Wall Street Ducks are Quacking While Technical

Indicators Deteriorate

By the Curmudgeon

Introduction:

We continue our new format of quick takes and charts

for this weeks column. Many thanks to

readers whove emailed me (ajwdct@gmail.com)

to approve it.

Again, readers are encouraged to email the Curmudgeon

with any comments, suggestions, or concerns.

We take reader feedback very seriously!

Victor has his own piece this week titled: Reverse

Repos: Wall Street Newcomers Need a Monetary Education!

QUICK TAKES & CHARTS:

GMO: WHEN THE DUCKS ARE QUACKING, FEED EM

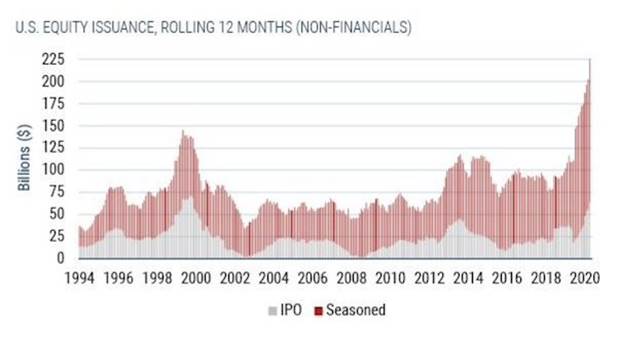

Stock issuance is the highest ever, as firms and Wall

Street know when its time to sell to eager buyers. (Yet, the market has

absorbed the new supply of stocks without blinking!)

Source: GMO and Federal Reserve Board

Dubious new records: Yes, we are witnessing new price records for the S&P 500,

NASDAQ, and a host of other markets. That, in isolation, should not be

worrisome. What should worry you, though, is that records are being set on the

valuation front. By almost any measure forward or backward looking we are

staring at some of the most expensive valuations in history, especially in

growth stocks. But weve talked about that inconvenient truth many times

before. Heres a new worry: Stock issuance in 2021 is also setting a new record, blowing away the last high set in the run-up

to the Tech Bubble. This is a dubious item to celebrate if history is any

guide.

There is never an unambiguous Batman-style beacon

signaling a market top, but record-high stock issuance is an ominous sign that

should have Gotham on edge. Wall Street knows an eager, price-insensitive buyer

when it sees one. As the cynical expression goes, when the ducks are quacking,

its time to feed em.

..

Bloomberg: Wall Street Is the Most Bullish on Stocks

in Almost Two Decades

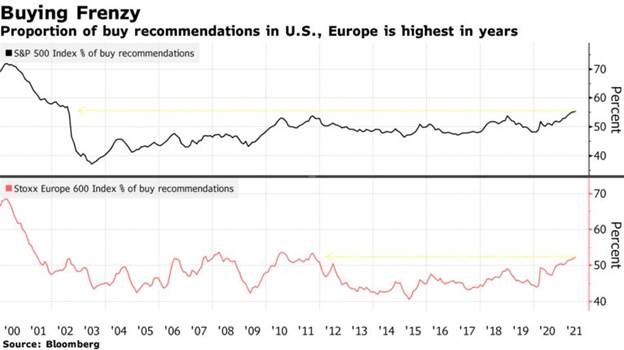

Its been two decades since Wall Street analysts were

this upbeat. About 56% of all recommendations on S&P 500 firms are listed

as buys, the most since 2002. Its one more data point

that shows the extent of the euphoria sweeping markets after a blockbuster

earnings season.

While analysts are historically a bullish bunch,

theyre turning even more optimistic in the face of relentless stock market

gains and corporate earnings that topped even the highest expectations. For all

the concerns about the delta variant, Chinas regulatory crackdown or waning

Federal Reserve stimulus, it hasnt made much of a dent yet on stock prices.

...

.

Barrons:

Unstoppable Rise of Big Tech

Big Techs dominance has some investors seeing a peak in valuations.

Apple, which leads the pack with a $2.4 trillion market value; Microsoft ($2.2

trillion); Alphabet ($1.8 trillion); Amazon ($1.6 trillion); and Facebook ($1

trillion) now account for 23.3% of the S&P 500 indexs value. At the end of 2019, the Big Tech companies

were about 18% of the S&P 500. Since then, each of the stocks has gained at

least 70%.

Nonetheless, the regulatory overhang is real, even if

there are signs that the risks have been priced in. Tech regulation is gaining steam in

Washington, but the courts could hold back the most aggressive efforts. And

some investors think that the worst-case scenarioforced breakupscould unlock

value to the benefit of shareholders.

Apple, Microsoft, Amazon, Alphabet (Google), and

Facebook now comprise ~25% of S&P 500s total value as per this chart from

Bloomberg:

Curmudgeons View: I despise big tech companies, which are so

pervasive theyre taking over our lives. Almost every day, I feel Im hostage

to Amazon, Google, and Microsoft (dont use Apple or Facebook). And youre really stuck if you have a tech

problem, especially with Amazons software.

Reference: Big

Tech Companies Dominate the Stock Market but For How Long?

..

.

.

..

..

Spending Splurge Bill Coming Due, by Danielle Park,

CFA

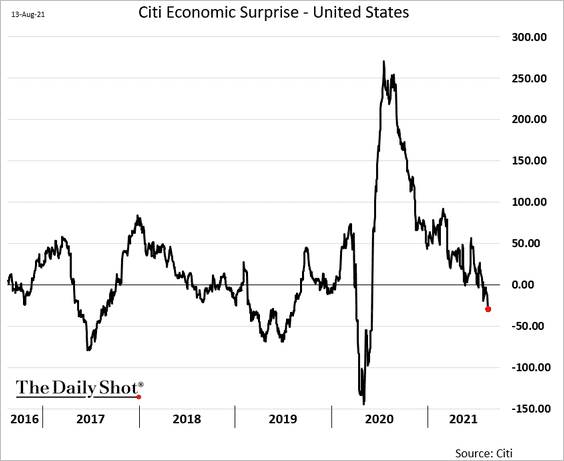

Frenzied consumption buying in the west has been

coming off the boil since last winter, with leading economic data disappointing

consensus expectations (below zero) since May US Citi Economic Surprise

Index since 2016:

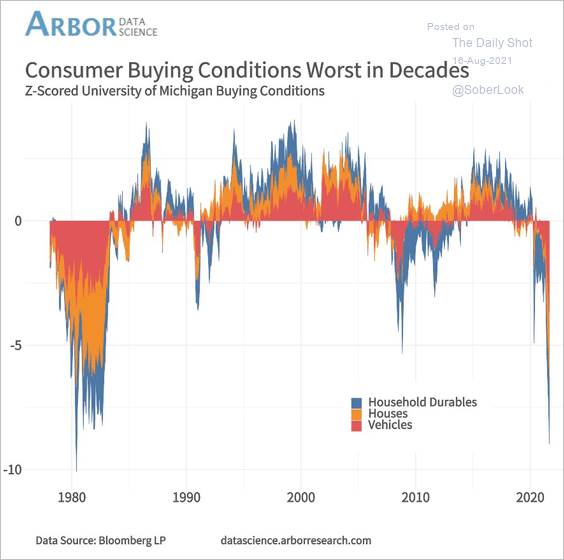

Amid record-low interest rates, (retail) prices have become so elevated

relative to incomes that consumer buying conditions for big-ticket items

(vehicles, housing, and durable goods) are now the worst in decades (shown here

since 1975).

After the pandemics initial spending splurge, the bill is due, and global

growth is mean reverting again. Commodity prices have been signaling this for

months: lumber (-71%), iron ore (-31%), steel rebar (-16%), copper (-16%), oil

(WTIC -25%) and silver (-20%) are just a few of the recent standouts.

Meanwhile, stock prices have been trading in a world

of their own dreaming. Wake-up calls are overdue.

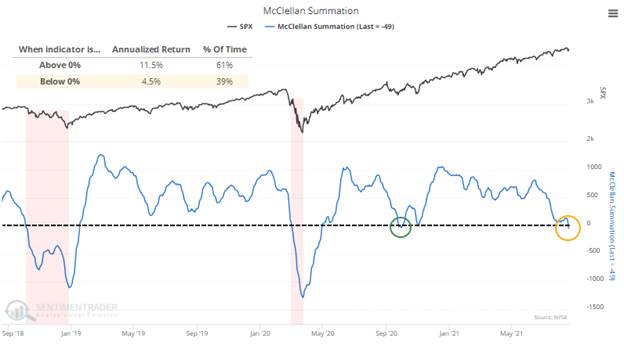

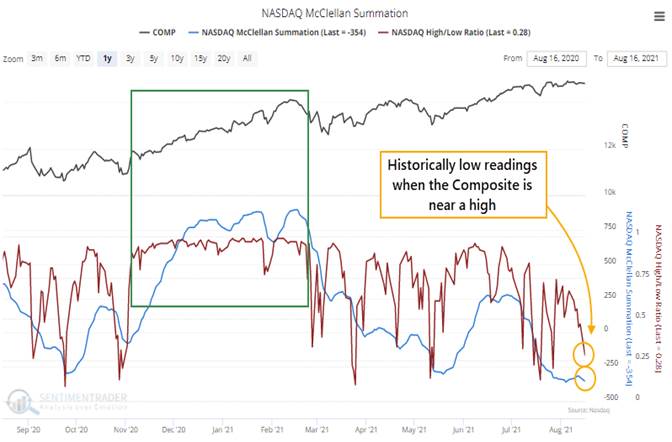

Sentiment Trader: LONG-TERM BREADTH IS NEGATIVE

Despite the S&P rallying on Friday to close at yet

another new high, the McClellan Summation Index is negative. The worst possible

combination for this indicator is when it is below zero and declining.

That's when the worst selloffs happen. The current readings for the S&P 500

(SPX) and NASDAQ are now negative and declining as we see in the following two

charts:

Source: Sentiment Trader

On the NYSE, there are also now more securities

falling to 52-week lows than rising to 52-week highs. When this is below zero,

the S&P's annualized return is only about a third of what it is when it's

above zero.

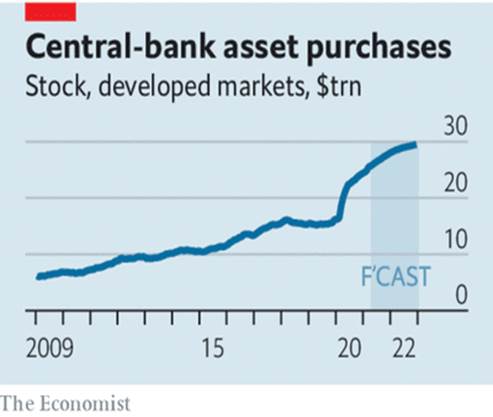

Debate over QE within central banks is dominated by

short-term considerations about the need for stimulus. Yet there is only weak

evidence that accumulating or holding bonds helps economies much when, as now,

financial markets are calm.

The trouble is that investors have been encouraged to

interpret decisions about qe as a signal about when

central banks might raise interest rates, a policy whose effects are more

tangible.

The resulting sensitivity of interest-rate expectations to QE announcements

makes the policy hard to unwind. The Fed is nervous about triggering another taper

tantrum, the episode in 2013 when the suggestion that it might curtail its

bond-buying shook markets (see End Quote below).

.

Selected Quotes:

"To me, everything, everythingand I emphasize everything

from here going forward through the rest of the year and certainly through

2022 and maybe into 2023I believe is the inflation story. Peter Boockvar, Chief Investment Officer,

Bleakley Advisory Group.

"If you plug in the current inflation rate over the past

four quarters (about 4%), the gap between GDP and its potential for the second

quarter of 2021 (about -2%), a target inflation rate of 2%, and a so-called

equilibrium interest rate of 1%, you get a desired federal funds rate of

5%." John B. Taylor, The Fed's State of

Exception.

The Fed has trained investors to buy the dip. Not

surprisingly, they jumped in at the 40-dma to buy rather than waiting for a test

of the 50-dma. (Although it was on lower volume and weaker breadth.) Lance Roberts, Real Investment Advice.

The S&P 500 is up

18% this year and sits just 1% below all-time highs, but a broader look at

markets reveals a much less constructive tape. The U.S. yield curve is at a

1-year low, emerging markets are negative YTD and both copper and oil are down

double digits from recent highs. Following a strong V-shaped

recovery, there are many signs of slower growth. Michael Hartnett,

BofA Global Research Chief Investment Strategist.

The S&P 500 tends to track the ISM PMI (which

measures U.S. manufacturing production) and on a Y/Y basis, the ISM will likely

turn negative by Oct. Supportive of Michaels view, the BoA

Global Industrials team noted that their Industrial Momentum Indicator,

which tends to lead Global PMI, declined yet again. Michael expects negative

returns for stocks and credit in the second half of 2021 and suggests

investors own defensive quality. Longer term, Michaels view remains that geopolitical

risk and nationalism are inflationary. Candace Browning, BofA Global

Research Director.

..

Closing Quote:

What the Fed worries about is that the minute it

starts taking away the liquidity (tapering its bond purchases), markets will

become not just volatile, but dysfunctional.

Mohamed A. El-Erian, Chief

Economic Advisor at Allianz, the corporate parent of PIMCO

...............................................................................................

Stay healthy, enjoy life, success, good luck and till

next time

.

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since 1971) to profit in

the ever changing and arcane world of markets, economies and government

policies. Victor started his Wall Street

career in 1966 and began trading for a living in 1968. As President and CEO of

Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and

development platform, which is used to create innovative solutions for

different futures markets, risk parameters and other factors.

Copyright © 2021 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).