Is

Fed Chair Powell a Phony or a Fool?

By Victor

Sperandeo with the Curmudgeon

Introduction:

To listen to Fed Chair Jay Powell, speak, one must

have the stoicism of a 75-year-old Buddhist monk. Although Powell said

absolutely nothing new, as Bloomberg noted (Stock Markets Don’t Like Listening to Jay Powell)

the stock market belly flopped into a waterfall decline as soon as Powell

spoke. Since the upcoming Fed Interest rate hikes were so well known, you may

wonder why this news gets discounted so many times?

Discussion:

About 15+ years ago, I was approached by a Norway

based Quant Hedge Fund that wanted to include KEY WORDS AND DATA into an

algorithm which was to be used for “verbal sensitive” computer trading. I passed, as I didn’t think it could be

done. I was wrong!

In fact, every time Powell mentioned “raising

rates” in his interview, the computers sold. Other data, like CPI

estimates, are also programmed for buy/sell decisions. The resulting trades are

instantaneous. Traders cannot submit on-line orders to keep pace. The computers are far faster than humans.

Powell is either a phony or a fool? He cited the tight

job market and strong economy as a reason to raise rates. What is he talking

about? Yet those are lagging stats! They have no meaning as to whether rate

hikes are appropriate in two months.

Let’s now examine the latest GDP report to show that

the economy is not as strong as you might believe.

First, the +6.9% GDP reported for the 4th quarter of

2021 was primarily due to inventory building rather than final sales. Inventory

rebuilding in the 4th quarter surged $173.5 billion, up from a decline of $66.8

billion in the 3rd quarter. That added 4.9 percentage points to the overall GDP

gain, accounting for an outsized 71% of GDP growth. The increase in private inventory investment

was led by retail and wholesale trade industries.

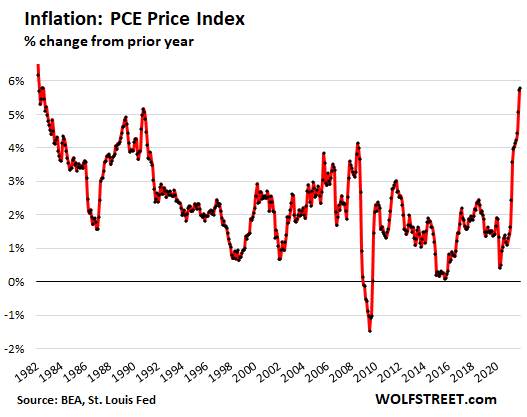

Second, the GDP price deflator [1.] was equal

to real GDP! The BEA

reported, “The price index for gross domestic purchases

increased 6.9 percent in the fourth quarter, compared with an increase of 5.6 percent in the third

quarter. The PCE price index (the Fed’s favorite inflation gauge)

increased 6.5 percent, compared with an increase of 5.3 percent.”

Note 1. The GDP

price deflator is a more comprehensive inflation measure than the CPI index

because it isn't based on a fixed basket of goods.

Lastly, consumer sentiment is declining (68.8% to

67.2% currently) and the economy is slowing (the

Atlanta Fed estimate for the 1st Quarter of 2022 is basically flat or + 0.1%). Yet investment banks are suggesting four to seven

interest rates increases this year? Is anyone LOL?

Stock Market Reaction:

The week ended mixed.

The DJI, S&P 500, NDX 100 futures were all up for the week while the

Russell 2000, Mid-Caps, Dow Transports, net breadth, A/D cumulative index were

all down. Note that the DJI held its

December 1, 2021, closing low, which is a bullish divergence.

The stock market is in an intermediate correction at

best, or the first leg down of a bear market. However, there is no bear market

confirmation yet.

Talk of Fed Rate Hikes:

Meanwhile, Bank of America jumped on the

bandwagon of much higher short term interest rates by forecasting six rate

increases this year. So is BNP Paribas. Those forecasts were topped by Nick Chatters,

investment manager at Aegon Asset Management who told the FT, “Based on what Powell said

yesterday, there’s a reasonable probability of seven rate hikes this year, one

at each meeting. That could cause investors to fall off chairs.”

All that is just talk to lower inflation

expectations. I believe there is ZERO chance

of even four rate increases this year. I’m still sticking with two rate hikes

in 2022 as reiterated here.

Quantitative Tightening, Reverse Repos and Real

Tightening:

The amount of decline in risk assets without any

actual Fed monetary “tightening” is amazing to witness! Powell said nothing about raising rates more

than 25 bps at a time, how high rates might rise, or how much the Fed

balance sheet would run off due to maturing debt not replaced (aka Quantitative

Tightening).

The Treasury Department “pays” the Fed at the

maturity of the bond by subtracting the sum from the cash balance it keeps on

deposit with the Fed, effectively making the money disappear.

The Treasury needs to replenish that cash it “paid”

the Fed by selling new bonds. When the Fed dealer banks (but NOT the Fed) buy

those bonds they reduce bank reserves, thus draining money from the financial

system. Alternatively, the bank buys the

new bond (s) in its "Hold to Maturity" account, in which case

no reserves are involved. The money in the financial system stays the same.

Currently, Fed assets are $8,860 trillion, but will

be ~ $9.1 trillion in March. The Fed’s Reverse

Repos total $1,615, trillion. As we have stated in many earlier posts like

this one, Reverse

Repos are a drain of money and reserves on the economy, but the Fed can end

them overnight.

I think you will see the reverse repos decline as the

Fed’s total assets decline through the year. That will effectively neutralize

any overall tightening from the anticipated Fed balance sheet runoff.

Talk of Quantitative Tightening is a magician sleight

of hand to make the Fed look like THEY REALLY CARE ABOUT CURTAILING

INFLATION. They are trying to FOOL MOST OF THE PEOPLE. The estimate for a runoff

in debt maturities on the Fed’s balance sheet is about 4% or $355-380

billion. That’s neutral for the economy

and inflation.

The lack of knowledge being spewed about monetary

policy and the Fed’s balance sheet is astonishing. When a note, bill or bond

“matures” from the Fed’s portfolio it means nothing for the real economy.

Nothing changes, except who printed the latest batch of fiat money.

Now a huge difference would be if the Fed SELLS

DEBT (without it being reverse repos)! That would be REAL TIGHTENING,

because money used to buy those bonds would be removed from the financial

system.

As the Richard Cookson wrote in Bloomberg,

“Central bank assets will stop growing this year, undermining a major source of

support for all types of bonds. But if inflation remains persistently high,

central banks won’t simply be able to let their assets roll off as they mature,

as most assume. They will have to start selling them. That is the big

problem.”

Money Supply and Inflation:

In a fascinating display of dishonesty, neither Jay

Powell nor anyone else I’ve recently listened to ever mentions money supply

anymore as a reason for inflation. Jay

Powell has not said he would decrease the money supply as Paul Volker did in

November 1979. Yet it is a fact that

“Inflation is always a monetary phenomenon.”

For those of you who never heard Milton Friedman

speak, please listen to a talk he gave in the late 1970’s: “Milton

Friedman Speaks: Money and Inflation (B1230) - Full Video.” The

first 15 minutes is all you need to hear. Friedman proves, using six different

countries in different times, that the quantity of money printed, and prices

are perfectly correlated.

“There is never in history been an inflation that was

not accompanied by an extremely rapid increase in the quantity of money. There has never been in history an increase

in the rapid quantity of money that has not been accompanied by inflation.” Never

is a very long time!

Conclusions:

The key political goal of the Fed is not to cause a

recession, but make it look as if they are fighting inflation.

With Joe Biden’s approval numbers in the tank

(see below), a recession and crash in

the markets would end power for the Democratic Party for a very long time!

The FOMC policy is one of delaying the stopping of

QE, jaw boning that “interest rate increases” are coming without any plan or

details. The Fed wants to retain total flexibility and obfuscation. They know

that YoY the CPI will decline in the next four months (from its current high of

7%) and the economy will slow.

Therefore, very few rate increases will be needed before the mid-term

elections. The Fed’s hidden agenda is to stall any real inflation medicine if

possible.

However, if the banks are correct and Fed increases

rates four or more times, expect a major Bear Market and a

recession/depression.

If the Fed is bluffing, expect another strong leg up

as forecast by contrarian David Hunter, who expects an “epic melt-up”

followed by a monumental decline after that.

Closing Cartoon:

Does the figure below look like Jay Powell to you?

End Quotes:

Keep in mind the words of the man dubbed “the

Maestro,” who demonstrated how the Fed PUT should be executed and how to do it using

smoke and mirrors.

“The number one problem in today's generation and

economy is the lack of financial literacy.”

“If you think you understand what I am saying ,you do

not understand what I am saying.”

–

Alan Greenspan

………………………………………………………………………………………………………

Stay healthy, enjoy life, success, good luck, and

best wishes. Till next time....

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2022 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).