us know what you think.

Confounding Market

Action after Fed Chair Speaks:

On Wednesday afternoon, Fed Chair Jerome Powell’s comments

caused a major stock market rally (which turned out to be a “one day wonder”). U.S. stock market indexes increased 2.75% to

3.4%, with the S&P 500 up ~3% on the day.

The huge rally, which occurred in the last hour of trading, started

immediately after Powell said, “A

75-basis-point increase is not something the committee is actively considering.”

Powell added, “Further 0.5% (50 bps) moves should be on the

table at the next couple of FOMC meetings.” He then clarified that the Fed was not

considering any larger rate hikes at this time.

Powell also outlined the Fed’s Quantitative Tightening

(QT) [1.] plan to reduce its

~$9T balance sheet. ……………………………………………………………………………………………………………

Note 1. We explained Quantitative

Tightening, Reverse Repos and Real Tightening in an article

titled, “Is Fed Chair Powell a Phony or

a Fool?

…………………………………………………………………………………………………………….

The Fed said it will reduce the size of its balance sheet by

$47.5 billion a month for three months starting in June. The run-off will increase to $95 billion a

month starting in September, split between $60 billion of U.S. Treasuries and

$35 billion of MBS (Mortgage-Backed Securities), according to a statement

Wednesday from the Federal Open Market Committee (FOMC).

The markets were assuming a reduction of $95 billion a month

starting in May. Therefore, this delay

initiating QT is yet another Fed stall tactic in its so called “fight” against

inflation. Astonishingly, the equity market

saw that announcement as bullish on Wednesday as it rallied strongly into the

close of trading.

In a stunning reversal on Thursday, which we’ve never seen before (combined Sperandeo/Curmudgeon market experience

of 56 and 54 years, respectively), the equity markets opened lower and sold off

all day. Popular stock indexes saw declines of -3.12% (DJI) to -5.36% (NDX

100). The NYSE Advance/Decline ratio

flipped from 3/1 on Wednesday to 1/10 on Thursday!

Thursday was the worst day in markets since May of 2020,

wiping out $5,800,000,000,000 of the S&P 500's market cap. That’s almost SIX

TRILLION DOLLARS!

Bonds were also sold aggressively, with the 30-year Treasury

Bond yield increasing from 3.01% on Wednesday to 3.15% on Thursday, then jumping

to 3.23% on Friday (bond prices decline as yields rise). The 10-year Treasury

Note yield closed at 3.12% on Friday.

Unlike Wednesday’s late stock market rally, no one had a

credible explanation of why the markets reversed on Thursday. There was no

clear-cut news to form a consensus opinion.

Apparently, the Fed wants the markets down.

Speaking virtually on May 6th at the Strategic

Investment Conference, hosted by John Mauldin, analyst Jim Bianco said The Fed will

continue to raise rates until inflation “really moderates.” That means it needs

to get back to the Fed’s target of 2% inflation. If the Fed stops raising rates

short of reaching its target inflation, Bianco said it risks losing its

credibility “for a generation.”

Bond price declines this year are the worst since 1842 (more

below) and if the Fed continues tightening it will crush stock prices and home

values too, according to Bianco.

Worst Year for Bond Market Since 1842:

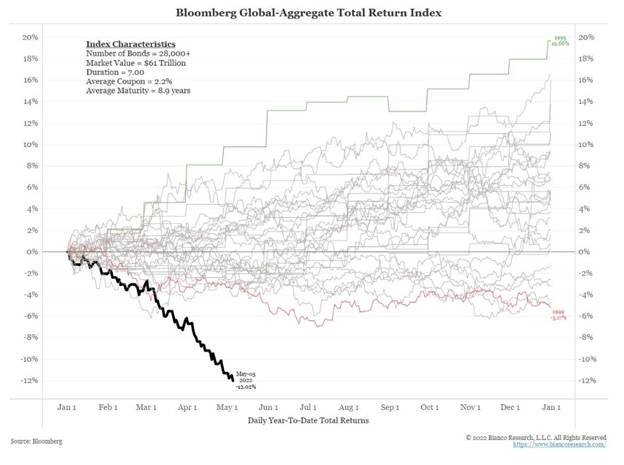

For the past 30 years prior to 2022, the worst year for the

bond market was 1999, when the AGG had a total return of -5%. Its best year was

1995, when it rose 19%.

Almost never has the U.S. bond market lost as much money as

in the first four months of 2022, according to Edward McQuarrie, an emeritus professor of business at Santa Clara

University who studies asset returns over the centuries.

Long-term Treasury bonds lost more than 18% this year through

April 30. That surpasses the previous record, a loss of 17% in the 12 months

ending in March 1980, says Mr. McQuarrie. The broad bond market has performed

worse so far in 2022, he says, than in any complete year since 1792 except one.

That was all the way back in 1842, when a deep depression approached

rock-bottom.

April was the worst month ever for the bond market. “We have

seen nothing like this,” Bianco said. “The bond market has never been this bad

in terms of total return.” Bianco likened the bond markets YTD decline to the

S&P 500 being down 50% to 60%.

There is “tremendous stress” in the bond market, he said.

“There is going to be a problem,” but the bond market is too complex to say

where it will eventually be. This stress is because of a Fed error last year,

when it chose to use the word “transitory,” instead of dealing with inflation

when it was only 3%. The Fed could have raised rates in the second half of 2021. Here’s an eye-opening chart contrasting bond

market total returns over the past 30+ years:

The total return of the aggregate bond index (AGG)

year-to-date is shown in the dark black

line trending straight down. The other lines show the total returns for the

AGG for each of the prior 30 years.

“The only way to get the inflation rate down that much is to

keep markets under stress,” Bianco said. “The Fed will raise rates until

inflation comes down or something breaks.”

Victor’s Assessment:

My belief is the Fed’s new method of “fighting” inflation is

to cause a “reverse wealth effect,”

which will scare people into spending less (consumer spending accounts for ~70%

of U.S. GDP).

In particular, I

believe the Fed’s raising rates is a cover-up. The Fed is so far beyond the curve of

inflation versus interest rates it can’t catch up. Some economists like John Williams of ShadowsStats

say prices are increasing at 15% rather than the 8.5% CPI!

Assuming an inflation rate of 8.5%, increasing the Fed Fund’s

rate to 3.5% via multi-month 0.5% rate hikes will mean nothing. To stop

inflation the U.S. government must drastically decrease spending, while the Fed

must slow Money supply (M2) growth to 4%.

However, that would most likely crash the markets and thereby cause a

recession.

……………………………………………………………………………………………..

Comment and Analysis:

A fact that few understand is that raising short term

interest rates has nothing to do with too much borrowing. Commercial and

Industrial loans peaked at $2.929 trillion in June 2020 and have declined in a

straight line to $2.520 trillion.

Therefore, one has to ask why is the

Fed raising rates? Yes, it will slow down borrowing more, but that is not what

is causing inflation. Inflation is caused by government spending beyond what is

taxed with the resulting deficit being monetized by the Fed and banks (you may

call that money printing, keystroke entries or creating money out of thin air).

Our thesis is that Fed inflation “fight” is causing financial

markets to tank which makes people feel poorer.

Indeed, the prospect of losing money as rates rise seems to be freaking

many people out. After pouring $592 billion into bond funds last year,

investors have redeemed a net $104 billion so far in 2022, according to the Investment Company

Institute. Even if they don’t own

financial assets, people are terrified by headlines of major stock and bond market

declines. That fear results in decreased

spending or “demand destruction.” This is clearly the Fed’s nefarious plan,

but will the pain be worth the gain?

Add to this reason for rising prices: Supply Shortages caused by Covid-19 induced

shutdowns and Russia’s war in Ukraine. The Fed can’t stop these shortages by

raising rates.

Powell says that the economy and employment are strong so

raising rates will not hurt the economy too much. Really? First quarter GDP was down - 1.4% - is that

strong?

Friday’s BLS non-farms payroll report for April stated the U.S.

created 428,000 new jobs. However, that

should be put into perspective as +340,000 jobs came from the Birth Death Model

Forecasts (which are made up, assumed, estimates, but not actually counted jobs). We explained the Birth Death Model hoax in

this post.

Real counted jobs (seasonally adjusted) were 428,000 -340,000

or 88,000. The previous month the estimated Birth Death Model showed only

23,000 added. That is only 6.8% of this month’s

estimates! Why such a huge difference?

àThe BLS should explain this discrepancy, but they

never will.

Sidebar - FOMC Member

Composition:

It may be of interest that of the current 17 members of the

FOMC (12 Federal Reserve bank presidents and five appointed by a President and

confirmed by the Senate), only two have worked in the private sector? What

these FOMC members determine via monetary policy effects 340 million Americans,

yet the overwhelming majority never worked in the real world (private finance, banking,

or industry).

This fact should make

you all understand why the current Fed has been so inept, if not dysfunctional.

…………………………………………………………………………………………………

Conclusions – The Free

Money Party is FINALLY OVER:

From Hedgeye: “After

pumping up markets with monetary meth at record speed, high noon has come for

the unelected, ivory tower-perched, elites who control our financial freedom.

Saddled with record high inflation, the blind Federal Reserve has decided to

ignore the economic signals of an impending recession and send markets crashing directly into the ground.”

From Victor: The real threat to the U.S. economy

comes from the private sector corporate bond market. The BBB’s yield of 4.60%

has doubled since October of the last quarter of 2021. If it goes to 6%+ that

is big trouble for corporate refinancing.

Meanwhile, the CCC (junk) bond market is currently yielding 11.79% -- up

from 6.6% last year and likely headed to 14% to 15%. This is where the Fed will

have to reconsider the strategy of “Killing Bonds “by threatening to raise

rates to the extent Powell says they will.

Closing Quote:

In the James Bond film “Goldfinger,”

with Bond on a gold table with a high-powered laser gun cutting through it and

headed for his groin… Bond says, “OK, Goldfinger do you expect me to talk?” Auric

Goldfinger responds: “No Mr. Bond, I expect you to die!”

Now substitute the FOMC for Goldfinger; the bond and stock

markets for Bond (who is about to die) and you get the picture of what’s going

on right now with financial markets as the Fed begins to seriously “fight

inflation.” And that’s after this year’s

extremely volatile stock market with the worst bond market performance since 1842!

Stay healthy, enjoy

life, success, good luck, and best wishes.

Till next time....

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2022 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).