Who Controls

the United States of America?

By

Victor Sperandeo with the Curmudgeon

Introduction:

Most people would answer the leadership of the

Democratic and Republican Parties.

Lets examine that belief and then see who really is in control of the

Unites States of America. Well then

move on to discuss related topics, including examples of overwhelming

speculation and acceptance of unprecedented risks in financial markets.

Congress, Lobbyists, and Political Contributions:

Most Congressional representatives listen to their

leadership. If not, they dont get to be the head of important committees, get

campaign financing, or political endorsements and so may not get re-elected.

In reality, political parties tend to vote in unison

and act more like gangs than individual representatives for their districts,

states and for the people that voted them into power.

Corporations and industry groups, labor unions,

single-issue organizations, collectively spend billions of dollars each year to

gain access to elected officials and decision-makers in government. Their motive is to

influence the thinking and actions of politicians. That happens because the political and

economic power that creates company profits and causes winners and losers is in

large part determined by Congressional legislation.

Ever since Citizens United v. FEC allowed

corporations to spend an unlimited amount of money in American elections, large

companies injected unprecedented sums into congressional and presidential

candidate election campaigns. At the same time, transparency eroded as

"dark money" groups, keeping their sources of funding secret, emerged

as political powerhouses.

The intent of most of those large corporate

contributions was to erode competition and strengthen monopoly power [1.].

For example, Alphabet (the parent company of Google)

spent $27,739,455 on political donations

and $8,850,000 on lobbying in 2020 vs $12,780,000 in 2019. Microsoft donated $20,920,628, AT&T

spent $13,266,403, while Amazon coughed up $12,759,813 in 2020.

Note 1. Historically, competition was the enemy of

both Robber Barons (prominent U.S. businessmen in the late 19th century

who had become rich through ruthless and unscrupulous business practices) and Communist

Dictators (like Fidel Castro who condemned competition).

Personal note: I receive about 10 solicitations per day from

the GOP through emails and texts asking for money. One never knows what they will do with the

money requested. You cant write back

and ask as the email address is cryptic, e.g., info@itsourgreatamerica.com. Yet the name on that email stated it was from

House Rep Republican Jim Jordan, who does not know me at all, and I have never

given him a penny.

Its all a scam to get money for a cause you dont

know about and for a party that is not for the average American citizen (Mitch

McConnell is certainly proof of that).

I can make a safe prediction: The Republican Party

will become a Trump party in the future.

Corporatism Explained:

I submit that that the actual political and economic

system in the U.S. today is corporatism

(also called corporativism). The

control of the 535 members of Congress, members of the Supreme Court and

President are, in reality, the 500 largest revenue producing U.S. based

multinational corporations, which are not the same as the companies in the

S&P 500). For reference, the list of

the largest U.S. corporations by revenue is here.

Walmart leads the list of

corporate revenue earners with $559 billion.

I wonder why they were deemed an essential business that was

permitted to remain open during the shutdown?

Those 500 companies received an estimated $14.4

trillion in gross income in 2020. Lets compare that to U.S. GDP. The gross (nominal) GDP in calendar year 2020

was $20,932.8 trillion, while total real GDP was $18,422.6.

>Thereby, those 500 large companies had revenue

equivalent to 68.8% of nominal GDP and 78.2% of real GDP! Meanwhile, corporate

tax revenues are decreasing:

The

U.S. government collected about $230 billion in corporate taxes in 2019,

about 6.5 percent of federal revenues in 2019. Thats down from 9

percent of federal revenue in 2017, before passage of the Tax Cuts and Jobs Act

(TCJA). While revenues and profits have steadily increased, the share of

federal tax revenues from the corporate income tax has been decreasing

for decades it was about 33 percent of revenues in the early 1950s.

Actually, fewer companies control the U.S.

economy. According to talk show host Bill Mahr, Amazon, Apple, Google, Facebook now account

for 21 percent of the entire U.S. economy.

Its much worse than that, according to NYU Marketing

Professor Scott Galloway, who was a guest panelist on Mahrs

March 12th program.

There

are now six companies that are worth more than the bottom 372 in the S&P

500 (Tweet

correction to transcript). Amazon, since March, has added more market

capitalization than all of European retail (sales). We have effectively four

companies (Amazon, Apple, Alphabet/Google, and Facebook) that are so

dominant that weve been overrun.

There's more full-time lobbyists working in Washington for Amazon than

there are U.S. Senators. There are more

people working in PR and marketing communications at Facebook manicuring Sheryls

image than there are journalists at the Washington Post. We are so

beyond any sense of balance in our economy. The (entire) ecosystem is out of

control. We absolutely need to break these companies up (The Curmudgeon

couldnt agree more with that!)

The Rich Get Richer and Pay More Taxes Too:

For reference, 143.3 million taxpayers reported

adjusted gross income of $10.9 trillion and paid $1.6 trillion in

individual income taxes in 2017 (the latest tax year available). Lets

compare that to the top 1 percent of taxpayers:

·

The share of income earned by

the top 1 percent of U.S. taxpayers (i.e. the rich) rose from

19.7 percent in 2016 to 21.0 percent in 2017.

The share of the income tax burden for the top 1 percent rose as well,

from 37.3 percent in 2016 to 38.5 percent in 2017.

·

According to the Tax Foundation, the top 1 percent of

U.S. taxpayers accounted for more income taxes paid than the bottom 90

percent combined!

·

The top 1 percent paid

roughly $616 billion, or 38.5 percent of all income taxes, while the bottom 90

percent paid about $479 billion, or 29.9 percent of all income taxes. They paid a 26.8 percent average individual

income tax rate, which is more than six times higher than taxpayers in the

bottom 50 percent (4.0 percent).

Many of the top 1 percent are CEOs or executives of

the 500 large companies. Through their

companies, they controlled about 78% of real GDP in 2020 and individually

earned 32% more money than 143.3 million people earned in 2017!

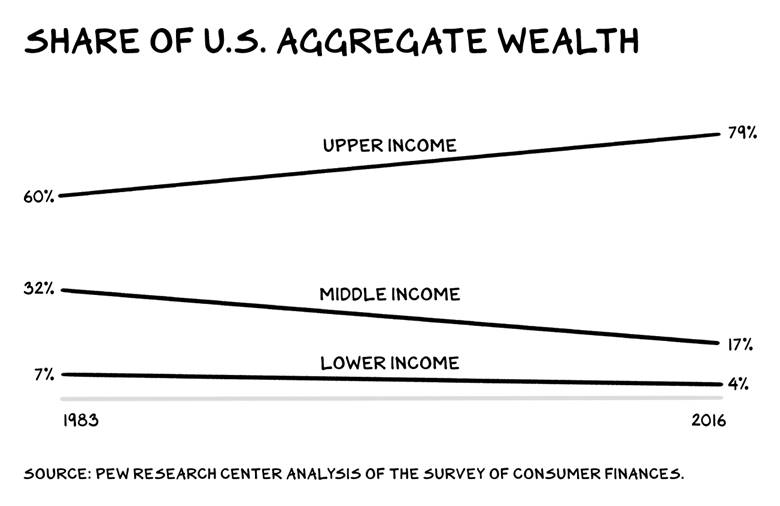

Prof. Galloway worries

that our government has been co-opted by the wealthy and is focused on

protecting the previous generation of winners, even if it means reducing future

generations ability to win. He asks, arent we borrowing against our

childrens prosperity to protect the wealth of the top ten if not one

percent?

What do you think after looking at the chart below?

..

..

.

.

.

.

..

..

...

..

..

.

.

.

.

..

.

..

......

Market Comments:

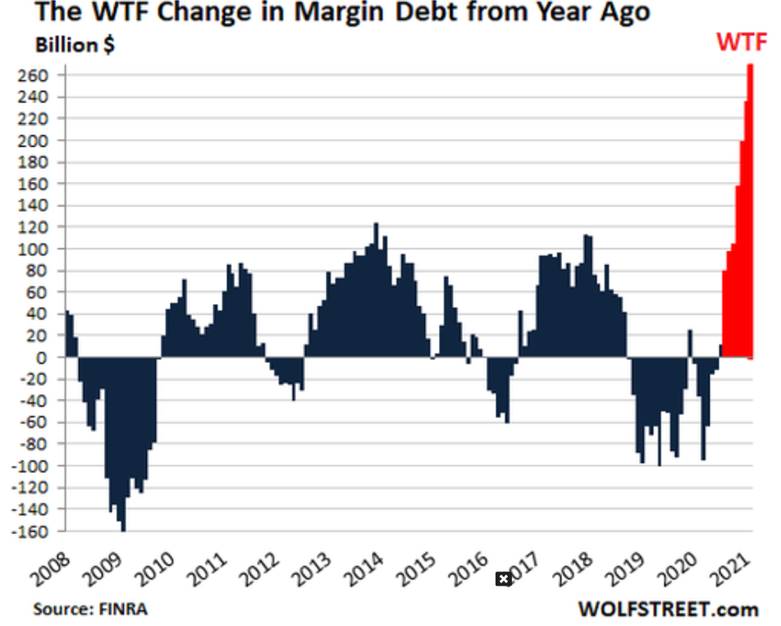

The markets are rampant with speculation. Bitcoin, margin debt, and penny stock

volumes are all at record highs and increasing at exponential rates.

Margin debt the

amount that individuals and institutions borrow against their stock holdings as

tracked by FINRA at its member brokerage firms is just one indication of

stock market leverage. (FINRA reports it monthly). Other types of stock market

leverage are not reported at all, or are disclosed only piecemeal in SEC

filings by brokers and banks that lend to their clients against their

portfolios, such as Securities-Based Loans (SBLs). No one knows how much total

stock market leverage there is. But margin debt shows the trend.

In February, margin debt jumped by another $15

billion to $813 billion, according to FINRA. Over the past four months, margin

debt has soared by $154 billion, a historic surge to historic highs. Compared

to February last year, margin debt has skyrocketed by $269 billion, or by

nearly 50%, for another WTF sign that the all-asset mania has gone berserk:

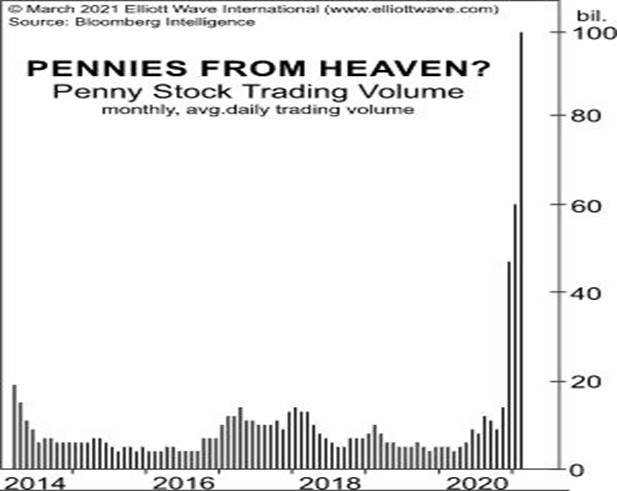

Meanwhile, total Penny Stock Dollar Volume hit

$72 billion this past January, the highest level since the first three

months of 2000, when the dot-com mania peaked. Other than those three

months, when penny-stock dollar volume averaged a whopping $155 billion, the

value of shares traded in January 2021 was the highest. This suggests a nearly

unprecedented acceptance of risk. The chart below shows the average daily

trading volume in penny stocks. Does it look reasonable to you?

.

President Biden is calling Vladimir Putin a killer

in response to an interview question. That may be true, but Russia has more

nuclear warheads than any other nation, including the U.S. So, Bidens

provocation was not at all intelligent diplomatically, to say the least! The Kremlin described the U.S. presidents

remark as very bad, and recalled its ambassador to analyze what needs to be

done about the two countries relations.

I believe China, Russia, and perhaps Iran will

challenge Bidens authority as they see him as a weak figurehead.

That is a new, unrecognized risk for financial

markets (especially so called risk assets), which are at historic valuations,

long in the tooth (aged), and characterized by unprecedented wild speculation.

Conclusions:

Multinational corporations can buy anyone with a pittance of gross revenue. THAT IS WHO

CONTROLS AMERICA TODAY!

.

Arthur

Jensen Pitches Economic Determinism's New World Order to Howard Beale

There is no America.

There is no democracy. There is only IBM and ITT and AT&T and DuPont, Dow,

Union Carbide, and Exxon. Those are the nations of the world today.

The clip above is from

the classic movie Network which came out in 1976 and was well ahead of its

time. The Fiendbear believes that if Hollywood isnt too afraid, there should

be an updated remake. Instead of TV the theme would be streaming and social

media (think of how Facebook and Twitter control speech and content).

.

Many of those companies (e.g., Alphabet/Google)

significantly contributed to Joe Bidens presidential campaign. Biden is for open borders and no tariffs.

For example, AT&T owns CNN, who hated Trump. Why?

AT&T has locations in 120 countries around the world. They want open

borders and no tariffs. AT&T made a

total of $13,266,403 political contributions in 2020 and spent $12,820,000 in

lobbying in 2019. It wouldve been more

if not for the companys huge debt burden.

The biggest media conglomerates in America are

AT&T, Comcast, Walt Disney, National Amusements (includes Viacom Inc. and

CBS), News Corp and Fox Corporation (both owned in part by the Murdochs). Those six mainstream media companies

believe it is far more profitable to sell and influence public opinion rather

than report the news!

>You dont get the news from those sources; you

get pure propaganda.

Conversely, you get totally honest news, and more

facts from the Curmudgeon (and other unbiased) blog posts than the mainstream

media. Thats because the authors dont

deal in other conflicting businesses like the big six media companies do.

When asked why he robbed banks, Willie Sutton said,

because thats where the money is. The

same principle applies to politics.

End Quotes:

The corporate and political goals are best

exemplified by these two quotes:

All over the place, from the popular culture to the

propaganda system, there is constant pressure to make people feel that they are

helpless, that the only role they can have is to ratify decisions and to

consume. Noam Chomsky

Whoever

controls the media, controls the mind. Jim Morrison

Stay calm, be well, think positive, and till next time

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since 1971) to profit in

the ever changing and arcane world of markets, economies and government

policies. Victor started his Wall Street

career in 1966 and began trading for a living in 1968. As President and CEO of

Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and

development platform, which is used to create innovative solutions for

different futures markets, risk parameters and other factors.

Copyright © 2021 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).