Flat

Yield Curve, Weakening Economy, Fed Rate Hikes and Financial Accidents

By the

Curmudgeon

Introduction:

The yield curve is flattening, inflation is surging

while the economy is weakening. We

analyze what all that means in this post. Please let us know what you think.

Flat Yield Curve Implications:

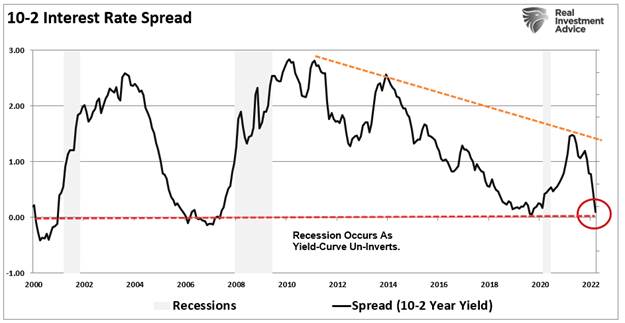

The relatively flat yield curve (1.) suggests

the economy is weakening (more evidence below).

Yet the Fed is way “behind the curve” on rate hikes and talked about

more aggressive tightening this week.

Note 1. As of Friday March 25th, 2

year T-Note yield is at 2.284% vs the 10 year T-Note at 2.488%.

As we all know, Fed rate increases slow economic

growth by raising borrowing costs and reducing economic demand. Lance Roberts noted in his article on the Potemkin Economy:

“The most significant risk is the Fed becoming

aggressive with tightening monetary policy to the point something breaks. That

concern will manifest itself as a dis-inflationary impulse that pushes the

economy towards a recession. The yield curve may be telling us this already.”

Source: Real Investment Advice

……………………………………………………………………………………………………….

Fed Rate Hikes, Inflation, Lower Profit Margins:

Yet the Fed had no option but to hike rates (Chairman

Powell talked about more aggressive rate hikes to come this week) with consumer

inflation running at nearly 8% annualized and producer inflation at 10%.

As discussed in

last week’s Curmudgeon column, the spread between consumer and

producer price inflation is the largest on record. “When the Producer Price

Index is rising at a rate far more than the Consumer Price Index (as it is

now-- 10% vs 8%), it suggests a highly abnormal state of economic affairs,

warranting heightened investor caution.”

Eventually, inflation will erode profit margins

leading to layoffs, automation, and other actions to reduce overall costs.

Simultaneously, the consumer will reduce spending (~70% of GDP) as real

wages fail to keep up with higher living costs, especially energy prices.

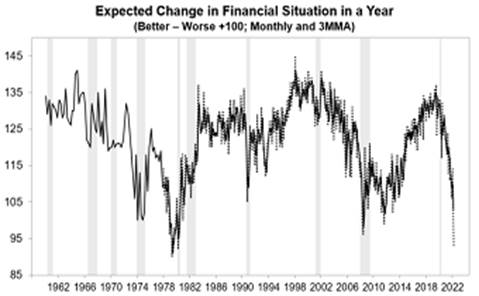

Consumer Confidence Continues to Decline:

The University of Michigan’s final estimate of

its March

2022 Index of Consumer Sentiment declined from its

preliminary estimate to new ten-year and Pandemic lows. That’s shown in this

table and chart:

|

|

Mar |

Feb |

Mar |

M-M |

Y-Y |

|

|

2022 |

2022 |

2021 |

Change |

Change |

|

Index

of Consumer Sentiment |

59.4 |

62.8 |

84.9 |

-5.4% |

-30.0% |

|

Current

Economic Conditions |

67.2 |

68.2 |

93.0 |

-1.5% |

-27.7% |

|

Index

of Consumer Expectations |

54.3 |

59.4 |

79.7 |

-8.6% |

-31.9% |

|

|

|

|

|

|

|

U.S. Economy is Weakening:

EPM Macro Research says that “real

economic growth continues to decline. Furthermore, higher inflation will crush

real income and push the economy near recessionary conditions. There is no

substantial evidence for a pivot higher in growth. The downturn will persist.”

Indeed, the Atlanta Fed’s GDP Now estimate of 1st

quarter 2022 economic growth 0.9 percent on March 24, down from 1.3

percent on March 17. After recent releases from the U.S. Census Bureau and the

National Association of Realtors, the estimate of 1st quarter real

gross private domestic investment growth decreased from -4.2 percent to

-5.8 percent.

“After a month of oil prices we have not seen in

nearly a decade and weeks of record-high fuel prices, high-frequency data

suggest that consumers are beginning to react,” wrote Natasha Kaneva, head of

commodities research at J.P. Morgan.

“While a recession has been a risk scenario, we worry

that the odds are increasing, and it could become the base case,” says Marc Chandler,

managing partner and chief market strategist at Bannockburn Global Forex.

Recession Clock is Ticking:

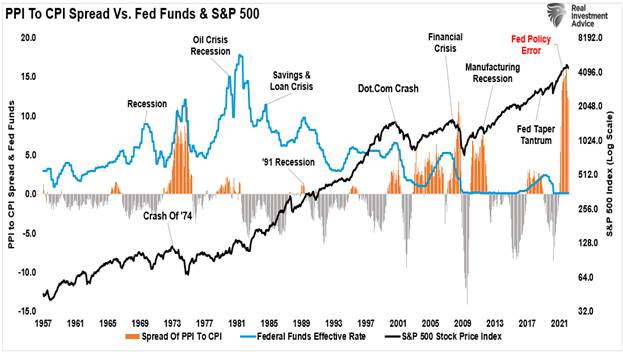

Lance Roberts of Real Investment Advice says, “With the

recent Fed rate hike, the (recession) clock has started ticking. There

is no previous period where Fed rate hikes did not lead to a crisis, recession,

or bear market.”

During previous periods where the inflation spread

was positive, and the Fed was hiking rates, it preceded either a recession,

bear market, or a crisis. That’s

depicted in this graphic:

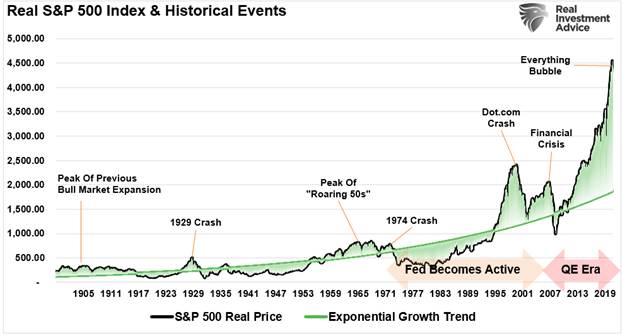

Is a Financial Accident Imminent?

Regarding Fed rate hikes resulting in a financial

accident, Bloomberg’s John Authers wrote:

“10-year Treasury yields have been trending downwards

ever since Paul Volcker raised rates enough to cause a recession in the early

1980s. Every time it touches or at least nears the downward trend line, a

financial accident occurs.”

The markets ultra-high valuation strongly increases the risk of a financial

accident resulting from aggressive Fed rate hikes or geopolitical shock. Over

the last 13-years (since the March 2009 bottom), the pace of stock price

increases accelerated due to massive fiscal and monetary interventions,

extremely low borrowing costs, and unrelenting “corporate buybacks.” As shown

in the chart below, the deviation from the exponential growth trend is so

extreme it dwarfs the “dot.com” era bubble.

Conclusions:

As the Fed hikes rates in a futile effort to slow

inflation, it will result in an earnings recession, which will be coincident

with an economic recession. That will

surely prolong the bear market we’re now in.

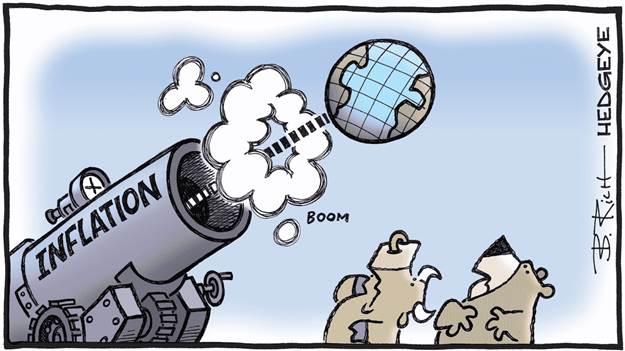

Cartoon of the Week:

........................................................................................................…

Stay healthy, enjoy life, success, good luck,

and best wishes. Till next time....

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2022 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).