Markets Celebrate

Excesses; Fed Chair Has Skin in the Game!

By the Curmudgeon

with Victor Sperandeo

Introduction:

At Jackson Hole, WY on Friday, Fed Chair Jerome Powell

reiterated the Fed could start tapering its asset purchases this year and

short-term interest rates aren't changing anytime soon. Stocks hit record highs (on very low volume)

during the speech as investors yet again shrugged off fears of an early pullback

in Fed support.

Powell didnt provide a specific timeline for

starting scaling back the Feds $120 billion-per-month in bond buying, a

program started last year in response to the Covid-19 crisis. While the economy

is on a strong path forward, the Fed will be carefully assessing incoming data

to see how risks like the delta variant of the virus might impact progress

toward its goals, Powell said.

How many times have we heard that gobbledygook? Its amazing to this old timer how events

that were supposedly discounted weeks ago are celebrated by the market when

they play out as expected. Worse, is when the often-celebrated event doesnt

live up to expectations or is a bust (like the U.S.-China trade deal), there is

never a sell-off to return to reality!

In addition to the Fed being the ultimate wealth

inequality machine, new research suggests that its policies have discouraged

productive investments in the real economy. Also, theres an inherent conflict

of interest for Fed Chair Powell never disclosed. Much, much more, including Victors incisive

comments and conclusions.

QUICK TAKES:

Fed Decries a Wealth Gap It Helps Perpetuate,

by Lisa Abramowiczs of Bloomberg:

The longer the central bank continues ultra-easy

monetary conditions, the more the richest families benefit disproportionately.

Federal Reserve officials often decry the

unprecedented disparity between the wealthy and poor. But they usually avoid

mentioning the direct role they have played in widening these financial

disparities over the past few decades.

The Fed is actively making the wealth gap more

pronounced. Its policy of keeping interest rates near zero and buying trillions

of dollars of bonds has suppressed volatility and turbocharged asset prices,

fueling some of the biggest stock and bond returns in history. As of March, the top 10% of wealthiest U.S.

households owned an unprecedented 89% of all corporate and mutual fund shares

outstanding. That compares with 84% 15 years ago, before the central bank

embarked on any of its quantitative easing programs, Fed data show.

(And what weve argued for years): February research,

The Savings Glut of the Rich by Atif Mian of Princeton University,

Ludwig Straub of Harvard University and Amir Sufi of the University of Chicago,

suggests that the lopsided distribution of wealth is more than a social

issue; its dissuading productive investment. Instead, the study shows

that wealthy people are parking more of their cash in debt funds, which account

for a significant proportion of lending to U.S. governments and households.

Basically, the U.S. and lower-income families are becoming more indebted, rich

people have more money tied up in debt funds, and less money goes toward

fostering innovation and prosperity.

.

(Powell has) Skin in the Game: FOMC Style,

by Dylan Grice

According to disclosures required by the Orwellian-sounding Office

of Government Ethics, FOMC Chair Jerome Powells private

incentives are for continued inflation of asset prices.

The OGE requires members of the executive to file

278e forms disclosing the source of all income and assets beyond their public

pay. The precise dollar value of holdings isnt disclosed in the reports, but

broad ranges are.

Its difficult to see where Jerome Powells incentive

is to remove the punch bowl as the party is getting started

(William McChesney Martins October 1955 speech). It's very easy, in contrast, to see his

incentive to add an extra kick to it. Why? Powells net worth is heavily

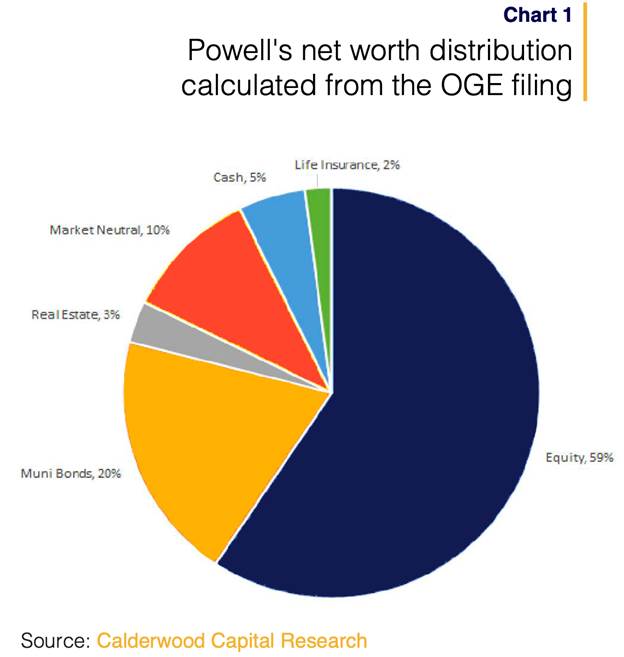

invested in financial assets as per this chart:

We find it noteworthy that around 60% of Powells net

investable worth is in (primarily U.S.) equities, a share which is likely much

higher today given the stellar performance of U.S. equities since the filing

(+39% for the S&P 500).

Equally important is what is absent from the

portfolio. In particular, we find it interesting that Powell owns no

Treasuries. True, theres an exposure to a more tax-efficient version

municipal bonds , but if Powells portfolio is a variant on the classic 60-40,

theres a very clear under weighting of nominal assets relative to that

framework.

Fed Chairman Powell is no different than any other public

official connected to the U.S. government.

They all use their knowledge of inside information for personal

gain. While Martha Stewart went to jail

for insider trading, no one in the U.S. government went to jail for over 12

years.

I submit that the Fed Chair and any member of the FOMC should

have their assets managed by a Blind Trust! That would eliminate any conflicts

of interest.

.

Almost Daily Grant - QE Progress Report:

Reserve bank credit, or

interest-bearing assets on the Fed balance sheet, rose to $8.32 trillion,

up $26 billion from a week ago. That

$8.32 trillion figure represents a 19% year-over-year increase, and 122% higher

than the Feds holdings in August 2019.

The Peoples Bank of China warned in its

quarterly monetary policy report earlier this month that the U.S. faces the

most severe inflation risk of any major economy, thanks to the

fast-growing gap between the money supply and economic output. A bearish pivot

from the Middle Kingdom would be no small development: China itself holds

some $1 trillion in Treasury's, equivalent to 4.5% of total supply. Foreign

creditors as a whole hold a record $7.2 trillion, or one-third of the public

debt (The Fed owns ~ 25% of all Treasurys outstanding).

...

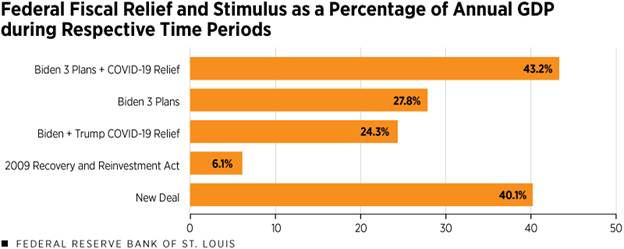

St Louis Fed:

Recent U.S. Government Stimulus vs New Deal

Curmudgeon Comment: So, any

way you cut the cake, recent U.S. Federal Stimulus programs have been greater

than New Deal government spending after the Great Depression and 7 times

spending for the 2009 Recovery and Reinvestment Act!

.

In 2021 so far, U.S. M&A deals have already

nearly reached 2020 levels, with 2,320 deals through Q221 compared to 2,933 in

all of 2020.

Most mergers in the U.S. are never looked at by

regulators! Slightly more than 2,000 deals were filed to government antitrust

enforcers between October 2018 and September 2019, the most recent period

reported by the FTC and the Justice Department, which share antitrust duties.

The government reviews account for about 10% of nearly 22,000 acquisitions or

company investments announced in that period involving a U.S. company,

according to data compiled by Bloomberg.

...

..

..

..

..

..

..

..

....

..

..

..

..

..

..

..

..

..

..

.

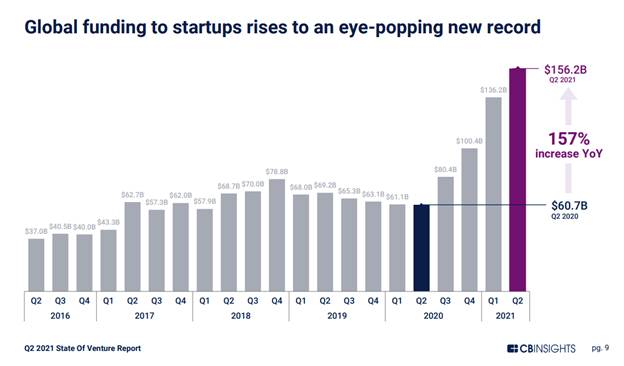

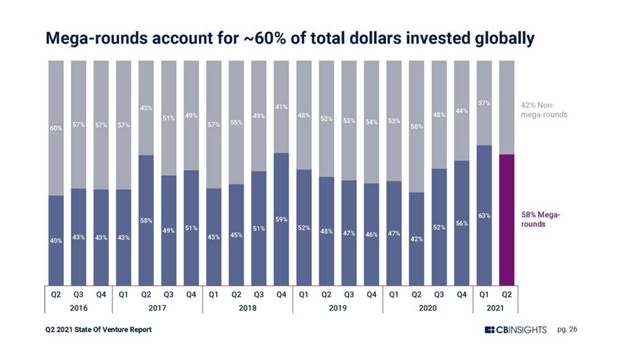

CB Insights- VC Bull Market (via email):

Startups had a blockbuster quarter for funding in Q22021,

raising $156B in funding. Investors piled onto mega-rounds the $100M+ deals accounted for roughly 60% of total dollars

invested globally.

An outpouring of mega-rounds has helped drive the surge in

venture dollars, with mega-rounds accounting for 58% of total funding in the

second quarter.

In fact, in Q22021, the number of $100M+ rounds

nearly tripled, hitting an all-time high of 390. This is the second quarter to

surpass the 300 mark, with the previous record held by Q12021s 367

mega-rounds.

Exits in the quarter also reached an all-time high, with

2,893 IPOs and M&As a 109% YoY increase. Didi Chuxings IPO at a

valuation of $73B was the largest exit of the quarter.

.

August 2021 Elliott Wave Global Market Perspective:

We have little doubt that it will take a long period

of austerity to correct the world's multi-generational debt binge...

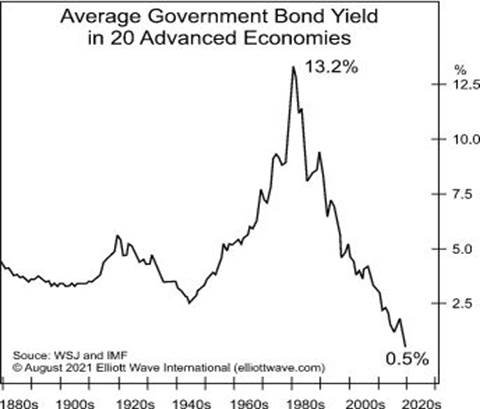

The chart below illustrates the interest-rate

environment that holds together this global house of cards. In July, the

average interest rate across 20 [advanced] economies fell to 0.5%, a new low

(by far) dating back at least a century.

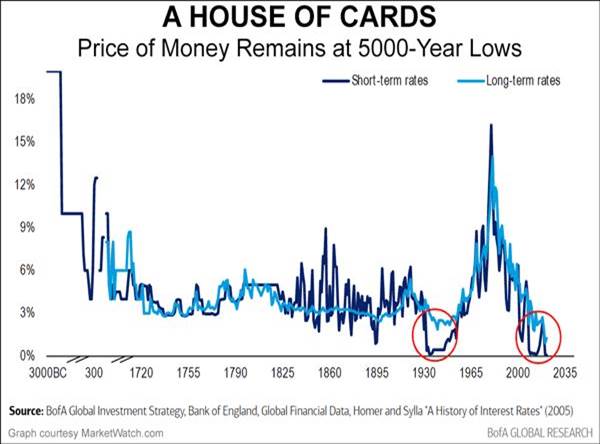

This chart below is a version of one published by Sidney Homer and Richard

Sylla in their 2005 book: A History of Interest Rates. Astoundingly, it

shows a potential 5,000-year low in both short-term interest rates and

long-term interest rates.

When interest rates start to rise, and it becomes difficult to service debt, a

brutal austerity will be the order of the day.

Curmudgeon Comment: As

Victor and I have stated so many times, there will be a huge price to pay

for the Feds debt monetization that has repressed interest rates for so

long and inflated so many bubbles. See

Victors Conclusions below.

Research shows that hangovers tend to worsen over

time during periods of heavy drinking.

Yet the Fed has disregarded that maxim as it continues to figuratively

spike the punch bowl with high proof alcohol!

At some point in time, foreigners will lose

confidence in the U.S. dollar, sell Treasurys in droves and crash the

greenback. That will cause interest

rates to skyrocket along with U.S. debt service costs. That, in turn, could set of more dollar

selling.

--> Its inevitable that the U.S. dollar will

lose its great privilege as the worlds reserve currency. DoubleLines Jeffery Gundlach certainly agrees.

.

Victor - Its All About the Money:

Lets review some recent financial history:

- From

June 2009 (the beginning of the economic recovery) till the end of 2018,

the M2 Money Supply increased from $8,440.9 Trillion to $14,377.2

for a compounded increase of 5.76%.

- The

Fed Funds interest rate went from a 0 to 0.25% range from June 2009

till Dec. 2015. It moved up 0.25%

again in Dec. 2016 and 2% more (till Dec. 19, 2018) to a 2.25-2.50%

range. That was a total of eight

Fed Fund rate increases after Trump was elected.

- Also

under Trumps tenure, the Fed reduced its balance sheet by -9.9%

compounded (from 1/25/17 to 7/10/19) without any increase in inflation

(CPI was 1.49% during the above time period).

- From

Dec. 2018 to June 2021, the M2 money supply increased from

$14,377.2 to $20,431.3 a 15% compounded rise or 2.6 times (compounded

increase) for the previous 9.5 years.

- During

this entire time period, money velocity crashed (due to ZIRP and

the Fed paying interest on bank reserves). That led to a CPI of 1.92%

(below the Feds 2% target) from 12/31/16 till the end of 2020.

Fast forward to July 2021: Due to the

incredible, stupendous increase in bank reserves, monetary base and M2 (since

March 2020 when the Fed intervened as credit markets froze), the CPI has

averaged 6.6% for the first seven months of this year. Thats an annual

inflation rate of 7.9%!

Victors Conclusions:

MMT proponents say a country can print any amount of

money (fiat currency) it desires to pay for huge government spending and budget

deficits. [For reference, please read MMT

When Theories Collide with Reality]

As weve clearly seen, the major consequence of such

money created out of thin air is soaring investment markets and bubbles

inflating everywhere. That benefits the

owners of the FED, Chairman Powell, and other asset holders, but it doesnt do

much for the real economy (see Fed Decries a Wealth Gap It Helps Perpetuate above).

The current mix of U.S. government fiscal policies

and Fed monetary policies are a systemic risk to everyones way of life. Its a

game of musical chairs where the Fed finances huge government budget deficits

seemingly without consequences, while asset prices rise nonstop to ever greater

bubbles.

Sadly, it has to end with an eventual collapse of the

financial system and the U.S. as a Constitutional Republic, then warping into a

dictatorship when hyperinflation or bankruptcy conclude this madness. But no

one can predict when that might happen?

End Quote:

History shows that the overturning of a government

structure also comes with the death of the people who have most benefited from

it. A great example is the French

Revolution as per the following quote.

Little by little, the old world crumbled, and not

once did the king imagine that some of the pieces might fall on him.

........................................................................................

Stay healthy, enjoy

life, success, good luck and till next time

.

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since 1971) to profit in

the ever changing and arcane world of markets, economies and government

policies. Victor started his Wall Street

career in 1966 and began trading for a living in 1968. As President and CEO of

Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and

development platform, which is used to create innovative solutions for

different futures markets, risk parameters and other factors.

Copyright © 2021 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).