Stock Market

Valuations Enter the Twilight Zone and Wall Street Could Care Less

By the

Curmudgeon with Victor Sperandeo

Introduction:

When do bull markets end? Historically,

its when buying power/pressure is exhausted. After a long, sustained rise in prices

investor sentiment becomes euphoric. Thats a strong confirmation that the vast preponderance of

money that can be attracted to the market has already been committed. In the past, this exhaustion of sideline

buying power led to a market top as profit taking from pros overwhelmed amateur

latecomers that wanted to get in on the action.

BUT THIS TIME HAS BEEN

DIFFERENT! We examine why in this post.

Victor then provides his unhedged market comments and assessment.

Discussion:

The combination of Fed

supplied liquidity, exponentially increasing money supply, all-time highs in

margin debt, options & penny stock volume, U.S. federal government stimulus

payments (used to speculate in stocks), and negative real interest rates have

combined to cause unprecedented amounts of speculative money that CONTINUES

flowing into stocks.

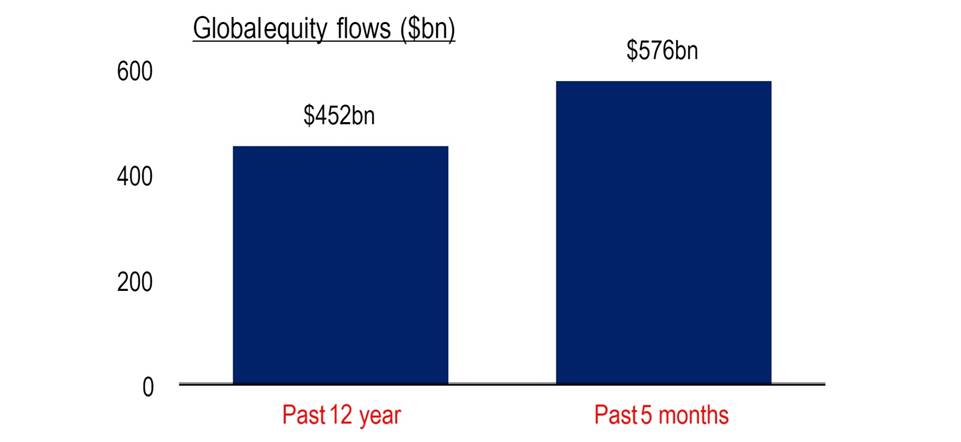

Equity funds have attracted

more money ($576 billion) in the past five months, then all the inflows

recorded over the previous 12 years ($452 billion), according to

data from BofA! In the past week

alone, a net $15.6 billion went into stocks.

Source: Bank of America Global Research

BofA

private clients, with $3.1 trillion assets under management (AUM), have a record

63.6% allocated to stocks. Compare that to 39% in February 2009 - one month

before the market bottom. The investment bank has equated this stampede into

stocks as a "melt-up" in markets.

Sentiment has

become overwhelmingly bullish. The latest sentiment survey by American

Association of Individual Investors (AAII) showed retail investors are their

most bullish in the past three years.

"Sentiment is in very

worrisome territory as is valuation, yet money flows continue to push

indices higher," said Tobias Levkovich, Citi's

chief U.S. equity strategist.

No one seems to worry that the

market has become incredibly expensive.

The new mantra seems to be buy high, sell NEVER (not higher).

For example, the S&P 500

trailing P/E is now 46.92 vs 21.19 one year ago. Thats a P/E

expansion of 121+% (stock prices rose while earnings decreased over the past 52

weeks). The S&P index made its fifth

new all-time closing high in the month of April and fourth new all-time high

this past week alone!

The P/E of the Russell 2000

cannot be calculated, because the cumulative earnings of the underlying

companies are negative!

Meanwhile, volatility has

been collapsing. The VIX (CBOE

volatility index) hit a recent closing low of 16.67 on Friday, April 9th. Thats the lowest

level since early 2020. The VIX was

37.21 on January 29th. Such

current low volatility is a sign of extreme investor complacency.

Indeed, many traditional

market-top signals, ranging from retail investor surveys to valuations, have

been flashing red for some time.

Yet it seems few if any have

heard bells ringing? Nothing has been able to stop the inexorable rise in stock

prices.

Image Credit: Hedgeye

Earnings are Peaking!

You may think the stock market

is a discounting mechanism? We

dont! A BofA earnings

per share (EPS) model for global equities is peaking this month and expected to

roll over (please refer to the chart below).

The model is composed of Asian export growth, global PMI, US Treasury

yield curve and Chinese financial conditions.

BofA global EPS model peaks in

April 2021 at 35% YoY

Source: Bank of America Global

Research

..

SoGens Albert

Edwards wrote in a note to clients:

The highly regarded Chicago Fed National Activity Index (CFNAI)

collates 85 U.S. economic indicators into an aggregate measure. It is

calibrated so that zero represents trend GDP growth. The economic activity in

February has fallen back to trend only around 2% or slightly below. It may be

this data is an anomaly but keep a very close eye on

this as given the recent rally, the market is now very vulnerable to cyclical

disappointment.

>In fact, the CFNAI

was 1.09 in February, down from +0.75 in January!

For Q1 2021, the estimated

earnings growth rate for the S&P 500 is 24.5%, according to Factset. With stock valuations so high,

theres little room for disappointment in future earnings. That implies that if the U.S. economy slows

after the anticipated first half 2021 pop, corporate profits will decline

leaving the stock market quite vulnerable to a selloff.

Market Analysts Comments:

Keith McCullough of Hedgeye says the pros were bearish going into last

week. In an email to clients, he wrote: Wall Street is short the

S&P 500 by a net -44,528 (futures) contracts. We told you it would be a short squeeze. Thats the thing about short squeezes, when volatility

goes into this bucket and volatility goes into the teens and falling toward 10,

its bullish.

"Goldilocks and melt-up

are popular terms this week and we think that can be seen through market

valuation," said Emmanuel Cau, head of European

equity strategy at Barclays. "We remain optimistic but theres less upside

left in our view."

"You should definitely be

worried about valuations and all the more so when people start justifying

extremely high valuations," said Fahad Kamal, chief investment officer at

Kleinwort Hambros. "We are risk-on,

but we haven't put our foot down on the accelerator because of valuations in

some parts of the market."

"We see reasons to expect

periodic bouts of higher volatility in the near term," analysts at UBS

Global Wealth Management said in a report published Friday.

"Very near term, we

expect equities to continue to be well supported by the acceleration in macro

growth and see buying by systematic strategies and buybacks driving a grind

higher. But we expect a significant consolidation (-6% to -10%) as growth

peaks over the next three months," Deutsche Bank Chief Strategist

Binky Chadha wrote in a research note to clients on April 6th.

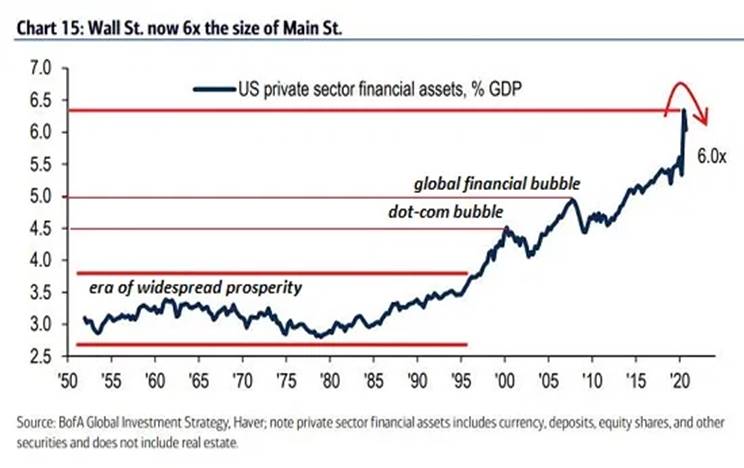

Charles Hugh Smith: If we compare financial-bubble

assets (Cloud Castles in the Sky) to the nations Gross Domestic Product

(GDP), a (flawed) measure of real-world activity, we find financial bubble

assets are worth over six times the nations real-world economy. This reflects

what happens to the valuations of Cloud Castles in the Sky when money is

created out of thin air and then leveraged into fantastic, monstrous illusions

of wealth.

>Please read Mr. Smiths End Quote below.

..

Victors Comments:

Welcome to The Twilight Zone!

No society in the history of

the world has ever had these kinds of free money policies, which benefit

those in power and thereby widen income inequality.

My current market views are as

follows:

· Risk on

with equities continuing to rise until the U.S. spending bills (e.g.,

infrastructure) are complete.

· Bonds -

choppy to down, especially if inflation is perceived to be rising rapidly.

· Dollar

- stable to up as rates continue to rise.

· Gold

choppy to down (needs to close over $1900/ounce to technically confirm a

bullish uptrend)

· Silver

is the most undervalued asset at this time.

End Quotes:

This over eagerness to buy

is a classic sign of a bubble. Unknown

Buyers know there will always

be a greater fool willing to pay more for an over-valued asset because the

Fed has promised us it will always be the greater fool. Since everyone knows the Fed will always save

the day should valuations falter, buyers know there will always be a greater

fool willing to pay more for an over-valued asset because the Fed has promised

us it will always be the greater fool. Charles Hugh

Smith

The essence of a speculative

bubble is a sort of feedback, from price increases, to increased investor

enthusiasm, to increased demand, and hence further price increases

...Wishful

thinking bias appears to play a role in the propagation of a speculative

bubble. Robert Shiller

Speculative bubbles are most

typically a function of leverage, which takes its cue from aggressive

lending practices (when uncollateralized paper loan claims dwarf the pool of

reserves of the system). Paul Brodsky and Lee Quaintance

To ultimately survive, it is

also essential that you become aware of the (warning) signs of a bubble

and avoid them at all costs. You will probably leave profits on the table but

will also avoid the painful and debilitating financial collapse that

follows along with those who were either too short-sighted or greedy to avoid

entrapment in the Pollyanna Paradox.

Matt Blackman

.

>Stay tuned for part II

of Who

Controls the United States of America? with fresh insights from

Victor. Well

try to post that piece tomorrow.

..

Stay calm, be well, life will

get better, and till next time

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned

(since 1971) to profit in the ever changing and arcane world of markets,

economies and government policies.

Victor started his Wall Street career in 1966 and began trading for a

living in 1968. As President and CEO of Alpha Financial Technologies LLC,

Sperandeo oversees the firm's research and development platform, which is used

to create innovative solutions for different futures markets, risk parameters

and other factors.

Copyright © 2021 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).