Perspective:

U.S. Economy and Stock Market Implode in just 21 Trading Days!

By the

Curmudgeon with Victor Sperandeo

Economic Overview:

It’s ultra-frightening and super scary! The coronavirus is having a

significant negative impact on U.S. economic activity and future prospects,

with predictions emerging for losses of up to five million jobs this year and a

drop in economic output of as much as $1.5 trillion.

A recession is now all but certain, according to a Wall Street Journal

survey of 34 economists, which projects a downturn that would last months at

least, and might even surpass the severity of the 2007-09 “great recession,”

which was triggered by the housing collapse and subprime loan debacle.

Let’s examine a few recent economic numbers and forecasts:

- U.S. initial jobless claims jumped by 70,000 last week – the largest

spike since 2012 – to 281,000.

This week’s figures will be much worse. A Reuters survey of

economists’ forecasts as many as 1.5 million new claims, almost triple the

U.S. record. Goldman Sachs is predicting 2.25 million.

- A poll by Survey-USA suggests around 9% of the U.S. workforce

(14 million people) won’t take home a paycheck this week, while another

quarter are working reduced hours.

- The United Nations Economic and Social Commission for Western Asia

issued a report that predicts more than 1.7 million people in the Middle

East will lose their jobs due to the coronavirus pandemic, spiking

unemployment by 1.2%.

- Goldman Sachs economists forecast a historically sharp and swift U.S. recession,

with 2nd quarter GDP sinking a stunning 24% after

a 6% decline in the 1st quarter.

- Goldman expects U.S. GDP to contract by 3.8% for the full year on an annual

average basis, and 3.1% on a fourth quarter over fourth quarter basis.

- IHS Markit forecasts 2nd quarter GDP growth plunging to -13%, GDP

contracting 1.7% in 2020 (year over year), unemployment approaching 9% by

December, and inflation slipping to 1.3% in 2021.

- With respect to consumer spending, IHS anticipates huge

declines this April – between 40% and 90% in transportation,

entertainment, gambling, lodging, food away from home, and travel, with no

recovery until August and full recovery not until June 2021.

- Credit conditions tighten and housing starts to decline: As

unemployment rises and amidst financial uncertainty, banks will tighten

lending conditions. IHS says this will impede housing starts,

particularly for multi-family units. Total starts will decline 250,000 by

the fourth quarter. IHS also allowed for temporary 5% declines in both

state and local and private nonresidential construction, with full

reversal not until mid-2021.

-->The staggering economic and social implications of the coronavirus

outbreak in the U.S. are only now beginning to become clear. No one can accurately forecast when this will

end, and life returns to normal.

Gulp! The stock

market declines have been breathtaking: The S&P 500 has declined

31.93% from 2/19/2020 to 3/20/2020, while the Russell 2000 has cratered 40.22%

from 2/20/2020 to 3/20/2020. That fall occurred in only 21 trading days!

For Dow Theorists, please note that the DJI has dropped 35% from

2/12/2020 to 3/20/2020, while the DJT has imploded by 38% from 2/20/2020 to

3/20/2020 (again that was only 21 trading days). We are deep into Dow Theory bear

market territory.

Past is Prologue:

History sets the context for the present.

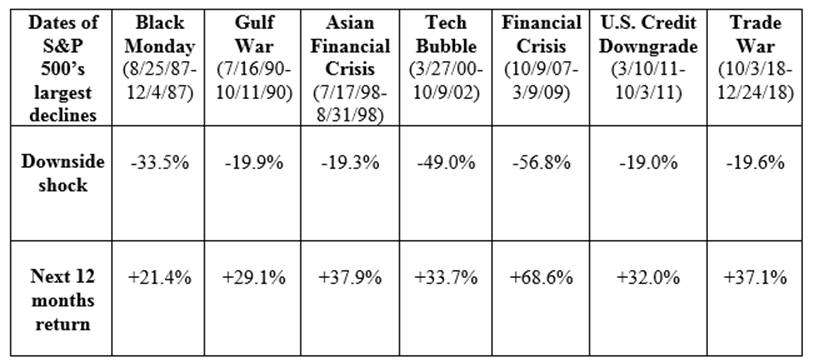

In the past, when a crisis or shock fades and fears abate, the next

twelve months consistently delivers a strong stock market comeback, as per this

table courtesy of Blackrock:

………………………………………………………………..

………………………………………………………………..

Victor’s Comments:

When will the states stop the “Shelter in Place” orders? It seems the cure is worse than the disease.

For example, why is California governor Gavin Newsom predicting that roughly 25.5

million Californians (or 56% of the state’s population) will get the virus over

an eight week period? On what is he basing that number? If he assumes a 3%

mortality rate, he must expect 500,000 to 1 million deaths just in California.

But based on what?

Wayne Allyn Root today suggested that the U.S. should follow the South Korean model to defeat

the virus. Or at least as closely as possible. That country has had the most success in the

world in fighting and surviving the coronavirus pandemic. In a nation of 51 million (about 10 million

more than the population of California), South Korea has had under 9,000 cases

and under 100 deaths.

In Italy –the deadliest COVID-19 country to date, with a higher death rate

than China– 23% of the population are over 65. The youngest Italian to die was

55 years old.

The point is if we don’t stop the shutting down of the economy a 1930’s

depression is a sure thing. There will

not be a V bottom and recovery as many predict.

The budget deficit and national debt will explode to $3 to 4 trillion this

fiscal year, depending on the extent of the government bail-out programs.

Fortunately, we have not seen any announcements of bankruptcies yet or

derivative blowups by banks or hedge funds.

A few points on a future U.S. economic recovery - once the current

recession has ended (who knows when?):

1. No more corporate stock buybacks

with government money, e.g. loans and grants or tax cuts to companies who then

use the money to buy back shares and pay dividends.

2. Do not repeat the Japan “lost decade(s)” syndrome.

3. After this crash people will be cautious. This time, I do not believe

consumers will quickly forget what befalls them.

……………………………………………………………

Victor’s Stock Market Forecast and Perspective:

I expect the U.S. stock market to rally in April, after the poor earnings

are announced. However, the Bull has

been killed by the virus and U.S. matador. Its over as we know it. So don’t expect an advance to new high’s

anytime soon!

-->Stocks down 30-40% in 21 or 22 trading days is a “come to Jesus

(watershed) moment” for many investors and traders.

-->What the Trump administration seems to be saying [1.] is death has

no consequences and the U.S. is going to heaven.

Curmudgeon Note 1. Kaiser Health News reported on Friday that

public health professionals dismissed the President’s claims that the spread of

the coronavirus and the threat of a pandemic snuck up on us as being “simply

astonishing” and “simply untrue.”

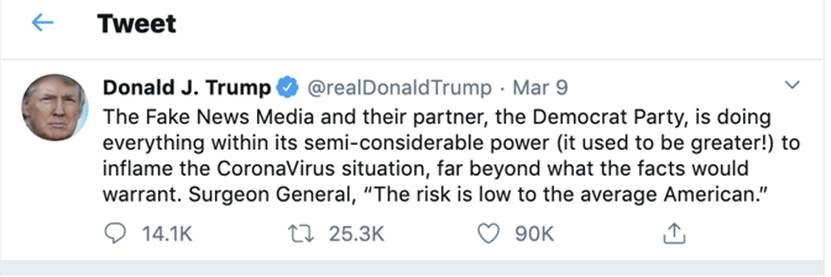

Check out Trump’s March 9th tweet:

Curmudgeon’s Conclusions:

Due to the swift and deep selloff in the last month (actually 21 or 22

trading days), we believe the U.S. and most other equity markets are positioned

for a strong but short-lived rebound.

However, the recent decline has not fully discounted the economic impact

of the coronavirus (COVID-19) pandemic.

We advise readers to try to ignore financial markets and instead

concentrate on protecting their health, finding “feel good” diversions (like

reading a good book, listening to classical/relaxing music or doing

yoga/meditating), and communicating with friends and family.

………………………………………………………………….

Closing Quotes:

“This shock is very big,” said Bruce Kasman, head of economic research at

JP Morgan. “You are going to see in the next two months the consequences of the

actions taken in terms of economic activity. That set of trade-offs is not

really clear in policy makers’ minds right now.” (See Kasman’s final quote below).

“What a recession from something like this should look like is a sudden

stop and recovery,” said R. Glenn Hubbard, a Columbia University economist who

was a top White House economist for President George W. Bush. “What could

happen, though, is a doom loop.”

“A public health emergency is morphing into an economic emergency,” said

David Shulman of the UCLA Anderson School of Management. “The basic outlines of

the economy will be determined more by biology than by economics.”

“Things look so gloomy right now that perhaps we should be grateful if we

can get out of this health crisis with a brief recession,” said Bernard Baumohl

of the Economic Outlook Group. “You just

cannot rule out the prospect of a longer, more destructive depression. What is clear is that we are in a race

against time.”

“You need an unemployment system that in this moment can pivot to 100 percent

reimbursement to 100 percent of people who are not at work,” said Heather

Boushey, President of the Washington Center for Equitable Growth, a think tank

focused on inequality and growth. “And wage replacement for people who have

hours cut back.”

Let’s end with a more optimistic quote from Bruce Kasman:

“Unlike the 2007-09 downturn, the economy will likely rebound quickly if the

government can slow the spread of the disease and lower the death rate. I don’t

think the economy is fundamentally imbalanced or at a fragile position at this

point,” said Kasman. “I don’t think it has to play out like 2008, 2009 where

you had most longer-lasting problems unwound.”

…..……………………………………………………………

Good luck and till next time….

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since 1971) to profit in

the ever changing and arcane world of markets, economies and government

policies. Victor started his Wall Street

career in 1966 and began trading for a living in 1968. As President and CEO of

Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and

development platform, which is used to create innovative solutions for

different futures markets, risk parameters and other factors.

Copyright © 2020 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).