Inflation, Debt Monetization, MMT; “Earnings are Pesky

Details”

By the Curmudgeon with Victor

Sperandeo

Introduction:

Regretfully, we've run out of fresh insights to share with

readers about the totally dysfunctional U.S. monetary/fiscal policies, corruption and "off the wall" markets.

All that Victor and I have learned about the economy and markets

(combined 110 years of experience) now appears to be obsolete, useless and mostly

counter-productive.

Therefore, we present illuminating charts and excerpts

of what others are saying about the extent of the overt manipulation of

markets, the resulting distortion of their values, and the "Alice in

Wonderland" way they now work. Victor

weighs in with a few choice comments.

.....................................................................................................

WSJ OpEd - How the Fed Is Hedging

Its Inflation Bet:

The Fed has bought (or offset by buying similar maturity mortgage backed

securities) 76.4% of all the federal debt issued during the pandemic, almost

nine times the share of federal debt purchased by the Fed during World War II.

The Fed now holds 33.6% of all publicly held federal debt, roughly the same

percentage of the debt held by all other American investors combined. The Fed

also holds 35% of all federally insured mortgage-backed securities.

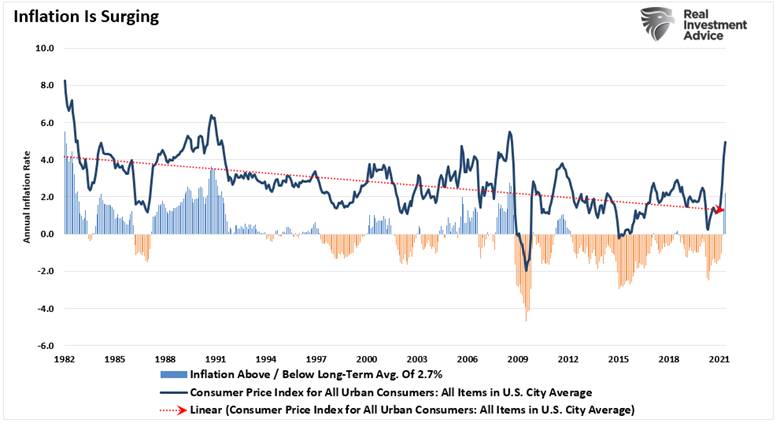

Victor: Is Inflation Transitory?

The discussion of inflation being “transitory" or

not is laughable if it wasn’t so important. Since inflation is a monetary

phenomenon, this question should be based on the CAUSE of prices moving

higher or lower. Therefore, the question

of will price increases slow from the current level should be restated as:

“Will Fed Chairman Powell slow the quantity of QE/money printing?"

Of course not! Thereby, inflation will NOT BE

TRANSITORY!!! Yes, prices in some areas

will slow and some will increase, but that is not inflation.

If the stock market rises and house prices (not included

in the CPI calculation) increase 17% next year will that be considered

“inflation?” No, but many non-stock owners will be priced out of buying a home. Do you think that's good

for main street?

Biden's Neo-Populist Economic Doctrine, by Nouriel

Roubini:

The United States has moved into a de facto, if not de

jure, state of permanent debt monetization – a policy that began under

President Trump and Fed Chair Jerome Powell.

Under this arrangement, if inflation were to rise

moderately, the Fed would have to adopt a policy of benign neglect, because the

alternative – a tight anti-inflation monetary policy – would trigger a market

crash and a severe recession. This change in the Fed’s stance represents

another sharp break from the 1991-2016 era.

Furthermore, given America’s large twin deficits, the

Biden administration has given up on pursuing a strong-dollar policy. While it

does not favor a weaker greenback as openly as Trump did, it certainly would

not mind a currency shift that could restore US competitiveness and reduce the

country’s surging trade deficit [1.].

Note 1: The U.S. international trade deficit in goods and services increased to $75.7 billion in June from $71

billion in May (revised), as imports increased more than exports. (August 5,

2021). Year-to-date, the goods and services deficit increased $135.8 billion,

or 46.4 percent, from the same period in 2020. The trade deficit was $451

billion for all of fiscal year 2020.

Real Investment Advice MacroView: MMT – When Theories Collide With Reality:

There is no doubt that since 2020 both Republicans and

Democrats alike have shunned fiscal responsibility for the short-term

gratification of MMT (Modern Monetary Theory).

From the $2.2 trillion CARES Act to the $900 billion

HERO Act, to President Biden’s $1.9 trillion American Rescue Plan, the

government has plunged into MMT with both feet.

If you are unfamiliar with MMT, Stephanie Kelton,

PhD and Stony Brook University Professor, describes it as a macroeconomic

school of thought or paradigm that explains how a sovereign country that

controls its currency behaves. Stephanie explains:

“MMT starts with a simple observation, and that is that

the U.S. dollar is a simple public monopoly. In other words, the United States

currency comes from the United States government; it can’t come from anywhere

else. So, what that means is that the federal government is nothing like a

household.

For households or private businesses to spend they’ve

got to come up with the money, right? And the federal government can never run

out of money. It cannot face a solvency problem with bills coming due that it

can’t afford to pay. So it never has to worry about finding the money to be

able to spend.”

However, while the Government can indeed “print money

to meet all obligations,” it does NOT mean there are no consequences.

Victor's MMT Rebuttal:

Let me reiterate that in the history of the world

(since 900 AD), all fiat currencies die. I've discussed this in detail here and here. Thereby, Stephanie Kelton's thesis on unconstrained money printing

with no consequences is false. MMT will eventually cause hyperinflation, as It always

has. To think differently is the definition of “insanity.”

....................................................................................................

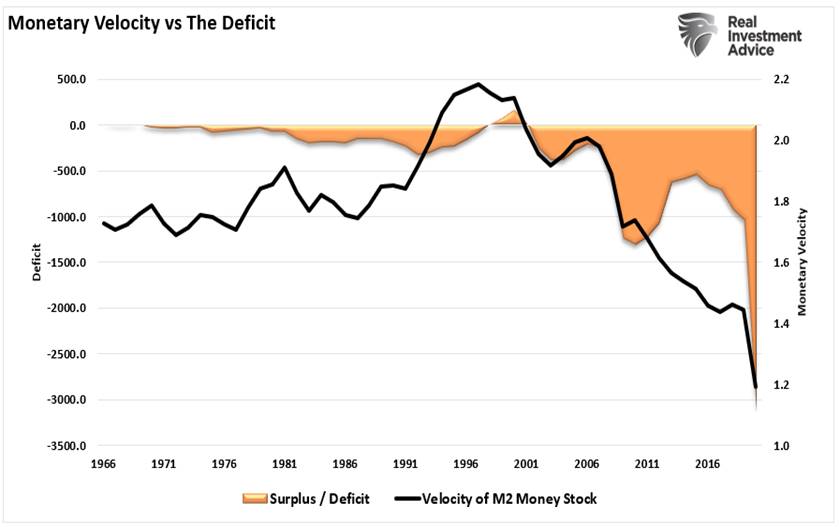

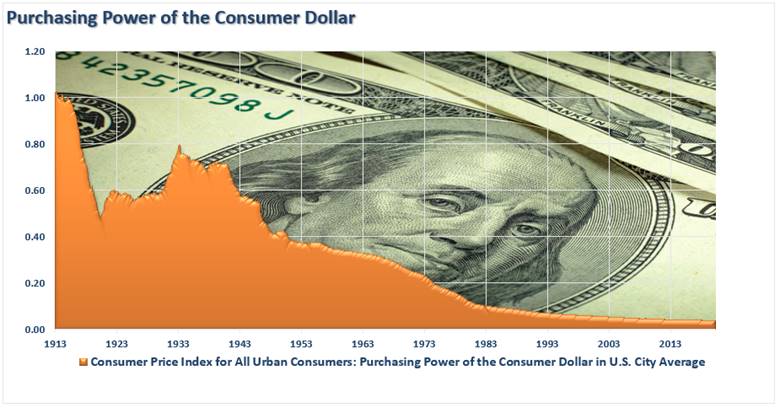

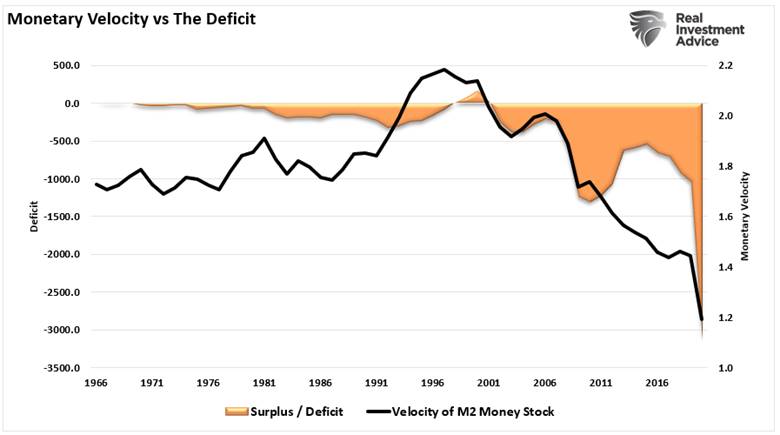

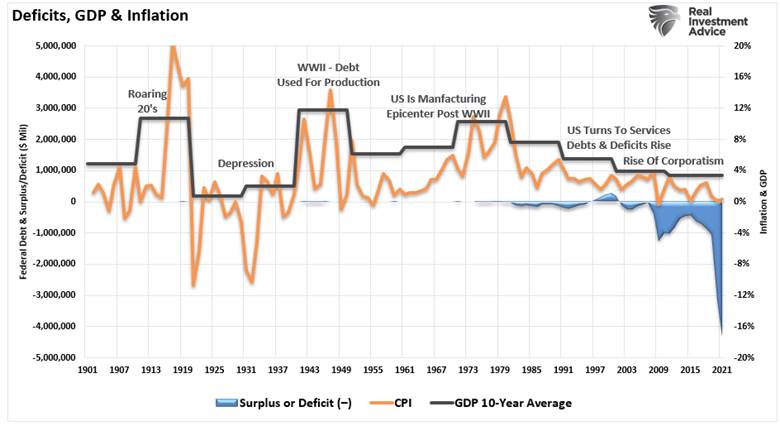

Here are a few charts to illustrate the false premise of "money

printing" to finance budget deficits without any negative effects:

Curmudgeon Note:

In a presentation published on August 5th, the Congressional Budget Office detailed its recent projection that the federal budget deficit would hit $3

trillion this year and average $1.2 trillion per year through 2031.

The allure of MMT is strong amid the current

economic upheavals. Such is particularly the case since it makes possible every

progressive program from unlimited public works, federal jobs, uneconomic green

energy schemes, “Medicare for all,” free college, free housing, and a host of

others. However, as the Mises Institutes correctly notes:

“The promise of something for nothing will

never lose its luster. So MMT should be viewed as a form of political

propaganda rather than any real economic or public policy. And like all

propaganda, we must fight it with appeals to reality. MMT, where deficits don’t

matter, is an unreal place.”

We will likely continue to pay the price of misguided

economic policies that only work in the mathematical formulas generated in

“Ivory Towers.” Still, in the “real world,” these theories, while well

intentioned, always yield a negative result for those it was supposed to

help.

..............................................................................................

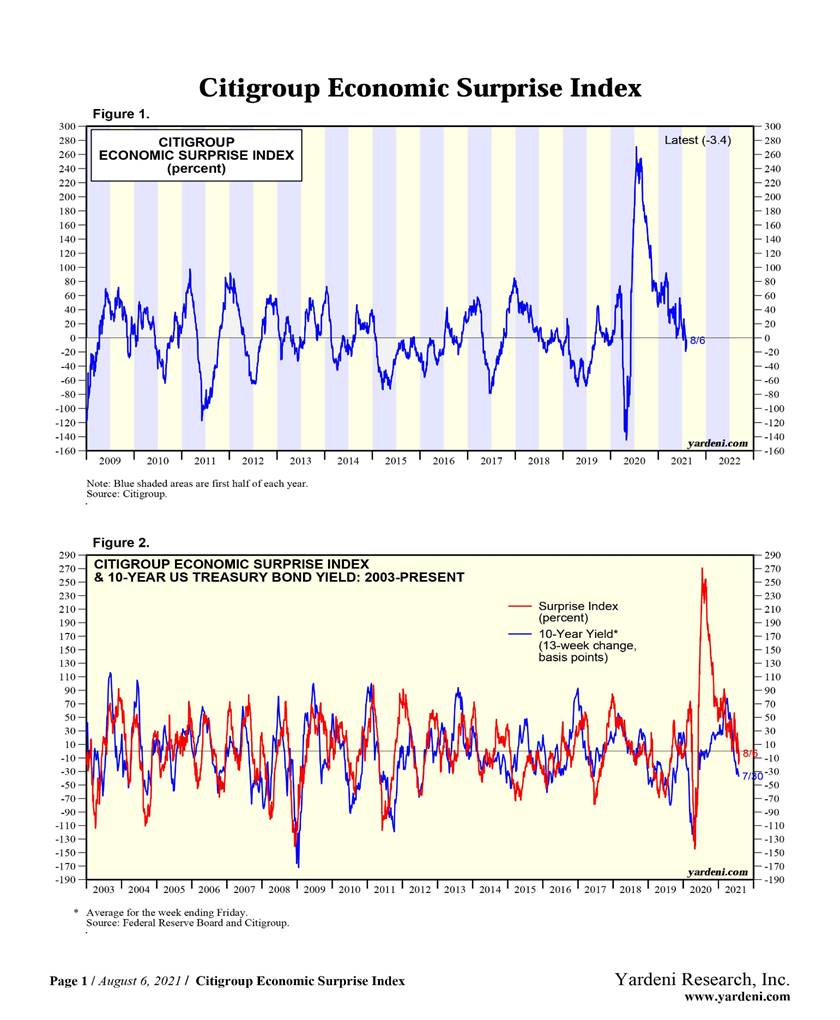

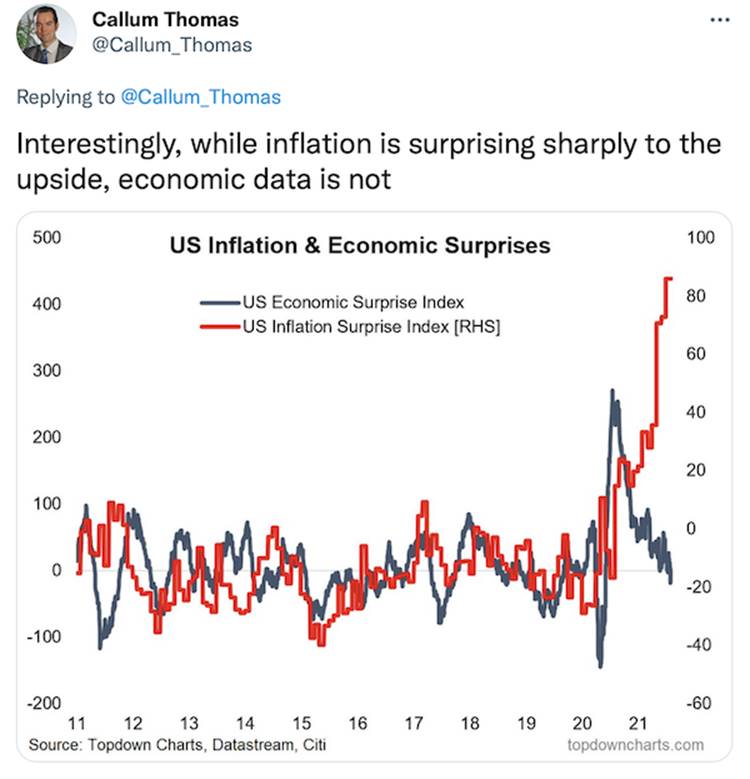

Citi's Economic Surprise Index: Straight line decline and now negative!

The Citi Economic Surprise Index measures the

pace at which economic indicators are coming in ahead of or below consensus

forecasts. When the index is negative, it means that the majority of reports

are coming in below expectations, while a positive reading indicates that most

data is coming in ahead of expectations.

Having peaked at 275 in the 3rd Quarter 2020, a straight line decline

took the index negative this week. The

current reading is -3.4, as of August 7, 2021.

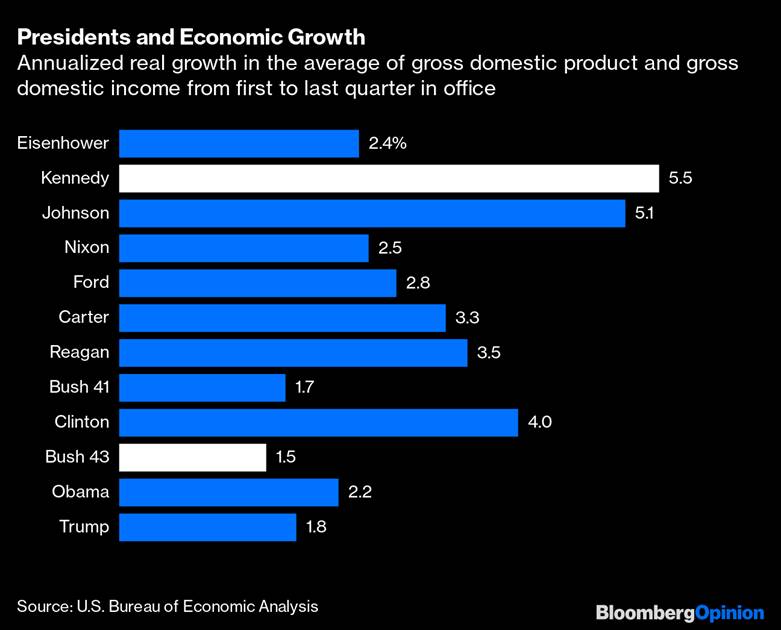

Bloomberg Opinion: Weak U.S. Economic Growth

for Decades

Curmudgeon Comment: It's ironic that this

period of exceptionally slow economic growth has coincided with the longest and

strongest U.S. equity bull market of all time.

.................................................................................................

SOGEN's Albert Edwards in a note to clients:

Real yields continue to collapse

to new record negative lows, falling in the US below MINUS 1.2%.

Chairman Powell was at a loss to explain the drivers behind this recent decline

in yields, so attributed it to technical factors (always a cop-out when you

have no idea) as he thinks the fundamentals remain strong. Really? I know central

banks tend to live in a parallel universe where they hear no evil, see no

evil and speak total nonsense, but just look at the collapse in the

Citi economic surprise index (charts above) for hard data (even including

the more upbeat survey data, US economic surprises have slumped into negative

territory). This together with the increasing threat of imminent tapering -

which usually leads (perversely) to falling bond yields - leads me to think

that the U.S. bond market rally is actually wholly explicable (i.e. it's

forecasting a U.S. recession).

John Dizard's FT column

(on line subscription required) is always worth a read. This week he discussed

the potential for an old-fashioned inventory-led recession next year

when the current bottlenecks affecting container shipping dissipate. All that

“delayed stuff, when it finally lands where it is supposed to, looks as though

it will create a big enough pile to trigger a bad inventory recession.

..............................................................................................

Stock Market Valuation: Shiller P/E for S&P 500:

The Shiller P/E (or CAPE ratio) is a valuation measure

that uses real earnings per share (EPS) over a 10-year period to smooth out

fluctuations in corporate profits that occur over different periods of a

business cycle. At 38.54 (as of August 6th close) it's now at the

second highest level in history:

.......................................................................................................

According to Bloomberg,

$27 trillion has been added to equity values in a little over a year.

.......................................................................................................

The New Era of Investing and Meme Stocks:

To the best of our knowledge, we've never seen such

greedy, reckless speculation rewarded for such a long period of time. Whatever happened to the saying "Bulls

and bears make money, but pigs get slaughtered?"

Trading volume and the number of trades from

"retail investors" in the first half of 2021 surpassed all of

2020. “The retail revolution that began last

year marked the beginning of a new era of investing—and we saw that

continue throughout the first half of 2021,” said Bob Cortright, founder and

CEO DriveWealth.

So called “meme stocks" were top-of-mind

with global retail investors, as AMC Entertainment Holdings Inc. (AMC)

was one of the most traded symbols across all regions. GameStop Corp. (GME)

also continued to garner interest across the globe. A newcomer to the scene,

Coinbase (COIN), also made an impact with retail investors as

cryptocurrency trends continue to pick up steam.

In June alone, "retail investors" bought

nearly $28 billion of stocks and exchange-traded funds on a net basis,

according to data from Vanda Research’s VandaTrack.

More than 10 million new brokerage accounts are

estimated to have been opened in the first half of this year, according to JMP

Securities. That's more than in all of 2020.

Robinhood Doubles in Price in 3 Days......by Pam Martens and Russ Martens

Robinhood (the enabler of

meme stocks) is the poster boy for the craziest, most unregulated

stock market era since 1929. That one ended in tears. This one will also.

Robinhood is the trading app used by millions

of young, inexperienced retail investors to trade stocks and options on their

mobile phones. The company went public last Thursday on the Nasdaq stock market

(the wonderful folks who brought us the dot.com crash in 2000). Robinhood

closed the trading week last Friday with a share price of $35.15 – an

embarrassing 7.5 percent below its IPO price of $38. Curiously, so far this

week, through Wednesday’s closing price of $70.39, the stock has soared 100.256

percent from Friday’s closing price.

In an efficient, regulated stock market that is

capable of engaging in its core function of price discovery, Robinhood would

not have doubled in price in three trading sessions. The company lost $1.4

billion in the first quarter of this year and has yet to report its second

quarter earnings or even announce the date that it will report those earnings –

or lack thereof.

But in this crazy stock market era, earnings are

just pesky details. The business media actually reports on how many times a

company’s name is mentioned on Reddits’ Wall Street Bets forum. For example,

Reuters – an international business wire – reported yesterday that Robinhood

“was the most mentioned stock on WallStreetBets, the Reddit platform at

the center of this year’s ‘meme stock’ rally, over the past 24 hours, according

to sentiment tracker SwaggyStocks.”

................................................................................................

Charlie Munger, vice-chairman of Berkshire Hathaway on the run up of Game Stop and other meme stocks:

“That's the kind of thing that can happen when you get

a whole lot of people who are using liquid stock markets to gamble the way they

would in betting on race horses. And the

frenzy is fed by people who are getting commissions and other revenues out of

this new bunch of gamblers. And of course, when things get extreme, you have

things like that short squeeze."

"It's not generally noticed by the public, but

clearinghouses clear all these trades," he said. "And when things get

as crazy as they were in the event you're talking about, there are threats of

clearinghouse failure. So it gets very dangerous."

.......................................................................................................

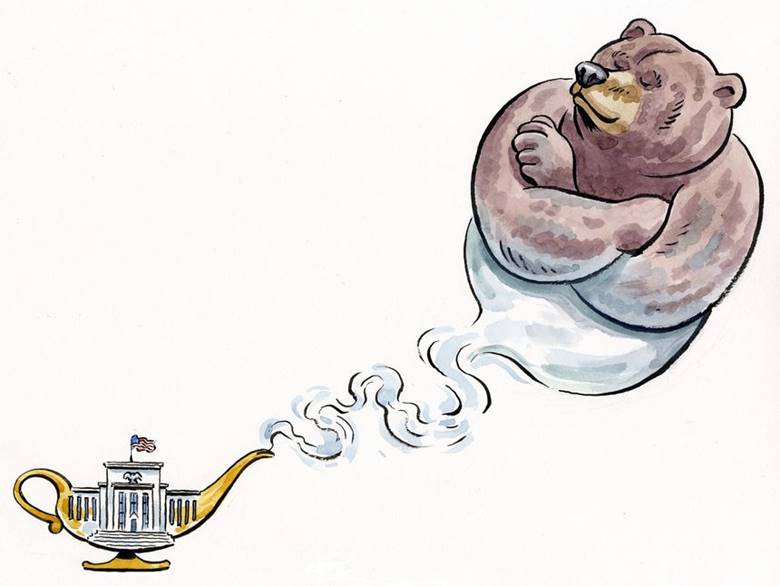

Closing with a Cartoon:

We close with a cartoon which we hope you enjoy.

ILLUSTRATION: DAVID GOTHARD

...............................................................................................

Stay healthy, enjoy life, success, good luck and till

next time….

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since 1971) to profit in

the ever changing and arcane world of markets, economies

and government policies. Victor started

his Wall Street career in 1966 and began trading for a living in 1968. As

President and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the

firm's research and development platform, which is used to create innovative

solutions for different futures markets, risk parameters and other factors.

Copyright © 2021 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).