2021-

Another Incredible Year for U.S. Equities; 2022 Forecasts

By the

Curmudgeon with Victor Sperandeo

2021 Market Year in Review:

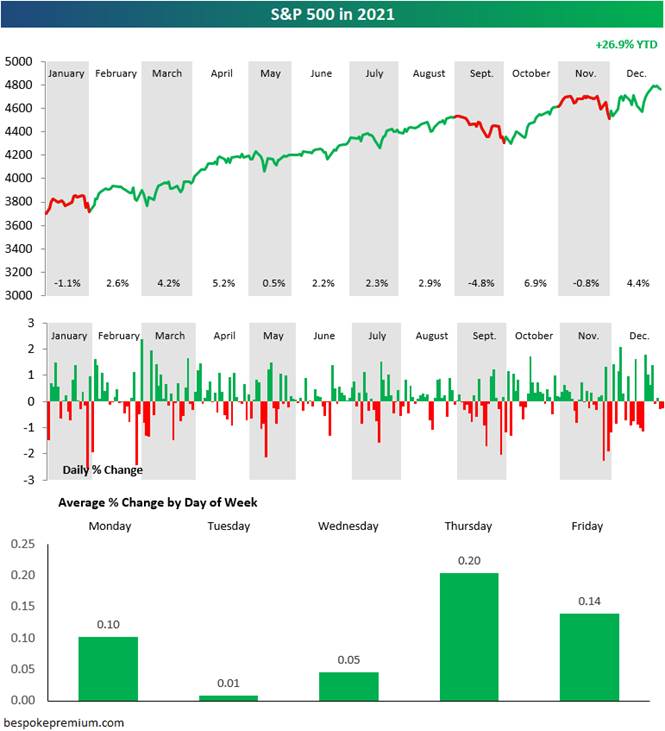

The S&P 500 rose +26.9% in price in 2021, while

dividends boosted its total return to +28.7% for the year. Pretty good considering money market funds

and savings accounts earned <0.1% and bond funds had a negative total return

in 2021!

It is the third straight year of double-digit gains for the

broad index, and the second amid the Covid-19 pandemic. Here are other highlights:

- The S&P hit

70 all-time new highs in 2021.

- The best stretch

of the year was the seven months from February through August when the

S&P gained over 21% with no down months.

- The best month of

the year was October, when the S&P gain 6.9% and easily recover all of

September's losses.

- There were only

three down months -- January (-1.1%), September (-4.8%), and November

(-0.8%).

- There were just

four multi-day declines of more than 4%, and there was just one draw down

of more than 5%.

- The 5% draw down

occurred from September 2nd through October 4th for a total drop of

5.2%.

- While the S&P

closed out the year with two down days (which wasn't a surprise), the

index closed 2021 near all-time highs after breaking out nicely in late

December.

- The Shiller PE

ratio for the S&P 500 closed the year at 39.98 after 40+ readings on

12/29 and 12/30/21. Note that the

median Shiller PE is 15.86 while the minimum was 4.78. So, the current

Shiller PE is 8.37 X the minimum reading and 2.52 X the median (average

value)!

As of 12/30/2021 the NASDAQ-100 Index (dominated by

the big tech names) was up +48.88% for 2021, +196.31% for 5 years and + 552.24%

for 10 years.

The combined market values of Apple, Microsoft,

Google-parent Alphabet Inc., Amazon, and Meta Platforms—the company once

known as Facebook stand at $10.1 trillion as of Wednesday’s close. That’s up

from $7.5 trillion at the start of the year, reflecting a 35% rise that

exceeds the gains of the Dow, S&P 500, and Nasdaq Composite in what has

been yet another strong year where stocks prices increased more than earnings.

As a result of the big tech stock price run up, a

larger portion of the market is under the sway of just a few big names. The

five aforementioned—along with Tesla and chip maker Nvidia — now

comprise more than 27% of the S&P 500’s total value. And that seems likely

to grow even further. Apple alone is on the cusp of reaching the $3 trillion

mark, and at least 13 market analysts have price targets on the stock that

would put the company’s market value well past that milestone. And Wall

Street’s median price target of $4,000 for Amazon’s shares would put the

e-commerce giant past the $2 trillion mark—up 17% from its current value.

.…....…..…..…..…..…..…..…..…..…..…..…..…..…..………..…..…..…..…..…..…..…..….....

Warning Signs Flashing (as they have been for years):

Inflation could turn companies’ and customers’ finances

upside down. Many companies that have been market darlings are losing money.

Big-name stocks continue to log giant one-day swings. However, individual

traders and institutional investors are hungry to take bigger risks and willing

to accept bouts of volatility.

“When you see your friends making a ton of money in the

market, everyone jumps in,” said Zhiwei Ren, a portfolio manager at Penn Mutual

Asset Management.

“We’ve never seen anything like that in history,” said Dean

Curnutt, chief executive of brokerage Macro Risk Advisors, referring to the

volatility in some single stocks. “The up crashes have been gigantic.”

Figures from Macro Risk Advisors show that stocks such

as GameStop, AMC, Tesla and Nvidia Corp. were more volatile on days the shares

were rising than when they were falling, upending the market’s typical

dynamics.

“Who said it was escalator up, elevator down for stocks?”

wrote Mr. Curnutt in a note to clients.

These moves lured many investors, both institutional and

individual, into options, a shift that can make the market vulnerable to bigger

swings, some traders have said. Trading activity in options, which give traders

the right to buy or sell stocks at a specific price by a stated date, hit the

highest level in the industry’s history in data going back to 1973. That’s yet another sign of extreme

speculation.

Victor’s Comments:

2021 (and the previous 12 years) showed the Fed in its full

corrupt form and glory. The U.S. is

nothing like the laws that our founding fathers designed – the U.S.

Constitution.

The creation of the Federal Reserve Act of 1913 was a

sham, or a cover for the bankers from the very beginning [see “The Creature from Jekyll Island,” by

G. Edward Griffin for the real history of the Federal Reserve Act.]

- Milton

Friedman - a great economist and educator -

suggested that the money supply increase at 6% per year automatically

without FOMC intervention.

- Ludwig

Von Mises - the great Austrian economist – advocated

continued adherence to the Gold Standard.

–> Mises was 100% correct! He predicted everything

we now witness today with fiat money (e.g., “the everything bubble,” widening

income inequality, etc.). Sadly, the undisciplined control of money supply

growth is likely to end the liberty that created the greatest nation in world

history.

In my opinion, we are now nearing the end of the U.S. government’s

ability to “kick the can down the road” (e.g., Congress’ vote to raise

the debt ceiling, while the Fed continues to monetize1 most of the

newly issued U.S. Treasury debt since March 2020).

Note 1. As a result of

the latest round of QE, the Fed’s balance sheet increased from about $7.4

trillion at the end of 2020 to nearly $8.5 trillion as of September 29, 2021

(last date available). It’s surely over

$9 billion today.

The U.S. official debt has grown, since going off the gold

standard, to an incredible $29.494 trillion (as of 12/29/21) - from $398

billion from 6/30/71. That is an 8.72% compounded rate. This does not include

Off Budget debt at about $11 trillion or Unfunded Liabilities estimated as high

as $ 200 trillion. In 10 years at the 51.5-year trend, the official debt will

be $68.050 trillion! This seems impossible but it’s what the math suggests.

The Fed has turned the Wizard’s Wand of printing money (aka

“key stroke entries”) into the visible end of America by abusing its

power.

The words of Rep. Louis T. McFadden - a powerful House Member – ring loud

and clear today:

“Mr. Chairman, we have

in this country one of the most corrupt institutions the world has ever

known. I refer to the Federal Reserve Board and the Federal Reserve Banks.

The Federal Reserve Board, a government board, has cheated the Government of

the United States and the people of the United States out of enough money to

pay the national debt. The depredations and iniquities of the Federal Reserve

Board has cost this country enough money to pay the national debt several times

over. This evil institution has impoverished and ruined the people of the

United States, has bankrupted itself, and has practically bankrupted our government.

It has done this through the defects of the law under which it operates,

through the maladministration of that law by the Federal Reserve Board, and

through the corrupt practices of the moneyed vultures who control it.”

“The Federal Reserve Bank of New York is eager to enter into

close relationship with the Bank for International Settlements....The

conclusion is impossible to escape that the State and Treasury Departments are

willing to pool the banking system of Europe and America, setting up a world

financial power independent of and above the Government of the United

States....The United States under present conditions will be transformed from

the most active of manufacturing nations into a consuming and importing nation

with a balance of trade against it.”

→ That’s exactly what happened! Indeed,

McFadden2 was a true soothsayer.

Note 2. The McFadden Act of 1927 rechartered the

Federal Reserve Banks in perpetuity, liberalized branch banking rules, and

revised a wide range of laws related to the treatment of banks that were not

members of the Federal Reserve System.

………………………………………………………………………………

The world we live in today and what will happen to the U.S.

is a mixture of the Welfare State, Corporativism, and Fascism! For sure, it’s

not capitalism.

Readers are encouraged to review these Curmudgeon blog posts

where I explain my views in detail:

Economic Fascism, Corporatism, and the Move to

Anarchy in the U.S.

How Does America Keep Functioning While It

Sinks Into Depravity and Corruption?

The Fed Creates Another Moral Hazard and Ends

Free Markets

U.S. Government Economic Numbers Are Not What

You Think They Are!

Rather than end my polemic discourse

on a gloomy note, please consider the following 2022 New Year's resolutions,

courtesy of Mike Luckovich, The Atlanta Journal-Constitution:

……………………………………………………………………………….

Victor’s 2022 Forecasts:

Money supply growth is the key to the markets – not interest

rates. The Fed has given guidance via talk about reducing their U.S. government

bond and mortgage debt purchases, with all purchases ending in March 2022.

- The U.S.

equity market should continue with a slow rise till then - unless war

or an unknown event occurs. Fed talk is nothing more than a stall, which

is keeping the “musical chairs” game intact.

- Inflation

will continue above trend but be a bit lower as supply chain constraints

ease.

- Without Congress

passing President Biden’s “Build Back Better” spending plan, the debt

markets will be stable to up.

- After March, excuses

will start to roll in about why the Fed is not raising rates as

suggested. I feel for reputation’s

sake only, the Fed will raise rates 25 to 50 bps well before the 2022

mid-term elections, but they will use that as an excuse to not raise rates

further.

- President Biden

can name three more FOMC members. These new members will not likely

vote for raising rates in any meaningful way.

- It’s important to

note that there are $1.696 trillion outstanding in Reverse Repo’s

as of 12/30/21 (with the high being $1.758 trillion on 12/20/21). The Fed can end those in part or in

whole at any time. If so, that money deposited at the Fed will be returned

to the banking system and U.S. economy.

- My strong belief

is that when the Fed raises rates after March, they will allow the Reverse

Repo’s to decline substantially. So,

net-net, there will be no real tightening of monetary policy.

End Quote:

“If nothing changes, nothing changes. If you keep doing what

you're doing, you're going to keep getting what you're getting. You want

change, make some.”

― Courtney C. Stevens, The Lies About Truth

Happy New Year! Stay healthy, enjoy life, success, good luck

and all the best for 2022...

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2022 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).