Magnificent

Six Stocks Up Mightily; Rest of Market Down in L Shaped Economic Recovery

By the Curmudgeon with

Victor Sperandeo

Introduction:

We cover a lot of important topics in this post. The divergence between big tech names and the

rest of the market has well exceeded the Nifty Fifty extremes, as Fiendbear

points out below. Stock valuations,

according to Warren Buffet’s favorite indicator are in the stratosphere, at the

highest level since the dotcom top. The

U.S. economy has yet to recover while John Williams of ShadowStats sees

a long bottoming processes in an “L shape” as noted in his comments.

Victor re-iterates his call for hyperinflation in the U.S. and provides his

opinion on topics related to our article posted earlier this week:

Sperandeo/Curmudgeon:

End Game for U.S. Debt Spiral: Hyperinflation, MMT, and Minimum Basic Income.

Large Cap Tech Stocks Distort Stock Market Indexes:

Would it not be for six big tech stocks – Apple, Facebook, Amazon, Netflix,

Microsoft, and Google’s parent Alphabet – the S&P 500 would be DOWN this

year. The Washington Post reports that through

Tuesday, these six stocks collectively were up more than 43% in 2020, while the

rest of the companies in the S&P together lost about -4%. Those numbers are each slightly higher at the

end of trading this Friday, highlighting the ongoing divergence between big

tech and the rest of the market.

The S&P 500 closed the week up 0.7% and 11.65 points on Friday at

3397.16, a new closing high. Apple was responsible for about 60% of the S&P

500’s gains after climbing 8.2% to $497.48 this week. Apple’s influence on the

Dow Jones Industrial Average was even starker. The blue-chip benchmark was

unchanged on the week, at 27,930. Without Apple, which contributed 259.61 Dow

points, the DJI index would have fallen 260.30 points, or -0.9%. The NASDAQ

Composite rose 2.65% to 11,311.80. In

sharp contrast, the small cap Russell 2000 was down -1.61% for the week and

-0.76% on Friday.

Market breath has been weakening. On Friday, just 220 stocks in the S&P 500

closed higher for the day, and that was far from an anomaly. The S&P

500’s cumulative advance/decline line—a measure of the number of stocks

finishing higher versus those finishing lower that technicians use to gauge the

market’s underlying strength—has been falling even as the S&P 500

progressed to a record.

With the stocks analyst Ed Yardeni dubs “the Magnificent Six”

accounting for more than one-quarter of the S&P index’s value, investors

who think they are buying a diversified slice of the broad U.S. stock market

are actually making a concentrated bet on companies that share many attributes,

analysts said. “It’s a big headache for

investors,” Yardeni said.

“The dependence on such a small number of mega-cap stocks is not a healthy

sign for the markets or the economy at large,” said Michael Farr, chief

executive of the investment firm Farr, Miller, and Washington. “It’s hard to

determine what will knock the halos off these companies’ heads. My best guess

is that it will take a more definitive improvement in the economic growth

outlook or rising interest rates.”

“It’s more of the same,” says Dave Donabedian, chief investment officer at

CIBC Private Wealth Management. “Winners in the last month are the same winners

for the last year.” And those same

stocks have been the leaders for the past decade, which is unprecedented. Almost always, the leaders in any given bull

market, are laggards in the next stock market up cycle. Not so this year!

Fiendbear notes: “I call them the MAGA

stocks. Microsoft Apple Google Amazon. Worth about 6 trillion out of about 22

trillion in the S&P 500. An unprecedented divergence putting the Nifty

Fifty to shame. Apple has gained 1 trillion this year in one of the worst

economies. I never thought I would live to see a bubble this big but here we

are.” [Curmudgeon agrees 100%!]

Stock Market Valuations Hit Post Dot Com Bubble High:

The Magnificent Six stocks are far from cheap, trading at a

price-to-future-earnings ratio (forward P/E) of about 44. To some investors,

continued investor demand for such high-priced stocks is itself a worrying

sign. Buying them at current ultra-high valuations amounts to making “an

extremely bearish” bet on prospects for the rest of the economy, according to

Richard Bernstein, a New York-based investment manager. “You’re basically saying, ‘No other stock

will grow,’” he added.

With respect to stock market valuations, the stock market

capitalization-to-GDP indicator, also known as the "Buffett

indicator," is flashing RED.

The historical average of the indicator is 1, and before the dot-com

bubble, it hovered at 1.71. According to Yahoo Finance, the Buffett Indicator is at

1.7, signaling that the stock market is highly overvalued.

Unprecedented Big Tech Influence on Economy and Markets:

The market’s growing reliance on a handful of tech industry heavyweights

underscores a societal dominance that may be spawning a winner-take-all economy

and warping political debates, critics have said.

In a front page story in its August 20th print edition, the New York Times wrote “As the economy

contracts and many companies struggle to survive, the biggest tech companies are

amassing wealth and influence in ways unseen in decades.” Highlights:

The stocks of Apple,

Amazon, Alphabet, Microsoft and Facebook, the five largest publicly traded

companies in America, rose 37 percent in the first seven months this year,

while all the other stocks in the S&P 500 fell a combined 6 percent,

according to Credit Suisse. In the 12

months through the end of June, these five companies earned nearly $500 million

a day in net income combined.

As the tech-dependent S&P

500 roared back from its pandemic crash earlier this year, these companies

faced growing political opposition, including the threat of regulatory

action in the United States and Europe aimed at curbing their influence.

Those five companies now

constitute 20 percent of the stock market’s total worth, a level not seen from

a single industry in at least 70 years. Apple’s stock market value, the highest

of the bunch, reached $2 trillion on Wednesday — double what it was just 21

weeks ago.

The tech companies’ dominance

of the stock market is propelled by their unprecedented reach into our lives,

shaping how we work, communicate, shop, and relax. That has only deepened

during the pandemic, and as people shop more frequently on Amazon,

click on a Google or Facebook ad or pay up for an iPhone, the companies receive

a greater share of spending in the economy and earn ever larger profits. This

is why investors have flocked to those stocks this year at the expense of the

scores of companies struggling in the health crisis and are betting that their

position will be unassailable for years.

Indeed, “Covid-19 was the perfect positive storm for these guys,”

said Thomas Philippon, a professor of finance at New York University.

Critics say these tech titans have grown in part because of a range of

anti-competitive practices. European regulators are investigating whether

Apple’s App Store breaks competition rules. U.S. regulators are looking at

whether large tech firms committed antitrust abuses when acquiring other

companies. Some antitrust scholars believe the rise of industry-dominating

companies has led to stagnant wages and increased inequality. Last month, the

giant tech company CEOs were grilled by members of the House Judiciary antitrust

subcommittee. They seemed to have

escaped without any action taken against them to constrain their monopoly

powers.

“Any single action by one of these companies can affect hundreds of

millions of us in profound and lasting ways,” said Representative David Cicilline, a Rhode Island Democrat, in his opening

statement at the hearing. “Simply put: They have too much power.”

According to some competition experts, the concentration in some industries

is greater today than in the late 1800s, when Congress passed sweeping

antitrust legislation to curb the power of the railroads.

“The regulatory environment next year is going to be brutal for these

companies. It doesn’t make any difference who the [U.S.] president is,” said

Roger McNamee, co-founder of Elevation Partners, a Silicon Valley

private-equity firm. “The issues facing these tech companies are becoming more

serious all the time. And the market may not be able to count on them.”

Disappointing U.S. Economic News and L Shaped Recovery:

Last week’s economic news was not good.

Weekly jobless claims rose back above one million; the Empire State and

Philadelphia Fed indexes (measures of manufacturing activity in the New York

and Philadelphia regions) came in below expectations; and the Fed’s minutes

from its July meeting highlighted the economic risks ahead stating more federal

stimulus would likely be needed to mitigate the ongoing recession.

Fed officials at the meeting “agreed that the ongoing public health crisis

would weigh heavily on economic activity, employment, and inflation in the near

term and was posing considerable risks to the economic outlook over the medium

term,” the meeting summary stated. The Fed reached a consensus on the need for

more fiscal help from Congress, which went into recess without a deal for more

rescue funding even as critical elements such as enhanced unemployment

insurance remain expired.

The minutes “underscored the need for a fiscal package,” said Quincy Krosby, chief market strategist at Prudential Financial.

“Chairman Powell has been adamant that we need to see another package,

especially because they see the negative effects of the slowdown.” Yet that is not happening and may not occur

till after the November elections.

Even though strict lockdowns ended weeks ago in the U.S. [1.],

many people across the country are still avoiding malls, restaurants and other

businesses. The shift in behavior points to a reshaping of American commerce,

fueling questions about the strength and speed of the economic recovery as the

coronavirus continues to spread. Through

August 15th, daily visits to businesses were down 20% from last

year, according to a New York Times analysis of foot traffic data from

the smartphones of more than 15 million people.

Continued weakness at brick-and-mortar stores has enormous implications

for an economy that has had years of gains wiped away in the months since the

pandemic hit. The disparities in how people shop hint at a prolonged,

uncertain, and uneven economic recovery.

Note 1. Strict rules are still largely in place in California

where only essential businesses are open.

Malls, shopping centers, gyms are closed while indoor dining is not

permitted in most counties. The SF Bay

Area was effectively shut down this past week due to lightning induced fires

that caused evacuations, prolonged power outages, and very bad air quality

which forced residents (like the Curmudgeon) to remain indoors in their homes.

Shadowstats John

Williams comments:

·

Initial Claims for Unemployment Insurance Widened

Unexpectedly Widened (August 20th, Department of Labor). New claims for

unemployment deteriorated unexpectedly for the week ended August 15th, on top

of negative revisions to the prior week’s detail.

·

That was consistent with a prolonged “L”-shaped

economic recovery [2.] now unfolding.

·

July 2020 Cass Freight Index® Held in Deep Annual

Contraction, Consistent With Bottom–Bouncing Manufacturing, but Running

Increasingly Counter to “Booming” Retail Sales.

·

Panicked, Unlimited Federal Reserve Money Creation and

Federal Government Deficit Spending Are Triggering Major Domestic Inflation.

·

With Dollar Debasement Intensifying, Holding Physical

Gold and Silver Protects the Purchasing Power of One’s Assets.

Note 2. L-shaped economic recovery is characterized

by a steep drop followed by a long period of high unemployment and low economic

output. The Great Depression, which lasted 43 months with four straight years

of negative GDP growth, was L-shaped. This is unlikely in the current

environment, considering the strength of the U.S. economy before COVID-19 and

the unprecedented economic support from the Federal Reserve.

….………………………………………………………………………………………………….

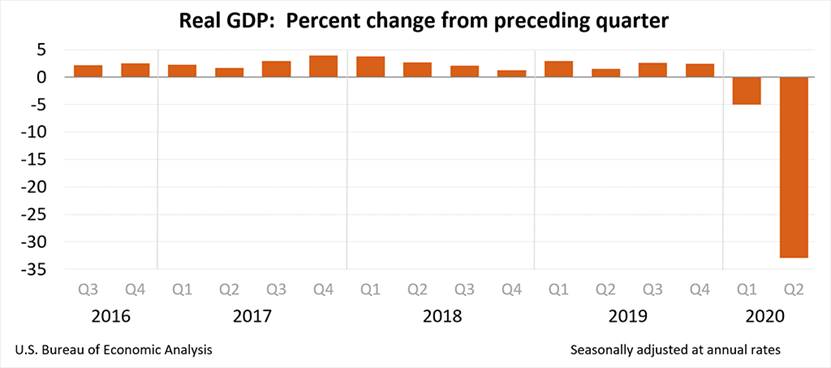

Most economists believe that U.S. GDP (see chart below) will turn

upward in the third quarter as businesses continue to open. But with the

extreme decline in business activity during the first half of 2020, it will

take sustained growth to return the economy to its pre-recession level. In its

June economic projections, the Federal Reserve Open Market Committee projected

a 6.5% annual drop in GDP for 2020, followed by 5.0% growth in 2021 and 3.5%

growth in 2022. The simple math of these projections suggests the economy may

not return to its 2019 level until 2022.

Adding to the prognosis for a slow economic recovery is the fact that the

rest of the world is also fighting the COVID-19 pandemic, including many countries

where growth was already more sluggish than in the United States. And if the

virus resurges in the fall or early 2021, the recovery may turn jagged with

significant setbacks along the way. It’s

important to note that five of the Magnificent Six tech companies derive

significant revenues from non-U.S. sources. The only exception is Amazon with its huge

e-retail and cloud computing services.

Victor’s Comments:

I stand 100% behind my call for hyperinflation, which I believe is

a highly probable outcome for the U.S. economy in the years to come. I believe Modern Monetary Theory (MMT) will

FAIL, because to replace U.S. debt with newly “created money” would be taking

profits (i.e. interest payments on debt) away from the most powerful

institution in the world – U.S. banks!

All money is “loaned into existence,” because the banks get a piece of

the action.

Moreover, as we enter a prolonged recession next year (~ 1% GDP), it’s

likely that politicians advocating Universal Basic Income (UBI) will demand a

minimum guaranteed income for all and that is where the hyperinflation will

originate from. The UBI will come from

the U.S. Treasury; not the FED which can’t SPEND MONEY, IT CAN ONLY LOAN MONEY.

The USSR lasted a long 69 years (till its demise in 1991). The U.S. in its

current form (off the Gold standard using fiat money) is 49 years old. Peoples

Republic of China (PRC) is 42 years old in its current form (since Deng

Xiaoping became PRC leader in 1978 and ushered in a series of far-reaching

market-economy reforms). As envisioned

by the U.S. Constitution, gold lasted 143 years (1791-1933). During that long period the U.S. experienced

4% GDP growth with only a trace of inflation.

Closing Quote:

One of our U.S. founding fathers said of debt (emphasis added):

“And to preserve their independence, we must not let our rulers load us

with perpetual debt. We must make our election between economy and liberty,

or profusion and servitude. If we run into such debts, as that we must be taxed

in our meat and in our drink, in our necessaries and our comforts, in our

labors and our amusements, for our callings and our creeds, as the people of England

are, our people, like them, must come to labor sixteen hours in the

twenty-four, give the earnings of fifteen of these to the government for their

debts and daily expenses; and the sixteenth being insufficient to afford us

bread, we must live, as they now do, on oatmeal and potatoes; have no time to

think, no means of calling the mismanagers to

account; but be glad to obtain subsistence by hiring ourselves to rivet their

chains on the necks of our fellow-sufferers.”

THOMAS JEFFERSON

……………………………………………………………………………………………..

Good luck, be well, stay safe and till next time………………………….

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since 1971) to profit in

the ever changing and arcane world of markets, economies and government

policies. Victor started his Wall Street

career in 1966 and began trading for a living in 1968. As President and CEO of

Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and

development platform, which is used to create innovative solutions for

different futures markets, risk parameters and other factors.

Copyright © 2020 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).