More Extreme

IPO Valuations Latest Sign of Financial Euphoria

By the

Curmudgeon

Introduction:

U.S. stocks are now incredibly

expensive. According to the WSJ,

the 52 week trailing P/E of the S& P 500 is

currently 45.4 vs 20.11 one year ago. Bank

of America (BoA) says thats

the second most expensive reading since 1901, as per this chart:

Last December, we opined that

IPOs were in bubble territory and there were signs of financial

euphoria everywhere you looked. Well, it

has only gotten more extreme since then as we describe below. But first lets look at flows into and out of various types of

equities.

Bank of America The Flow

Show:

The 1st quarter of

2021 saw record inflows to global equity ($372bn), emerging markets ($65bn),

value stocks ($35bn), tech stocks ($30bn), financial stocks ($24bn). Global equity inflows were the largest as

a percent of Assets Under Management (AUM) in 15 years.

For the past week, BoA reports the following flows: $20.7bn into equities, $10.4bn into bonds,

$1.1bn out of gold; $0.9bn out of tech stocks (largest outflow since Sept

2020).

Soaring IPOs in 1Q-2021:

IPOs had a terrific 1st

quarter. Renaissance Capital says there were 100 IPOs that raised $39.2

billion. That's the most since the 133 IPOs in the 3rd

quarter of 2000, which raised $18.5 billion.

If IPOs from Special

Purpose Acquisition Companies (SPACs) are included, accounting for about a

whopping 75% of all public offerings in the quarter, the total number increases

to 398. The 298 SPACs raised $87 billion. In fact, at the current pace, there

could be more than 1,000 SPAC IPOs this year. That's

more than double the 486 IPOs in 1999, at the peak of the dot-com mania. On

average, the number of IPOs in a typical year is about 200.

"While end-of-quarter

volatility threatens to dampen activity, record filings have kept the pipeline

full, and several high-profile deals are set for the second quarter," the

Renaissance report stated.

There are currently some 89

IPO registrations on file, seeking to raise $12 billion. However, Renaissance estimates there are an

additional 250 companies that are IPO-ready. Some of them, perhaps about 25%,

are believed to have filed confidentiality, as allowed by the SEC. These are

companies with revenue of less than $1 billion that will publicly file when

ready.

Meanwhile, there's

a bundle of "unicorn" companies expected to go public sometime this

year. These are companies with valuations above $1 billion.

They include Squarespace,

Robinhood, Marqeta, Oatly

and Instacart. Others include Flipkart, Grab, AppLovin

and KnowBe4. CoinBase is planning a direct listing

with a value near $50 billion.

In the first quarter, the

largest IPO by deal size was Coupang at $4.5 billion, followed by dating app

Bumble at $2.15 billion, then solar company Shoals Technologies (SHLS), at $1.9

billion.

Not included on this list is

online gaming platform is Roblox (RBLX), which completed a direct listing and

began trading at a $42 billion market cap. The Roblox IPO was the first direct

listing this year.

Do you sincerely think any of

these new age companies deserve their current valuations?

Conclusions:

I believe we are in the late

mania stage of a gigantic stock market bubble.

In that phase:

· Everyone

notices the rising prices.

· Prices

detach from underlying economic reality.

· Euphoric

and increasingly irrational investors extrapolate recent price gains into the

future.

· Enthusiasm

spreads like a virus and causes rampant speculation.

· A

feedback loop ensues rising prices amplify stories that seem to justify high

valuations, which attract an ever-increasing number of buyers, e.g., 1999 -

mouse clicks became a valuation metric.

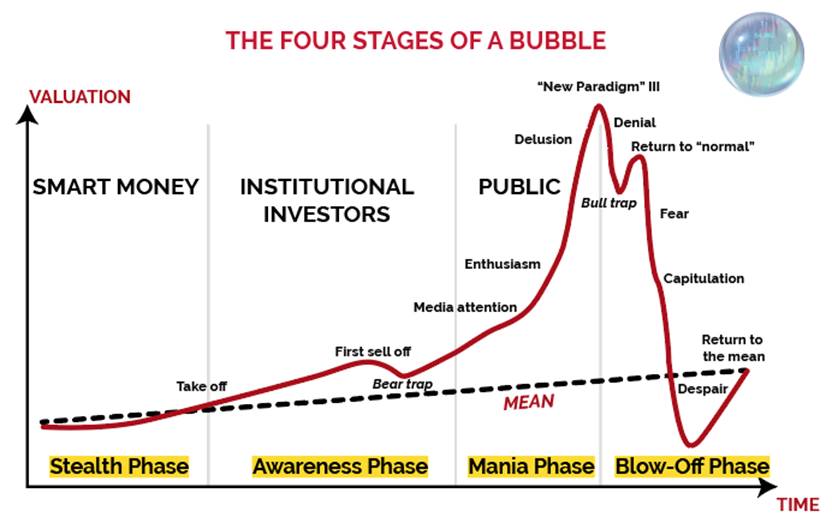

Recently, theres been a lot

of talk about the post-COVID economy

and markets being a period like the Roaring

20s. What do you think about

that and where do you think the U.S. stock market is today in the Four

Stages of a Bubble chart below?

End Quote:

The long, long bull market

since 2009 has finally matured into a fully-fledged epic bubble. Featuring extreme

overvaluation, explosive price increases, frenzied issuance, and hysterically

speculative investor behavior, I believe this event will be recorded as one of

the great bubbles of financial history

The one reality that you can

never change is that a higher-priced asset will produce a lower return than a

lower-priced asset. You cant have your cake and eat

it. You can enjoy it now, or you can enjoy it steadily in the distant future,

but not both and the price we pay for having this market go higher and higher

is a lower 10-year return from the peak.

Excerpts from, Waiting for the Last Dance: the hazards of asset

allocation in a late-stage major bubble, published by GMO.

.

Stay calm, be well, life will

get better, and till next time

...

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been

involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since

1971) to profit in the ever changing and arcane world of markets, economies and

government policies. Victor started his

Wall Street career in 1966 and began trading for a living in 1968. As President

and CEO of Alpha Financial Technologies LLC, Sperandeo oversees the firm's

research and development platform, which is used to create innovative solutions

for different futures markets, risk parameters and other factors.

Copyright © 2021 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).