Did Your

Market Timing Service Get You Out at the Top?

By the

Curmudgeon with the SuperBear

Disclaimer:

Due to increased anxiety caused by the Coronavirus and this

weeks stock market volatility/2-day crash, we will keep this blog post short

and to the point.

Introduction:

The sharp and scary market plunge is clearly depicted by this

chart which is worth more than 1,000 words:

On Thursday March 12th:

·

The Dow industrials shed

2,352.6 points, or 10% to 21,200.62 [1.].

·

The S&P 500 sank 260.74

points, or 9.5%, to 2,480.64.

·

The Nasdaq Composite slid

750.25 points, or 9.4% to 7,201.80.

Note 1. The Dow was down over

520 points in the last 10 minutes of trading to close at the low of the day.

..

After the first circuit breaker kicked in at the open after

the S&P 500 fell 7%, the equity markets resumed trading shortly before 10am

and stocks plummeted yet again. The Feds liquidity injection announcement sent

shares briefly higher before tumbling once again to close at the days lows.

These huge stock declines today came despite the New York Fed

announcing new rounds of liquidity to keep banks afloat. The steep losses this month show that there

has been little remedy provided by governments and central bankers that could

calm jittery investors.

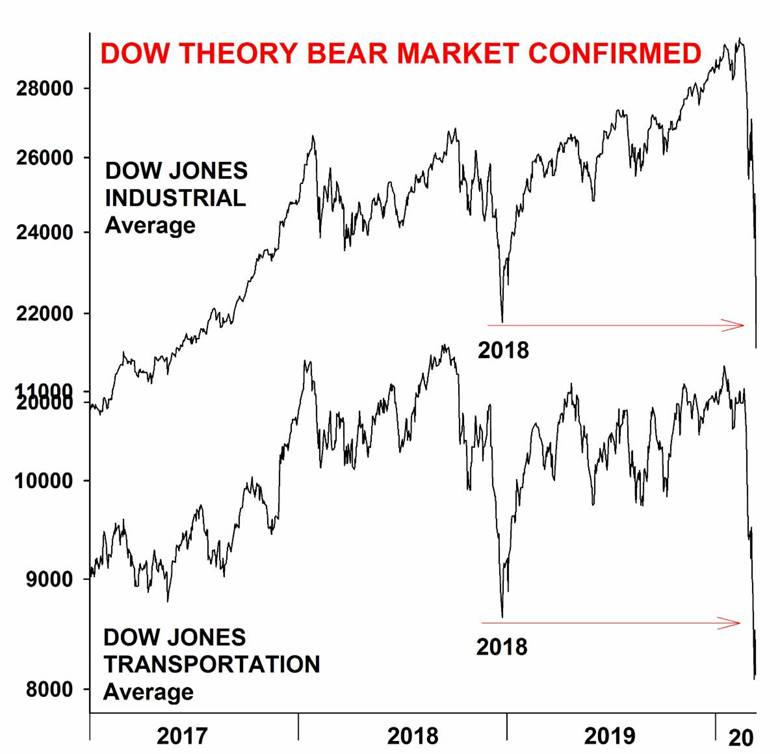

Dow Theory Bear Market

Signal:

The Dow Theory triggered a bear market signal today [2.], when the Dow Industrials joined the

Transportation Average by breaking below their 2018 lows as shown in this

chart:

Note 2. The Dow Theory bear signal is something

Victor anticipated earlier in the week.

He sent me a detailed analysis which I can email to readers on request.

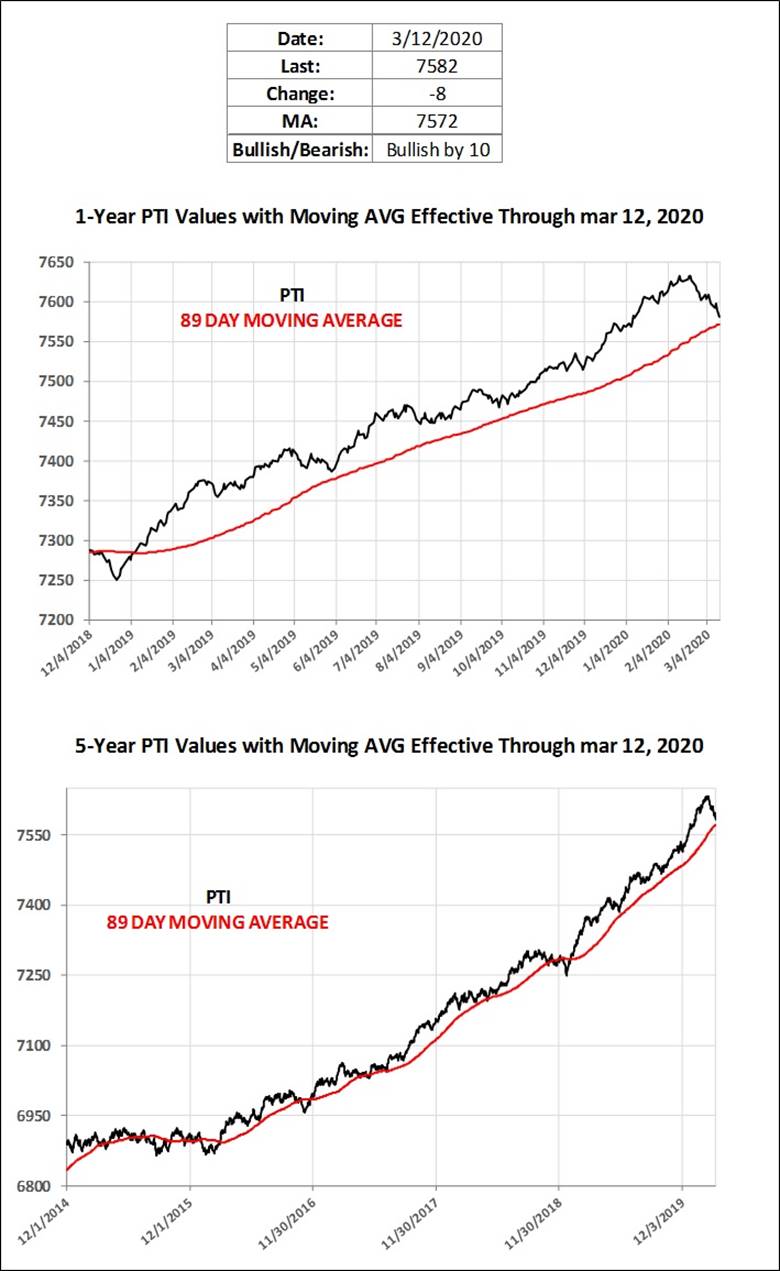

Richard Russells

Primary Trend Index (PTI):

This acclaimed index, which measures the primary trend of the

U.S. stock market, is now maintained by the Aden

sisters who this author respects tremendously for their hard work, honesty

and integrity. As of todays

nightmare on Wall Street (March 12th) it is still (barely) bullish

as per this chart:

Market Timing Overview:

In our last post Did You

Buy the Dip? How is Your Melt-Up Portfolio Doing? (03/10), we noted that all the top market timers were bullish or

neutral at the February 2020 top and none were bearish. As of Wednesday, March 11th Timer Digest evening hotline:

·

The Top Ten Consensus (of

stock market timers) is now Bullish with

4 Bulls, 3 Bears, and 3 Neutral.

·

The Top Long-Term Timers (of

stock market timers) are Bullish with 7 Bulls, 1 Bear, and 2 Neutral.

·

The Top Gold Timers are

Bullish with 5 Bulls.

In fact, Timer Digest

had two BUY recommendations for todays (March 12th) open:

·

Diversified Select Program:

On Thursday, the one third of the Fidelity Money Market Fund balance will be

used to Buy Select Biotechnology (FBIOX).

·

Model Portfolio: On Thursday,

one-eighth of the money market fund balance will be used to Buy the SPDR S&P

500 ETF (SPY) at $273.00; the order good through Friday.

ΰThe moral of this story is that you cant trust market

timing, especially in fast market conditions or when there are unexpected

shocks to the global economy, like the coronavirus and oil price war.

Recommendation for

Investors (not Traders):

We believe the only viable and safe hedge against stock and

other asset class steep declines is cash, CDs, T-bills, or high grade bonds

that you intend to hold to maturity (for my granddaughters Trust account I

have several bonds that mature in 3 to 4 years and are highly unlikely to

default, but they might be called).

Decide how much exposure you want to various asset classes

(stocks, bonds, gold, REITs, commodities, managed futures, etc.) and more or less maintain those positions.

The exception is when you feel a given asset class is

severely overvalued and/or the outlook is very bleak. In that case, its OK to reduce or even

eliminate that asset class from your portfolio.

I did that for Treasury notes and T-bonds which I used to purchase all

the time for clients, my family, friends and myself when I was managing money.

Treasuries were eliminated because the real yield was either negative or only

marginally positive (before taxes).

ΰObviously, I was wrong about the outlook being bleak

when the 10-year T-Note was at 2%, as it is now well below 1%! However, I have no regrets for not buying

T-Notes or any long-term bond.

As a result, Ive built up a sizeable cash/CD/T-bill position

which buffers the losses Im taking on at risk investments. I also own a lot of gold coins and gold

futures contracts through a managed futures fund I own

which is always long gold. Heres what

the latest Aden Forecast (subscription required and recommended) has to

say about the yellow metal:

GOLD IS UNIQUE:

As you know, gold has

traditionally been a safe haven during uncertain

times. For thousands of years its been the safe haven

of choice. And even though gold has been volatile, this time has not been an

exception. Thats primarily due to the fact that gold

is gold. Its durable, its accepted throughout the world, and it has the

longest track record for being the worlds favorite global money and wealth...

dating back to 3000 BC.

During times of war,

revolutions, economic chaos, political upset and devaluations, for example,

gold has always emerged as #1. It has enabled people to flee from one country

to another, taking their savings with them, say in the form of gold coins. Gold

has also maintained its purchasing power for thousands of years.

Gold is currently in

strong demand. The worlds central banks have been piling into gold because

they know the global economic outlook is not good. Theyre trading theyre cash

and bonds for gold. And now, private investors are starting to do the same.

By all indications, this

trend is going to continue in the years ahead. So you

clearly want to hold onto your gold and other precious metals. If you havent bought

yet, its not too late. The bull market is still in its early stages and it has

a lot further to go.

The U.S. dollar and gold

used to move in opposite directions, but that hasnt been the case in recent

years. Overall, however, gold is much stronger than the dollar.

..

Closing Quotes (from

today):

We are beyond the logical, mathematical approach to things,

said Steven Dudash, president of Chicago-based IHT

Wealth Management. Weve got complete overreactions going on because of the

fear of the unknown. When you see that, you cant expect to see a logical

response to interventions, he added.

Markets simply dont know what the next steps are in terms

of the virus spread, said Edward Park, deputy chief investment officer at

Brooks Macdonald. We will see a dip in global growth in Q1 and Q2 and all the

fiscal stimulus out there cant avoid that.

Until there are details on the steps that leadership intends

to pursue to remedy the economic effects of the viral outbreak, equity markets

will be vulnerable, said Carl Tannenbaum, chief economist at Northern Trust.

Markets are likely to remain volatile. The fear coming off

from the coronavirus is going to be something that continues over the next few

weeks at least, said Paul Sandhu, the Asia-Pacific head of multi-asset quant

solutions and client advisory for BNP Paribas Asset Management in Hong Kong.

Comments from the SuperBear:

The biggest crash since 1987 causes the old bear to come out

of his cave. First off, I want to give big thanks to the Curmudgeon and Victor

for keeping the fires of rationality going through years of Fed induced mania.

I just have a few thoughts to add.

First off this is the first time that Ive seen the Fed fail

in its mission to do whatever it takes to keep the markets rolling. A surprise

rate 50 bp cut had no impact and promises of practically unlimited liquidity

could not stop the markets from rolling lower. Now next week expectations are

for another Fed rate cut of 75 bp or maybe even 100 bp to really try to shock

and awe the markets. Even if they just go for a pedestrian 50 bp that brings

the Fed Funds down to 75 bp which doesnt leave much room for further conventional

moves.

I suspect that things will get worse before they get better.

Ive been watching the spread of the coronavirus from the start when it was

still contained in Asia. My concern was the ease of its transmission more than its

lethality. Dead or really sick people have a hard time

spreading viruses. Now weve come to the point where institutions and

businesses are shutting down. Im not sure anyone can estimate how big of an

impact this will have going forward. Cases in the US are still listed as under

2,000 but when more tests become available that number is likely to increase tremendously.

The rest of this month and April could see a pandemic worse than any other in living

memory. I cant imagine this wouldnt be a total disaster for an economy built

on debt and leverage.

As the Curmudgeon mentioned above folks are still not all

that worried. Ive seen client notes comparing the current crash to previous

crashes and stressing that the market have always recovered. That has certainly

been the pattern for the past 30 years, but it is possible that will no longer

be the case. Maybe the Fed can pull another rabbit out of its liquidity hat and

keep the game going a bit longer. There is always a chance since they are

willing to try anything that is ruinous in the long run if it can kick the can a

little further down the road. However, if the Feds multi-decade financial

experiment is coming to an end, we may see a bear market that will rival the

great bear markets of the past (1929-1942; 1966-1982)

Good luck and till next time

.

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since 1971) to profit in

the ever changing and arcane world of markets, economies and government

policies. Victor started his Wall Street

career in 1966 and began trading for a living in 1968. As President and CEO of

Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and

development platform, which is used to create innovative solutions for

different futures markets, risk parameters and other factors.

Copyright © 2020 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).