Mixed Sentiment and

Composite Indexes; Bad to Horrific Economic Outlook; Debt Crisis Looming; Relax

Nonetheless!

By the

Curmudgeon with Victor Sperandeo

Preface:

We re-iterate that readers should NOT pay much, if any, attention to financial

markets until the COVID-19 pandemic stabilizes and new cases/deaths start to

level off. Doing so, with the volatility

expected, will surely raise your anxiety levels.

Instead, we highly recommend participating in video meetings of your

choice, reading good books, talking with friends and family, practicing

meditation and deep breathing, listening to relaxing music, etc. At least till the Shelter in Place orders are

lifted.

Introduction:

At its recent low on Monday March 23rd, the S&P 500 had

fallen much faster and by much more than any bear market in post-World War II

history during its first 23 trading days. Indeed, it was off by about -34%,

more than six times greater than any bear market post-1945. The intensity of

volatility over the past 5 weeks has been especially noteworthy, reaching

all-time highs based on many measures.

As we expected and noted in last weeks post - Curmudgeon/Sperandeo:

Perspective: U.S. Economy and Stock Market Implode in Just 21 Trading Days!,

there was a huge three day rally from Tuesday to Thursday, before Fridays ~4+

% selloff in the popular averages.

Lets examine what stock market sentiment, trend indicators, and the near-term

economy are saying now.

Sentiment and Market Trend Composite Indicators:

Its a mixed picture.

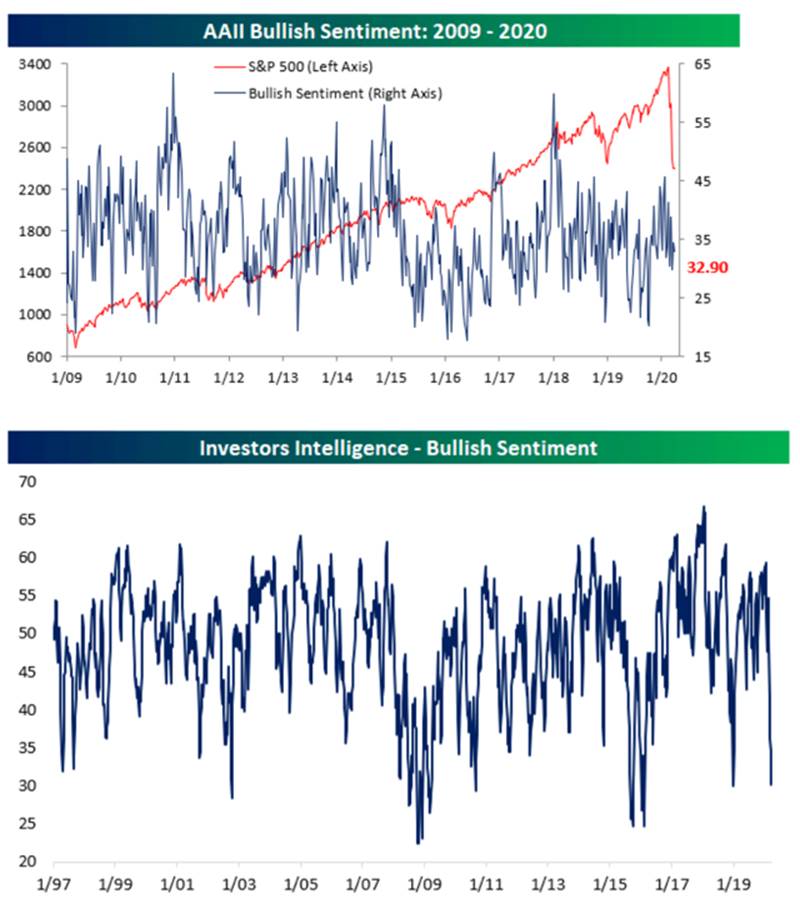

Investor sentiment from AAII's weekly survey are showing bearish

readings right now, despite the big rally this week. Thats not surprising after the 23-trading

day market stock market crash. Only

32.9% of respondents reported as bullish this week, down from 34.4% last week.

Bearish sentiment increased to 52.1% from 51.3%.

As of Saturday night March 28th, the Timer Digest top ten

stock timer consensus is Bearish with 2 Bulls, 7 Bears, and 1

Neutral. The Top Long-Term Timers are Bearish

with 1 Bull, 5 Bears, and 4 Neutral. To a large extent you should ignore such

expert market timers or even take their consensus as a contrary indicator.

That is because they seem to be always wrong when you need their advice most

(almost all were bullish at the top and throughout the first 3 to 4 weeks of

the bear market)!

Leutholds Major Trend Index (MTI) ticked

up this week to 0.90 which is only slightly bearish (0.95 to 1.05 is

considered neutral).

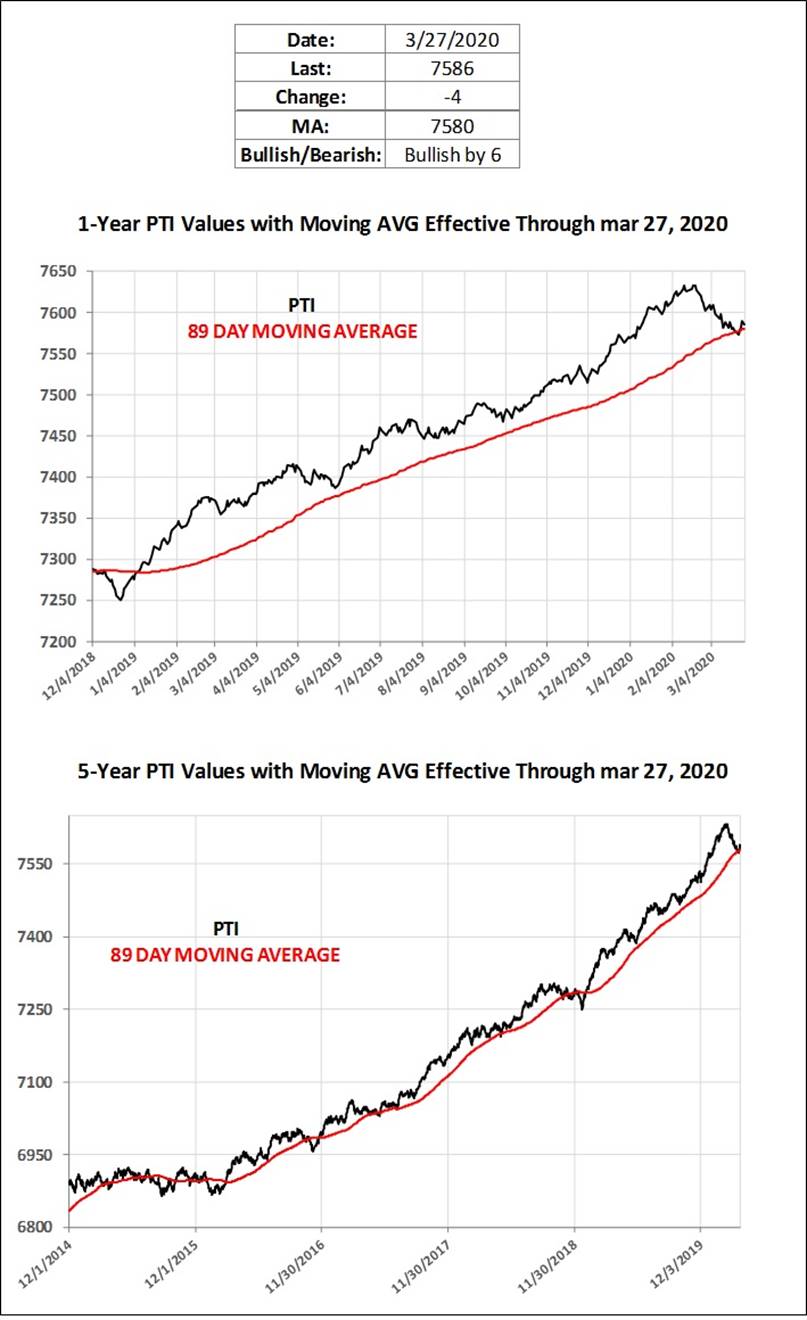

The late and great Richard Russells Primary Trend Index (PTI) is bullish

by 6 points and slightly above its 89 day moving

average:

U.S. Economy will be Bad to Horrific:

Thought Thursdays off the charts 3.3M new initial jobless claims report

was bad? It certainly surprised

economists who had forecast only about 1M new claims.

Did you notice last weeks Michigan Consumer sentiment index

report? At 89.0, it dropped 11.9

Index-points in March. That was the

fourth largest one-month decline in nearly a half century [1.]. The Index of Consumer Expectations, at

79.7, decreased by a whopping 13.5% or 12.4 index points from the February 2020

reading of 92.1.

Note 1. The steepest monthly decline

in this index was barely larger at -12.7 Index-points in response to the

deepening recession in October 2008, and there were two declines of 12.2 points

in response to the 1980 recession and Hurricane Katrina in September 2005

.

;

.

Chief Economist Richard Curtain wrote: There is no silver bullet

that could end the pandemic as suddenly as the military victory that ended the

Gulf war. To avoid an extended recession, economic policies must quickly adapt

to a new era that will reorder the spending and saving priorities of consumers

as well as the relative roles of the public and private sectors in the U.S.

economy.

.

The economic numbers are going to get a whole lot worse,

which is very scary if you still have a job or live off your investments.

Economists surveyed by Fortune predict a -8% to -30% drop in 2nd

quarter GDP and an unemployment spike that will grab headlines for many weeks. St. Louis Fed President James Bullard said

U.S. unemployment could rise to 30 percent in a few months.

Shadowstats John

Williams wrote: Pending Economic Impact of Pandemic: Likely the Deepest

Headline GDP Drop in Modern History (Post-World War II Reporting). From commentary 1430:

- Financial-System Insolvency Laid Bare by the Pandemic, as

Circumstances Accelerate Towards a Hyper inflationary Great Depression.

- Federal Reserve Moves Towards Unlimited Currency Creation.

- While the Federal Government Promises Unfettered Deficit Spending.

- All Looking to Bailout Wall Street and the Banks, and to Provide Some

Consumer Liquidity Relief.

-->It's going to be very, very ugly. That implies that, for no other

reason (like technical analysis of historic bear market price patterns), we

will see a re-test of last Mondays stock market lows, especially if volatility

persists. Please see Stock Market Outlook below for more insight and

perspective.

Feds Bazooka Monetary Programs and Unprecedented Fiscal

Stimulus:

The response of both the Federal Reserve and the U.S. federal government

have been unprecedented. The Fed has stated that its willing to provide unlimited

monetary stimulus, announcing program after program, as its balance sheet

exceeds $5 trillion for the first time.

Similarly, the $2.2 trillion fiscal stimulus package passed by

Congress is more than double the $800 billion package passed in 2009 to ease

the Great Recession.

The Financial Times says the increase in fiscal

spending and loans in the U.S. this year alone will reach more than 10% of

gross domestic product (GDP). Thats

larger than the rise in the U.S. federal deficit through financial crisis years

2008 and 2009 combined.

Of course, that will lead to $4 trillion dollar deficits,

but thats the day after tomorrows problem. Or is it? See Victors comments below on the exploding

U.S. debt.

These efforts will likely dampen the economic fallout that has already

begun to take place, but the full impact that will be realized is still largely

unknown. The spike in new jobless claims to 3.3 million coupled with the sharp

drop in Consumer Sentiment indicate that the ongoing economic damage will

be significant for the next few months, if not longer.

..

Victor: When Will Debt Become an Issue?

Debt has not yet been an issue for the U.S. economy or financial

markets. Even the bond vigilantes are a

thing of the past. That will all change once the national debt becomes so large

that paying interest on the debt becomes a major government budget item and a

burdensome percentage of projected tax revenues.

President Trump signing this so called Stimulus

Package into law on Friday guarantees the end of the U.S. political system

as we know it in 10 years (or maybe less time).

Heres why:

The national debt is currently $23.5 trillion with an additional $1

trillion budget deficit forecast in January by the CBO for the 2020

fiscal year, which ends on September 30th. But that was BEFORE the

economic toll of the coronavirus could be factored in!

With the $2.2 trillion fiscal stimulus package, $2

trillion in estimated reduced tax revenues collected, and additional

unemployment insurance/social programs required to mitigate a recession, I

estimate the fiscal 2020 budget deficit to be ~$4.7 trillion.

[Im not alone in forecasting such a large U.S. budget deficit. Ben Ritz wrote in Forbes that America Is On Track For A $4 Trillion Deficit In 2020.]

As a result, the U.S. national debt will be $28.2 trillion by

9/30/2020. Lets be a bit conservative

and say its 28 trillion.

Now project ten years, as the CBO does, and use the long-term trend of U.S.

debt increases from 6/30/71 (which was $398 billion) as we went off the Gold

Standard internationally in August 1971. From June 30, 1971 to March 2020 -or

48.75 years- the debt compounded at an 8.72% annual rate.

Assume $28.5 U.S. stated national debt as of September 30, 2020. When

compounded at the 8.72% annual rate, it would result in a 2030 U.S. stated debt

of $64.6 trillion! And thats NOT

INCLUDING off balance sheet budget items or the Feds (monopoly money) balance

sheet which is now $5.3 trillion and going higher!

The historic (from 1926) average all duration U.S. Treasury paid interest

rate is 5.99%. Lets round that to

6%. Apply that 6% rate to a $64.6

trillion U.S. national debt and you get $3.88 trillion of interest payments in

2030.

Curmudgeon Note: Yes, we know that no one believes interest

rates will ever be normalized again. But

even at a 2% interest rate youd have ~$1.3 trillion in interest payments on

the 2030 national debt. See Victors

remarks below relating to 2030 interest payments as a percent of U.S. tax

revenues.

..

...

...

What will collected tax revenues

be? From 2000 to the present time, U.S. tax revenue has grown at a 2.85%

annual rate. Being very generous, lets

use the current projected CBO base number of $3.632 trillion for September 30,

2020. So, in ten years the U.S. will

receive $4.819 trillion in tax revenue assuming no more recessions or tax cuts.

Assuming the amount of interest as a percent of revenue is 81%. OK, say the

average interest rate on U.S. treasury securities is 3%. Thats $1.94 trillion which would be 40% of

tax revenues in 2030!

Perhaps, now you see that the interest on the U.S.

national debt will be impossible to pay in 10 years time.

You can borrow to create debt, but any loan shark will tell you... you

cant borrow interest- to pay interest. The dollar will be cremated. The result

will be HYPER-INFLATION (as John Williams has also forecast for quite

some time)!

..

Stock Market Outlook (Curmudgeon):

Does any of the above tell us where the stock market is going after the

largest three-day rally in almost 90 years (since 1931)?

It could possibly be one to sell or sell short on rallies to hedge a

portfolio in the near term. Too early to

buy, but there might be good long-term value from these levels, especially

considering all the monetary and fiscal stimulus thats now in place. That puts

the market somewhere between a sucker's rally and a long term buy.

Hence, we advise investors to do little or NOTHING until volatility

subsides and the COVID-19 new cases/death curves flatten.

.

.

Closing Quotes:

When an investor focuses on short-term investments, he or she is observing

the variability of the portfolio, not the returns in short, being fooled by

randomness."

Nassim Nicholas Taleb

The stock market is the story of cycles and of the human behavior that is

responsible for overreactions in both directions.

Seth Klarman

Unless you can watch your stock holding decline by 50% without becoming

panic-stricken, you should not be in the stock market. Warren Buffett

Where wealth is health, bankruptcy is death.

John Maiorana (oohGiovanni)

.

.

Good luck and till next time

.

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since 1971) to profit in

the ever changing and arcane world of markets, economies and government

policies. Victor started his Wall Street

career in 1966 and began trading for a living in 1968. As President and CEO of

Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and

development platform, which is used to create innovative solutions for

different futures markets, risk parameters and other factors.

Copyright © 2020 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).