Inflation,

Markets, Fed Policy, Elections and War in Ukraine

By Victor

Sperandeo with the Curmudgeon

Introduction:

Just the facts Maam is the theme of this

article. That quote is from the popular Dragnet TV series, which aired from

1951-to-1959.

CPI History:

The BLS definition and components of the Consumer

Price Index (CPI) have been changed many times over the years to make it

more politically friendly. Using just

the facts from 1913 to date we find:

- From 1791 (U.S.

on the Gold standard) to 1913, prices rose 0.12% per year.

- From 1913 to 2022

(or 109 years and 2 months), the CPI compounded at 3.11%. GOLD compounded at 4.25% during that

same period.

- From August 1971

(after Nixon took the U.S. off the Gold standard) to 2022, the CPI

compounded at 3.91%.

- The current

year-over- year CPI (ending in February 2022) was + 7.9%.

Market Drivers:

Today, price rises created from inflation (the

increase in the M2 money supply) and shortages from supply chain disruptions

are driving the markets. The uncertainty

from the Russia-Ukraine war is a close second.

Based on these fundamentals and technical analysis, I

reiterate that U.S. stocks are in a Bear Market (re-confirmed with the

Dow Transports making a new low for the year on Friday, April 8th). The

secondary correction (bear market rally) from 3/8/22-to-3/29/22 is over, from

my observation.

Recession and Effect on U.S. and French Elections:

I believe the U.S. and the European Union (EU) are going into

a recession this year. Sharply rising

interest rates (see Consequences of Fed Policy below for details) are

cascading throughout the economy in the form of higher borrowing costs,

squeezing households and businesses alike. Car loans, credit cards and

corporate debt all stand to get more expensive as rates rise.

That implies that the U.S. mid-term elections in November

will be a big winner for the Republicans.

In a previous post, I wrote that the last time

there were six Fed rate increases in one year was 1994. The Dems lost 54 House

seats, 8 Senate seats, and 10 Governors.

Curmudgeon Note:

On Tuesday, Matthew Luzzetti, Deutsche

Bank's chief US economist wrote, "We no longer see the Fed achieving a

soft landing (i.e., the Fed raising rates just enough to control inflation

without causing a recession). Instead,

we anticipate that a more aggressive tightening of monetary policy will push

the U.S. economy into a recession."

Deutsche Bank is the first major Wall Street firm calling for

a recession and bear market in stocks. Luzzetti thinks this view will eventually become consensus.

--> For another perspective, please see BoAs hawkish Fed

forecast below.

...

In addition, the critical French elections second round

will be held on 4/24/22. It will be a

potential game changer for the EU and rest of the world.

Marine Le Pen (viewed as

a Donald Trump-like politician) has suddenly become a serious challenger to Emmanuel

Macron, the current President of France. Mr. Macron won the first-round election on

Sunday with 28.5% of the vote ahead of Ms. Le Pen with 24.2%, according to

polling firm Elabe. The French president now faces an

April 24th showdown with Ms. Le Pen that polls say will be much more tightly

contested than ever before.

Consequences of (future) Fed Monetary Policy:

Bonds are down more than stocks this year. Currently, the iShares TLT (20+ year

U.S. Bond) ETF is down -14.28%, while the iShares AGG (U.S. Aggregate

Bond) ETF is down -7.32% year to date.

For comparison, the SPDR S&P 500 SPY ETF is down -5.23% year

to date (Source: Yahoo Finance).

At the beginning of 2022, the average interest rate on a 30-year

mortgage was about 3%. Today it

stands at 4.72%, according to Freddie Mac. That translates into sharply higher

borrowing costs for Americans looking to buy a home. The 30-year mortgage rate is tethered to the

yield on the 10-year Treasury note, which has increased to 2.715% in

anticipation of future Fed Funds rate increases.

Meanwhile, the 2-year T note yield has climbed to

2.516% as per this one-year chart:

The 10- and 30-year Treasury bond yields are 2.715% and

2.746%, respectively. Combined with the 2-year yield, we have a very flat

yield curve. (Source: Market Watch.com)

Summing up, bonds of all types continue to decline as the

FOMC members bash the debt market with threats of much higher interest rates to

come and talk of Quantitative Tightening (QT) to reduce the Feds

balance sheet.

BofA Global Research on Fed Rate Hikes:

BofAs U.S.

Economics team has raised its expectations

for Fed rate hikes. They are now looking for 50bps hikes in each of the next

three meetings, with 25bps thereafter and a terminal Fed Funds rate

of 3.25-3.50%. Thats 25bps higher than

its prior forecast.

BofA believes that risks to their Fed forecast are tilted to

the upside. If inflation looks like it is heading below 3%, then their current

call should be hawkish enough. Conversely, if inflation gets stuck above 3%

then the Fed will need to raise rates until growth drops close to zero, risking

a recession.

The bank expects inflation to peak with the March CPI and the

rates team suggests this peak likely means a risk of lower nominal yields as

inflation moderates. BofA is comfortable with its forecast of a 2.5% 10-Year T

note yield by year-end 2022.

Geopolitical Strains and the Russia Ukraine War:

Energy and food shortages are beginning to cause riots in

some nations. For example, in Peru over

food prices and in debt laden Sri Lanka over power blackouts.

More importantly, the Russia-Ukraine war is escalating. Asset manager BlackRock maintains the

likelihood of a Russia-NATO conflict is at a high level, even as the

U.S. and its allies are working hard to prevent it.

The global BlackRock Geopolitical Risk Indicator

(shown below) attempts to capture the market attention to geopolitical risks.

Their overall geopolitical risk indicator has spiked to its highest level in

more than a year. This is driven by elevated market attention to

conflict-related risks generally, and Russia-NATO conflict specifically.

Source: BlackRock

..

..

..

..

..

..

..

..

....

..

..

..

..

..

Up till now, theres been no serious talk of peace from any

of the Western Nations, e.g., the U.S., UK, or the EU. However, that may be changing based on UK

Prime Minister Boris Johnsons surprise visit to Ukraine on Saturday, April

9th. Calling Russias war on Ukraine

inexcusable, Johnson pledged to intensify sanctions on Moscow, not just

freezing assets in banks and sanctioning oligarchs but moving away from the use

of Russian hydrocarbons. He also promised Britains help with clearing mines

left behind by Russian forces and said Britain would liberalize trade with

Ukraine.

What this war is certainly producing is a clarity about a

vision for the future of Ukraine, where together with friends and partners, we,

the U.K., and others, supply the equipment, the technology, the know-how, the

intelligence, so that Ukraine will never be invaded again so that Ukraine is

so fortified and so protected that Ukraine can never be bullied again, never be

blackmailed again, never be threatened in the same way again, Johnson said at

the news conference alongside Ukraine President Volodymyr Zelensky.

Last week, U.S. Chairman of the Joint Chiefs of Staff Mark A Milley warned of a prolonged

conflict in Ukraine that could take years to end. I think NATO, the United

States, Ukraine and all the allies and allies that support Ukraine are going to

be involved for some time, Milley, the top U.S. military official, told the

House Armed Services Committee.

No Nuclear Weapons!

Also, talk of nuclear weapons being used by Russia is

insanity to the 10th power. One nuclear bomb would take civilization back 75+

years. Anyone who mentions using Nukes

is a complete nihilist and should be arrested for crimes against humanity

(Curmudgeon: as is the case with Russias

persistent bombing and killing civilians in Ukraine).

Who will win a conventional (non-nuclear) war in

Ukraine? One classic slogan is:

God is on the side of the big battalions. George Bernard Shaw,

However, no winners would exist if nuclear weapons were to be

used.

Conclusions:

The first quarter of 2022 was one of the most volatile and

difficult quarters in my 56-year career as a financial professional (starting

in January 1966). The reason is the multitude of different factors affecting

all the markets at the same time.

The coronavirus surges, high inflation, a multi -faceted war,

a likely recession due to dramatic Fed Policy changes, a flat or inverted yield

curve, a major debt market decline, all punctuated by weak political leaders

more interested in power than the people they were elected to serve. Its been very challenging to live through

all of this!

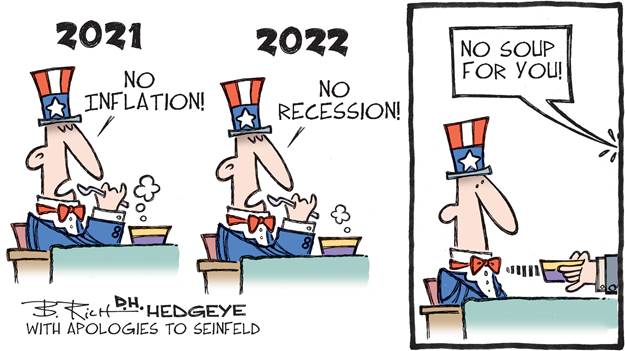

Cartoon of the Week:

End Quote:

Perhaps these words are worth thinking about now:

He who has a why to live for can bear almost any

how.

Stay healthy, enjoy life, success, good luck, and best

wishes. Till next time....

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2022 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).