Elevated Stock Market Sentiment, Technical Divergences,

and the Fed

By the Curmudgeon with Victor

Sperandeo

Introduction:

Trading was choppy on Wall Street this week after the

three major stock indexes (DJI, S&P 500, NASDAQ) set all-time highs on

Monday. The downbeat end to the week suggests concern about how strong the

economic recovery will be in the second half of this year.

Inflation is raging, with all gauges accelerating to

the upside. Yet bond prices have

rallied, presumably on expectations of a weakening economy that will reduce

credit demand and slow inflation. 10-year Treasury note interest rates have

fallen to 1.29% (as of July 16th) from around 1.6% at the start of

June. Nonetheless, junk bond-Treasury spreads continue to hover at all-time

lows which indicates incredible complacency.

Go figure?

Most of the U.S. government’s pandemic relief efforts

have ended (no more “stimi” checks to speculate on

meme stocks) and the Federal Reserve is starting to discuss cutting back its

enormous monthly bond purchases (AKA tapering).

Meanwhile, new variants (e.g., Delta) of the

coronavirus are threatening to weaken economies around the world. COVID-19

cases are increasing in the U.S. with pandemic restrictions being reimposed in

some areas, like Los Angeles County’s indoor mask wearing mandate.

There are also many technical divergences that once

were traditional warning signs. Also,

copper prices (often considered a leading economic indicator) have fallen, gold

prices are stagnating, and oil prices are now rolling over. It seems that financial markets are sending

an overall risk-off message from a commodity and fixed income perspective.

Despite all of the above,

investor sentiment remains sky high. That used to be a classic “sell signal,”

especially when valuations were this high for so long and technical negatives

persist (more on that below).

Historical precedents of market behavior have been

cast aside, which confounds many old timers like the Curmudgeon. This time it really is different, or so it

seems? Let’s have a closer look in this article.

Comment and Analysis:

“We’ve been throwing up our hands for a while,” said

Jason Goepfert, president of Sundial Capital Research which publishes the

excellent Sentiment

Trader advisory service.

“For whatever the reason, the market is just rolling

over all these historical indicators that before had a very consistent track

record.”

Yet there are some cracks within the stock market’s

foundation. Jason explained, “There is a

lot of rotation under the surface, with too-few stocks above their 50-day

averages, and low correlations among sectors.”

Here are a few technical negatives that show

newfound hesitancy and anxiety among real investors and professional traders

(not retail amateurs who have no fear of losing money in stocks):

Market breadth (Advance/Decline line) has recently deteriorated—even as

major indexes have continued to hit all-time highs. This price-breadth divergence is particularly

evident on the NASDAQ, as depicted in the chart below, where we see the A/D

line is a rather steep decline as the index rolls over:

Chart courtesy of Market in and Out

.......................................................................................….

·

As of July 15th,

only about 49% of stocks in the S&P 500 traded above their 50-day moving

averages, according to FactSet, a level that is below average and

one that is a sharp reversal from just a few months ago, when that metric

reached more than 90%.

·

Fewer stocks are hitting new highs. On July 16th,

there were 76 new highs on the NASDAQ vs 125 new lows. That comes with the

NASDAQ composite index only 2% off its all-time high.

·

Stocks of companies most

closely tied to the strength of the economy have slumped, while mega tech

stocks continue to soar to new heights.

·

Small stocks (e.g., Russell

2000) have badly lagged large cap stocks (e.g., S&P 500). On July 13th, there were more new

lows than new highs within the Russell 2000 Index for the second consecutive

day. Over the last six months, the

Russell 2000 Index is up a mere 1.9%. The S&P 500 and Dow have rallied 15%

and 10%, respectively. The relative

under performance of the Russell 2000 could be viewed as a red flag for market

bulls.

·

There have been massive draw

downs in cryptocurrencies, SPACs [special-purpose acquisition companies],

non-profitable tech companies, and meme stocks.

Highlights of July BofA Fund Manager Survey (FMS):

·

FMS Investors are much less

bullish on growth, profits, and yield curve steepening.

·

They have unwound

junk>quality, small>large stock, value>growth stock trades back to

Oct'20 levels (pre-vaccine/election).

·

FMS investors maintain big

longs in stocks (big tech) and commodities.

·

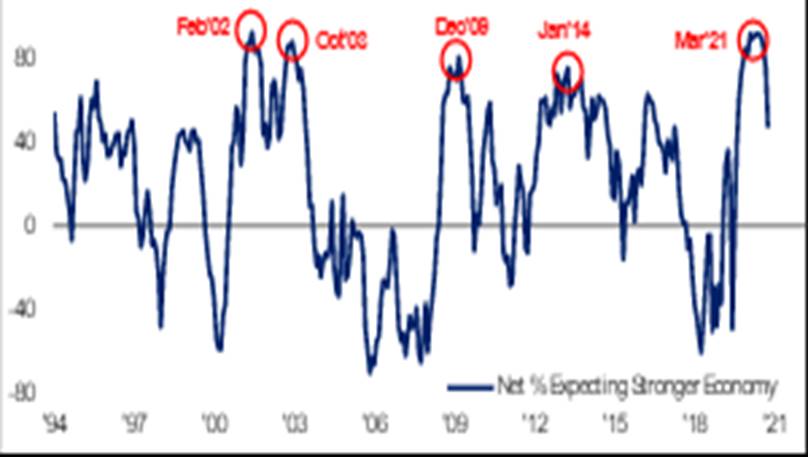

Cyclical "boom" has

peaked: July growth expectations are at 47%, down from the 91% peak in March

2021.

·

Global GDP & EPS readings

show macro momentum weakest since Q3 2020.

FMS economic expectations have peaked - Net % of

Respondents that say Global Economy Will Improve:

Chart Courtesy of Bank of America Global Research

……………………………………………............…............…........…....….

·

Fiscal optimism is fading: FMS expectation for U.S. infrastructure stimulus is

down to $1.4tn (was $1.9tn in April 2021).

·

Investors predicting higher

inflation is way down at 22% (was 93% in April).

Inflation expectations fall drastically-Net % Expecting

Higher Global CPI:

Chart Courtesy of Bank of America Global Research

……………………………………………............…............…........…....….

·

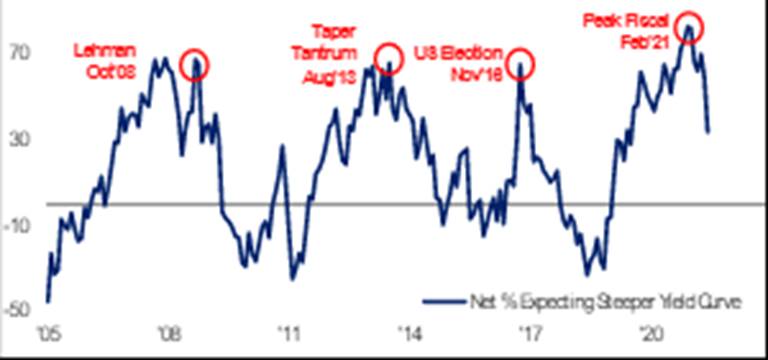

Expectations for steeper

yield curve are at 2-year lows, despite FMS investors belief that the first Fed

rate hike will be in January 2023 vs previous expectation of November

2022. That’s

shown in the chart below.

Expectations for a steeper yield curve fall

drastically -Net % Expecting Steeper Yield Curve:

Chart Courtesy of Bank of America Global Research

........…..…....…......…....…....…....…....…....…....…....…..…....…..….....

Earnings Beats and the Stock Market:

Following 1st Quarter 2021 earnings

season’s biggest beat in U.S. history (+23%), Wall Street analysts have

increased earnings estimates by 7% for the 2nd Quarter. That’s the biggest

upward revision since 2000!

B of A is expecting corporate earnings to beat

analyst estimates by 11% in the 2nd half of 2021. However, the bank warns that blowout earnings

don't always correspond to rising stock prices. Since

1996, 75% of down quarters (excluding the Great Financial Crisis) occurred in

quarters with earnings beats. In 2000, despite earnings beating analyst

consensus for 10 straight quarters, the S&P 500 declined for four

consecutive quarters.

Cartoon of the Week:

The painting “COVID Declared a Pandemic – 2020”, by

Hadi Aghaee at the Triton Museum in Santa Clara, CA

..............................................................................................………

Victor’s Comments – a Historical Perspective:

In 1971, I started an option’s firm called Ragnar

Option Corp. We traded OTC puts and calls.

As the CEO owning 1/3 of the firm, I handled the discretionary trading

and the inventory. We made firm markets on the (then illiquid) put and call

options business. We were very successful! I also

traded futures when the situation called for it. Thereby, I learned my knowledge of Wall

Street trading via derivatives.

Around 1972, I learned about investing by reading the

Federal Reserve Board meeting minutes back to 1959. Indeed, the Fed had a great deal of influence

on the markets.

At the time, I was an Economic/Finance major attending

evening classes at City College of New York.

During the day, I became a technical analyst/tape reader while closely

observing market trading. My college

education only taught me about Money and Banking – nothing about the Fed that

really counted.

One day I came across the term “Fed Funds,”

but did not know exactly what that term meant.

Yes, it was cash, but what was the Fed Funds Rate? I decided to ask all my friends, who were

mostly option and futures traders. Of the eight traders I asked, not a single

soul knew exactly what the Fed Funds Rate was! That’s

because in 1972, the Fed was relatively unknown by today’s standards. Today, of course everyone on Wall Street

knows what it means as well as do most soccer moms!

The key to the above story is that people like me had

a huge trading edge at the time. But

today, everyone has learned that the Fed is King, so much so that the

expression “Don’t fight the Fed” became an axiom.

Today, when Fed monetary policy is so easy, stock

market sentiment gets very high and stays

elevated. That’s

in sharp contrast to the 1970’s when metrics like P/E ratios, Price to Book

ratios, Advance/Decline lines, etc. were much more meaningful in assessing or

forecasting stock prices.

Graham and Dodd’s teachings from their book “Security

Analysis” was what the Street focused on then, along with the “Intelligent

Investor,” also by Benjamin Graham. For traders, “The Technical Analysis

of Stock Trends,” by Edwards and MaGee was the

Bible. Today, reading and following the guidelines of those great books may

well lose you money!

....…......…....…..…....…..…....…..…..…....…..…..…....…..…....…….

Curmudgeon Note: In a December 6, 2017

webcast, Bank of America’s top U.S. market strategist Savita Subramanian said,

“Dodd and Graham? We don’t

use that here anymore. Hah, hah, hah.” Yet that book was her “bible” when she

studied finance at Columbia Business School (2002) as per this

post.

....…......…....…..…....…..…....…..…..…....…..…..…....…..…....…….

The bottom line is everyone is now aware of the Fed

and its “Printing Press” power, so what you see is what you get. However, stock

prices are also moving up on goods and services prices increasing (i.e.,

inflation). It appears that as long as the Fed wants to prevent U.S. economic growth

from turning negative, it will put petal to the metal and print more money, regardless

of if inflation is above their 2% target.

QE + ZIRP keeps asset prices very high, as

we’ve stated for many years now.

Victor’s Conclusions:

The Fed chooses to ignore the killer problem of

inflation, especially for those in retirement or on a fixed income. I believe

consumer price inflation will continue at rates from 3.5%-to-5% and accelerate

from that base (the Curmudgeon concurs).

As long as QE and ZIRP continue, asset prices will stay high and income

inequality will widen.

Today’s “investors” are believers and are profiting

from this speculative mania without any reference to value or the warnings of

Benjamin Graham. Currently high stock

(and bond) valuations have never proven to be a good investment. Therefore, I

suggest this quote guide you:

“Whatever begins, also ends.” Seneca the Younger.

End Quotes:

“Markets are just doing their own thing. Something

has changed. Whether it’s unprecedented stimulus or

maybe there is this generational change with young investors. This new surge

into the market keeps driving stocks higher,” Jason Goepfert, president of

Sundial Capital Research.

“I feel as anxious today as I’ve ever felt about the

financial world, because of my belief that the Fed has been pumping up asset

prices in a way that is creating a bit of an illusion. And I think it — I think the odds are now

sort of one in three, very high, that we will look at

this as an epic mistake and one of the great financial calamities of all time.”

Peter R. Fisher spent more than a decade working at

the Federal Reserve Bank of New York. Now, citing what he describes as

“financial mania,” he has a warning about the actions of the Fed system of

which he was once part.

.…........…......…....…..…....…....…..…....…....…..…..…....…..…....…..….

Stay healthy, enjoy life, success, good luck and till

next time….

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned

(since 1971) to profit in the ever changing and arcane world of markets,

economies and government policies.

Victor started his Wall Street career in 1966 and began trading for a

living in 1968. As President and CEO of Alpha Financial Technologies LLC,

Sperandeo oversees the firm's research and development platform, which is used

to create innovative solutions for different futures markets, risk parameters

and other factors.

Copyright © 2021 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).