Critique of Fed’s Semi-Annual Report to Congress

By the Curmudgeon with Victor

Sperandeo

Introduction:

The Federal Reserve Board said on Friday that its low

interest rate policies and bond buying (QE to infinity?) are providing “powerful

support” for the economy as it recovers from the coronavirus pandemic.

In its semi-annual report to Congress on monetary

policy, the Fed indicated that it plans to maintain that support until further

progress is made in recovering from last year’s coronavirus induced recession.

The U.S. central bank has kept its benchmark interest

rate near zero, while continuing to buy AT LEAST $120 billion a month in

Treasury bonds and mortgage-backed securities.

The Fed said Friday that these efforts will help ensure that “monetary

policy continues to deliver powerful support to the economy until the recovery

is complete.”

The report will be the subject of hearings in

Congress next week, including testimony from Fed Chair Jerome Powell about the

outlook for the economy, inflation, and the transition of monetary policy as

the impact of the pandemic recedes.

We summarize and comment on the Fed’s report in this

article summing it all up in Victor’s Conclusions. Don’t miss the Chart of the Week and

several precious End Quotes!

Fed Report Highlights:

Shortages of materials and "difficulties in

hiring" are holding back the U.S. economic recovery from the coronavirus

pandemic and have driven a "transitory" bout of inflation, according

to the almighty Fed:

"Progress on vaccinations has led to a reopening

of the economy and strong economic growth. However, shortages of material

inputs and difficulties in hiring have held down activity in a number of

industries."

"Against a backdrop of elevated household

savings, accommodative financial conditions, ongoing fiscal support, and

the reopening of the economy, the strength in household spending has

persisted," while the financial system remains "resilient,"

the Fed said. Resilient or incredibly

speculative?

With respect to its QE bond buying/debt

monetization, the Fed said:

“These purchases help foster smooth market

functioning and accommodative financial conditions, thereby supporting the flow

of credit to households and businesses. The Committee expects these purchases

to continue at least at this pace until substantial further progress has been

made toward its maximum-employment and price-stability goals. In coming

meetings, the Committee will continue to assess the economy’s progress toward

these goals since the Committee adopted its asset purchase guidance last

December.”

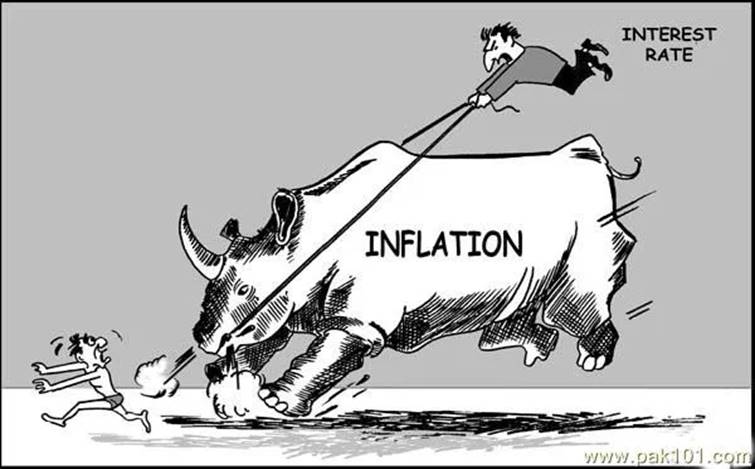

Regarding inflation, the Fed said (emphasis

added):

“The inflation rate over the longer run is primarily

determined by monetary policy, and hence the Committee has the ability to

specify a longer-run goal for inflation. The Committee reaffirms its judgment

that inflation at the rate of 2%, as measured by the annual change in the price

index for personal consumption expenditures, is most consistent over the longer

run with the Federal Reserve’s statutory mandate. The Committee judges that

longer-term inflation expectations that are well anchored at 2% foster price

stability and moderate long-term interest rates and enhance the Committee’s

ability to promote maximum employment in the face of significant economic

disturbances. In order to anchor longer-term inflation expectations at this

level, the Committee seeks to achieve inflation that averages 2% over

time, and therefore judges that, following periods when inflation has

been running persistently below 2%, appropriate monetary policy will likely aim

to achieve inflation moderately above 2% for some time.”

Victor’s Comment and Analysis:

An important question which no one seems to ask: Why

is the Fed’s inflation target set at 2%?

Do workers get a 2% raise after taxes? Is there a 2% hurdle for cost-of-living

increases in social security or welfare payments? If not, what’s so magical about 2% inflation?

The Fed attempts to answer this question in “Why does the Federal Reserve aim for inflation of 2%

over the longer run?”

However, it never explains why a 2% goal was chosen. Neither does this text from an official Fed

blog titled: From inflation targeting to average inflation

targeting:

“Since

1996, it has been understood among Fed policymakers that the (undeclared)

target for inflation was around 2%. In January 2012, Chairman Ben Bernanke made

this implicit inflation target explicit and official.”

One of the Fed’s two mandates is to achieve “PRICE

STABILITY.” In a 2% INFLATION ENVIRONMENT, prices double in 36 years. That

means home prices double in 36 years at a minimum. What of the new families

that want to buy a home and can’t afford to do so (even if mortgage rates were

zero)? Are they collateral damage for

the Fed’s 2% inflation target?

It bears repeating that increases in money supply

(M2) are the real inflation and price increases are the result (assuming money

velocity increases along with M2).

I believe the Fed aims to help big business and

enable the government to get additional revenue without increasing taxes. Their

monetary policy is not for the benefit of America’s workers.

Also, the Fed says it wants inflation to “average 2%

over time.” What time period is that?

Why not start measuring inflation after the U.S. went off the

international gold standard in August 1971?

Using the official CPI from 12/31/70 to date is +3.86%

annually. At that rate, prices in general double in 18.7 years! And by that

measure, prices have doubled 2.7 times in the last 50.5 years.

Cause and Effect – Fed Liquidity Fuels Junk Bond

Mania:

As we’ve stated many times before (check fiendbear.com links

of interest for all Curmudgeon blog posts), the Fed’s excessively easy monetary

policy, especially now, has created enormous asset bubbles and encouraged risk

taking to levels never seen before.

On example that we recently wrote about is the mania

in junk

bonds. It’s only gotten more

insane since then. The WSJ

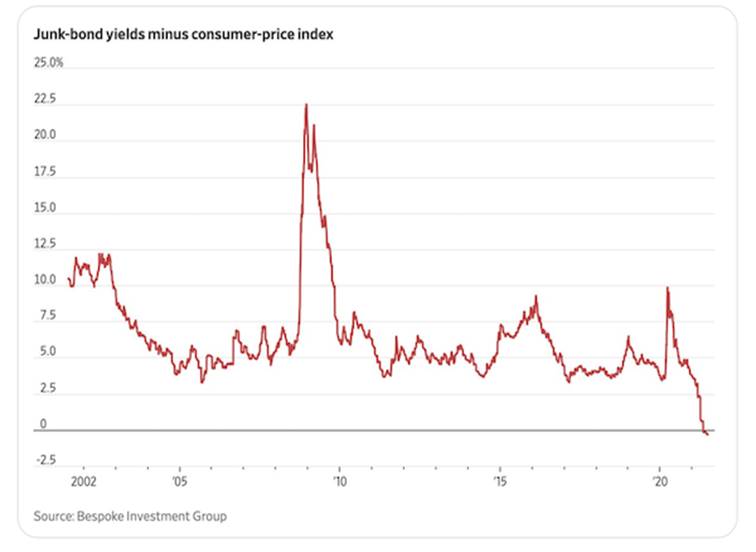

reported on Saturday that for the first time ever, the interest rate investors

receive for investing in the riskiest U.S. company debt fell below the

inflation rate.

A rally in corporate debt rated below investment

grade has pushed yields to record lows around 4.57%, according to ICE Bank

of America data through Thursday, while consumer prices rose 5% in May

compared with a year earlier. As of July

8th, the St. Louis Fed calculates the junk bond

yield at 3.97% - an all-time low.

That marks the first time on record junk-bond yields

have dropped below the rate of inflation, according to Bespoke Investment

Group.

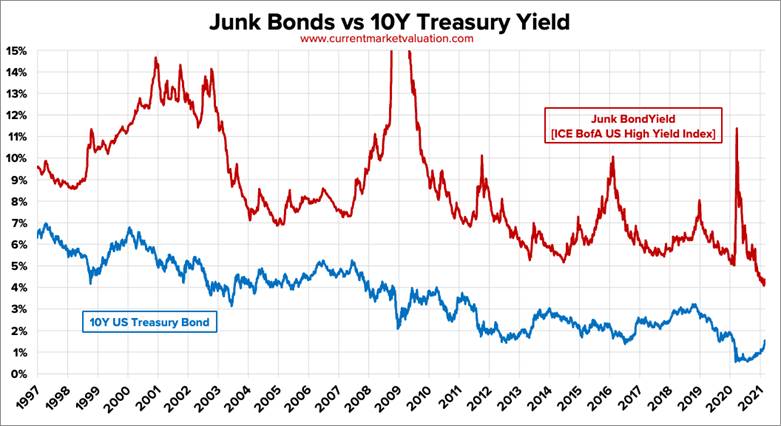

Meanwhile, the spread investors demanded to hold speculative-grade debt instead

of U.S. Treasury was 2.62% as of July 6th, according to Bloomberg Barclays

data. That is down from more than 10% in March 2020. Compare 2.62% to the historical average high

yield spread ~5.2%.

It’s actually far more egregious than that. An

index of the riskiest junk bonds – rated CCC – has increased by 30.91%

in the last 52 weeks.

Gennadiy Goldberg, U.S. rates strategist at TD

Securities, said the inversion indicates investors are chasing returns far

and wide in a low-rate environment, even in riskier places. “This is a function

of too much cash in the system and too few attractive assets for

investors to put their cash into,” he said.

Another Sign of Speculative Frenzy: U.S. Equity Fund Inflows:

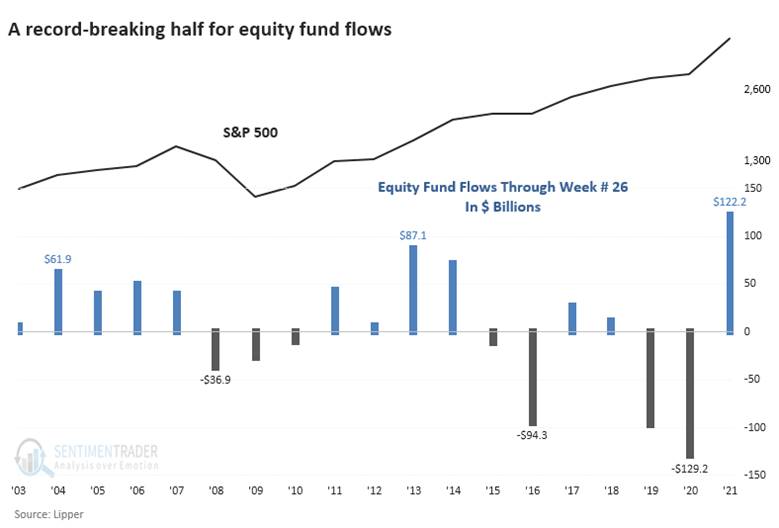

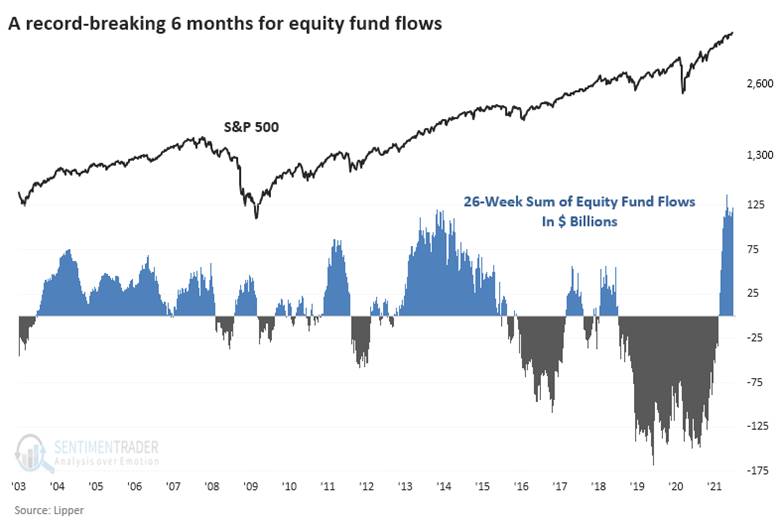

Through June, equity mutual funds and ETFs have taken

in more than $122 billion in assets, according to Lipper. That's the best first

half for flows in almost 20 years. The only first half that exceeds this flow,

in or out, was the pandemic-inspired outflow last year at the March 2021

lows. Two charts tell the story better than words:

Chart courtesy of Sentiment Trader

Chart courtesy of Sentiment Trader

.....…....…....…....…..…....…..…....…..…....…..…..…....…......…..…..…

Economist - Tapering without the Tantrum (?):

In America it looks increasingly weird that the Federal

Reserve is the biggest buyer of Treasuries, as it was in the 1st quarter of

2021. The U.S. labor market seems to be powering ahead with many job openings.

In June it added a stronger than expected 850,000 jobs, according to figures

released on July 2nd That’s despite a very low labor participation

rate.

On Wall Street, cash is so abundant that over

$750 billion is being stashed at the New York Fed’s reverse-repo facility (RRP)

most nights, mopping up some of the liquidity injected by the Fed’s QE. On June

30th RRP absorbed nearly $1 trillion. The Fed’s purchases of mortgage-backed

securities, given the red-hot housing market in the U.S., now looks incredibly

bizarre.

Some central banks have already begun to scale back

their asset purchases. The Bank of Canada began curtailing the pace of its

bond-buying in April. The Reserve Bank of Australia said on July 6th that it

would begin tapering its purchases in September. The Bank of England is

approaching its £895 billion ($1.2 trillion) asset-purchase target and looks

likely to stop qe once that is reached.

By comparison the Fed has been reticent to even say anything

meaningful about scaling back QE. Last month, Fed Chair Jerome Powell, said

that the central bank is “talking about talking about” tapering its purchases

of assets. Minutes of the Fed meeting preceding his comments, released on July

7th, revealed that officials thought it “important to be well-positioned” to

taper. Most economists expect an announcement by the end of the year. Don’t

hold your breath!

Exponential Growth of Central Bank Balance Sheets:

Global central banks’ balance-sheets will have grown

by $11.7 trillion during 2020-21, projects JP Morgan Chase (see chart

below). By the end of this year their

combined balance sheet size will be $28 trillion—about 3/4 of the market cap of

the S&P 500.

Separately, BofA Global Research says that

during the past 15 months, there was a total of $30 trillion of global

monetary and fiscal stimulus announced. That’s more than the stated total

national debt of the U.S. government.

Bof A Global Research has $3.2

trillion in AUM right now. Their clients

have an all-time record high of 64.9% in stocks (vs. a 55% average

equity allocation since 2005). The bank said that the very low level of yields

and Wall Street dependence on the Fed remain key reasons why stock and credit

“investors” still believe in TINA (there is no alternative).

.……..…..……..……..……..………..…..………..……..……..……..……..……..

Chart of the Week:

Chart courtesy of Bianco Research

....………………………..…...……………………..…………………………….

Victor’s Conclusions:

Let’s be honest and objective. The Fed’s monetary policy is deceptive at best

and deceitful fraud at worst. Printing money (AKA “keystroke entries”)

helps asset holders, not the average worker. It has also greatly inflated asset

bubbles in cryptocurrencies, stocks, bonds, real estate, art, etc.

Yet those who propose the Fed’s ultra-easy monetary

policies also preach inequality is bad. Yet they never criticize the Fed, which

has greatly widened income inequality by pumping up asset prices with “money

created out of thin air.” Indeed, Jim Bianco has called the Fed “the

greatest inequality machine” of all time.

In reality, the Fed is as corrupt an institution as

any in DC. If the

economy slows after the Fed scales back its bond buying/money printing later

this year or next, it will surely be increased again to keep the economy strong

for the 2022 midterm elections.

The Fed will make forecasts to further its own cause

-power! We all should assume its “guidance” is made up to fool most of the

people most of the time.

End Quotes:

“After eight years as President I have only two

regrets: that I have not shot Henry Clay or hanged John C. Calhoun.” Andrew Jackson. (Both men were pro central bankers).

“Henry Clay was a lifelong promoter of central banking and

participated in a pitched political battle with President Andrew Jackson over

the rechartering of the Bank of the United States in 1831—a battle that Jackson

won. One reason Clay was such a strong proponent of central banking was that he

saw it as a tool for lining his own pockets.” (As the owners of the Fed do

today).

“A power has risen up in the government greater than

the people themselves, consisting of many and various powerful interests,

combined in one mass, and held together by the cohesive power of the vast

surplus in banks.” John C Calhoun.

…………………………………………………………………………………………

Enjoy

summer, go to an outdoor concert, read a good book, visit with friends and

family, and till next time…….

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been

involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since 1971) to profit in

the ever changing and arcane world of markets, economies and government

policies. Victor started his Wall Street

career in 1966 and began trading for a living in 1968. As President and CEO of

Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and

development platform, which is used to create innovative solutions for

different futures markets, risk parameters and other factors.

Copyright © 2021 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating,

copying, or reproducing article(s) written by The

Curmudgeon and Victor Sperandeo without providing the URL of the original

posted article(s).