Will

the Fed’s Monetary Naivete Allow Inflation to Spiral Out of Control?

By Victor

Sperandeo with the Curmudgeon

Introduction:

The Federal Reserve Board concluded its December

meeting on Wednesday, announcing it will speed up the taper of its enormous

asset-purchase program (i.e., the latest round of QE). The Fed also indicated

it sees as many as three rate hikes in 2022.

Victor provides some background on the Fed’s extraordinary

loose monetary policy and offers his opinion on what the Fed’s 2022 plan means

for the economy, inflation, and markets.

His hard-hitting conclusions are provocative and food for thought.

Recap of the Fed’s Revised Monetary Policy:

The Fed said it will double the size of the taper of its

latest QE program, which started at the outset of the pandemic in March 2020

and was $120 billion of asset purchase per month.

The QE reduction is from $15 Billion monthly announced in

November to $30 billion now. So, this

round of QE will end by March 2022. During

that two-year period, the Fed would have created fiat money totaling $2.565

trillion dollars! And that’s not

counting the money created to buy corporate bonds and High Yield ETFs during

the beginning of the pandemic.

With the 2022 projection of three Fed Funds increases

(ending that year at 0.75-1.00%), three increases in 2023 and two in 2024 would

bring Fed Funds to 2.5%.

Those Fed Funds increases are of course “jawboning” as no

guarantee of any rate increases are stated.

Fed Chairman Jerome Powell on Wednesday cited asset

valuations as one of four key areas the central bank looks at when

assessing financial stability risk. “I would say, asset valuations ... are

somewhat elevated,” Powell said. What

an understatement!

With the CPI greatly understated at 6.8% Year over Year (YoY)

and 11 monthly CPI increases averaging an annual 7.6% (as of November), what

would history suggest about this revised Fed monetary policy? Will it have a significant impact on price

increases or money supply growth (actual inflation)?

In this article, I will explain why the Fed’s new plan will

not stop price increases or inflation!

Can the Fed Control Inflation

if it’s in Denial?

“Inflation is a choice. It’s a choice for which the

Fed is chiefly responsible for. The risk of an inflationary spiral arises when

policy makers first dismiss the problem and then cast blame elsewhere,” said

Kevin Warsh in a superb WSJ

editorial.

The “choice” is how many fiat dollars does the Fed inject

into the economy? The Fed does NOT control prices -only money supply and

interest rates.

But here is the main problem: The Fed Chairman doesn’t

acknowledge what inflation is, so how could he end its rise?

From a David Lin article titles, Fed

Chair Jerome Powell says money printing doesn't lead to inflation:

In his testimony with

Congress on Wednesday, Federal Reserve Chairman Jerome Powell said that historically,

changes in the money supply level have not affected levels in inflation. In

response to a question posed by Congressman Warren Davidson about whether “M2

[money supply] going up by 25% in one year” is going to “diminish the value of

the U.S. dollar,” Powell responded, “there was a time when monetary policy

aggregates were important determinants of inflation (since from 900 AD on) and

that has not been the case for a long time.”

Powell added that “the

correlation between different aggregates [like] M2 and inflation is just very,

very low, and you see that now where inflation is at 1.4% (**) for this year. Inflation dynamics

evolve over time, but they don’t tend to change overnight.”

** By stating that inflation is at 1.4%, Powell is referring

to the PCE (Personal Consumption Expenditures index) for 2021 -not the

CPI.

This was virtually a criminal statement as it is so false.

No, the reason that reported inflation has been low is because M2 growth

(see FRED

M2) was very low.

Warsh concludes that “The U.S. central bank has enabled price

increases that may soon pose a risk to financial stability.”

The correlation between CPI and M2 is very high:

On 12/31/08, M2 was $8,229.8 trillion.

·

On 12/31/18, it was $14,666.8

Trillion.

-->So, in those 10 years, M2 grew at 5.95% while the CPI

advanced at 1.8%.

Since 12/31/18 to 10/31/21, M2 grew to $21,178.2, which was a

13.8% annual rate or 2.32 times faster than the previous 10 years. No wonder, the CPI has advanced 6.8% YoY –

the highest rate of increase in almost 40 years!

In 1981, the primary way inflation was stopped was to

decrease money supply (M2) growth.

That’s best stated in the Summary of this

article:

“During Paul Volcker's

tenure as its chairman (1979-1987) the U.S. Federal Reserve limited the rate of

growth in the U.S. money supply and increased short-term interest rates. These

policies are widely credited with bringing down inflation and, after a

recession in the early 1980s, leading to a prolonged period of economic

growth.”

CPI Would Be Higher if its Components Had Not Changed:

It should be noted that before 1982, the CPI calculation was

much different than today. According to ShadowStats,

if inflation was calculated based on the old formula, the CPI would be between

14 and 15%!

For example, the BLS categorizes “Housing” as “owners’

equivalent rent,” which is 22% of the CPI.

It’s up 3.5% this year, while home prices in 2021 increased by over 20%.

A better gauge of the real CPI is Import Prices, as

they are not adjusted (fudged) by the BLS.

Import prices are up 11.7% YoY!

Please understand that the CPI is a “cost of living index,”

which is calculated according to the whims of the BLS bureaucrats. It is NOT a

CONSTANT cost of a fixed basket of goods and services.

So all

inflation indexes are subjective and controlled by the U.S. government and its

agents. It is greatly in their interest to keep those price indices low.

If a law passed to pay

all members of Congress $200,000 per 1% rise in the CPI, I’m sure that the BLS

would make the CPI calculation similar to ShadowStats’

numbers. In that case, the CPI would

be closer to 15%, which would put an extra $3M in the pockets of the members of

Congress!

Will the Fed’s New Plan Work?

Again, do you think the Fed’s new policies arrest price

increases and stop inflation? Empirically NO! Let’s

look at history for a guide….

In December 1980, the Fed Funds rate closed at a yearly high

of 18.90%. CPI was +12.52% that year. Fed Funds ranged in the mid-teens all

year, with a low of 9.03% in July. Fed

Funds reached a high of 19.1% in 1981, as the CPI was 8.92% in 1981.

-->So, raising short term rates had little impact on

reducing the CPI.

It should also be noted that price increases come in waves as

inflationary psychology takes hold (till it’s broken by a significant reduction

in money supply growth):

·

From 1960-1964, CPI

compounded at 1.2%

·

From 1966-1970, at 4.59%

·

From 1971-1975, at 6.88%

·

From 1977-1981, at 10.06%

Flash forward to today: Fed Funds are at 0 to .25% with

import prices (our CPI proxy) increasing at 11.7%.

How in the world will a 1.75% Fed Funds rate in 2022 stop

inflation (money supply growth) or its result – price increases?

Discussion and Analysis:

Despite all

the above evidence, the Fed didn’t say anything about curtailing money supply

growth, which is THE prerequisite to stop price increases. But again, the Fed chair seems to be in

denial of that important relationship.

Raising short term interest rates to 1.75% means little to

the economy, but it has a great impact on equity markets. That is the real

issue.

Lowering money supply growth inevitably leads to higher

interest rates. However, raising rates

alone, while maintaining high money supply growth (>10%) will not stop price

increases.

Readers over 60 might remember this slogan: “The stock market

has predicted nine of the past five recessions—a joke from Paul Samuelson,

master Keynesian of decades ago (the Curmudgeon used his classic Economics

textbook in Economics 101 in the Fall of 1965).

Samuelson’s great rival on the supply-side, Wall Street

Journal editorial maestro Robert L. Bartley completed the thought when he

quipped, “and in the other four (stock market forecasts of recessions), Washington

got the message and mended its ways in time.”

For sure, the stock market is not the economy, even though

it’s one of the 10 Leading

Economic Indicators (LEI) from the Conference Board. Yet the Fed’s influence on the market has

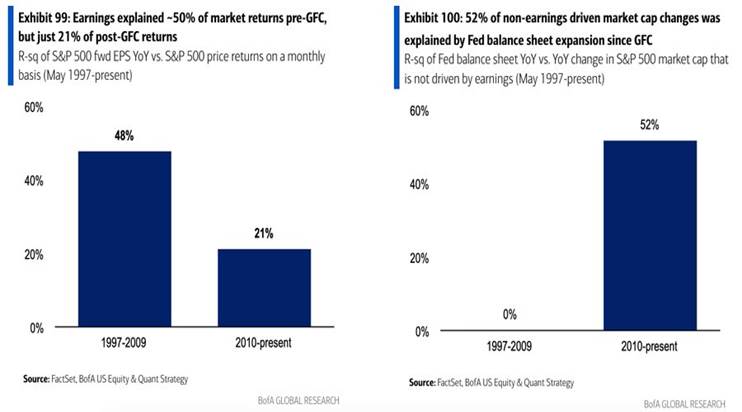

never been greater. As noted by the Curmudgeon in a recent blog

post, 52% of stock market cap changed were due to Fed balance sheet

expansion since the global financial crisis (GFC). Meanwhile, corporate earnings were only

responsible for 21% of post-GFC stock market returns.

That’s shown in these two charts:

Conclusions:

The newly announced Fed policy proposals are a sham. The Fed is trying to make it look like they

are doing something to reduce inflation.

They are not! They have spoken on

who they represent and it’s not the common man!

I sincerely believe, the Fed does not seem to care about the

average person’s financial struggle to survive, or the economy, or the

financial health of the U.S. Instead,

the Fed seems to focus on the credit, bond and stock markets and the wealth it

represents.

The Fed’s real mandate seems to come from its secret owners-

the top 1% of the population in wealth and power.

With over 400 PhD researchers working at the Fed, I’m not the

only one that understands reality.

→ Genghis Khan would be humbled by this group of empire

builders!

End Quote:

A great President said it best: “Inflation is as violent as a

mugger, as frightening as an armed robber, and as deadly as a hit man.” Ronald

Reagan, 40th president of the United States from 1981 to 1989.

...................................................................................................…

Stay healthy, enjoy

life, success, good luck and till next time….

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2021 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).