Inside

BofA’s Negative 2022 Stock Market Outlook

By the

Curmudgeon

Introduction:

BofA Chief

Investment Strategist Michael Hartnett maintains his view of negative U.S.

stock market returns this year, driven by an interest rates shock. Let’s explore that thesis, look at historical

stock market declines during midterm election years, and hint at possible

surprises from this week’s FOMC meeting.

BofA’s 2022 Equity Market

Outlook:

In-line with BofA’s Economics

team, Michael agrees the Fed is well behind the curve in hiking interest

rates. In addition, leading indicators for corporate profits, like the NY

Empire Manufacturing Survey (highly correlated to the S&P 500 as

per graph below), are starting to head south. Michael thinks the combination of

rates up and profits down is bad for credit and stocks.

Source: BofA Global Investment

Strategy, Bloomberg

BofA GLOBAL RESEARCH

Hartnett believes

"interest rates shock" is just beginning and

rate expectations are too

low. He notes that stocks, credit, and

housing markets have been conditioned for an indefinite continuation of the

"Lowest Rates in 5000 Years.” So, it might only take a couple of Fed rate

hikes to cause an “event” (see Conclusions below).

Michael notes investors aren’t

short just yet with $52B of inflows into stocks 2022 YTD. He recommends being

long volatility, high quality, and defensive stocks on tighter financial

conditions.

BofA U.S. Equity &

Quantitative Strategist Savita Subramanian agrees that some of the bearish

themes for equities that the bank worried about in 2021, such as tighter

monetary policy and margin pressures from labor, are now playing out. Here’s an interesting historical drawdown

table for your consideration:

Table 1: 3-month S&P 500 drawdowns in midterm

election years

Midterm year Peak to Trough

Drawdown

|

1930 Apr-30 Jun-30 -25% |

|

1934

Feb-34 May-34 -20% |

|

1938 Jan-38

Mar-38

-29% |

|

1942

Jan-42 Mar-42

-12% |

|

1946

May-46 Sep-46

-20% |

|

1950

Jun-50 Jul-50

-14% |

|

1954

Aug-54 Aug-54 -4% |

|

1958

Feb-58 Feb-58 -4% |

|

1962

Mar-62 May-62

-22% |

|

1966

Jul-66 Oct-66

-16% |

|

1970

Apr-70 May-70

-23% |

|

1974

Aug-74 Oct-74 -25% |

|

1978

Sep-78 Nov-78

-14% |

|

1982

May-82 Aug-82

-14% |

|

1986

Sep-86 Sep-86 -9% |

|

1990

Jul-90 Oct-90

-20% |

|

1994 Feb-94

Apr-94

-9% |

|

1998

Jul-98 Aug-98

-19% |

|

2002

May-02 Jul-02

-28% |

|

2006

May-06 Jun-06

-8% |

|

2010

Apr-10 Jul-10

-16% |

|

2014

Sep-14 Oct-14

-7% |

|

2018

Sep-18 Dec-18

-20% |

|

Average drawdown= -16% |

Source: BofA Global Investment

Strategy, Bloomberg

BofA GLOBAL RESEARCH

.……………...…………………………………………………...…….………………………….

Curmudgeon Comments:

BofA’s Hartnett writes that

the Fed will be raising rates in highly overvalued credit and equity

markets. He adds that Fed tightening

always "breaks" something.

What could that “something” be

this time around – stock, bonds, real estate, art, cryptos, take your pick?

One possible surprise at this

week’s FOMC meeting would be for the Fed to further accelerate the tapering of

its bond purchases, winding them up by mid-February, a month earlier than

currently scheduled, wrote Nomura economists Aichi Amemiya, Robert Dent,

and Kenny Lee in note to clients. That would represent a marginal reduction of

$20 billion in Treasury and $10 billion in agency mortgage-backed securities

acquisitions but would send a signal to the market about the Fed’s

anti-inflation resolve.

The U.S. central bank

continues to buy $40 billion of Treasuries and $20 billion in MBS per month,

adding to its near-$9-trillion balance sheet.

That means that it is easing, rather than tightening, monetary policy,

while “talking” of the need to curb inflation.

Fed “talking the talk” is why Victor believes there will be

only two rate hikes this year.

Economists Cynthia Wu of Notre

Dame and Fan Dora Xia of the Bank for International Settlements have

estimated a “shadow fed-funds rate,” which is based on its asset

purchases and tracked by the Atlanta Fed. The Wu-Xia shadow funds rate was

minus 1.15% as of Dec. 31st, according to the Atlanta Fed.

Ryding says Wu estimates that

a change in the Fed’s balance sheet equal to 10% of U.S. gross domestic

product—about $2 trillion—is roughly equivalent to a 100-basis point change in

the fed-funds rate.

As for the Fed beginning to

normalize its balance sheet, the Nomura economists think the announcement could

come as early as the March or May FOMC meeting. Most Fed watchers expect a

later start to the process of reducing the central bank’s securities holdings,

after two or more rate hikes. And almost all think the Fed will allow maturing

issues to run off at a predictable pace, rather than sell securities outright.

Conclusions:

Nowhere is the impact of Fed

monetary policy more apparent than in elevated asset prices – from the doubling

of the S&P 500 since its March 2020 bottom to home prices jumping over 20%.

The end of the pandemic means

the end of excess stimulus, which likely spells the end of excess asset

returns. Check the recent charts of

Zoom, Peloton and Netflix, among other highfliers for evidence.

Investors will be listening

carefully to what Powell and his cohorts say at the FOMC meeting this week (and

beyond) about ending QE (for now), normalizing rates (“neutral is the new

tightening”), and reducing its balance sheet (which Modern Monetary Theorists

says can grow to infinity?).

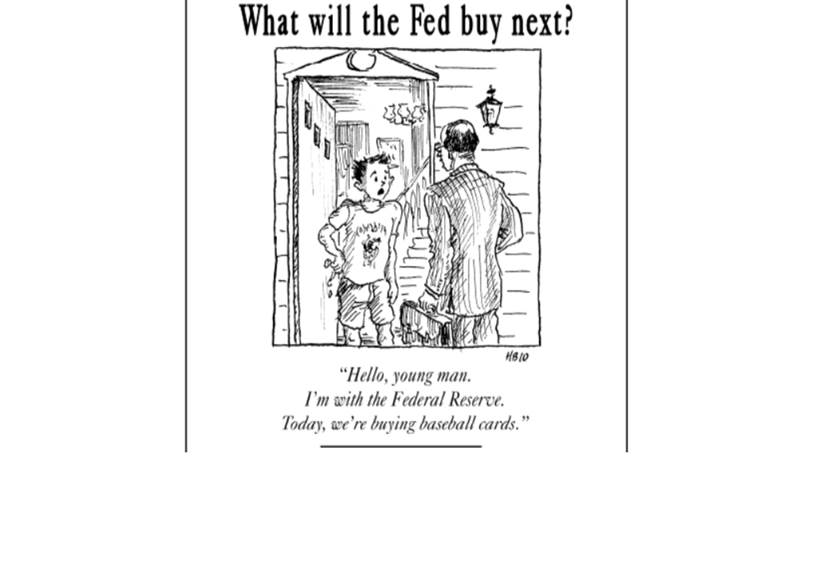

Closing Cartoon:

Stay healthy, enjoy life,

success, good luck and all the best for 2022.

Till next time.…

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2022 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).