Fed T-Bill

Buying Persists Despite Ultra Easy Financial Conditions

By the

Curmudgeon

Disclaimer:

Victor said he had nothing new to add to this weeks

Curmudgeon post, but is working on a future piece tentatively titled,

Financial Chicanery and Fed Sorcery.

It will detail how the U.S. Federal Reserve and U.S. Treasury have

created a merry-go-round system where banks can purchase U.S. Treasuries at no

risk in their Held-to-maturity (HTM) securities account.

Introduction:

With all the news about the coronavirus, Fridays strong jobs

report, Trumps celebration of his impeachment acquittal, and the U.S.

Democratic Party is disarray, we prefer to not comment on those topics. Instead, we expose the dichotomy of:

1.] The Fed increasing its balance sheet (again) to liquefy

the repo market (which is supposedly short of cash?) by buying Treasury bills

and mortgage securities

.

2.] Multi-decade lows in two Federal Reserve measures of

financial market stress indicates there is plenty of liquidity to fuel

financial markets.

We hope that you appreciate several eye-popping charts weve

included, especially T-bills on the Feds Balance Sheet. It may be quite difficult to get your brain

to reconcile them.

A Peek at the Feds

Balance Sheet Trend:

Victor and I as well as many others noted that the Fed

started to end its runoff program, whereby they would no longer submit

proceeds of maturing securities (Treasuries and mortgage bonds) they owned to

the U.S. Treasury, but instead roll them over by purchasing similar

securities. Our piece was titled: Feds Balance Sheet Runoff

is All About Bank Reserves; Who Does the Fed Represent?

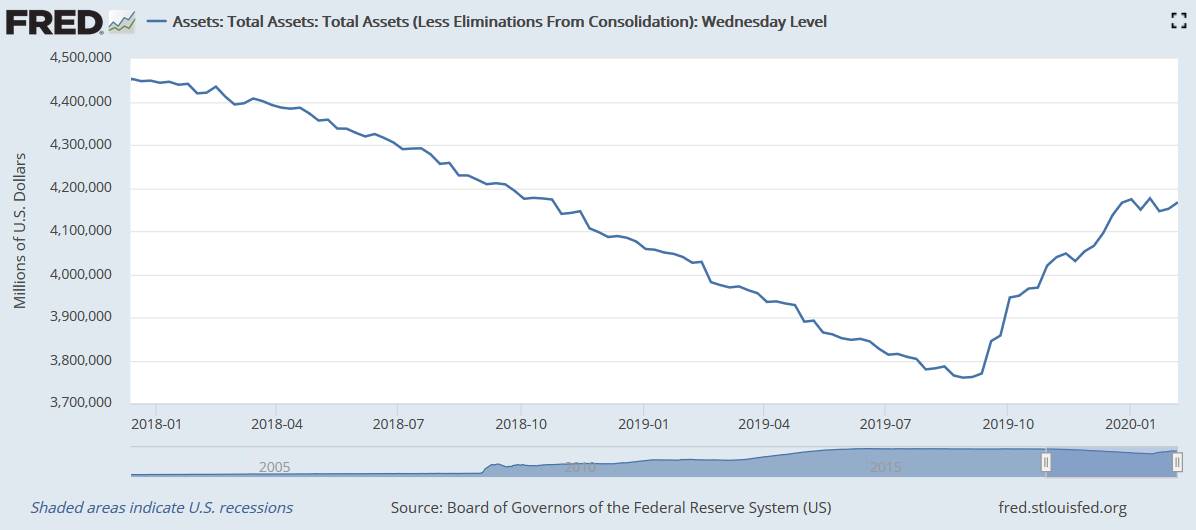

In the graph below, one can clearly see the steady decline in

the Feds balance sheet up till September 4, 2019 when the Fed commenced buying

T-Bills (and later mortgage securities) to provide liquidity to the repo

market. The Curmudgeon analyzed that

dynamic in a blog post titled: Fed Launches New Round of QE

with a Stated Different Purpose.

The hockey stick like upturn in the graph below seems to

now be leveling out at $4.17 Trillionnot too far from the $4.5 Trillion peak

in the Feds Balance Sheet.

.

The Feds Repos and

T-bill Scorecards:

Total repos on the Fed's balance sheet of February 5th (released

Thursday afternoon February 6th) have plunged by $85 billion from

the peak on January 1, to $170 billion, below where they'd first been on

October 2, 2019. This is seen in the

graph below:

Under these "repurchase agreements," the Fed buys

Treasury securities and mortgage-backed securities (MBS), guaranteed by Fannie

Mae and Freddie Mac or Ginnie Mae, whereby the counterparties commit to buy

back these securities at a fixed price on a specific date, such as the next day

(overnight repo) or a longer period, such as 14 days (term repo). Repos are by definition in-and-out transactions. When a repo matures

and unwinds, the Fed gets its money back, and the repo on the Fed's balance

sheet goes to zero.

By buying these securities, the Fed adds liquidity to the

market for the duration of the repo. When the repo matures and unwinds, the

liquidity gets drained from the market. When a new repo transaction occurs, the

process starts over again, but with a different amount and with a different

maturity date.

Meanwhile, The Fed continued to increase its ballooning

holdings of T-bills (Treasuries with maturities of one year or less) at a rate

of about $60 billion per month. To increase its stash, the Fed has to buy the amount of the maturing T-bills, and it has to

buy the amounts needed to obtain the targeted increase of about $60 billion a

month.

Over the five weekly balance sheets since January 1, the Fed

has added $78 billion in T-bills, and the total amount of T-bills on the Fed's

balance sheet has now ballooned to $248 billion (see graph below). These

T-bills are a major part of the Fed's strategy to bail out the repo-market. The

Feds T-bill purchases are supposedly an attempt to increase Excess Reserves

that Fed member banks have on deposit at the Fed (for which they earn interest

and are in effect paid not to lend money).

The Fed blames low Excess Reserves last September for the

banks' refusal to lend to the repo market, which then caused the repo market to

blow out. So, bringing up Excess Reserves to an "ample" level is the

goal of these T-bill purchases. Once that "ample" level is reached,

the Fed said it will back off this program.

..

The Feds extremely aggressive response to the repo blowout

in September, as well as their timidity in pulling back from that

response could be signaling to markets that this is a Fed with a very low

tolerance for market fluctuations, said Blake Gwinn, a strategist at NatWest

Markets, who joined the bank last year from the markets group at the New York

Fed.

.

Opinion:

The Curmudgeon believes

the so called ample level of excess reserves was reached a long time ago and

the Fed is disguising the real purpose of its T-bill buying which is a ploy to

prop up U.S. stock and bond markets. That despite they are both egregiously

over-valued from a historical perspective.

As the Fed has bought

T-bills with money created out of thin air, some of that new money has flowed

into stocks, derivatives (like futures, options, structured products, and ETFs)

and corporate/junk bonds, pushing prices significantly higher.

.

Financial Stress

Conditions at Multi-Decade Low:

Several analysts (and the Curmudgeon) have wondered why the

Fed needs to liquefy the repos market when overall liquidity seems to be

plentiful. [Victor says that its

because theres not enough bank cash in the repos market, even though there are

plenty of excess bank reserves].

Lets look at two measures the Federal Reserve uses to gauge financial market stress and liquidity:

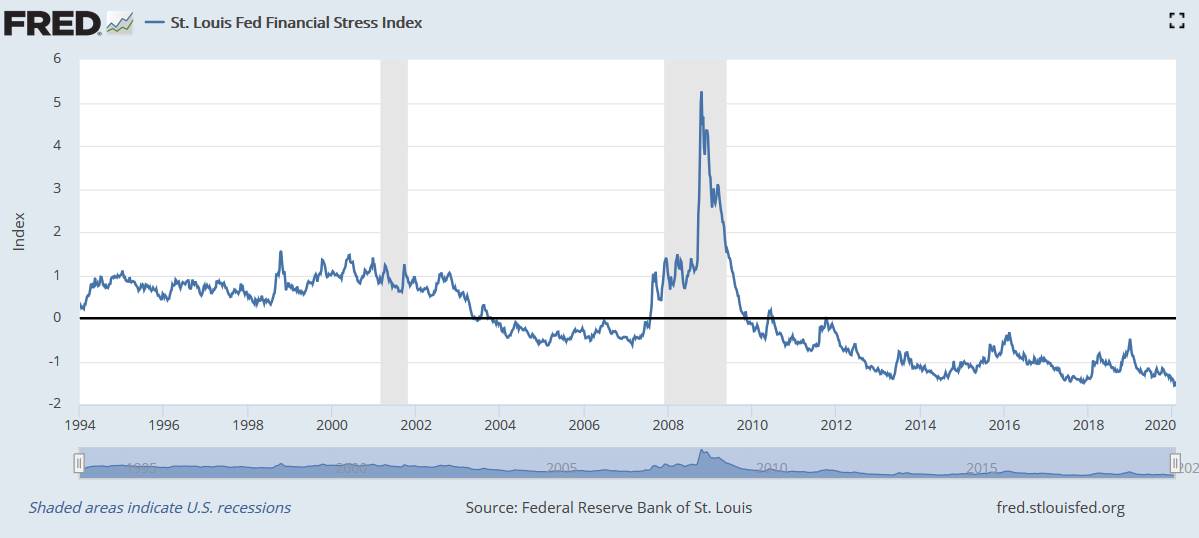

1. The St Louis Fed

Financial Stress Index (STLFSI) measures

the degree of financial stress in the markets and is constructed from 18 weekly

data series: seven interest rate series, six yield spreads and five other

indicators. Each of these variables captures some aspect of financial stress.

Accordingly, as the level of financial stress in the economy changes, the data

series are likely to move together.

The STLFSI fell to

-1.6 for the week ending January 17th (readings are monthly). That was the lowest level since the index was

created at the end of 1993.

Citation:

Federal Reserve Bank of St. Louis, St. Louis Fed Financial Stress Index

[STLFSI], retrieved from: https://fred.stlouisfed.org/series/STLFSI, February

9, 2020.

Note: The average value of

the STLFSI, which began in late

1993, is designed to be zero. Thus, zero is viewed as representing normal

financial market conditions. Values below zero suggest below-average financial

market stress, while values above zero suggest above-average financial market

stress.

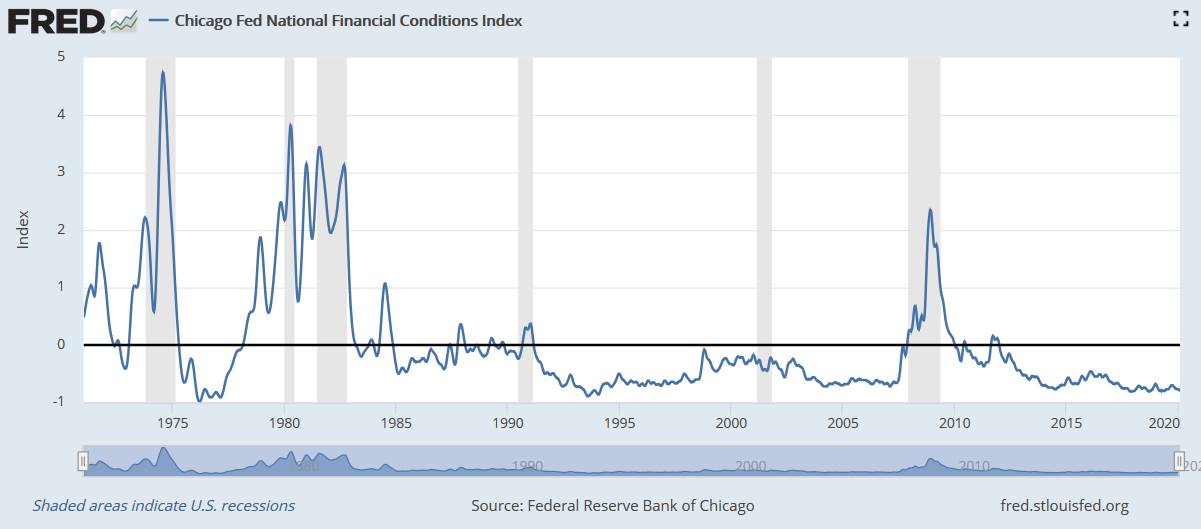

2. The Chicago Fed's National Financial Conditions

Index (NFCI) provides a comprehensive weekly update on U.S. financial

conditions in money markets, debt and equity markets and the traditional and

"shadow" banking systems. Positive values of the NFCI indicate

financial conditions that are tighter than average, while negative values

indicate financial conditions that are looser than average.

The NFCI was at -0.79 on January 31st, which is a

smidgen higher than its multi-decade low of -0.80 reached two times in

2019. That index has been negative since

January 2012, implying that financial conditions have been lose (easy money)

for a very long time.

Citation: Chicago Fed National Financial Conditions

Index [NFCI], retrieved from: https://fred.stlouisfed.org/series/NFCI, February

9, 2020.

..

Conclusions:

How does one reconcile the continued Fed purchases of T-bills

when junk bond yields are at all-time lows, stock market indices are at

all-time highs, mortgage rates are at multiyear lows, real rates on all

Treasuries are negative and financial conditions are at multi-decade levels of

easy money?

One would think such new money creation at this time would

cause accelerating inflation, but that isnt happening because the newly

printed money never gets into the real economy. Instead, it gets deposited at the Fed rather

than being lent out and some of it finds its way into financial markets. That

is where the inflation is today!

Closing Quotes:

The expansion of the Feds balance sheet whether [the Fed]

calls it QE or not is good for risk sentiment, said Scott DiMaggio, co-head

of fixed income at Alliance Bernstein

in New York.

The Fed goes out and buy bills, the seller of bills then

buys coupons, the seller of coupons then buys credit and the seller of credit

buys riskier credit, said Andrew Brenner, head of international fixed income

at Nat Alliance Securities. There

is so much excess money, he added.

I don't mean to be disrespectful, but it seems

counter-intuitive that an index measuring financial

market stress can be at an all-time low when at the same time the Federal

Reserve feels it is necessary to add $400 billion due to repo market

illiquidity, Peter

Atwater tweeted to the St. Louis Fed.

.

Good luck and till next time

.

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and

received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since 1971) to profit in

the ever changing and arcane world of markets, economies and government

policies. Victor started his Wall Street

career in 1966 and began trading for a living in 1968. As President and CEO of

Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and

development platform, which is used to create innovative solutions for

different futures markets, risk parameters and other factors.

Copyright © 2020 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).