Tech Companies

Dominate the Stock Market but For How Long?

By the Curmudgeon

Introduction:

The Wall Street Journal (on-line edition-subscription

required) said on Saturday that technology companies are set to end the year

with their greatest share of the stock market ever, eclipsing a dot-com

era peak in the latest illustration of their growing influence on global consumers

and economy.

Tech stocks now account

for nearly 40% of the S&P 500, on pace to eclipse a record of 37%

from 1999, according to a Dow Jones Market Data analysis of annual market-value

data going back 30 years. And that does NOT include Amazon [1.] which

is in the consumer- discretionary sector. If Amazon, with a market value around

$1.6 trillion, was reclassified as a tech stock, it would make the tech

sector’s dominance over markets even bigger, the Journal article stated.

Note 1.

The Curmudgeon believes that Amazon is by far the

largest tech company in the world. That’s because they design their own IT infrastructure,

including computer servers and storage equipment. How many know that Amazon is now the largest

computer company in the world? And that’s without

selling ANY computer servers?

Of course, Amazon also makes and sells consumer

electronic products like e-Readers, tablet computers, intelligent

speakers/displays, Fire TV sticks and other gadgets (owned by the Curmudgeon

and many, many others). They have also

embedded Internet TV and “Alexa” into many television sets (like the large

screen Toshiba TV the Curmudgeon just bought).

By the way, the voice recognition capability of

“Alexa”, especially on the Echo device, has deeply deteriorated over the last

four or five years. And what’s that you heard about Machine Learning/Deep Learning?

……………………………………………………………………………………………………

According to Reuters, mega tech and internet-driven

stocks have gained 49.23% this year, compared to a 7% gain for the S&P 500.

They are up 9.6% on average since Sept. 21, versus 6.6% for the S&P 500.

In an August 2020 Curmudgeon post, we described

how six big tech stocks distort market indexes. It’s only

gotten worse since then.

In this article, we analyze the influence of big tech on the

economy, markets and are everyday lives.

We then reflect back 15 and 20 years to see

what happened to the largest capitalization stocks of those eras.

Digital Lifestyle Enhances Tech Companies Appeal:

The tech companies’ dominance of the stock market and economy

is propelled by their unprecedented reach into our everyday lives, shaping how

we work, communicate, shop, and spend leisure time. That has only deepened

during the pandemic induced lockdowns, as people shop more frequently on

Amazon, click on a Google ad, check Facebook for social media stories, buy an

iPhone or subscribe to new services from Apple (especially Apple TV+). In the corporate world, more companies are

flocking to the cloud for computing and storage services from Amazon AWS,

Microsoft Azure, and Google Cloud. As a

direct result, the tech giants receive a greater share of spending in the

economy and earn ever larger profits.

“We’ve had a mandated digital lifestyle,” said Alison Porter,

a portfolio manager focused on the tech sector at Janus Henderson Investors.

She remains confident in the biggest tech companies because of their reliable

growth and prominence as people stay home much more due to pandemic induced

restrictions.

While data show the tech giants

employ fewer workers than many previous market leaders, they do invest heavily

in their businesses and allow other firms and consumers to buy and sell goods

and services more efficiently. Amazon is probably the best example of that. For

years, it plowed back earnings into investment into its core businesses (e-Retailing

and Cloud Computing).

Howard Marks, co-founder of investment firm Oaktree Capital

Group LLC, said in a recent memo to clients that measures of how expensive tech

stocks are relative to current profits could actually understate the potential

of these companies because they spend so much to drive their rapid growth.

Analysts estimate the tech sector’s share of S&P 500

corporate profits could reach about 36% this year, FactSet data show.

The information-technology sector has a price/earnings ratio of 28 based on the

group’s profits from the past year, compared with a ratio of 24 for the S&P

500. Communication-services firms trade at 25 times earnings, while Apple,

Microsoft Corp, Facebook Inc., and Alphabet (Google) have valuations in the

mid-30s. Netflix’s ratio is about 90, while Amazon’s is roughly 130.

Apple (AAPL) is the

world’s largest tech stock. Earlier this

year, it became the first U.S. company to hit a $2 trillion market

capitalization, accounts for more than 7% of the index on its own- down a tick

from the 8% of the S&P 500 in September.

Its market cap is larger than the cumulative total of the stocks in the

Russell 2000 index.

“They (mega cap tech stocks) have received an added boost

over the last 10 years because the broad economic backdrop has been

lackluster,” said David Lebovitz, a global market strategist at J.P. Morgan

Asset Management. That’s quite an

understatement as the economic recovery that started in June 2009 was the worst

in all of U.S. history!

Because the S&P 500 is weighted by a company’s market

value, the biggest internet firms have overshadowed declines in

several sectors this year. In another illustration of the group’s strength

during the pandemic, the S&P is outpacing a version of the index that gives

every stock an equal weighting by nearly 10 percentage points this year, a gap

that would be the highest since the late 1990s.

“The longer this backdrop continues, the further they’re

going to pull away from the pack,” said Amanda Agati,

chief investment strategist at PNC Financial Services Group, which is favoring

companies more tied to remote work and learning recently like technology,

health-care and consumer-staples firms.

Impact of Increased Regulation Discussions?

Amazon and other large internet companies have come under

increasing regulatory scrutiny in recent weeks, with a Democratic-led House

of Representatives panel recently finding that Congress should consider

forcing the tech giants to separate their dominant online platforms from other

business lines. The Democratic report found that the four tech

companies -Facebook, Amazon, Google, and Apple enjoy monopoly power in their

respective domains. You can read the full 450 page report here.

Senator Elizabeth Warren seemed to have initiated the call to

break up big tech:

“Today’s big tech companies have too much power—too much

power over our economy, our society, and our democracy.” – Elizabeth Warren

The WSJ article says that few analysts expect the biggest

tech firms to soon be broken up. While regulatory

actions are often slow to play out, many investors think regulation could be

another source of volatility in the weeks ahead.

Interest Rates and a “Permanently High Plateau”:

Ultra-low interest rates have also given a big boost to mega

cap tech stocks, as there is no competition from bonds, CDs, or other fixed

income investments. Indeed, a major

assumption that momentum traders have been relying on to keep stock market

multiples at a “permanently high plateau” (Irving Fisher quote just

before the 1929 stock market crash) is for interest rates to stay near

current levels for the foreseeable future.

As noted many times in previous

Curmudgeon posts, we think a U.S. dollar crash and/or accelerating inflation

could result in sharply higher interest rates, independent of the Fed’s QE

programs.

John Hussman says: “Believe what you wish

about the Fed’s ability to keep stock prices elevated forever. I expect that

we’ll do just fine if that’s the case. I just think it’s

a terrible idea to rely on the idea of a “permanently high plateau.”

………………………………………………………………………………………………………..

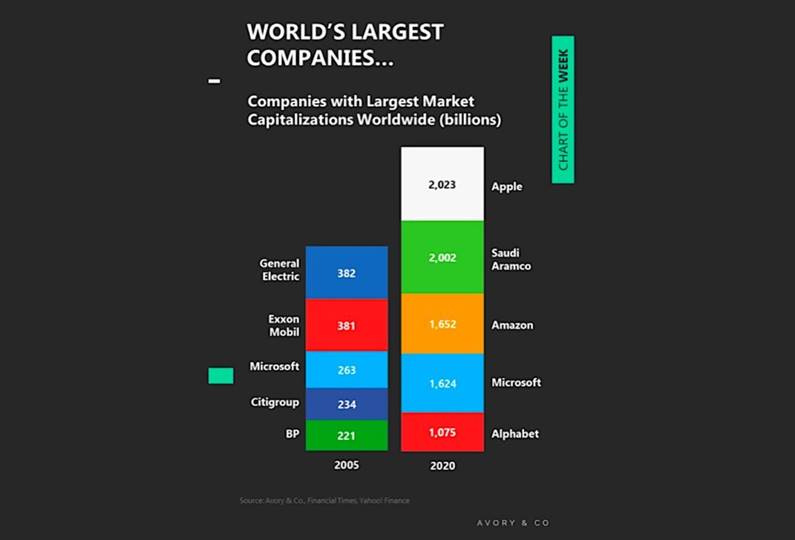

2005 vs 2020 – World’s Largest Stocks by Market Cap:

In 2005, General Electric was #1 with a market capitalization

of approximately $382 billion. Today, Apple is the largest company in the world

with a market capitalization of $2,092.79 Billion (~$2.1 trillion).

Note that four of the five top market cap companies have

fallen off the mega cap radar screen (especially GE). Only Microsoft, with its reinvention as a

cloud computing (Azure) leader is currently in the top five.

In 2005, many of the technologies we use today were either in

their infancy or not yet invented. For

example, there was no iPhone (or 4G) or cloud computing, while eCommerce was

just starting to ramp up.

According to iWeblists. here are the largest capitalization

U.S. tech stocks (we included Amazon) in $ billions as of October 12, 2020:

1. APPLE INC. AAPL 2000.48

2. AMAZON AMZN 1646.25

3. MICROSOFT

CORP. MSFT 1633.18

4. ALPHABET INC. GOOG 1030.60

5. FACEBOOK, INC. FB

753.37

9. TESLA, INC. TSLA

404.40

13. NVIDIA

CORPORATION NVDA 339.66

Note. We did not include #21 Netflix which,

in our opinion, is a content creation and distribution company, much like

Warner Brothers. In fact, Amazon AWS hosts almost all computing and storage for Netflix.

……………………………………………………………………………………………………….

A Study in Market Cap over 20+ Years:

At the top of the DOT COM peak in March 27, 2000, Cisco

Systems Inc. became the most valuable company in the world with a stock market capitalization of $569 billion. As of Oct 12, 2020, Cisco’s market cap was

$168.70 billion. That means Cisco

stock is worth 29.6% of what it was worth 20+ years ago, or a decline of over

70% over 2+ decades.

On March 10, 2000, Sun Microsystems (one of the “4

horseman of the Internet” in the late 1990s) had a market cap of $164.5 billion

according to Reuters.

It lost 98% of its stock market value in 2009, was sold to Oracle on

January 27, 2010 and subsequently shut down after almost all employees were

laid off. But at least if you held SUN

stock prior to its buyout by Oracle, you would’ve

received cash when the deal closed.

Conclusions:

So many times in the past 53 years, the Curmudgeon has heard

seemingly endless talk you could buy certain types of stocks and hold them

forever, as their earnings would always grow and they would maintain or gain

market share. Here are just a few:

·

The “nifty 50” or “1 decision

growth” stocks were big name brand large cap stocks from 1968-1972.

·

Small cap stocks thoroughly outperformed

large caps from 1975 to 1986 with the assumption that they were nimbler and

therefore would grow earnings faster than their big cap brothers. However, a

lot of that outperformance was due to U.S. dollar strength that continued till

the Plaza Accords of September 22, 1985.

·

In the late 1970s and early

1980s, during a period of accelerating inflation, energy/natural resource

stocks dominated the pack. Inflation was

perceived to continue in double digits for the foreseeable future.

·

From around 1996 to 2000,

Internet stocks, tech companies and companies that started to sell products on

the Internet boomed in price. That all

ended in the DOT COM crash which was followed by the fiber optic bust/meltdown.

·

For many years now, large cap

U.S. growth stocks (especially the tech giants) have trounced all other

categories of equities. It’s amazing to see the 12 month returns of large cap U.S.

growth vs: large cap value, small cap, international, or any other stock market

classification.

So why not just buy and hold the large cap tech

stocks or the NASDAQ 100 index (QQQ ETF) they dominate? Well, that would’ve

worked magnificently since March 2009!

So much for 20-20 hindsight!

However, the sun also sets and what was the

“in-thing” today is out of favor tomorrow. The big tech companies could face

severe monopoly like restrictions or could be broken up into smaller pieces,

such that they would no longer have the same scale and power they have today.

We have thoughts on the outlook for all of the big

tech names, but that is something for another day and possibly a consulting

job.

………………………………………………………………………………………………...

Be well, stay safe and calm, good luck and till next

time…….

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned

(since 1971) to profit in the ever changing and arcane world of markets,

economies and government policies.

Victor started his Wall Street career in 1966 and began trading for a

living in 1968. As President and CEO of Alpha Financial Technologies LLC,

Sperandeo oversees the firm's research and development platform, which is used

to create innovative solutions for different futures markets, risk parameters

and other factors.

Copyright © 2020 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).