The Death of Sanity

By the Curmudgeon with Victor

Sperandeo

Introduction:

Once again, we present illuminating charts and quick

takes that we hope readers find of interest.

In addition, Victor explains the collapse of loans and money velocity as

well as relating the Fed's QE/monetary inflation to future price increases.

We won't be repeating what we've said over and over

about asset bubbles and manias. Let us know what you think of our new format

(email the Curmudgeon at: ajwdct@gmail.com).

Chart-O-Rama:

Since 2007 (which includes the

2007-2009 recession with > 50% drop in stock prices), the stock

market has returned nearly 200%, which is more than twice the growth in GDP and

nearly 4-times the growth in corporate revenue. This disconnect is a function

of the nearly $8 trillion increase in the Fed’s balance sheet, hundreds of

billions in stock buybacks, PE expansion, and ZIRP. With “Price-To-Sales”

ratios at the highest level in history, one should question the ability to

continue borrowing from the future?

Source: Lance Roberts, Real

Investment Advice

...........................................................................................

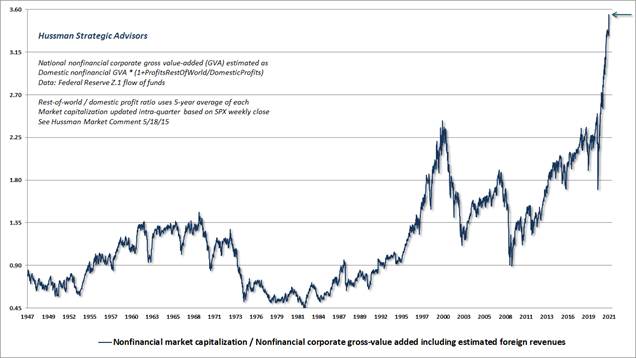

The chart below shows the ratio of nonfinancial market capitalization to

corporate gross value-added (MarketCap/GVA), which is the single most reliable

valuation measure we’ve introduced over time, based on its correlation with

actual subsequent market returns across history. Notably, U.S. nonfinancial

gross value-added is at a record high. The insanity you’re looking at is

all numerator.

Source: Hussmanfunds.com

This is what a speculative bubble looks like. Jeremy Grantham is

right – “Seriousness is flagged by the language that you use.” Valuations have

reached record extremes while our measures of “uniformity” across market

internals have shown increasing deterioration and dispersion, reflecting

increasing selectivity and emerging risk-aversion. In recent weeks, this

dispersion has widened further. This is serious. Among additional features of

market action to monitor, keep an eye on credit spreads and low-grade bond

yields, as well as any tendency for the number of individual stocks setting

52-week lows to expand – though I suspect those may coincide with stock market

weakness rather than preceding it.

It may be the greatest collective error in the history of investing to

pay extreme multiples for extreme earnings that reflect extreme profit margins

and extreme government subsidies, while imagining that those multiples also

deserve a “premium” for depressed interest rates that reflect depressed

structural economic growth.

…………………………………………………………………………………………..

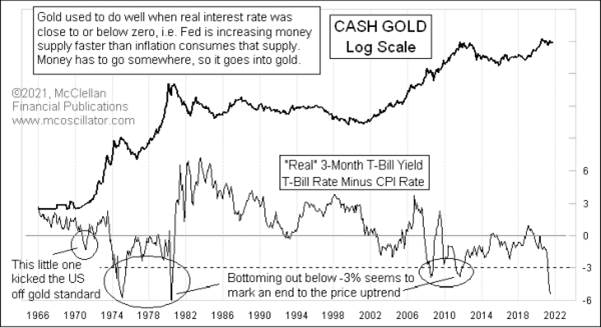

A big negative real yield is a sign of a huge imbalance in the banking

system, and horribly misguided Fed policy.

It says that the Fed is WAAYYYY behind the power curve, and has let inflation

get away from them.

The very real question right now is about whether the

current Fed is not going to do its job, and respond as it would have in the

past to a ridiculous spread between the inflation rate and its short term

interest rate targets. We arguably have

a Fed whose honchos are collectively stupid enough to not only think

that 2% is their goal (statutorily it is 0%), but who also think that 5%+ is

just “transitory” and so they don’t need to do anything about it.

Tom McClellan, The McClellan

Market Report

.................................................................................................

As a researcher focused on confidence and its impact

on decision-making, I can’t shake the feeling that when it comes to risk all

those colorful pie charts (see below) are misleading given where investor

sentiment is today. As I look ahead, the benefits of diversification,

which so many count on to mitigate losses when markets turn down, may not be

there.

All ships (asset classes) have risen together atop an enormous wave of

improving sentiment. While I will leave it to others to debate how we

arrived at this point, what is clear today is that most portfolios are now

comprised almost entirely of assets with extremely high sentiment, devoid of

assets where there is low sentiment, let alone hopelessness.

Put simply, when it comes to mood, every slice of

the pie is now piping hot. Portfolios that investors believe are

well-diversified aren’t. They are highly concentrated in one mood:

euphoria.

................................................................................................

Annual Inflation surged to new record highs in the

July 2021 Producer Price Index (Bureau of Labor Statistics – BLS). The July

2021 Producer (PPI) jumped 1.03% in the month and by a record 7.77%

year-to-year (BLS). The July 2021 Producer Price Index continued to explode

across the board, setting new record levels of year-to-year Inflation at 7.77%

[previously 7.31% (last month)] for the Total PPI-FD (Final Demand), 11.87%

[previously 11.68%] for the PPI-FD Goods Sector and 5.82% [previously 5.18%]

for the PPI-FD Services Sector.

Systemic Turmoil is

just beginning, with both the Fed and U.S. Government driving uncontrolled U.S.

dollar creation, between unconstrained Money Supply growth and uncontained

Deficit Spending. Again, continued extraordinary Monetary and Fiscal Stimulus

will be needed at least into 2022, quite likely into 2023, irrespective of the

nature of the COVID-19 vaccines. Indeed, likely leading into accelerating

inflation, Hyperinflation, both extreme Monetary and Fiscal stimuli are

underway.

.................................................................................................

Bloomberg Business Week April 2019 cover: Is Inflation Dead?

Goehring & Rozencwajg has no doubt: inflation is going to return with a vengeance.

Record-high stock and bond prices clearly signal that investors are

convinced inflation will never return. Investors who read Business Week back in

1979 were tipped off that a trend in place for years — inflation — was about to

reverse with massive investment implications. Readers of BusinessWeek/

Bloomberg in 2019, have now been tipped off that a trend in place for 40

years — disinflation — is about to reverse as well. The magnitude of the

investment implication will be just as large as it was in 1979.

Today’s stock market trades at record high valuation

levels while interest rates have never been lower. The 30-year Treasury yield

hit an all-time low of 1.25% last summer and $15 trillion of sovereign debt now

trades with negative yields — a first in 4,000 years of financial history.

....................................................................................................

Victor- Money Velocity and Inflation:

Surprisingly (or maybe not?), there's very little

discussion of this topic by the mainstream financial media. That despite the well known fact that the

extent of price increases comes from the turnover of money, i.e. the velocity of the money supply [1.].

What most miss is that low interest rates and low

maturity spreads are correlated with low loan activity ... and thus low money

velocity. We explain all this and the

inflation implications of the Fed's "money printing" below.

In the mid 1990s, money velocity was hovering at 2.2.

In the last quarter of 2007 it was 1.97.

However, it's now collapsed to 1.12 (as of July 29, 2021). That's a

decline of 43.4%!

Below is a chart depicting the total collapse of the

M2 money

stock velocity from the St.Louis Fed.

Note 1. The velocity of money

is the frequency at which one unit of currency is used to purchase

domestically- produced goods and services within a given time period. It's the

number of times one dollar is spent to buy goods and services per unit of time.

If the velocity of money is increasing, then more transactions are occurring

between individuals in an economy.

.....................................................................................................

We've stated many times that the Fed essentially paid banks to NOT loan money by paying them

interest on their bank reserves. Without

loans, small business stalls and a large part of U.S. job growth comes from

small business. Hence, the weak U.S. GDP

numbers for the last several years.

Banks lend the money that's on deposit, charging the borrowers a higher

interest rate, and profiting off the long term/short term interest rate spread.

The interest rate banks charge their most creditworthy customers for short term

loans is the prime rate, which is now at 3.25% (since March 16, 2020).

With such tiny spreads, and a low prime rate, banks

have little or no cushion against defaults, and thereby don’t make many short

term loans. Hence, money velocity has

staid at extremely depressed levels (see chart above).

Ironically, that's all caused by the Fed's ZIRP and QE

which has kept both short and long term rates unbelievably low. That in turn

puts a lid on the interest rates banks can charge borrowers such that their

interest rate spread is very small.

As Milton

Friedman famously said, "Inflation is

always and everywhere a monetary phenomenon in the sense that it is and can be

produced only by a more rapid increase in the quantity of money than in

output.”

Hence, the extent of the price increases that RESULT

from inflation (the printing/creation of money "out of thin air") are

a function of the velocity of money. In last week's

Curmudgeon post, I stated that as long as

the Powell led Fed continues its money printing (QE), inflation will NOT BE

TRANSITORY!

In conclusion, we've shown that the Fed is not helping

the U.S. economy or workers by keeping interest rates at virtually zero. Moreover, they've planted the seeds for

further inflation with their non-stop money printing (QE), which has resulted

in the ballooning of so many asset bubbles along with its balance sheet (which

now stands at $8.3T as of August 14, 2021).

...............................................................................................

Stay healthy, enjoy

life, success, good luck and till next time….

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been

involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since 1971) to profit in

the ever changing and arcane world of markets, economies and government

policies. Victor started his Wall Street

career in 1966 and began trading for a living in 1968. As President and CEO of

Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and

development platform, which is used to create innovative solutions for

different futures markets, risk parameters and other factors.

Copyright © 2021 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).