U.S.

Government Economic Numbers Are Not What You Think They Are!

By Victor Sperandeo with

the Curmudgeon

U.S. Government economic numbers are not what you

think they are!

by Victor Sperandeo with the Curmudgeon

Introduction:

As Ive stated many times in these posts, one cannot

trust ANY U.S. government economic numbers unless you can prove them

yourself. Such skepticism is especially

true in election years like 2020.

The U.S. GDP estimates come from the Bureau of

Economic Analysis (BEA). To make these numbers look good, BEA misleads,

mischaracterizes and concocts estimates that deceives the public in order to

paint a positive picture of the economy.

U.S. Government Skullduggery:

The scam today is the $2.4 Trillion of federal

government coronavirus stimulus programs (an excellent summary of the

U.S. economic stimulus program for businesses can be read here).

For example, the CARES program allocated up to

$46 billion for loans and loan guarantees for air carriers, other

related businesses, and businesses critical to maintaining national

security. These are the same airlines

that spent all their earnings buying back their own stock. Incredibly, that $46 Billion gift is

counted as an increase in U.S. GDP.

The government handout to the airlines is not

supposed to be reoccurring, but maybe it will be if the airlines continue to be

in financial difficulty?

Foreboding Signs of Economic Trouble:

Here are a few other signs of U.S. economic weakness:

60 percent of Resturants have permanently closed

as of July 25th says Yelp and The Hill. However, that percentage is surely higher

now with the restriction prohibiting indoor dining in many states, like

California.

A WSJ editorial (9/12-13/2020 print edition)

titled A Plea to Save New York editorial states:

The Partnership

for New York City has estimated that a third of small businesses will

close permanently. New York Citys unemployment rate was 19.8% in July, one

of the highest rates in the country.

This damage will be felt for years.

As noted in our companion piece, Global

Economies Rebound, but wont reach Pre-Coronavirus levels till 2022,

airlines are flying at greatly reduced capacity, cutting jobs and retiring

aircraft. For example, United Airlines will eliminate 16,000 jobs next month as

it shrinks operations.

Also, many retail stores are closed, require

reservations to enter or are permitting only 1 to 3 customers in the store at

any one time (after a temperature check plus health related Q&A).

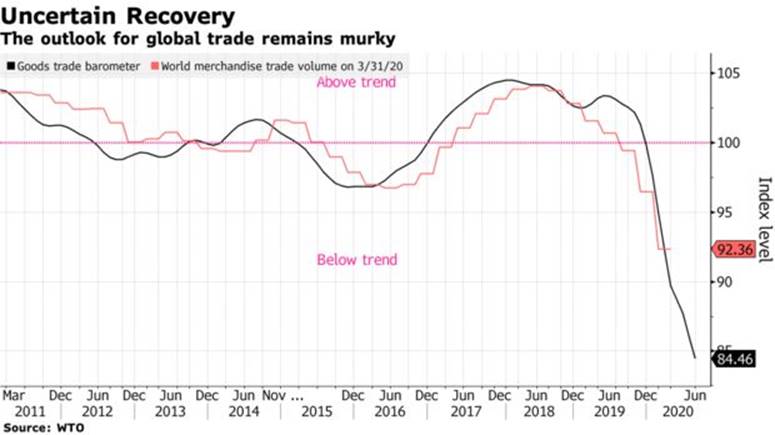

Have a look at this eye opening chart of World Trade,

courtesy of Bloomberg. It speaks for

itself:

I could bore you with many more of the impossible

growth realities being projected, but instead urge you to look behind the

numbers.

Guess Whats Included in U.S. GDP?

Did you know that the phantom deficit spending

programs (like income handouts to corporations) and printed fiat currency

(that was created out of thin air by the Fed) are counted as part of U.S.

GDP?

The Fed balance sheet on 2/12/20 was $4.182 trillion

but on 6/10/20 it was $7.010 an increase of +$2.828 trillion or +68%!

Also, the Feds bond purchases, like investment grade

corporate bonds, broad market index bond ETFs and High Yield Bond ETFs,

created profits for BlackRock (iShares ETFs), State Street Global Advisors (JNK

ETF) and other investment banks offering such corporate bonds and ETFs.

Doublines Jeffery

Gundlach had this to say about the Feds buying of such bonds:

The Federal

Reserve is presently acting in blatant non-compliance with the Federal Reserve

Act of 1913. An institution violating

the rules of its own charter is de facto admitting that said institution has

failed and is fundamentally broken.

.

Sidebar: Fed Buying U.S. Debt at Auctions

Do you realize that the Fed buying Treasuries and

Mortgage bonds is equivalent to the U.S. government selling the same debt

twice?

·

First when the Treasury sells

bonds/notes/bills in the new issues open market auction.

·

Then again, when the Fed buys

those fixed income securities from its primary

dealers with freshly printed (aka keystroke) fiat dollars.

If Abbott and Costello arranged this sharade it would

be a comedy routine like Whos on First.

.

CBO Estimates of U.S. GDP and Budget Deficits:

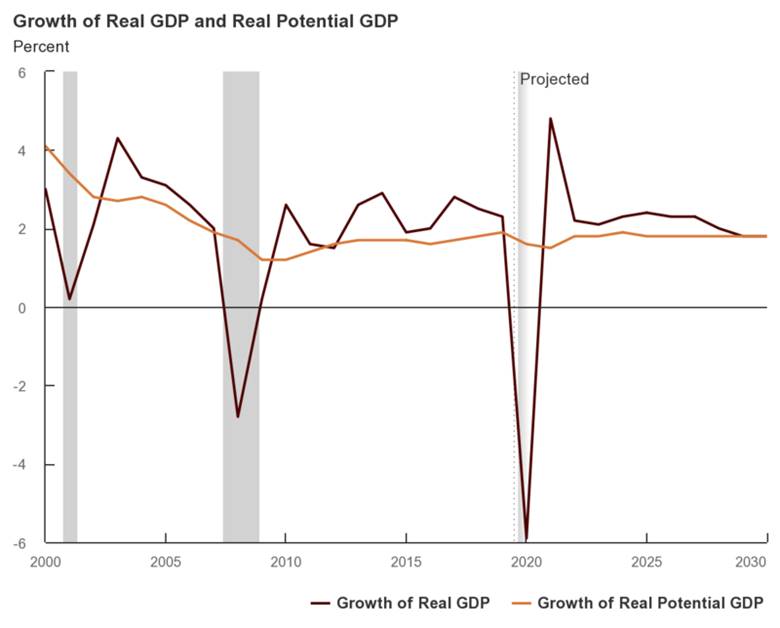

The CBO (Congressional Budget Office) Update

to the Budget Outlook 2020-2030, September 2020 projects

that from 2020 to 2030, annual real GDP will be 3.4% lower, on average, than it

projected in January. The annual unemployment rate, which was projected to

average 4.2%, is now projected to average 6.1%.

CBO projects a federal budget deficit of $3.3

trillion in 2020, more than triple the shortfall recorded in 2019. At 16% of GDP, the deficit in 2020 would be

the largest since 1945.

In fiscal year 2021 (the so-called mystical V

Recovery year), the deficit is projected to be $1.8 trillion or 8.6% of GDP.

Thereby, the real 2020 U.S. government deficit

is actually the sum of: $3.3 trillion fiscal deficit + 2.9 trillion bond buys

by the Fed + $6.2 trillion in federal government stimulus payments +

off balance sheet spending or somewhere north of $12.4 trillion!

Each of those numbers is historic in its own

way. It puts the U.S. on a course to

eclipse World War II-era highs in the budget deficit, national debt and

handouts. Of course, the Federal

Reserves balance sheet is at an all-time high and likely to climb higher in

the months ahead.

Victors Conclusions:

All the above fiscal and monetary stimulus is not

recurring and so its contribution to GDP is a mirage.

What is permanent is the millions, if not tens of

millions of small businesses that are now dead and buried. Their capital and

jobs are gone and will never see the so called V recovery, which the

Curmudgeon and I dont believe will happen. (John Williams of ShadowStats has

been forecasting a L shaped economic recovery for some time).

Many of the small business survivors and workers

urgently await the next stimulus package thats been stalled by party line

Congressional differences.

Do you believe in the tooth fairy? Good luck with all the propaganda you will

read, see, and hear!

Closing Quote:

To understand what is really happening in the economy

vs what you might read or hear, please reflect on this quote:

Appearances to the mind are of four kinds. Things

either are what they appear to be; or they neither are, nor appear to be; or

they are, and do not appear to be; or they are not, and yet appear to be.

Epictetus 50

AD-135 AD

Good health, good luck and till next time

.

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative (non-correlated)

investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since 1971) to profit in

the ever changing and arcane world of markets, economies and government

policies. Victor started his Wall Street

career in 1966 and began trading for a living in 1968. As President and CEO of

Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and

development platform, which is used to create innovative solutions for

different futures markets, risk parameters and other factors.

Copyright © 2020 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).