Are

U.S. Stocks in a Bear Market?

By Victor

Sperandeo with the Curmudgeon

Introduction:

All three major U.S. stock indexes fell for a third

consecutive week, continuing their slide to start 2022, with investors worried

about the prospect of higher interest rates and their negative effect on stock

prices.

Last week, I wrote that there would be no

bear market in stocks this year.

I am still of the belief that we are NOT in a bear market as I write

this commentary and there won’t be one in 2022.

Why is simple – a bear market will likely cause a

recession which would end the Democratic Party for a generation. I’ll try to explain this in more detail

below.

Biden and the Fed – Avoid Recession at all Costs:

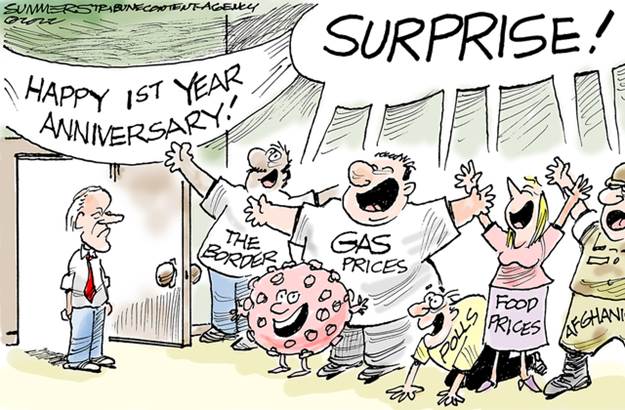

President Biden’s approval has recently dropped to

new lows. According to the PBS News Hour, more Americans disapprove

than approve of how Biden is handling his job as president, 56% to 43%. Currently, just 28% of Americans say they

want Biden to run for reelection in 2024, including only 48% of Democrats.

Americans are even more downbeat about his handling of the economy, with just

37% approving.

Image Credit: USNews.com

If the Fed raises rates which causes a recession, Biden will

be toast. Hence, he’s likely to

pressure the Fed NOT to aggressively raise rates.

Moreover, Biden has just appointed three new

Democratic party FOMC members, who are not likely to vote to raise rates

repeatedly. Instead, they are likely to

be focused on the November midterm elections and will not permit a recession to

start before then.

Biden also reinstated Jerome Powell as Fed

Chairman. In my opinion, that was a huge

mistake as Powell has not done a good job of running the Fed (other than

continue inflating financial assets).

Fed’s Inflation Fighting is Moral Suasion:

For example, the Fed’s policy to fight inflation is

all talk and lame excuses. Powell blames

inflation on shortages created by the coronavirus. Thereby, not a concrete step

has been taken to end inflation, aside from lowering the monthly QE allotment

over a few months. Yes, that lowers

inflation, mainly of financial assets, but does not stop real price increases. That would require a substantial tightening

of monetary policy which would raise rates and lower money supply growth. Yet that tough medicine would slow the U.S.

economy.

The Fed’s policy of “talk the talk” is called “moral

suasion.” Threats of rate increases without saying when that might happen.

As I wrote in last week’s column, the fact that

Goldman Sachs and JP Morgan Chase are forecasting more rate increases than the

FED has tells me that the Fed will not do more than two rate increases this

year. I’m still of that opinion.

Curmudgeon Comment:

To support Victor’s opinion on few Fed rate hikes,

consider what Greg Ip wrote in the WSJ January 18th print edition:

“Federal

debt, which since 2019 has shot from 80% to around 100% of GDP, is more easily

sustained with low rates, although slower growth works in the opposite

direction. Indeed, one reason interest rates may be low is that investors

think the Fed won’t raise them so much for fear of a stock market crash. It

raised rates above 2.25% in 2018, then reversed course when stock and commodity

markets wobbled.”

Indeed, the Fed has become more politicized than ever

as this cartoon illustrates:

ILLUSTRATION: Chad Crowe

…………………………………………………………………………………………...

Sidebar - Yellen’s Magical Crystal Ball Inflation

Forecast:

U.S. Treasury Secretary Janet Yellen told CNBC on Thursday that she continues to

forecast inflation falling close to 2% by the end of 2022.

“If we’re successful in controlling the pandemic I

expect inflation to diminish over the course of the year and hopefully to

revert to normal levels by the end of the year, around 2%,” she said during the

CNBC interview.

Yellen maintains that inflation is a “shared

responsibility” between the Biden administration and the Fed and expressed

confidence the central bank was moving appropriately.

I wonder what evidence that was based on? Or how magically inflation will drop from 7%

YoY now to ~2% by years end?

……………………………………………………………………………………………

Classifying Stock Market Trends:

While stock market crash predictions are as well

advertised as “you should get your booster” and “buy Bitcoin,” I have to be a

contrarian.

A bear market may indeed occur, but not from Fed

talk. Let’s look at the evidence from the U.S. equity markets.

The Dow Jones Industrials made a high on 1/4/22 and

have since declined by -6.89% (as of 1/21/22) in 17 days. That is historically considered as a “minor”

sell off or short-term decline. [1.]

Note 1. A short-term decline is defined as days to

weeks vs intermediate declines of weeks to months, and long-term bull and bear

markets months to years).

To classically state we are in a bear market, the

DJI, S&P 500, and Nasdaq (NDX or NDX 100) indexes must close below their 200-trading

day moving averages (MAs) with the MA “declining.”

The NDX 100 rallied from its March 16, 2020, low to

November 9, 2021 - or 613 days - without a 10% correction. It is finally down -12.98% from its last high

(using the NDX 100 Futures). This can be considered an intermediate term

correction for the NDX 100. However, to say were in a bear market is beyond

premature. It is utterly false.

A Dow Theory bear market signal (is it still

relevant?) would be triggered if BOTH the Dow Industrials (DJI) and Dow

Transports (DJT) indexes each close below their previous important lows

(measured by volume). The last “minor”

DJI lows were from 11/8/21-12/1/21.

The Dow Transports have slightly closed below its

last minor lows, but the Dow Industrials have not. That creates a “divergence,”

which could be interpreted as a bullish omen.

I have the charts of the Dow and Rails/Transports

from 1885 (obtained from the late Richard Russell). Having reviewed them hundreds of times the

decline of the last 17 days takes place thousands of times and amounts to very

little. Of course, the market will tell

the tale, but as of now nothing is confirmed.

The Week Ahead:

Keep in mind that the Fed meets next Tuesday and

Wednesday. FOMC meetings often move

markets, even if there is really nothing new that’s reported. Investors will be watching closely for more

guidance on the central bank’s plan to raise interest rates.

Also, Apple, Microsoft and Tesla are among tech

giants reporting in a busy earnings week.

Overall, about a fifth of the S&P 500 and nearly half of the Dow

Jones Industrial Average companies are expected to provide their quarterly

updates during the week starting Monday, according to FactSet.

The Well-Advertised Crash?

Any professional investor understands that the

CURRENT stock market valuations - in all metrics - are at record highs (see

almost any previous Curmudgeon post).

When this bubble bursts and the recognition come, it

will awesome! Like when a nuclear bomb goes off the decline will NOT be orderly

but will be like pandemic induced waterfall decline from 2/20/20-to-3/16/20.

Conclusions:

If I see some facts based on historical data that

depicts a bear market is here, I’ll be the first to say so. I believe that if

any further bad economic news appears, it will lessen the need for the Fed to

raise rates. In that case, prepare for a

rally in stocks and bonds.

Jeremy Grantham, the famed and respected investment

manager, who has been calling market bubbles for decades, said the historic

collapse in stocks he predicted a year ago is underway, and that the Fed can’t

stop it.

I believe he is NOT objective as he is too invested

in his own opinion. That is best

expressed by the quotes below.

End Quotes:

“Attachment is a manufacturer of illusion and whoever

wants reality ought to be detached.” – Simone Weil

“Illusion is an anodyne, bred by the gap between wish

and reality.” — Herman Wouk

...………………....………………….....………..…..….…....………..…...………..…

Stay healthy, enjoy life, success, good luck and all

the best for 2022. Till next time.…

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies, and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2022 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).