Eye Opening Charts and Commentary are a Wake-up Call

for Investors

By the Curmudgeon

Introduction:

Article excerpts and charts this week as selected by the

Curmudgeon. Hopefully, they’ll be a wake-up call or at least a sanity check for

bullish investors and speculators.

Victor’s thought-provoking comments are here.

Please email the Curmudgeon (ajwdct@gmail.com) to express your

interests, opinions, suggestions, comments, or concerns. Have a great week!

Stock, Bond and Real Estate Prices Are All

Uncomfortably High, by Robert Shiller

The prices of stocks, bonds, and real estate, the three major

asset classes in the United States, are all extremely high. In fact, the three

have never been this overpriced simultaneously in modern history.

Clearly, this is a time for investors to be cautious. Beyond

that, it is largely beyond our powers to predict. Consider this trifecta of

high prices:

·

Stocks. Prices in the American market have been elevated for years,

yet despite periodic interruptions, they have kept rising. A valuation measure

that I helped create — the cyclically adjusted price earnings (CAPE) ratio —

today is 37.1, the second highest it has been since my data begin in 1881. The

average CAPE since 1881 is only 17.2. The ratio (defined as the real share

price divided by the 10-year average of real earnings per share) peaked at 44.2

in December 1999, just before the collapse of the millennium stock market boom.

·

Bonds. The 10-year Treasury yield has been on a downtrend for 40

years, hitting a low of 0.52 percent in August 2020. Because bond prices and

yields move in opposite directions, that implies a record high for bond prices

as well. The yield is still low, and prices, on a historical basis, remain

quite high.

·

Real estate. The S&P/CoreLogic/Case-Shiller National Home Price

Index, which I helped develop, rose 17.7 percent, after correcting for

inflation, in the year that ended in July. That’s the highest 12-month increase

since these data begin in 1975. By this measure, real home prices nationally

have gone up 71 percent since February 2012. Prices this high provide a strong

incentive to build more houses — which could be expected eventually to bring

prices down. The price-to-construction cost ratio (using the Engineering News

Record Building Cost Index) is only slightly below the high reached at the peak

of the housing bubble, just before the Great Recession of 2007-9.

There are many popular explanations for these prices, but

none is adequate.

Curmudgeon Suggestion: consider

the illustration below (from the NY Times) as a comprehensive explanation. The three heads shown could be those of the

last three Fed Chairs – Powell, Yellen, and Bernanke.

Timing is important, yet it’s impossible to time the markets reliably. It would

be prudent, under these circumstances, for investors to make sure their

holdings are thoroughly diversified and to focus on less highly valued sectors

within broad asset classes that are already highly priced.

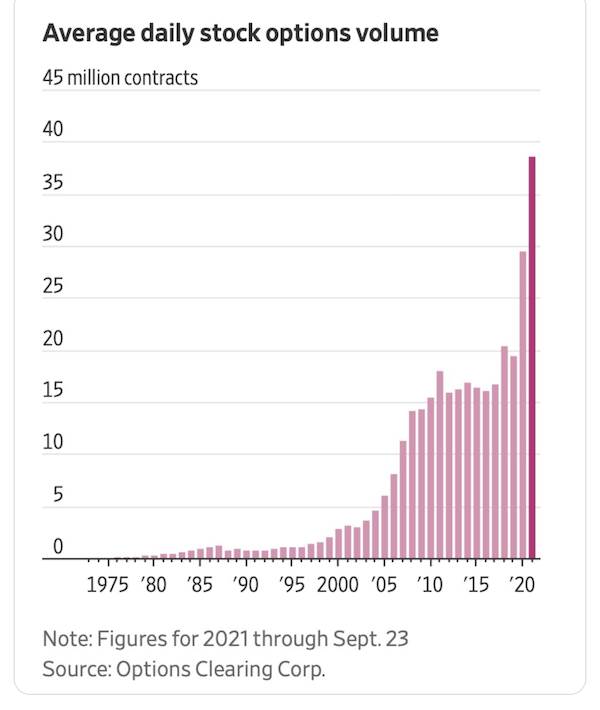

WSJ: Individuals Embrace Options Trading,

Turbocharging Stock Markets

Professional investors have long tracked the options market

for clues on the stock market’s next turn. Now, favored by individual investors

for its small upfront investments and potentially quick payoffs, options

trading is hitting levels never seen before.

At

times, options trading has dwarfed activity in stocks, creating leverage that

traders and analysts say stands to accentuate both up and down moves in the

market.

Nine

of 10 of the most-active call-options trading days in history have taken place

in 2021, Cboe Global Markets data show. Almost 39 million option contracts have

changed hands on an average day this year, up 31% from 2020 and the highest

level since the market’s inception in 1973, according to figures from the

Options Clearing Corp. By one measure,

options trading by individual investors has risen roughly fourfold over the

past five years, according to Cboe data.

“I’m

hooked on the options,” said Britt Keeler, a 40-year-old individual investor

based in Winter Park, FL. “You could lose it all really quick but you could

hustle and kinda hit the jackpot. Everyone

is using leverage. And they’re using it because you can make a ton more

money,” he said.

By

one measure, options activity is on track to surpass activity in the stock

market for the first time ever. In 2021, the daily average notional value

of traded single-stock options has exceeded $432 billion, compared with $404

billion of stocks, according to calculations by Cboe’s Henry Schwartz. This

would be the first year on record that the value of options changing hands

surpassed that of stocks, according to Cboe data going back to 2008.

Some

analysts say the zeal for options trading is translating to bigger swings in

individual stocks, and fueling the momentum behind many rallies. When

individual investors buy call options, the Wall Street firms that sell options

often hedge their positions by buying the shares, further contributing to

rising markets.

“It

creates a circular kind of melt up. It’s a reinforcing loop,” said Mr.

Karsan, of options activity in individual stocks. (Curmudgeon: Until the music stops!)

The

activity can also exacerbate downturns, traders say, though for much of the

past year the stock market has recorded a steady climb higher. The heavy

trading has made quarterly dates when options expire a focus point for many

investors, who say hedging activity around the contracts can fuel greater

instability in the stock market.

Short-term

trading using derivatives including options can increase the prospect of a

violent shakeout if individual stocks or major indexes take an abrupt turn,

traders and analysts say.

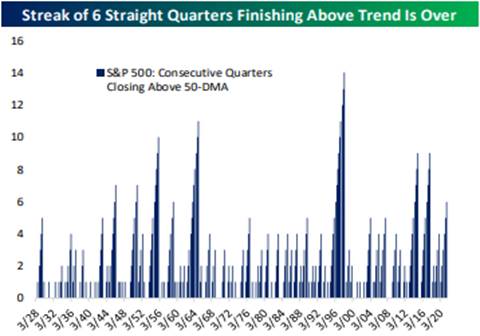

Bespoke: Charts of the Week

September proved to be a weak month for the broader market

just as it was last year. The drawdown in the S&P 500 snapped a six-quarter

streak of finishes above the 50-day moving average. While six straight quarters

of finishing above the 50-DMA is impressive, as shown in the chart below, it

wasn't close to a record streak.

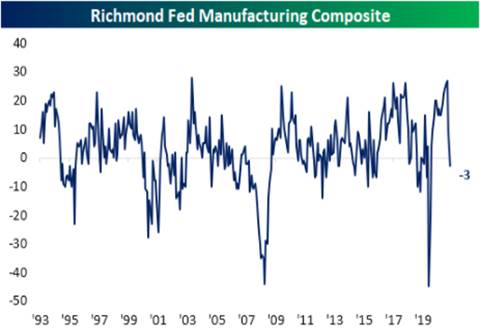

Richmond

Fed Manufacturing Composite turned in its first negative since the early

days of the pandemic. As this reading shows, companies are struggling to

produce the goods needed to meet consumer demand.

The Dallas Fed reported that its Manufacturing Business Activity

index fell to a level of 4.6. While

still positive and indicative of growth, this month's reading came in below

consensus forecasts.

Demand Is Not the Economy’s Problem. Supply Is, by

Mohamed A. El-Erian

Policy makers and central bankers are stuck in a mindset from

the last crisis and need to alter their thinking.

Cognitive traps (rear-view framing, confirmation bias, blind

spots, etc.) can slow the shift of policy makers’ focus to supply disruptions,

which have become the main cause of the economic malaise of today and tomorrow.

Instead, they reinforce some approaches, particularly in monetary policy, that

inadvertently amplify the stagflation winds that are starting to blow across a

growing number of countries.

Cognitive

biases are particularly problematic at a time of big changes in the operating

environment. This was clear in the aftermath of the 2008 financial crisis with

the overly cyclical economic mindset that delayed policy responses to what

constituted a structural and secular shock several years in the making. We are

seeing it today with one that is evolving too slowly from demand to supply.

Palm Valley Capital Management: Friends in Different

Places, by Eric Cinnamond

The

economy and financial markets could use a break from the Federal Reserve’s

“full-throttle” monetary policies. Stress is building with the economic and

asset price wheels spinning so fast there is a sense that at any moment

something could break. The Federal Reserve, in our opinion, has “QE’d” so hard

and for so long that their policies have become counterproductive.

Meanwhile,

Fed members attempt to justify current policies by claiming there is too much

slack in the labor market and inflation is transitory. The Fed’s views conflict

with some of the most pressing challenges workers and business owners are

experiencing.

Assuming

current trends continue, we expect the transitory inflation narrative will

eventually succumb to reality (persistant inflation) and threaten the Federal

Reserve’s ability to monetize debt and maintain negative real interest rates.

Without the Fed’s intrusive interference in the free markets, interest rates

would once again move freely, allowing asset prices to properly reflect their

underlying fundamentals. Ironically, instead of the Federal Reserve saving us

from inflation, we believe it will be inflation that saves us from the Federal

Reserve.

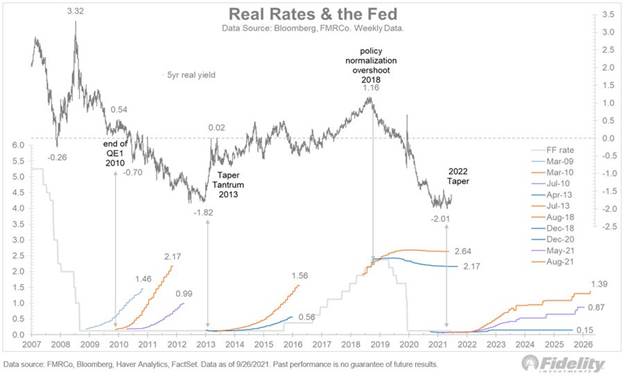

Tweets by Jurrien Timmer, Director of Global Macro

Research at Fidelity

Unless

inflation expectations rise along with nominals, real rates could become less

negative for a while. This chart shows that the 5-year real TIPS yield is about

where it was in the spring of 2013, when we had the original taper tantrum.

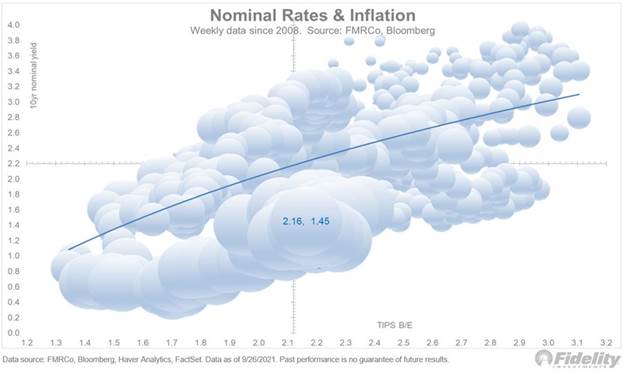

Given

the relationship between Treasury Inflation Protected Securities (TIPS)

break-evens and nominals, it’s possible that the 10-year yield could climb to a

2-handle if the Fed exits the scene. If so, that could cause some more

multiple-compression for equities.

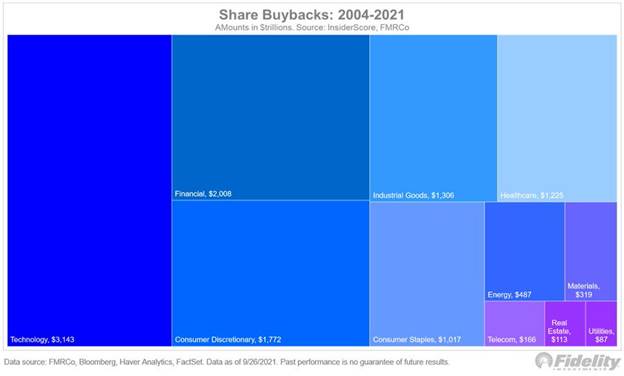

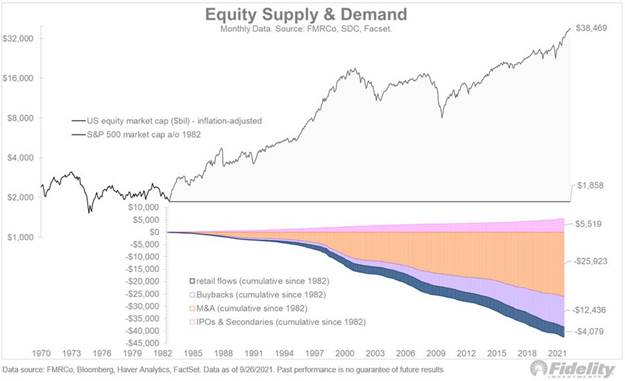

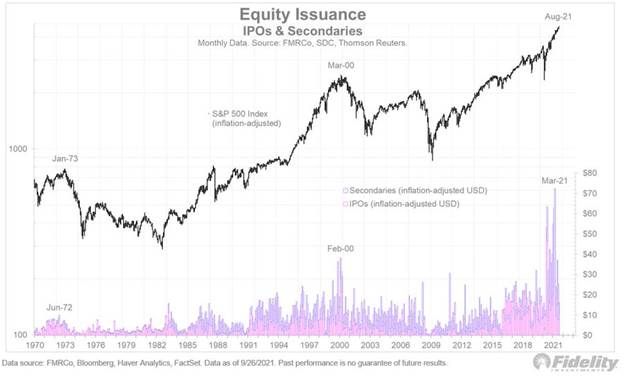

IPOs

and secondary offerings are surging, but share buybacks are strong also.

Over the years, the demand side of companies buying back their shares from

the public has outpaced the supply of companies selling their shares to the

public.

The

chart below shows cumulative share buybacks by sector. Since

2004, US companies have spent $11 trillion on repurchases, or about a fourth of

the market cap of publicly traded US equities. Wow.

The

chart below shows the cumulative stock supply and demand since 1982. I view the

early 1980s as the start of the modern financial era, so that seems like a good

place to start.

Price

is at the intersection of supply & demand. The chart below shows IPOs

and secondary issuance. With the surge of companies monetizing their value,

it’s tempting to draw parallels to 2000 and conclude that pretty soon the

stock market will be drowning in a sea of supply.

Real Investment Advice, by Lance Roberts

The data shows that nearly 40% of the time, two months of

positive performance gets followed by at least one month of negative

performance. Since 1871, there have only been 12-occurrences of 6-month or

greater stretches of positive returns before a negative month appeared.

For September, the S&P turned in a negative 4.89% return.

While the decline was average for a market correction period, the financial

media made it sound like the market just “crashed.”

If you didn’t like the recent decline, you have too much risk

in your portfolio. We suggest using any rally to the 50-dma next week to reduce

risk and rebalance your portfolio accordingly.

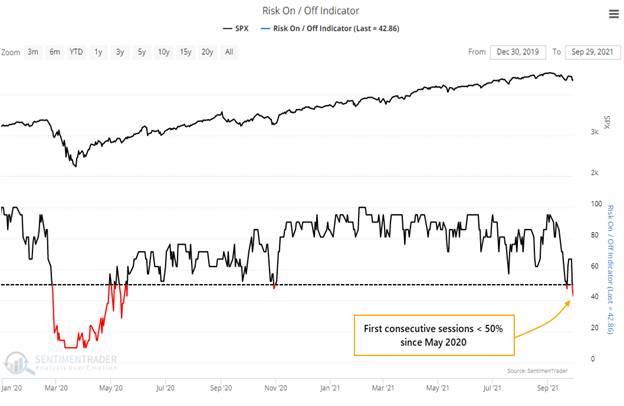

Tweet by Sentiment Trader- Has the tide really turned?

For the past 16 months, buyers came in the very next day

after investor behavior went to risk-off mode……. Until now. This just ended the longest streak of

risk-on behavior in 22 years.

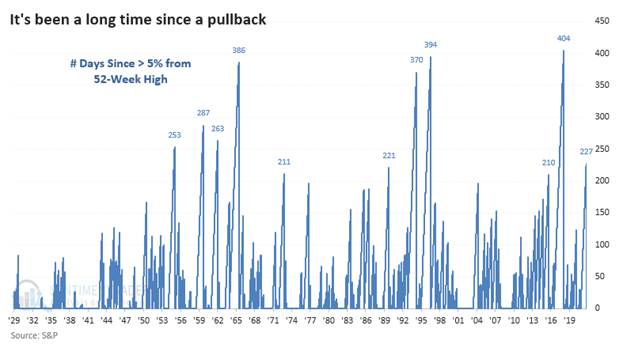

Sentiment Trader: S&P 500 Ends Streak

With

a loss to end the month, the S&P 500 finally ended its streak of 227 days

of being within 5% of a 52-week high. That was the 8th-longest streak of being

within 5% of a high since 1928.

The

S&P also ended its long streak of positive months. It was the first

lower monthly close in 7 months. That's not its longest streak but is one

of the longer ones when trading at an all-time high.

Fortune: Expect Stock Market Volatility in October, by

Anne Straders

In September, Bank of America's "Sell Side

Indicator," the firm's "contrarian measure of Wall Street's

bullishness on stocks, declined to 58.5%." That dip in bullishness

"resonates with our cautious market view, especially heading into the

[third quarter] earnings season, where multiple companies have already issued

disappointing guidance amid a worsening inflation environment," she wrote

in a Friday note to clients.

LPL's

Jeff Buchbinder argues "earnings is the big near term risk"

given how many companies have warned of supply chain issues, he told Fortune.

Meanwhile, although he notes there's a "low probability" of this

happening, Bunchbinder suggests that "if it looks like the Democrats

aren't going to get anything done" in October regarding passing an

infrastructure package, "we can see that as a risk to markets because

investors have priced in some of that spending," he suggests—even if

failing to pass it could mean some relief in terms of tax increases in the near

term.

End

Quote:

"The stock market is filled with individuals who know the price of

everything, but the value of nothing." — Phillip Fisher

.................................................................................................................................

Stay healthy, enjoy life, success, good luck and till next

time….

The Curmudgeon

ajwdct@gmail.com

Follow the

Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been

involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since 1971) to profit in

the ever changing and arcane world of markets, economies and government

policies. Victor started his Wall Street

career in 1966 and began trading for a living in 1968. As President and CEO of

Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and

development platform, which is used to create innovative solutions for

different futures markets, risk parameters and other factors.

Copyright © 2021 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).