Point Counterpoint

on U.S. Economy; Investment Risks Revealed

By the Curmudgeon

Introduction:

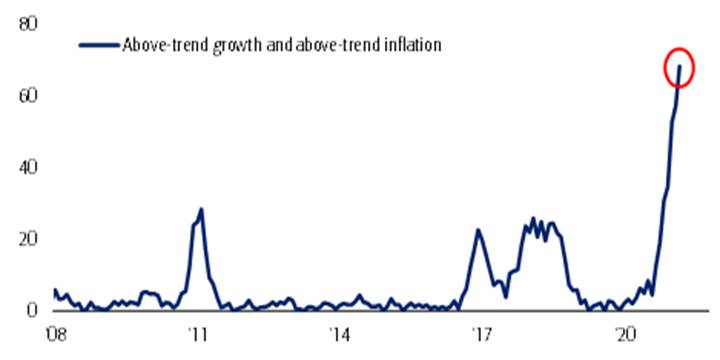

Those looking for above-trend

economic growth and inflation have a lot of company. Thats best exemplified by a Bank of

America Research survey of institutional investors. However, there is a strong dissenting view

from ShadowStats John Williams.

Both agree that inflation is accelerating, as weve chronicled in recent

posts such as Sperandeo/Curmudgeon: Critque of the Feds Transitory Response to

Rising Inflation.

Well examine highlights of

both views in this article.

Bank of America Research Fund

Manager Survey (FMS):

Michael Hartnetts Bank of

America Research monthly Fund Manager Survey (FMS) shows that 69%

expect to see both of these. Thats a

record high as per this chart:

Chart

courtesy of BofA Global Research

Hartnett says 69% of

respondents expect "above-trend" growth and inflation which is a record

high, but its not yet "stagflation."

A net 84% of FMS investors expect a stronger economy (down -6ppt Month

over Month), but still near all-time highs.

FMS economic expectations

still at all-time highs

(Net % of respondents say the

global economy will improve):

Chart courtesy of BofA Global

Research

..

Similarly, a net 83% of FMS

investors expect higher inflation in the next 12 months, (down -10%

Month over Month), but still extremely high.

In contrast, the Conference Boards forecast for U.S. real

GDP growth in 2nd Quarter 2021 is 8.6% (annualized rate), and an

annual expansion of 6.4% (year-over-year) in 2021. Following that robust

recovery, the Board forecasts economic growth of 3.7% (year-over-year) in 2022

and 2.9% (year-over-year) in 2023.

BofA Investment Clock (Fund

Manager Survey edition):

Which of the following do you

think best describes the global economy in the next 12 months?

Chart courtesy of BofA Global

Research

Those bullish views have

pushed fund managers into commodities and late-cyclical stocks. Overweight positions in those areas are close

to 15-year highs.

Investment Risks:

COVID-19 was named a global

pandemic on March 11, 2020. Now in May 2021, a mere 9% cite COVID-19 as the

biggest tail risk. The FMS reveals that

the #1 tail risk for investors is inflation (35%), while #2 is a Fed taper

tantrum (27%) and #3 is the popping of asset bubbles (15%).

Those and other risks are

illustrated in this chart:

Chart courtesy of BofA Global

Research

Hartnet thinks

that accelerating Main Street (real economy) inflation will trigger Wall Street

(financial market) deflations.

With such bullish views on

growth and inflation, the obvious risk for investors is that growth slows, and

inflation proves to be transitory.

Or conversely, that the

economy will actually be much weaker than the heady forecasts which are

so prevalent these days.

Is U.S. Economic Growth

Peaking this Quarter?

The Citigroup Economic

Surprise index, which measures the degree to which economic data is either

beating or missing expectations, dropped recently as some of the key economic

data came in weaker than the consensus expectation. That index is flirting with turning negative for the first time since

mid-2020.

· The

April 2021 Non-Farm Payrolls report came in well shy of expectations,

leading to a big debate about whether the labor market is already getting

tight.

· The

recent CPI report came in significantly higher than expected, thanks to

certain categories related to economic reopening.

· Housing

starts fell much more in April than economists predicted, owing to a litany of

constraints including land, labor and lumber.

· Overall,

expectations for growth remain quite robust. However, its starting to look

like some level of reality is now setting in.

John Williams on the U.S.

Economy:

ShadowStats John Williams takes a strong

contrarian view of the U.S. economy. In

particular, he states on his website that:

The Pandemic-Driven GDP Collapse

appears to have been Understated and the economic rebound

Overstated.

a] April 2021 Housing Starts

Dropped by a Statistically Meaningful 9.5% (-9.5%) in the Month, on Top of a

First-Quarter Contraction.

b] Despite April 2020

Automobile Assemblies in Production Holding Down by 22% (-22%) from February

2020 Pre-Pandemic Peak Activity, Nominal Retail Sales of Automobiles Were Up by

33% in the same period.

c] April 2021 Jobs Increased by 266,000, against

an Expected Gain of 1,000,000, With Unemployment Rising to 6.1% from 6.0%,

Instead of Falling to an Expected 5.8% -- But It Was Worse Than Headlined!

Major Downside Economic Revisions will

be forthcoming in the near future.

Annual Benchmark Revisions to key economic series have been recently

released or are pending, with major negative implications for the GDPs Annual

Benchmarking on July 29th.

a] On May 14th, for example,

the Census Bureau published major downside benchmark revisions to Manufacturers

Shipments, Inventories and Orders (2013-2020) [including nominal New Orders

for Durable Goods (NODG), which were revised lower by- 5.5% in 2020.

b] Also on May 14th, the

Federal Reserve scheduled for May 28th release its long-pending (multi-year

delayed) major downside revisions to its Industrial Production master

series.

c] Next is the May 27th Bureau

of Economic Analysis (BEA) Second-Estimate of First-Quarter 2021 GDP.

d] Where the Fed revised its

annualized First-Quarter 2021 Industrial Production growth May 14th) from 2.5%

to 1.2%. That should take a notch out of

revised First-Quarter GDP growth, as will todays May 18th benchmark reporting

of New Residential Construction.

April 2021 Annual Inflation

Soared to Record or Decades-High Levels as per PPI and Core CPI

rates:

a] April 2021 PPI Year-to-Year

Inflation of 6.17% was the largest advance since 12-month data were first

calculated in November 2010.

b] Monthly and Annual April

2021 CPI Core Inflation (Ex-Food and Energy) Hit 39- and 25-Year Highs of

0.9% and 3.0%, respectively.

John Williams Conclusions:

Sum and substance of the

forthcoming economic headline number revisions, pending and otherwise, is that

the Pandemic-Driven Collapse of the U.S. Economy was much worse than

headlined, and the recovery from same is far shy of where it has been hyped to

be.

GDP has been a lot weaker than

reported. We expect U.S. industrial

production to be revised downwards, which will cause the 1st Quarter

2021 real GDP to be lower than the initial BEA estimate of 6.4% (annual rate).

Also, the July 29th advance

estimate of GDP for the 2nd quarter of 2021 will be much weaker than

bullish forecasts (e.g. the Atlanta Fed GDPNow model estimate for

real GDP growth at a seasonally adjusted annual rate in the 2nd

quarter of 2021 is 10.1% as of May 18th).

In conclusion, the underlying

economic reality remains much closer to the ongoing depression level of

activity reflected in the recent headline Payroll Employment numbers.

Stay safe, be healthy, take care of yourself and

each other, and till next time

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since 1971) to profit in

the ever changing and arcane world of markets, economies and government

policies. Victor started his Wall Street

career in 1966 and began trading for a living in 1968. As President and CEO of

Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and

development platform, which is used to create innovative solutions for

different futures markets, risk parameters and other factors.

Copyright © 2021 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).