Critique of

The Fed’s “Transitory” Response to Rising Inflation

By Victor Sperandeo with the

Curmudgeon

Introduction:

“Inflation” is indeed a worry that the Fed continues

to ignore. That despite the much higher

than expected 4.2% Year over Year (YoY) CPI reported last week - a 13 year high

(analysis below)!

The CPI is a very subjective and an understated

measure of rising prices as we’ve discussed many times

before. In this recent

Curmudgeon post, I wrote: “The CPI does not accurately measure

inflation. It’s created by bureaucrats

at the BLS that tell you what inflation should be if you listen to them.”

Inflation is baked into the 24% increase in money

supply, which will continue to rise with the Fed’s financing U.S. government

debt with no tapering of QE in the near future.

The Fed’s methadone treatment of the U.S. debt is

largely ignored by the mainstream media. We’ve exposed it in several recent

blog posts, including Curmudgeon/Sperandeo: Inflation Inevitable as Fed Since Volcker Has

Becoming Increasingly Dovish and Sperandeo/Curmudgeon: U.S. Government Deception Exposed; Inflation to

Increase.

We elaborate further in this article along with an

explanation of a new Fed toolbox trick called “Yield Curve Control.” Let’s first look at negative real interest rates, which

together with excess liquidity, have caused the many asset bubbles we’ve been

writing about for years.

Negative Real Rates in Perpetuity?

Real interest rates have mostly been negative since

the Fed started QE in December 2008.

This has never been more true than today. Consider the following:

1. Treasury

yields have been negative after inflation for over 12 years. The 10 Year

Treasury Note nominal rate is at 1.63% as of Friday. That’s a current negative

real rate of 2.57% using April’s 4.2% CPI year over year increase. And you have to wait

a full 10 years to get your money back.

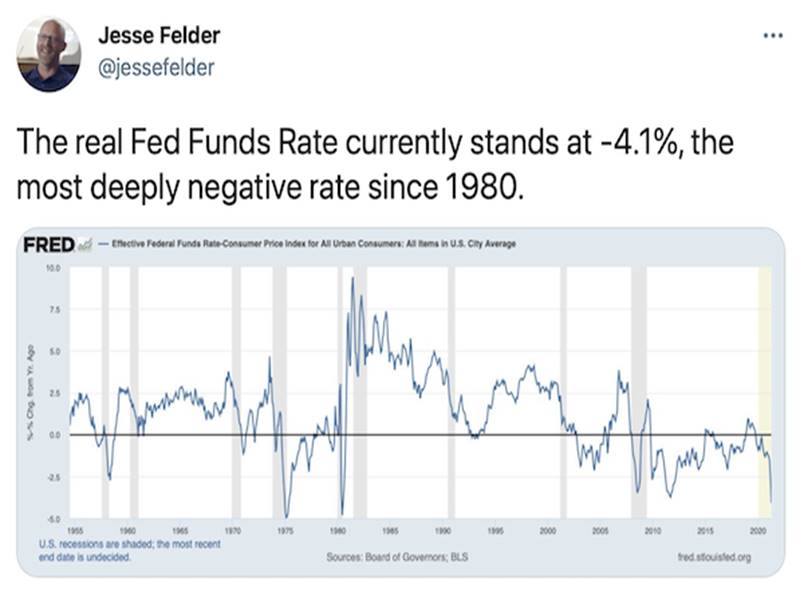

2. What about short-term rates? Consider this tweet by Jesse Felder on the Fed

Funds rate:

3. For the

first time since 1980 (or 41 years), the CPI is rising faster than the average mortgage

rate. Freddie Mac’s rate for a 30-year mortgage averaged 3.1% in the same

month, a smidgen above record lows. That

puts the interest rate on home loans at 1.1% below inflation or a negative real

rate of return for mortgage lenders.

Over the past 50 years, mortgages were an average 4%

above the inflation rate, although that gap’s been halved in the past

decade due to the Fed’s ultra-easy and unconventional monetary policies since

Lehman went bankrupt in September 2008.

Higher Than Expected CPI Reported, but Fed Yawns:

The U.S. Bureau of Labor Statistics (BLS) reported

on May 12th that the CPI for urban consumers increased 0.8% in April

on a seasonally adjusted basis vs the expected 0.2% by economists. The CPI rose 0.6% in March, which was also

more than expected.

Over the last 12 months, the CPI increased 4.2% (vs

3.6% forecast) before seasonal adjustment. This is the largest 12-month

increase since a 4.9% increase for the period ending September 2008.

The CPI core was also up much more than expected at

0.9% on a monthly basis and 3% YoY. The respective

estimates were 0.3% and 2.3%.

Here’s a Bank of America chart on the Core CPI components

with the biggest % month-over-month changes in April and their contributions to

the 0.9% pop in the core CPI:

Source: BofA Global

Research, Bureau of Labor Statistics

……………………………………………………………………………………………...

The shockingly high CPI numbers begged the Fed to say

something to temper the markets concern about accelerating inflation. Yet Chaiman Jay Powell maintained his belief

that inflation (i.e., price increases rather than money supply growth) are “transitory.”

Perhaps, Powell was thinking that because inflation

was very low one year ago (but has risen since), the

year over year (YoY) CPI numbers would decline in future months. But for at least the next three months, the

YoY CPI increases will likely be equally as large or larger, because much of

the U.S. economy was still in lockdown during May-June-July of 2020.

Bank of America, other investment banks and several

research houses believe inflation will be persistent rather than transitory.

Bank of America Global Research on “Transitory”

Inflation:

The inflation forecast is a story of three phases:

1) temporary burst of inflation as shortages drives

up goods prices and reopening support services;

2) softening or reversal of goods inflation and

leveling off of services inflation leaving tame

monthly core inflation prints starting in 4Q.

3) pace of tightening in the labor market pushes core

inflation modestly higher at a more measured pace.

The risk is that the repeated price increases in

phase 1 will send inflation expectations soaring. Higher expectations combined

with wage growth could convert temporary inflation into persistent.

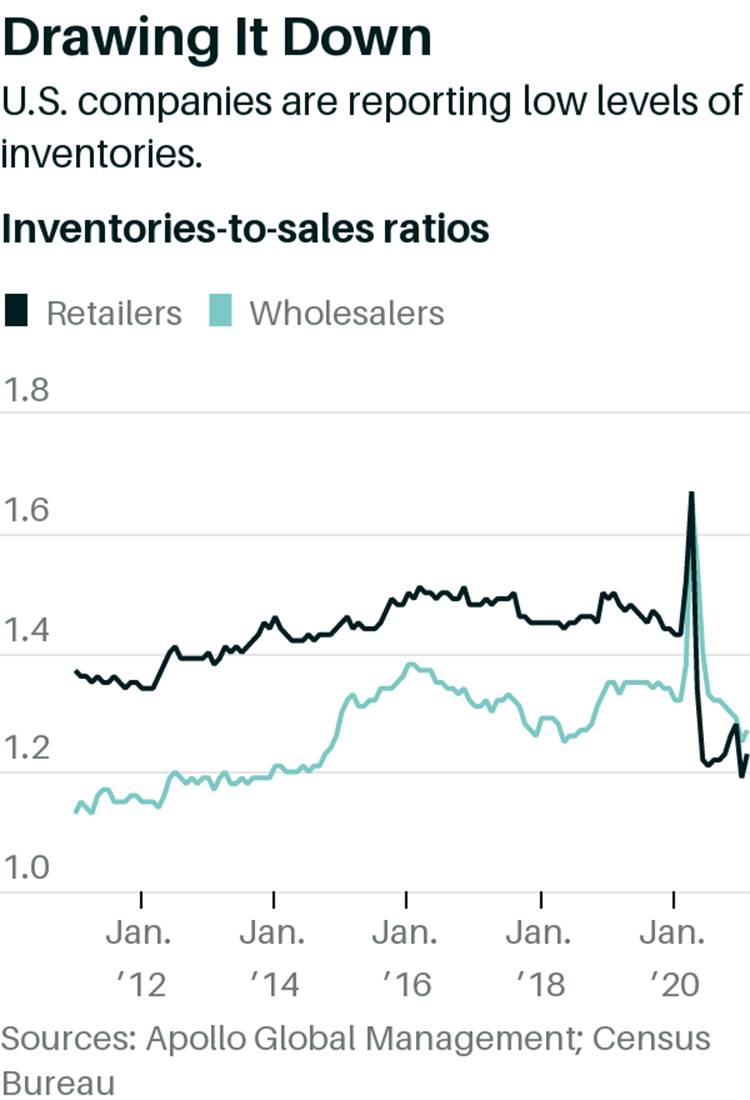

Monitoring inventories will help to understand the

inflation picture. The real inventory-to-sales (I/S) ratio has reached a

record low (see chart below), highlighting the imbalance in the economy.

Autos are the

biggest standout but nearly every major retail category witnessed a decline in

the real I/S ratio. This is a function of both demand and supply: the

stimulus and reopening-fueled burst in demand was not matched by a comparable

gain in supply. Instead, production has been hampered due to COVID-related

supply chain issues and labor shortages.

“Transitory” can feel like a long time says

Bank of America! The investment bank

thinks we are many months away from the economy feeling more balanced and that

inflation will stay high till then.

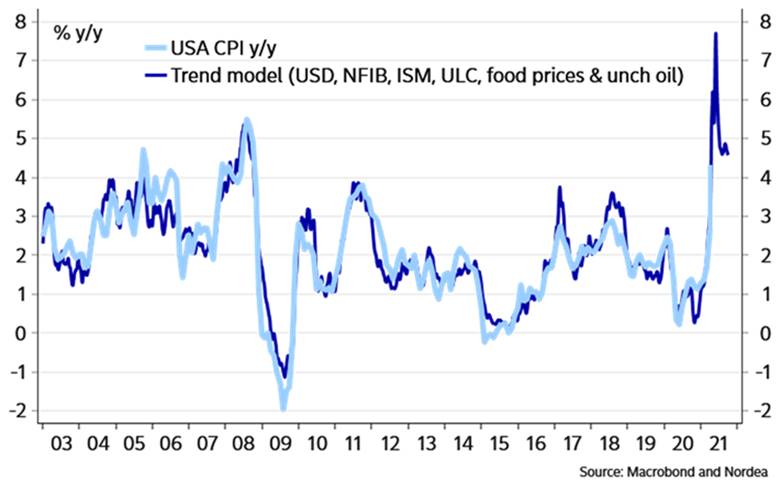

Nordea Bank Forecasts 8% U.S. Inflation by Summer:

Nordea investment bank is one of many that

believe inflation will continue to increase.

Nordea’s trend-model suggests that U.S.

inflation will be close to 8% (YoY)

by this summer before declining to an annual rate of almost 5% by year

end. That’s

shown in this chart of their trend-model vs CPI YoY:

Nordea asks, “Is this enough to scare you? Apparently, it hasn’t

scared the Fed!

The Nordic bank says that the true test is whether

inflation will stay high after summer. The “direct bonuses” of the Biden

administration will run until September, but in parts of the U.S. the stimulus

checks will already be halted during June (e.g., in Iowa and Mississippi). That

will provide an early look at how the labor market looks post the federal

government money handout.

Do you think the Fed is in denial of rising inflation

or is it being influenced by its secret owners to keep blowing bubbles?

The Markets Response – Nirvana Fantasy Land:

When not a word was “spoken” on 5/13/21 by the FOMC

members about inflation worries, the markets all resumed their upward

trajectory into the twilight zone, also known as nirvana

fantasy land.

The coup da grace came Friday. Why were the

markets up in a big way and bond yields declined a few bps? It was because the markets assess the Fed doesn’t care about inflation and will keep monetizing the

debt with no taper or rate rise in sight.

Moreover, the NY Fed suggests that “Yield Curve

Control” [1.] will now be implemented. You can read the hieroglyphics of spin

written in “Fed Speak” in an excerpt from a May 13th NY Fed

statement (emphasis added) which the markets cheered by rallying on Friday:

Effective

May 14, 2021, the Open Market Trading Desk (the Desk) at the Federal Reserve

Bank of New York is making technical adjustments to its purchases of Treasury

securities conducted on behalf of the Federal Open Market Committee (FOMC).

Specifically, the Desk is updating the maturity ranges for its purchase

sectors and the associated sector weights to ensure that the allocation across

sectors remains roughly proportional to Treasury securities outstanding in

those sectors….the Desk will segment its purchase

sectors for longer-dated securities into additional maturity ranges to

reflect last year’s introduction of a new benchmark security. The

Desk will also update associated sector weights.

I have no idea what the new “benchmark security”

is, do you?

Note 1. Under Yield Curve Control, the Fed would target a

fixed longer-term rate and pledge to buy enough long-term Treasury bonds to

keep the rate from rising above its target.

In theory that would enable the Fed to stimulate the economy, but in reality, it would be just another financial market

backstop (like QE and ZIRP).

………………………………………………………………………………………………

SIDEBAR: The

Fed is Playing with Fire:

A May 11th WSJ editorial by Christian Broda and Stanley

Druckenmiller is definitely worth

reading. Here’s

an excerpt:

Normally

at this stage of a (economic) recovery, the Fed would be planning its first rate hike. This time the Fed is telling markets that

the first hike will happen in 32 months or 2½ years later than normal. In addition,

the Fed continues to buy $40 billion a month in mortgages even as housing is

clearly running out of supply. And the central bank still isn’t

even thinking about ending $120 billion a month of bond purchases.

The

emergency conditions are behind us. Inflation is already at historical

averages. Serious economists soundly rejected price controls 40 years ago. Yet

the Fed regularly distorts the most important price of all—long-term interest

rates. This behavior is risky, for both the economy at large and the Fed

itself.

Even

after trillions spent to prop up the bond market, foreigners have continued to

be net sellers. The Fed chooses to interpret this troubling sign as the result

of technicalities rather than doubts about the soundness of current and past

policies.

Fed policy has enabled financial-market excesses. Today’s high stock-market valuations, the crypto craze, and

the frenzy over special-purpose acquisition companies, or SPACs, are just a few

examples of the response to the Fed’s aggressive policies. The central bank

should balance rather than fuel asset prices. The pernicious deflationary

episodes of the past century started not because inflation was too close to

zero but because of the popping of asset bubbles.

Chairman

Jerome Powell needs to recognize the likelihood of future political pressures

on the Fed and stop enabling fiscal and market excesses. The long-term risks

from asset bubbles and fiscal dominance dwarf the short-term risk of putting

the brakes on a booming economy in 2022.

……………………………………………………………………………………………..

Victor’s Conclusions:

An Andrew Jackson observation (more in End

Quotes) is related to the Fed’s negligent stance on inflation: “I weep for the liberty of my country when I

see at this early day of its successful experiment that corruption has

been imputed to many members of the House of Representatives, and the rights

of the people have been bartered for promises of office.”

The implications for today’s Fed and U.S. government

officials in power are crystal clear:

·

If the statistics on fiat

money printing are too high -hide them!

·

If the economy is not

stimulated by Fed easy money than manipulate the GDP numbers!

·

And by all

means lie, deceive and mislead the public to keep the stock market

casino on a roll.

Powell’s Fed Chairman’s term is coming up for renewal

early next year. Perhaps, Powell will become a real man and speak the truth before

then?

We will continue to see high inflation “results” from

federal government spending madness and ultra-easy monetary policies which is

akin to a fiat money drug disease (with a cover up of the results by ending the

money supply reports).

The Fed will likely continue to manipulate yields

using Yield Curve Controls. This last tool in the toolbox not used yet

is also called “interest rate repression.”

The U.S. system of government is in dire decline, as I’ve so often said. I

hope I’m wrong, but the way the Fed is handling the

inflation problem is very ominous for the long-term system of liberty the U.S.

was built upon.

End Quotes (especially meant for those in power):

“Any man worth his salt will stick up for what he

believes right, but it takes a slightly better man to acknowledge instantly

and without reservation that he is in error.” Andrew Jackson, 7th

U.S. President.

“Every man is equally entitled to protection by law.

But when the laws undertake to add... artificial distinctions, to grant

titles, gratuities, and exclusive privileges—to make the rich richer and

the potent more powerful— the humble members of society—the farmers,

mechanics, and laborers, who have neither the time nor the means of securing

like favors to themselves, have a right to complain of the injustice of their

government.” Andrew Jackson

(The Curmudgeon and I firmly believe this quote captures the essence of the U.S. degradation today.)

Finally, a mystic’s quote to understand the process

of government deception and cover-ups.

“When the human race learns

to read the language of symbolism, a great veil will fall from the eyes

of men. They shall then know truth and, more than that, they shall

realize that from the beginning truth has been in the world unrecognized,

save by a small but gradually increasing number appointed by the Lords of the

Dawn as ministers to the needs of human creatures struggling to regain their

consciousness of divinity.” Manly P.

Hall 1934.

Let’s hope that the Fed and government officials heed this quote

and start telling the truth!

………………………………………………………………………………………….

Stay safe, be healthy, take care of yourself and each

other, and till next time……

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned

(since 1971) to profit in the ever changing and arcane world of markets,

economies and government policies.

Victor started his Wall Street career in 1966 and began trading for a

living in 1968. As President and CEO of Alpha Financial Technologies LLC,

Sperandeo oversees the firm's research and development platform, which is used

to create innovative solutions for different futures markets, risk parameters

and other factors.

Copyright © 2021 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the original

posted article(s).