Did You Buy

the Dip? How is Your Melt-Up Portfolio Doing?

By the

Curmudgeon

Introduction:

No, we didnt buy the dip and we never believed in a melt-up

portfolio, despite huge advertisements and promotions for same.

Victor has warned for a very long time that the equity markets would just top without

any prior technical deterioration or warnings.

Indeed, the top market timers were ALL bullish or neutral at the end of

February when the sharp decline started in earnest. NONE were bearish!

Furthermore, Victor

said that a severe correction or bear market would start with an event(s) the Fed could not control. Obviously, the coronavirus is such an event.

Note that the Feds 50 bps emergency rate cut last week did not stop the

panic selling, which hit critical mass today (Monday, March 9th).

An oil price war between Saudi Arabia and Russia is another

event which the Fed can do nothing to mitigate.

After reviewing todays market sell-off we analyze and

provide perspective on oil, credit markets, and what might happen next.

..

Black Monday: March 9, 2020:

Stock markets around the world were a sea of red ink today.

The S&P 500 index fell by 7.6%. The UK FTSE 100laden with oil firms, such

as Shell and BP, and other natural-resource companiessuffered a similar

drop. Frances CAC 40 was down by 8.4%

as were other European bourses. Heres a

world stock market map you can check for daily

performance.

Investors rushed for the safety of government bonds. The

yield on the 10-year U.S. Treasury note closed below 0.5% for the first time

ever.

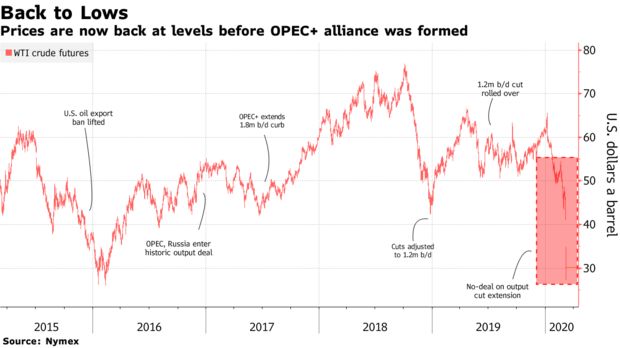

Oil Crash:

While theres growing anxiety about a global recession as

covid-19 spreads, the trigger for todays panic stock selling was a collapse in

the oil price, following a meeting of OPEC ministers and other oil producers on

March 6th. Russia, which is not an OPEC

member, refused to cut production to stabilize the crude oil price. The response from Saudi Arabia, OPECs

largest producer, was to start an oil price war. The oil kingdom offered discounts to its

customers and announced an increase in its output starting next month.

Today, the price of a barrel of the Brent oil benchmark blend

slumped by around a third, almost touching $31 before closing at $34.36. West Texas crude oil (spot) closed at $30.26

down from Fridays close of $41.57.

That was the biggest oil price drop since the 1991 Gulf War.

.

Thanks to the shale oil boom, the U.S. is once again a big

producer of oil, so our economy suffers (as well as gains from cheaper energy)

when oil prices fall. Listed oil

companies in the U.S. and Europe will endure a direct hit to profits if the oil

price stays where it is. Much of the red ink on March 9th was from listed oil

stocks.

An immediate effect of lower oil prices was a further tightening of corporate-credit

conditions for the riskiest borrowers. A boat load of investment-grade

issuershoteliers and carmakers as well as airlines and oil firmsmay also be

at risk. Many have seen their bonds

downgraded to junk status (rated 'BB' or lower by Standard & Poor's and

'Ba' or lower by Moody's).

ΰThe more stressed markets become, the more credit will be

withheld from those companies most desperate for cash to tide them over.

Another worry is that offshore borrowers of U.S. dollars may

find it hard to secure funding in the future. Japanese banks and insurance

companies have been voracious buyers of bonds in the U.S. and Europe. Were they

to back away, credit markets would come under further strain.

The Fed Responds (yet

again):

Today (March 9th), the New York Federal Reserve

has boosted its overnight repo

operations from $100bn to $150bn. That means there's an extra $50bn on

offer to U.S. banks, who might be worried about lending to rivals in the

current climate.

The two-week Fed repo operations on March 10th and

12th will also increase to $45bn from the current $20bn mark.

Big financial institutions fund much of their operations by

borrowing money over very short time periods. But if these short-term money

markets dry up as they did in 2007-8 when Bear Stearns and then Lehman went

bankrupt it can put Wall Street firms under extreme pressure (aka a liquidity

crisis).

Whats Next for Oil and

Stock Markets?

Goldman Sachs expects oil could fall as low as the mid-$20s,

which is the cash cost of production for some U.S. and Canadian producers.

Given that those companies are the swing producers in the market, those levels

would cause production cuts that would be likely to bring the market back into

balance.

Analysts say Chinese demand fell by at least 4 million

barrels at the height of its virus-related shutdown, and that demand isnt

fully back yet. Now other countries are severely cutting business production

amid quarantines, which will likely remove even more demand from the market. In

that environment, a price war becomes even more risky. And theres no initial

reason to think cooler heads will prevail.

While OPEC leadership retains hope that the price collapse

will be a catalyst for a reconciliation between the two oil heavyweights,

Russia President Putin may not quickly capitulate, wrote RBC Capital Markets

strategist Helima Croft. We fear that it could be a

protected struggle, as Russias strategy seems to be targeting not simply US

shale companies but the coercive sanctions policy that American energy

abundance has enabled.

For stock markets to stabilize, several things are required:

1.

Clear evidence that virus infection rates in

rich economies are peaking or even being reduced. NO MORE EVENT CANCELLATIONS!

2.

Oil prices must stabilize and

build a base such that confidence is restored.

3.

The price of risky financial

assets, such as stocks and high yield corporate bonds, must become cheap enough

to attract bottom-fishing investors. We

are a long way from fair valuations so dont try to buy the dip or catch a

falling knife.

Closing Quote:

I never buy at the

bottom and I always sell too soon. Baron Rothschild

Good luck and till next time

.

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since 1971) to profit in the

ever changing and arcane world of markets, economies and government

policies. Victor started his Wall Street

career in 1966 and began trading for a living in 1968. As President and CEO of

Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and

development platform, which is used to create innovative solutions for

different futures markets, risk parameters and other factors.

Copyright © 2020 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating,

copying, or reproducing article(s) written by The

Curmudgeon and Victor Sperandeo without providing the URL of the original

posted article(s).