Negative Real Interest Rates Harms Savers

but Rewards Extreme Speculation

By the

Curmudgeon with Victor Sperandeo

Introduction:

We hope readers enjoy our irreverent year end look at what the

financial mainstream media won’t address. Wishing you all the best for 2022

(please read our End Note).

Financial Repression (Victor):

When the government keeps interest rates below the inflation

rate savers receive a negative real rate of return on fixed term income

investments (like T-bills, T-notes, CDs, money market funds, etc.). That policy enables the government (e.g.,

U.S. Treasury) to borrow at extremely low interest rates, obtaining low-cost

funding for government expenditures and easier financing for budget deficits

(especially when the Fed buys over 50% of newly issued U.S. debt in its latest

round of QE).

Such “financial repression” has been ongoing for the

past 13 years:

From 1/2009 to 11/2021

T-Bills earned 0.56% compounded before taxes, while the (understated) CPI

compounded at 2.31%.

→Thereby, $1000 in U.S. savings became $739.39 in

constant dollar terms. That’s a negative

(government theft) return of -26.1% in 12.92 years. Meanwhile, the U.S. equity markets compounded

at ~15% annually over the same period.

→Savers were lured to higher risk investments, like

stocks, options, junk bonds, etc. in hopes of a positive real return. Market risk appeared to vanish with the Fed

and U.S. Treasury adding more liquidity on any serious dip in the markets.

Curmudgeon: We think

market risk may re-assert itself if the Fed and other central banks start

raising rates quicker than now anticipated.

With sky high valuations (see charts below), there will be no shock

absorber to cushion a steep market decline, as value players will likely sit on

the sidelines.

U.S. Equity Valuations Have Never Been Higher:

The U.S. equity market has never been so expensive relative

to underlying fundamentals as per the following two metrics.

Crescat Capital’s 15-factor valuation model is at record levels with 11 out of 15 fundamental metrics in

the 100th percentile historically.

Meanwhile, the Shiller P/E for the S&P 500 is at 39.65 as per

this chart:

……………………………………………………………………………………………………….

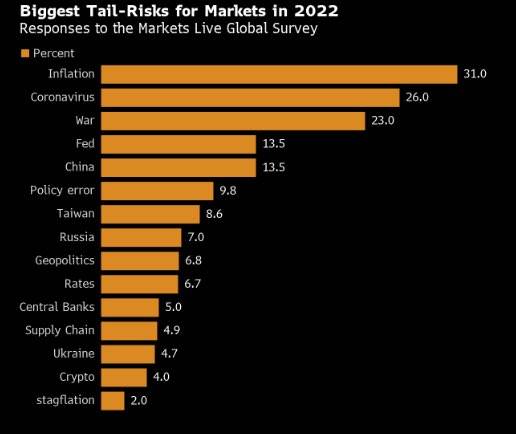

Biggest

Tail-Risks for the Markets in 2022:

The biggest risks for markets in 2022 are inflation, the

coronavirus, and geopolitical tensions, according to some 700 respondents to a

Bloomberg Markets Live Global Survey.

Curmudgeon Comment:

How could inflation be the biggest tail risk in 2022 when it

has been so widely publicized and likely discounted in 2021?

Vice

- ‘To the Moon’ Crash Is Coming:

A longtime venture capitalist sees the religious dedication

to Elon Musk, hype, and YOLO investing as almost a dot com-style pyramid

scheme in the making.

Just over two decades ago, Josh Wolfe co-founded Lux

Capital, a New York City-based venture capital firm dedicated to investing

in science and technology firms developing ideas with the potential to change

the world. The year was 2000, and the dramatic growth of the internet over the

previous decade had created a bubble that was beginning to burst. Over the next

few years, the NASDAQ would drop by more than 75% as a slew of heavily hyped

tech startups plunged into failure, humbling the recently overconfident

industry.

The market today reminds Wolfe in many ways of the same

forces that were so prominent at the height of the dot com boom, and perhaps no

single person better encapsulates the moment than the world’s richest man, Elon

Musk.

Inflation has already been here for a very long time, not in

the classic economic GDP numbers, but in asset prices. It matters not just that

asset prices are inflated, but because I think we'll see a scenario where the

poorest will be hit the hardest, as few fuel and food and basic consumer

staples see rising prices, when consumers’ incomes or portfolios are hit the

hardest. You're going to have this almost bifurcation of lower declining prices

at the high end of stuff that nobody really needs, and rising prices of the

stuff that people do need. It's going to be a potentially painful situation

when Wall Street is potentially seeing the bubble deflated and people clinging

to hope that their portfolios will come back.

The only thing the stock price measures is what

other people believe. It doesn't measure fundamental value or intrinsic

value, which is something you can look at by analyzing a balance sheet or an

income statement and seeing what the actual performance of a business is. You have

companies that are losing more money with every sale they make. Meaning they

have negative gross margins, and the more they sell, the more money they lose.

They must raise more money. You could show that you're growing sales 50 percent

or 100 percent, and you could be losing 75% or 125%. So, price is only a

measure of belief and expectations. Fundamentals are a measure of value. That

discrepancy between fundamentals and expectation is where great investors are

made.

Historically, when you had active investors in the market,

you could short overly excessive expectations—which were either typically

affiliated with fads or frauds or things that might face technological

obsolescence—and you could be long the things that were ignored and unsexy but

were great businesses, because they had good fundamental value and low

expectations. And a lot of great investors over time just made that pairs

trade. They would go long great companies, and short the crowd favorites that

eventually would come back to reality.

Curmudgeon: Sadly, the Fed, global central banks, and (to

a lesser extent) the U.S. Treasury have nurtured a speculative mentality that

has turned fundamental stock investing upside down. Please see: Know-Nothings are the New

Wizards of Wall Street.

T

Rowe Price Warns of ‘free-form risk-taking’ in Buoyant Markets:

Bill Stromberg, the chief executive of T Rowe Price, warned

that investors should “step away from risk” to avoid being burnt in an

increasingly speculative market. He told the Financial Times, “Even if

they are a year too early. Because when the market unwinds, it will be areas of

risk that unwind the most.”

“Over last two years there has been a way above-average

amount of speculation. We’ve been in a

cycle where there has been very free-form risk-taking.” Widely tracked indices are being propped up

by a small handful of extremely large, overvalued companies, Stromberg said,

while much of the rest of the market is “picked over.”

“Investors should remain disciplined,” he said. “I can’t tell

you when that period of speculation will end, but it won’t be

sustained.” Investors need to seek out

active managers who “are willing to step away from risk” to avoid being

scalded, he added.

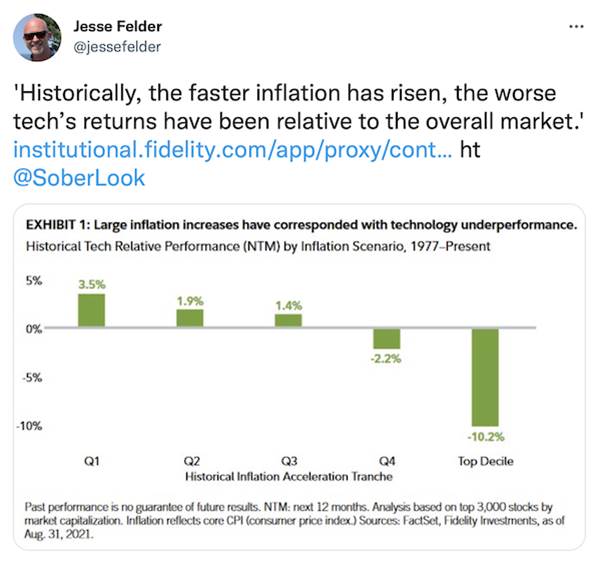

Fidelity: Could Technology’s Leadership Be Over?

Inflation had been exceptionally low for more than a decade

before jumping recently. This change may have important ramifications for sector

performance, and technology looks particularly vulnerable.

Curmudgeon: Victor and I

don’t think fossil fuels will be phased out for decades. That’s despite the UN

Secretary General saying that OECD countries should stop generating electricity

from coal by 2030 and the rest of the world by 2040.

Victor’s Conclusion:

Since 2008, the U.S. has not experienced a recession except

for the two-month (March to April 2020) coronavirus induced decline in

GDP. Unless the business cycle has been

repealed (?), a recession will come – perhaps sooner than most think.

The U.S. equity market is held up by five stocks (Apple,

Google/ Alphabet, Facebook, Microsoft, Tesla and Nvidia). Since the beginning

of 2021, they collectively accounted for more than a third of the rise in the

S&P 500.

When the long overdue recession arrives, Google, Facebook,

and other companies which get significant revenue from advertising will be sold

hard. The three other big tech high fliers will also decline. The S&P 500

and NDX 100 (NASDAQ 100) could be in a crash mode.

That scenario might happen if the Fed raises rates faster

than the markets expect. Or any negative

event that the Fed can't control (e.g., China invading Taiwan) could trigger a

stock market crash.

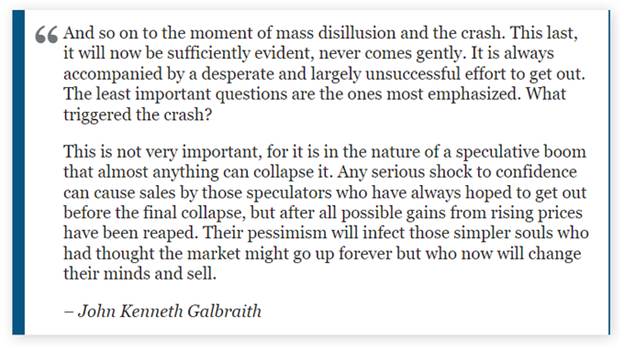

End Quotes:

“When the time comes to ask, ‘What triggered the crash?’,

the better question will actually be ‘What drove the bubble?’:

Fed-induced speculation. That’s where the lesson will be…. A crash is just

risk-aversion meeting a market that's priced for zero risk.”

John Hussman,

PhD and Manager of the Hussman funds.

...................................................................................................…

End Note:

We hope all readers are having a joyous, peaceful holiday

(despite Coronavirus anxiety). Wishing

all a happy, healthy, and prosperous new year. Let’s hope for a better 2022!

Stay healthy, enjoy

life, success, good luck and till next time….

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2021 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).