Analysis

of September 2020 OECD Economic Report: Living with Uncertainty

By the Curmudgeon

OECD Report Summary:

The coronavirus pandemic along with geopolitical uncertainty and aging

economic expansions have caused global economic growth to contract sharply in

the 2nd Quarter 2020. All G20

countries with the exception of China (you cant trust their economic numbers)

will have suffered recession in 2020.

The Organization for Economic Cooperation and Development (OECD) latest

forecast is for global GDP to fall by 4.5% this year, before growing

by 5% in 2021. In its June 2020 Economic

Outlook report, the OECD expected the global economy would contract by 6% this

year and grow 5.2% next year.

Although OECD forecasts a fragile recovery next year, in many countries

output at the end of 2021 will still be below levels at the end of 2019, and

well below what was projected prior to the pandemic. India, Mexico, and South

Africa will experience an even larger recession than the OECD anticipated three

months ago.

Uncertainty remains high and the strength of the recovery varies markedly

between countries and between business sectors. Prospects for an inclusive,

resilient and sustainable economic growth will depend on a range of factors

including the likelihood of new outbreaks of the virus, how well individuals

observe health measures and restrictions, consumer and business confidence, and

the extent to which government support to maintain jobs and help businesses

succeeds in boosting demand.

How successfully a country manages coronavirus cases will determine whether

it permits its economy to reopen or remain in a semi-locked down state. If a government can keep COVID-19 infection rates

at a bare minimum, occasional outbreaks are much easier to deal with. This is

reflected in the two countries leading the OECD latest gross domestic product

projections through 2021: China and South Korea economies are

expected to grow 8% and 3.1%, respectively in 2021. Conversely, Japan was already

careening into a recession before the coronavirus outbreak, which was

relatively mild in that country.

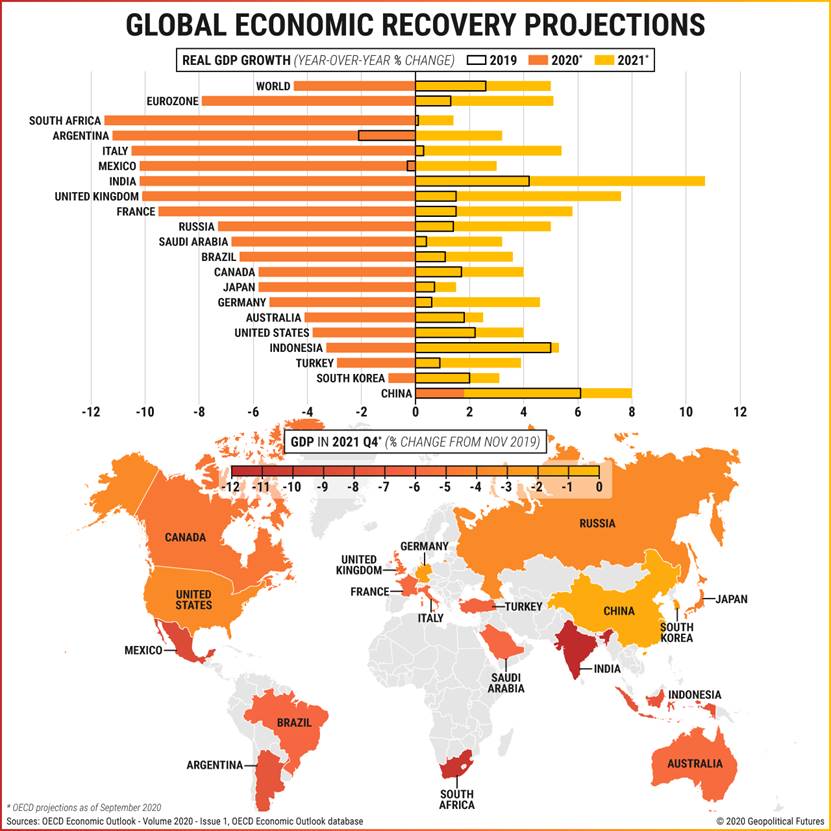

The OECD economic projections (see graph below) also make clear that

COVID-19 isnt the only factor involved. The U.S. has not managed the pandemic

very well, but its economy is still expected to bounce back better than most

nations. China and Europe are also

expected to perform better than expected.

In its September 2020 Economic Outlook report OECD says:

Prospects for economic growth

will depend on various factors, including the likelihood of new virus

outbreaks, the impact on consumer and business confidence, and the extent to

which government aid for jobs and businesses can boost demand. The

unprecedented policy support by governments needs to continue but become more

targeted and be flexible enough to adapt to changing conditions. Policymakers

need to convince people that they are working to improve their lives and

creating opportunities for all.

Output picked up swiftly

following the easing of confinement measures and the initial re-opening of

businesses, but the pace of the global recovery has lost some momentum over the

summer months.

"In most economies, the

level of output at the end of 2021 is projected to remain below that at the end

of 2019, and considerably weaker than projected prior to the pandemic, highlighting

the risk of long-lasting costs from the pandemic.

Image Credit: Geopolitical Futures

Key Messages from the OECD Report:

·

Policymakers have reacted and managed to buffer the

initial shock well.

·

Activity rebounded as confinement measures started to

ease, but momentum appears to be plateauing and confidence remains weak.

·

Policy still matters to boost confidence: improve health

care, maintain fiscal and monetary support, assist people and firms with

ongoing changes.

·

Recovery plans are a once in a lifetime opportunity to

encourage sustainable, inclusive, and green growth.

Comment and Analysis:

The OECDs forecasts seem to be Pollyanna-like optimistic, predicting

massive V-shaped recoveries in most of the worlds leading economies. For 2021, the OECD sees positive real GDP in

EVERY country it tracks with a 5.7% average for all 37 OECD countries. Yet most economists expect GDP in almost all

countries to decline well into 2021.

That was detailed in last weeks post titled Global

Economies Rebound, but Wont Reach Pre-Coronavirus Levels Till 2022.

Some of the country OECD estimates are contingent on policy assumptions

that may not materialize.

For example, OECD expects the U.S. Congress to approve another stimulus

package worth up to $1.5 trillion this fall. That despite the fact that negotiations have

reached an impasse. Reaching an agreement may be more difficult as the November

election approaches. ShadowStats John

Williams continues to forecast a L type of economic recovery for the U.S.

The OECD assumes that the United Kingdom (UK) will reach a "basic"

free trade agreement for goods with the European Union (EU). But

talks could be crushed by a controversial bill introduced by Prime Minister

Boris Johnson's government, which would break the terms of a previously

negotiated divorce agreement.

But what if the above agreements dont materialize? Or if COVID-19 vaccines prove less effective

than hoped? Or if the damage being wrought by the virus and the extreme rescue

measures being deployed in response lead to structural changes (e.g. travel

restrictions) that inhibit economic growth?

Closing Quotes:

"The world is facing an acute health crisis and the most dramatic

economic slowdown since the second World War. The end is not yet in

sight," Laurence Boone, OECD chief economist.

For the last five years, much of corporate cash flows were deployed into

share buybacks, not capital spending or productivity improvements. We're

probably in a more diminished state because of the financial engineering in the

past decade than we were prior to the previous financial crisis. We're in a bad

situation, Robert L Rodriquez, former managing

partner at FPA (who says Were in a Rolling Depression.)

.

Good health, good luck and till next time

.

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since 1971) to profit in

the ever changing and arcane world of markets, economies and government

policies. Victor started his Wall Street

career in 1966 and began trading for a living in 1968. As President and CEO of

Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and

development platform, which is used to create innovative solutions for

different futures markets, risk parameters and other factors.

Copyright © 2020 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the original

posted article(s).