Inflation

Rages at 40-Year High, Fed Nudges Rates Up 25bps

By Victor

Sperandeo with the Curmudgeon

Introduction:

Victor provides his perspective of the Dow Theory, 50

week moving average, the Fed’s fake inflation fight. BofA Global Research and

Sentiment Trader comment on high gas prices and inflation’s effect on the stock

market.

Two Most Important Stock Market Trend Indicators:

Based on 56 years of study, I can unequivocally state

that Dow Theory produces excellent long term trend indicators (Bullish

or Bearish), but it’s not a timing signal.

So being in a Bear Market has nothing to do with strong

secondary/counter trend rallies. In

fact, a key characteristic of a Bear Market is strong and fast rallies caused

by short covering, bargain hunting, and the “buy the dip” crowd.

Of critical importance is the “primary” (long

term) trend, which is months to years. That is now considered down, at

least from my perspective. A Bear Market

means we won’t see new all-time highs in stock indexes anytime soon. It also

implies a recession,

Another long-term indicator that has worked the best

in providing high stock market returns is the 200-day moving average (MA). When the 200-trading day moving average TURNS

DOWN and the price of the index closes below it, a Bear Market is

confirmed. This has now occurred everywhere I have looked.

Please refer to “The stock market indicators - as a guide to market

timing,” by William Gordon

for more details. Of the 10 major indicators of the stock market Gordon

researched for 68 years, the 200-day MA (with specific rules) and Dow Theory

were the best at an 18.5% and 18% return, respectively.

……………………………………………………………………………………………………….

Last Week’s Counter Trend Rally and the Fed:

After the Fed’s expected 25 bps rate increase, with

six more expected this year, and no mention of reducing its balance sheet, U.S.

equity markets rallied strongly. The

S&P at +6.8%, the Dow +6.5%, and the NASDAQ 100 +10.5% - all from their

closing lows.

After the Fed Chairman speaks the markets almost

always rally, mainly due to institutional buy programs.

It’s as If the market is attempting to make the Fed

Chairman look good, yet in this case he said nothing good!

The last time the Fed raised rates seven times in a

year was 1978, where they did it 9 times.

That caused a steep recession soon thereafter.

While we don’t know what the Fed will do to lower the

balance sheet, all odds point to letting the bonds and mortgages that mature

run off while not replacing them. I

don’t believe they will sell the debt they own.

The goal of the Fed is to LOOK LIKE they care about

controlling inflation, but not really doing anything to stop it. If they did, that would cause a recession

before the midterm elections.

I still believe there will be only one more rate

increase, because the economy is deteriorating rapidly. This differs with

Chairman Powell who says the economy is very strong, but inflation remains

high.

The FOMC stated this week:

“Indicators of economic activity and employment have

continued to strengthen. Job gains have been strong in recent months, and the

unemployment rate has declined substantially. Inflation remains elevated,

reflecting supply and demand imbalances related to the pandemic, higher energy

prices, and broader price pressures.”

“The invasion of Ukraine by Russia is causing

tremendous human and economic hardship. The implications for the U.S. economy

are highly uncertain, but in the near term the invasion and related events are

likely to create additional upward pressure on inflation and weigh on economic

activity.”

Powell is saying the U.S. economy is strong, that

inflation is caused by “supply-demand imbalances,” will remain high, but “weigh

on economic activity.” So, does that

mean the economy will weaken and if so, are six more rate increases

appropriate?

Regarding supply-demand imbalances effect on U.S.

inflation, why are China and Japan’s inflation rate under 1% year over year and

not subject to the same imbalances? (See

their money supply growth rates which are much lower than that of the

U.S.).

………………………………………………………………………………………………….

Victor’s Opinion:

How we can fix the inflation problem, when the Fed

Chair does not agree with the historical definition of inflation?

The Fed’s DISINFORMATION campaign is so grotesque and

so pernicious, that I must repeat and stress reality: that inflation is always

and everywhere a monetary phenomenon.

However, Fed Chair Powell does not mention that ever!

Esteemed economists/ philosophers such as Milton

Friedman Jean Bodin, Irving Fisher, David Hume, John Locke, Ludwig Von Mises and

Frederick Von Hayek, and Allan H. Meltzer all maintain that inflation is a

“monetary phenomenon.”

So did Professor Steve Hanke, a major critic of the

Fed, who wrote in the WSJ on February 23rd:

Jerome Powell Is wrong. Printing Money Causes Inflation.

The

Fed chairman insists the growth of M2 doesn’t ‘have important

implications.’ The math shows otherwise.

By

turning a blind eye to money, the Fed has allowed the printing presses to run

in overdrive. The money supply as measured by M2, which is the Fed’s broadest

measure of money in the economy, has been growing at record rates—with 39.9%

cumulative growth since February 2020. M2 is still growing at an elevated,

inflationary rate of 12.6% a year. Before the pandemic, you’d have to go back

to the early 1980s to find a monetary growth rate this high.

BoA Global Research - Gas Prices Will Stay High:

“Reducing Europe’s dependence on Russian energy isn’t

impossible but will be very expensive. The shift will mean that gas prices stay

higher for longer, we estimate 2023 gas prices of $200 bbl, or 6x pre-COVID

levels and this assumes Russian gas flows aren’t disrupted. Ultimately, the

European solution requires a combination of increased LNG imports, though

capacity constraints are a challenge, demand destruction and accelerated

investments in renewables.”

Sentiment Trader- Inflation and the

Stock Market:

“Moderate inflation is normal and expected, and the

stock market generally performs just fine during those periods. However, when

inflation reaches an abnormally high (or low) level, it is a warning sign for

stocks in general. And when the Producer Price Index is rising at a rate far

more than the Consumer Price Index (as it is now, i.e., 10% vs 8%), it suggests

a highly abnormal state of economic affairs, warranting heightened investor

caution.”

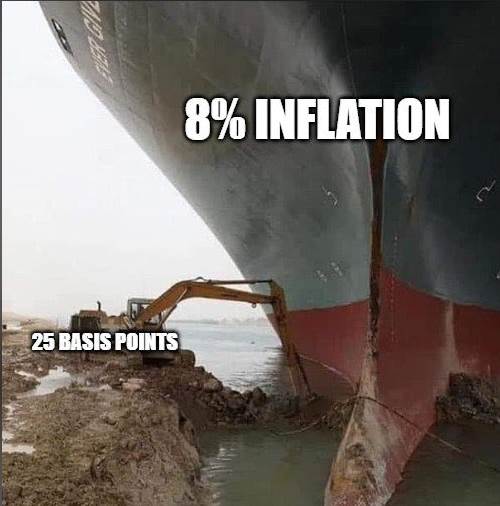

Cartoons - How the Fed is fighting inflation:

End Quote:

"Little else is requisite to carry a state to

the highest degree of opulence from the lowest barbarism, but peace, easy

taxes, and a tolerable administration of justice: all the rest being brought

about by the natural course of things.”

…………. Adam Smith

--> I’d add sound money without a Fed!

.........................................................................................................…

Stay healthy, enjoy life, success, good luck,

and best wishes. Till next time....

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2022 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).