Global

Economies Rebound, but Wont Reach Pre-Coronavirus Levels

Till 2022

By the Curmudgeon with

Victor Sperandeo

U.S. Economic Growth

Forecasts for 3rd Quarter 2020:

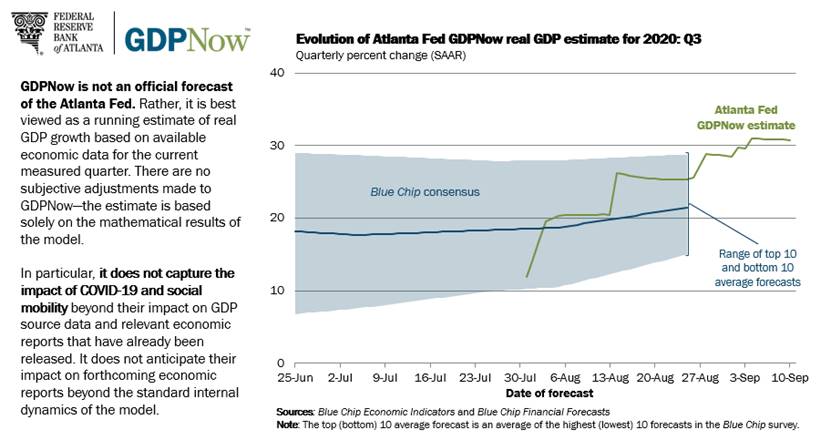

The closely watched (but

mostly wrong) Federal Reserve Bank of Atlanta GDP Now

estimates the U.S. economy to grow 7% (or at an annualized rate of 30.8%) in

the 3rd quarter.

NOTE: GDPNow is NOT an

official forecast of the Atlanta Fed. Rather, it is best viewed as

a running estimate of real GDP growth based on available economic data

for the current measured quarter. There are no subjective adjustments made to

GDPNowthe estimate is based solely on the mathematical results of the model.

..

Victor notes

that Goldman Sachs (the God of Wall Street) is forecasting

a 35% annualized GDP growth rate for the 3rd quarter. "We upgraded our near-term growth forecasts

based on the much stronger-than-expected August jobs report and the solid

summer data more generally, and our forecast of 35% is now nearly 14 percentage

points above consensus," Goldman said.

.....

.

While the 3rd

quarter U.S. GDP growth forecasts look quite good, it comes after a 9.1% non-annualized

contraction in the 2nd quarter.

U.S. GDP decreased at a 34.3% or $2.15 trillion last quarter.

Global Growth to Slow Starting

in 4th Quarter:

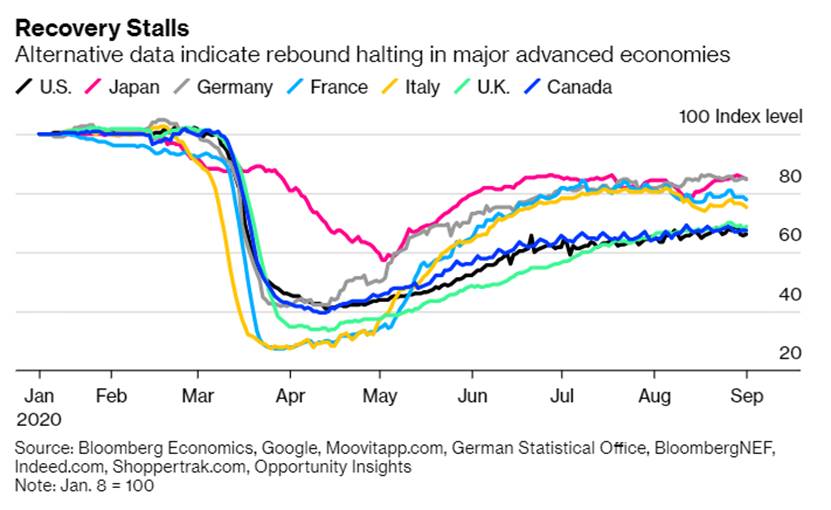

After the 3rd

quarter rebound, economists expect the U.S. economic recovery to slow to a

crawl, with the U.S. economy not returning to pre-coronavirus levels until early

to mid 2022.

The picture is similar

elsewhere. The United Kingdom reported 6.6% GDP growth in July relative

to June but noted that output was still 11.7% lower than in February. Economists are warning that recapturing all

the growth lost in the lockdown will take months as the recovery slows into

year-end.

"With most sectors of the

UK economy now open, the prospect of large bounces in activity is low.

Meanwhile, the fallout from the Chancellors plan to end the furlough scheme

and the recent pick-up in Brexit anxieties suggest the headwinds to the

recovery are beginning to increase," said Nikesh Sawjani,

UK Economist at Lloyds Bank.

ING Economics anticipates

the U.K. reaching pre-pandemic economic growth levels no sooner than late

2022. The U.K. suffered the most severe decline in output among developed

countries during the 2nd quarter, but the month-to-month sequence of

decline and recovery has been broadly similar in other rich countries.

The global economy contracted

for a second straight quarter in the three months through June, with widespread

lockdowns and individual efforts to avoid infection dealing a severe blow to

activity.

Across the Group of 20

leading economies, the 3.4% decline in output recorded in the first three

months of the year was already the largest since records began in 1998, but the

second-quarter drop was without precedent in the decades since the end of World

War II.

In a

blog post Friday, Philip Lane, the European Central Banks chief

economist, sounded a cautious note on Europes stuttering economic recovery and

weak inflation rate, leaving open the door to a fresh burst of stimulus in the

coming months.

In a

blog post Friday, Philip Lane, the European Central Banks chief

economist, sounded a cautious note on Europes stuttering economic recovery and

weak inflation rate, leaving open the door to a fresh burst of stimulus in the

coming months.

Airlines Take a Hit:

Worldwide, airlines are under

tremendous pressure from global government travel curbs and fear of air travel:

The CEO of Qantas Airlines says flights

are operating at only 20% of normal capacity.

Singapore Airlines is poised to trim

another 4,300 jobs as the carrier struggles to recover from the drop in

international air travel. The airlines operations remain in the single digit

percentages relative to 2019.

United Airlines, Finnair, and Hawaiian

Airlines plan additional layoffs.

Lufthansa may further trim its twin-aisle fleet, with the A380, 747-400 and

A340 now seen at risk of not returning to service. The carrier could shed 100+

aircraft overall as part of the move, with jobs also at risk thanks to reduced

operations.

Many flights have been cancelled,

especially international flights to and from the U.S.

Other Signs of Economic

Weakness:

There were signs of economic

weakness elsewhere, as fresh outbreaks of the virus prompted new restrictions

and additional caution among consumers, with declines in activity recorded in

Japan, India, Australia, Kazakhstan, Spain, and Italy. Between them, those

countries account for 15% of world output.

Emerging Markets Face Long

Road to Recovery:

While developed nations

economies are likely to experience mostly flat growth in 2021 and then recover

in 2022, the developing world will take longer to rebound to pre-coronavirus

growth readings.

For example, Mexicos

GDP is expected to take between two and six years to recover, according to the

deputy governor of Mexicos central bank.

Indias

economic recovery could be stalled for a prolonged period of

time, due to the severe lockdowns in that country. The outbreak hit the

Indian economy just as it started to witness the start of a recovery from a

growth slowdown originating in 2018. Covid-19 restrictions may accentuate this

situation.

The prospect of emerging

nations lagging industrialized countries in the current coronavirus crisis is

an outcome of volatile capital flows along with deterioration in macro

indicators in several of those countries.

It remains to be seen when such capital flows will return to pre-crisis

levels.

Conclusions:

Global economic growth has

rebounded this quarter, but the outlook beyond that is very murky and fraught

with risks to economic growth.

Navigating the immense social,

monetary, and financial pressures of such prolonged recoveries will obviously

be a major challenge for all governments going forward.

World economies are facing a

long slog of retooling businesses, reallocating resources, and retraining

workers in industries that are no longer viable. That kind of restructuring

could play out for quite some time before we see the sharp economic rebound the

global bourses have already discounted in stock prices.

Bloomberg says that stock markets are

vulnerable to disappointment in economic numbers in the coming months amid a

gradual curbing of emergency fiscal support.

Closing Quote:

We have seen (the) peak

rebound. From now on, the momentum is fading a little bit.

"Longer term is not

looking good right now in terms of support for consumption, and therefore

business investment and growth in the U.S. economy.

Joachim Fels, global economic

adviser at Pacific Investment Management Co., told Bloomberg Television.

..

Good health, good luck and

till next time

.

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974

bear market), became an SEC Registered Investment Advisor in 1995, and received

the Chartered Financial Analyst designation from AIMR (now CFA Institute) in

1996. He managed hedged equity and alternative (non-correlated)

investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned

(since 1971) to profit in the ever changing and arcane world of markets,

economies and government policies.

Victor started his Wall Street career in 1966 and began trading for a

living in 1968. As President and CEO of Alpha Financial Technologies LLC,

Sperandeo oversees the firm's research and development platform, which is used

to create innovative solutions for different futures markets, risk parameters

and other factors.

Copyright © 2020 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).