Know-Nothings

are the New Wizards of Wall Street

By the

Curmudgeon

Introduction:

Stocks, IPOs, SPACs, Real Estate, Cryptocurrencies, etc.

have all been experiencing the type of euphoria that are typically seen at

major market tops. We’ve chronicled all

those and more in previous Curmudgeon/Sperandeo posts, but that hasn’t

stopped the associated greed and speculation.

We constantly hear talk like: “It’s a

generational-buying moment,” or “retail investors defeat hedge funds,” or a

“new Roaring 20’s” is ahead, and (of course) “no risk of losses because the Fed

will always buy/bailout investors on any serious market decline.”

How long will such talk go on before the bubbles

eventually burst?

Risk is a Thing of the Past:

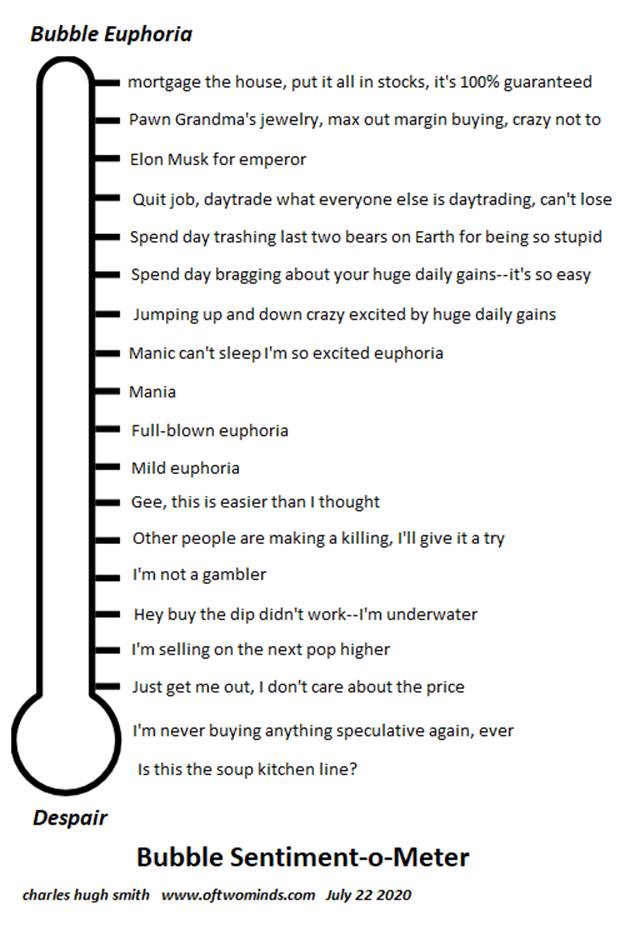

The underlying emotional mindset of today’s

“investing” crowd is best exemplified by this chart:

Perhaps, the most frustrating thing to this author is the discrediting of

financial professionals with decades of experience in both bull and bear

markets.

For most of the last 100+ years, those investors who

worked the hardest at learning the most, were disciplined, and had a great

respect for risk, were the most successful and admired stock market

participants. Now the glory often goes to those who know the least and don’t

even care. That has turned the traditional investing hierarchy upside down!

Why waste time and energy educating yourself about

stocks or the economy when sheer ignorance pays off so easily?

The March 2021 Elliott Wave Financial Forecast

reiterated that thesis:

A

backlash has emerged against the experienced professional, to the point that

someone with "a knowledge of history and value is eventually judged as an

impediment to success."

The April 2021 Elliott Wave Financial Forecast

added the following:

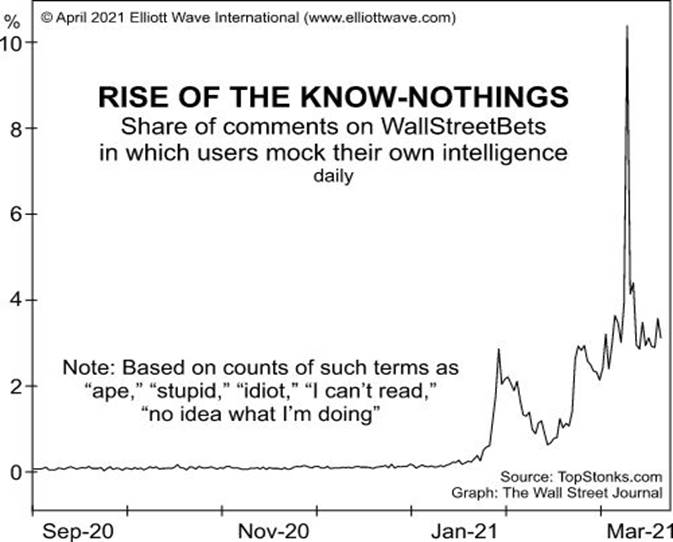

Newcomers

now revel in their ignorance. The chart below, from The Wall Street Journal,

shows the "Rise of the Know-Nothings." It's derived from the postings

on WallStreetBets' Reddit forum of GameStop fans.

In

the wake of GameStop's peak on January 28th, the percentage of those

professing stock market ignorance spiked to about 3% of those posting on

WallStreetBets. The use of terms such as "stupid," "idiot"

and "no idea what I'm doing" identified the know-nothings... The percentage

of know-nothing references [spiked] to a high of almost 11% on March 14. So,

the foundational basis for the New Era is idiocy.

Historically, such market psychology signals an end

-- not the beginning -- of a financial boom.

As we’ve noted many times, this time has been different, largely

due to the “free money party,” that has been perpetrated by the Fed (printing

money/QE + buying bonds/junk bond ETFs) and the U.S. Treasury (stimulus

payments used to speculate in stocks).

What could possibly go wrong?

Archegos Blow-Up and Leverage:

We believe a “black swan event,”like

cascading hedge fund blow-ups, could precipitate the end of multiple

bull markets followed by waterfall declines across the board as liquidity dries

up.

The Archegos hedge fund blow-up illustrates the

dangers that may lie ahead. Several

large investment banks were abruptly pummeled by a series of mysterious,

whale-sized trades. Goldman Sachs and Morgan Stanley — two Wall

Street powerhouses — were dumping multibillion-dollars’ worth of stock in

companies like Viacom and Discovery, the media companies.

Quickly, it emerged that the $50 billion fire sale

involved liquidating the assets of Archegos Capital Management, an

opaque family investment firm run by former hedge fund manager Bill

Hwang.

Hwang built up a huge position in derivatives on

stocks built on borrowed money. In late March, he was unable to offer his

bankers enough collateral to meet a margin call, so they were forced to quickly

liquidate his assets. Some banks took

humiliating, multibillion-dollar losses when they couldn’t sell Hwang’s positions

fast enough.

Last week, Credit Suisse Group asked investors

for up to $2 billion in fresh capital after losses from Archegos were

much more than previously disclosed. The

Swiss bank has been buffeted by the twin crises of the Archegos loss and the

collapse of another client, Greensill Capital. It said it would take

another $655 million charge related to Archegos, adding to a $4.7 billion

charge in the first quarter. Credit

Suisse said that it only had a small remaining exposure to Archegos after

selling 97% of its related positions by the end of last week.

Many knowledgeable analysts and investors believe

that the Archegos debacle is NOT a one-off situation but is symptomatic of

a broader and subtle danger to financial markets: leverage.

HSBC bond analyst Steven Major worries that the

Archegos affair signals that excessive leverage is a mounting risk.

“For all the best laid plans there are shocks we fail

to forecast and feedback loops that we cannot fully understand until after they

happen,” he observed in a recent report. “When leverage is the underlying

explanation behind what appears to be a series of individual episodes in

financial markets — the latest being Archegos — the narrative will

probably evolve from idiosyncratic to systemic risks.”

We’ll return to that theme later in this article.

Margin Debt Has Exploded:

In this recent Curmudgeon

post, we noted that:

In February

2021, margin debt [1.] jumped by another $15 billion to $813.68 billion,

according to FINRA. Over the past four months, margin debt has soared by $154

billion, a historic surge to historic highs. Compared to February last year,

margin debt has skyrocketed by $269 billion, or by nearly 50%.

Checking the FINRA website, we find that margin debt

increased ~$9 billion to $822.55 billion at the end of March 2021 – yet another

all-time high!

Note 1. Margin Debt

as used here is defined as “Debit Balances in Customers' Securities Margin

Accounts.”

It’s one thing to suffer a significant loss when one owns

shares outright, but quite another when speculator has leveraged their bets

using borrowed money.

“It’s very difficult not to be nervous. It’s classic stuff that after a

correction we’ll look back and say the signs were all there,” said Richard

Buxton, a veteran UK equity manager at Jupiter Asset Management.

The End Game for When the Music Stops:

Most “investors” don’t realize they’ve been playing a

game of Musical Chairs for years and are dancing

what seems to be never ending music. What

happens when the music stops and there are no more chairs left?

We envision a scenario where a black swan event

triggers "forced selling" by brokerage houses, when

"maintenance margin requirements" of hedge funds or family offices

are not met.

In a terrific article titled, “The Stock Market Is Just One Hedge Fund Blowup Away

from a Crash, Pam Martens writes:

Every

American should be up in arms over this (the Archegos fiasco) because the banks

involved with Archegos also own federally insured deposits. If those banks blow

up again because of their casino culture and tricked-up derivatives, it will be

the American taxpayer that once again has a gun put to their head to come to

the rescue — in a replay of the bailouts of 2008.

Five U.S. banks are holding $2.66 trillion in stocks and the

public has no idea if the stocks are actually owned by these banks or by

overleveraged, reckless hedge funds, which have a

history of blowing themselves up.

Three

of those five banks (JPMorgan Chase, Bank of America, and Citigroup’s Citibank)

are the three largest federally insured banks in the U.S. Together, the insured

banking units of these three financial institutions hold more than $4.8

trillion in deposits.

Many

large family office hedge funds are not reporting their stock holdings in a 13F

filing with the SEC and, thus, might have a similar type of derivative swap

contract with the banks, as did Archegos.

Furthermore, we think that the “buy the dip”

mentality, which has for so long dominated the average retail investor's stock

market activity, might result in many inexperienced and unsophisticated new

speculators (that never experienced a real bear market) to buy more stocks (or

call options) on margin.

The ensuing stock market decline could be further

exacerbated by the recent trend of selling put options with low premiums

(due to very low volatility and rock-bottom short-term interest rates). If the market drops suddenly, those put

options would increase exponentially creating large losses for naked options

speculators. There’s an old saying

(which has been ignored since at least March 2009): Never try to catch a falling knife!

The Great Taper May Have Already Started:

Bank of America Global Research predicts that the ultra-easy and unconventional monetary

policies of the world’s central banks will soon end.

To recap, BofA says there were a total of 201 central

bank interest rate cuts since February 2020 and 989 since the start of the

global financial crisis (GFC) in September 2008. Even more astonishing is that global

central banks purchased $1 billion of financial assets every hour since

February 2020 ($21 trillion since the GFC).

The issuance of U.S. Treasuries in 2021 will easily exceed the GDP of

Germany! And whom do you think bought most of those Treasury securities? THE FED!

BofA now forecasts ONLY $400 billion of global QE

from the big four central banks (Fed, ECB, BoJ, BOE) in 2022; down

substantially from $3.4 trillion in 2021 and $8.5 trillion in 2020.

Bank of Canada has already

taken the first step of tapering. Bank Governor Tiff Macklem said on April 21st

that purchases of government debt would be reduced by 25% to C$3 billion ($2.4

billion) and the timetable for a possible interest-rate increase would be

accelerated.

Could that be a leading indicator that global central

banks will start a tapering campaign? If

so, will the oceans of liquidity in the markets dry up accordingly?

Conclusions:

The combination of investor euphoria, leverage and

egregiously high valuations has proven a toxic mix many times in the past, from

Tulip Mania to the South Sea bubble to more modern stock market debacles like

1929-1932, 1973-74, 2000-2003, and 2008-2009.

Greed can quickly turn to fear when investors realize

that their profits are eroding fast, and that their leveraged positions

begin to take on an unexpected velocity of losses that catches most

speculators/ “investors” by surprise.

The market neophytes (which have never experienced a prolonged, grinding

bear market) will likely be in a state of shock - totally unprepared to deal

with the sudden negative emotions of denial, false hope, and wishful thinking.

Will this time be any different? Time will tell.

End Quote:

“Just remember, without discipline, a clear strategy,

and a concise plan, the speculator will fall into all the emotional pitfalls of

the market - jump from one stock to another, hold a losing position too long,

and cut out of a winner too soon, for no reason other than fear of losing

profit.

Greed, Fear, Impatience, Ignorance, and Hope will all

fight for mental dominance over the speculator. Then, after a few failures and

catastrophes the speculator may become demoralized, depressed, despondent, and

abandon the market and the chance to make a fortune from what the market has to

offer.” Jesse L. Livermore

Jesse Livermore started his first and only job as an employee

at the Paine Webber investment bank in Boston, MA. He soon earned more money

trading at bucket shops then at his official job. Livermore’s first big win came in 1901 (at

the age of 24) when he bought stock in Northern Pacific Railway. He turned

$10,000 into $500,000. He had a unique

respect for risk and emotional discipline.

………………………………………………………………………………………………

Stay calm, be healthy, optimism is the word, and till

next time……

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since 1971) to profit in

the ever changing and arcane world of markets, economies and government

policies. Victor started his Wall Street

career in 1966 and began trading for a living in 1968. As President and CEO of

Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and

development platform, which is used to create innovative solutions for

different futures markets, risk parameters and other factors.

Copyright © 2021 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).