All

Aboard a Derailed Train; Russia-Ukraine-NATO Flash Point Bears Watching

By the Curmudgeon with Victor Sperandeo

Introduction:

Lots of quick takes and charts for your reading pleasure.

Victor comments on the heightened tensions between Russia and the west over

Ukraine. Let us know what you think by emailing the Curmudgeon at

ajwdct@gmail.com.

Market now is ‘crazier than the dotcom

era’, says Berkshire Hathaway vice-chairman Charlie Munger

The current equity market is “crazier than the dotcom boom,”

Berkshire Hathaway vice-chairman Charlie Munger told the Sohn Hearts &

Minds Investment Conference on Friday.

Interviewed by Caledonia chairman Mark Nelson, the

97-year-old Munger said the stock market now is the most extreme he had seen in

recent history. “Some of the valuations

we saw in the dotcom boom were higher,” he said. “But overall, I consider this

as being even crazier than the dotcom boom which blew up in 2000.”

Many companies were now trading on the U.S. stock market at

prices that represented 35 times earnings – making it much harder for

ordinary investors to make money on the market.

The higher prices now being paid for good companies made it more

difficult to get good returns.

“It is hard to get results which could be called normal

results in investing,” Mr. Munger said.

“I want to make money by selling people things that are good for them,

not things that are bad for them.”

Munger said the purveyors of crypto currencies were

“not thinking about the customer, they are just thinking about themselves.”

Mr. Munger said there were plenty of people around today who

were overconfident of their own abilities, particularly those paid for

their commentary or advice.

“The ordinary human experience is to be way overconfident in

your own ideas, particularly if you’ve worked hard for them and express them to

other people,” he said. “The world is full of insanely overconfident people and

of course they make lots of mistakes.”

Tweet from @sentimentrader:

All Aboard a Derailed Train

This week, speculators in major equity index futures bought

aggressively, moving to a net long position of over $100 billion. That's nearly

twice as large as any other position extreme, in either direction, ever.

CEOs

and Insiders Sell a Record $69 billion of their Stock

CEOs and corporate insiders have sold a record $69 billion in

stock in 2021, as looming tax hikes and lofty share prices encourage many to

take profits.

As of Monday, sales by insiders are up 30% from 2020 to $69

billion, and up 79% versus a 10-year average, according to InsiderScore/Verity.

The selling is likely to increase even more as December is

often an active month for sales due to tax planning.

Jeff Bezos sold $ 9.97 billion in Amazon stock, four times

the 2019 level, but in line with the 2020 level. Zuckerberg sold $ 4.47 billion

in Meta, while Google founders Larry Page and Sergey Brin sold about $ 1.5

billion in Alphabet shares. Microsoft

CEO Satya Nadella sold nearly half of his shares in the company for $285.4

million.

Gunjan

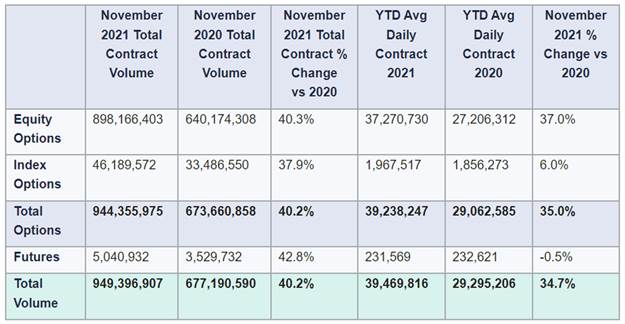

Banerji tweet – Record Run for U.S. Options Trading

Insane...record run for U.S. listed options market continues.

More than 940 million options changed hands in November, up 40% yoy and the highest monthly volume on record, according to

@OptionsClearing

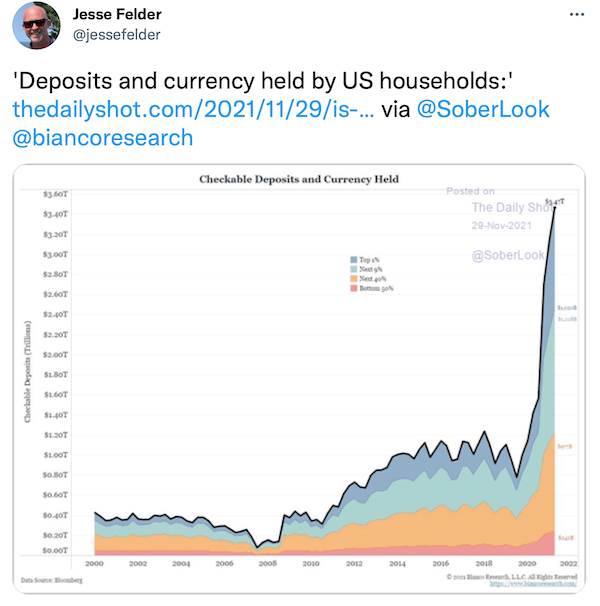

Tweet by Jesse Felder: Cash Held by

Public Spikes to Record High

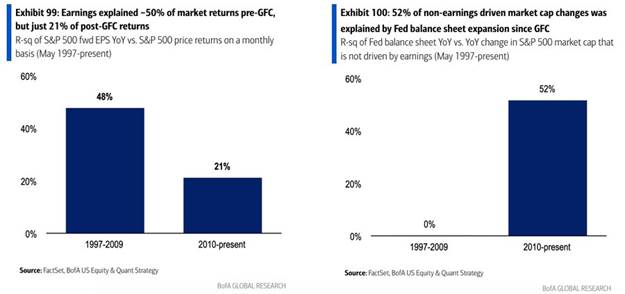

Tweet by Robin Wigglesworth – Fed (not earnings) Drive Stock

Market

Wild. Bank of America (BofA) estimates that corporate

earnings used to explain half of equity market returns up to the financial

crisis, but since then they explain only 21%.

Meanwhile, changes to the Fed's balance sheet explain 52% of

market returns since 2010, BofA estimates.

BofA Bearish for 2022:

BofA Global Research Chief Investment Strategist Michael

Hartnett is bearish on 2022, expecting a “rates

shock” and a tightening of financial conditions. Michael believes

the investment backdrop is similar to that seen in the

late ‘60s and early ‘70s when inflation and interest rates broke higher on high

budget deficits and points out that the winners then were real assets, real

estate, commodities, volatility, cash and EM while bonds, credit and equities

all struggled.

Other BofA Equity strategists largely agree,

suggesting the outlook for equities in 2022 is tepid at best. Sebastian Raedler sees downside for European equities on slower

growth and a withdrawal of monetary stimulus. He prefers defensives to

cyclicals and value over growth. Savita Subramanian

sees flattish U.S. returns ahead, pointing to Fed tightening, inflation and

rich valuations among other negatives, and is overweight energy, healthcare,

and financials and constructive on capex. Winnie Wu remains neutral on China

and Ajay Kapur is bullish on Asia (ex-China) and EM, but only until the

liquidity peak in March 2022.

The global rates team agrees that the liquidity situation is

about to turn, arguing that the peak in liquidity is likely just a quarter

away. They expect central bank balance sheet size to decline as well, with the

US Fed, the Eurosystem and the Bank of England all

expected to shrink their balance sheets to $18T by the end of ’23 from above

$20T in 1Q22. This would mean upward pressure on real rates and headwinds for

risk assets. And while key central banks begin a tightening cycle in 2022,

the BofA team believes that the Fed will have to hike more than expected, while

rate hikes in the Euro Area and in the UK will be slower than currently priced

into markets. Looking at the US, low rates have been a key driver for lofty

asset values, therefore higher rates will put pressure on asset prices and

activity, keeping the rate rise somewhat limited.

BofA economists and strategists predict robust GDP growth

with weak China the outlier; inflation is predicted to be above consensus but

like GDP should decelerate next 12 months; 3 Fed rate hikes forecast in '22

with 10-year Treasuries ending the year at 2%; US dollar and oil to remain

well-bid (oil peaks around $117/barrel in Q2), gold to appreciate (see Table 1

below).

Table 1: BofA Macro & Market Forecasts for 2021 and 2022

|

|

|||

S&P 500 rolling 10-yr % annualized returns since 1936:

Eric

Basmajian (@EPBResearch) Tweets: Charts Of The Week

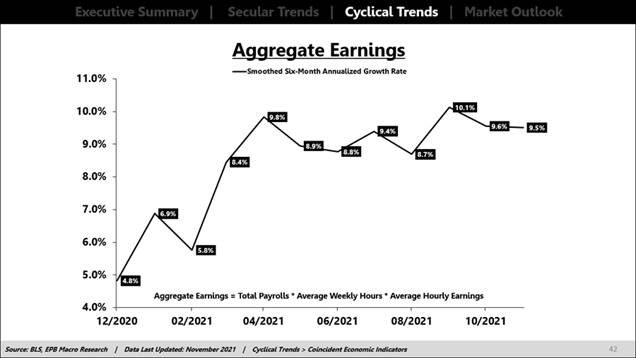

We can compile a metric called "Aggregate Earnings"

from the employment report, which takes total employees * average weekly hours

worked * average hourly earnings. The

product of these three data points represents aggregate weekly earnings. Aggregate

earnings are rising at a 9.5% annualized rate over the last six months, but how

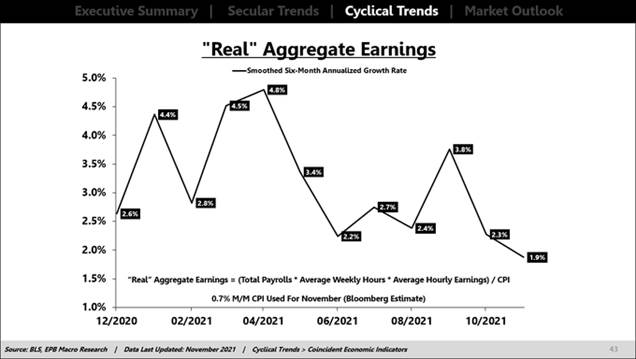

much of this is inflation? Using the

0.7% Month/Month estimate for the November CPI report, we can deflate aggregate

earnings and see that real aggregate earnings are only rising at a 1.9% rate.

Curmudgeon Comment:

Real earnings up only 1.9% vs S&P 500 total return over

30% in the past year? That dichotomy is greater,

because corporate earnings are overstated due to accounting tricks and EPS are

artificially boosted by share buybacks!

That makes stocks even more overvalued!

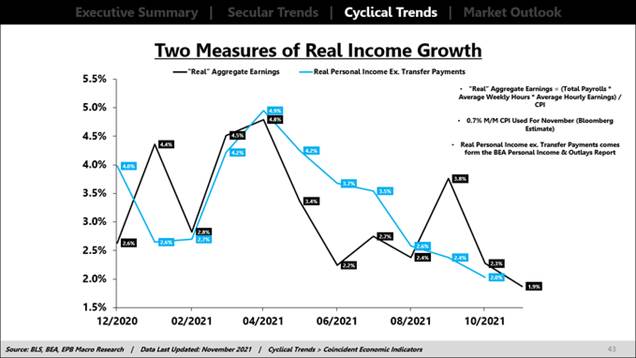

The persistent decline in real income growth is one of

the more critical trends impacting the consumer today as inflation

uncharacteristically rose in the early days of the recovery.

Curmudgeon Comment:

Compare the irony of declining real income (chart directly

above) with the record amount of cash/deposits held by

the public (Deposits and Currency Held chart from Jesse Felder’s earlier

tweet).

How did the public accumulate so much cash if real income has

declined? Answer via a tweet from the

St. Louis Fed:

“In an August survey of #LMI community stakeholders, 60% of

respondents noted that federal stimulus checks, small-business support,

unemployment benefits and rent relief were critically important for the

people and communities they serve.” http://ow.ly/TCEA50H3lAM

……………………………………………………………………………………………………...

Victor: Russia’s

Threats to Ukraine and NATO Could Lead to War

No one seems to be talking about a new threatening situation

that could lead to war. Russia has

placed troops on its border with Ukraine in preparation for a potential Russian

invasion of that country. NATO has also

been put on alert. It’s yet another important risk factor for investors to

consider.

U.S. intelligence has found the Kremlin is planning a

multi-front offensive in Ukraine as soon as early next year involving up to

175,000 troops, according to U.S. officials and an intelligence document

obtained by the Washington

Post. Half the military units that

would be involved in such an offensive had already arrived near Ukraine’s

border over the past month, a U.S. official said Friday.

In a chilling speech last Tuesday, Putin said Russia would be

“forced to act if its red lines" on Ukraine were crossed by NATO, saying

Moscow would view the deployment of certain offensive missile capabilities on

Ukrainian soil as a trigger.

"If some kind of strike systems

appear on the territory of Ukraine, the flight time to Moscow will be 7-10

minutes, and five minutes in the case of a hyper-sonic weapon being deployed.

Just imagine," said Putin.

"What are we to do in such a scenario? We will have to

then create something similar in relation to those who threaten us in that way.

And we can do that now,” he added.

U.S. President Biden and Putin will have a video call on December

7th to discuss this and related topics. "Biden will underscore U.S. concerns

with Russian military activities on the border with Ukraine and reaffirm the

United States' support for the sovereignty and territorial integrity of

Ukraine," White House spokesperson Jen Psaki said in a statement.

It’s been my experience that markets only react to the

outbreak of war; not to threats of same.

However, when markets are so extended and overvalued, this

Russia-Ukraine-NATO flare up will be watched closely.

Let’s wait for the outcome of that Biden-Putin video call

before re-assessing this geopolitical hot spot and the impact it might have on

financial and commodity markets.

End Quote:

“Price is what you pay. Value is what you get (or do not

get). Whether we're talking about socks or stocks, I like buying quality

merchandise when it is marked down.”

Warren

Buffet in a 2008 letter to shareholders.

...................................................................................................…

Stay healthy, enjoy

life, success, good luck and till next time….

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian, economist and financial innovator who has re-invented himself and the companies he's owned (since 1971) to profit in the ever changing and arcane world of markets, economies and government policies. Victor started his Wall Street career in 1966 and began trading for a living in 1968. As President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and development platform, which is used to create innovative solutions for different futures markets, risk parameters and other factors.

Copyright © 2021 by the Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing article(s) written by The Curmudgeon and Victor Sperandeo without providing the URL of the original posted article(s).