Fed Launches

New Round of QE with a Stated Different Purpose

By the

Curmudgeon

Overview:

To the surprise of no one (see ShadowStats Analysis below), the U.S. Federal Reserve will once again be buying vast amounts of

government-backed fixed income securities which will further boost the size of

its already-massive $4 trillion balance

sheet. The Fed says that at least

for now, the objective is to calm stress in financial markets, rather than a

new round of monetary stimulus to boost the U.S. economy.

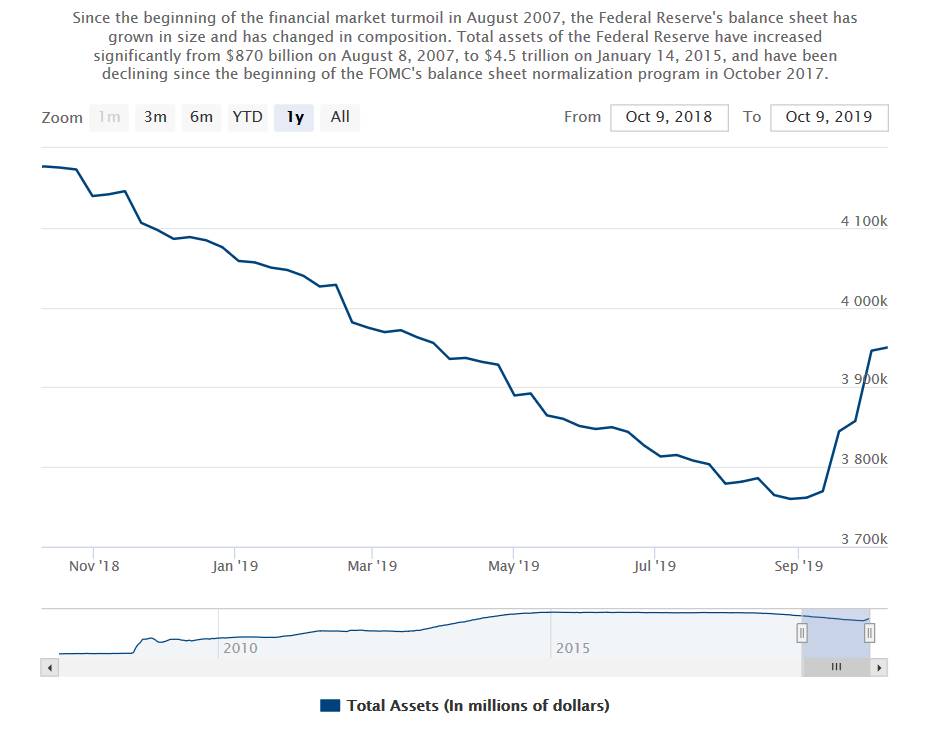

Heres a chart of the Feds

Balance Sheet over the last 12 months:

(Source: Federal Reserve

Board)

Caption: After

hitting a peak of over $4.5T, the Feds balance sheet had been declining since

October 2017, but has recently spiked upward to approach $4T.

..

The Fed announced on Friday it will launch a new program next

week that will purchase $60 billion of Treasury bills per month (using money

created out of thin air). It will then

adjust both the timing and amounts of T-bill purchases as necessary to

maintain an ample supply of reserve balances over time.

The buying will continue at least into the second quarter of

2020. New purchase amounts will be

announced on the ninth business day of each month.

Backgrounder:

The U.S. central bank is trying to stabilize money markets

after several turbulent weeks since interest rates for overnight repurchase agreements (repos) 1 essentially

short-term loans between banks and other financial institutions spiked in

September. The run-up spilled over into money markets, pushing the Fed Funds

rate temporarily above the range that policymakers were targeting.

Note 1. In the repo market, borrowers seeking cash offer lenders

collateral in the form of U.S. government securitiesfrequently Treasury

bondsin exchange for a short-term loan. The term of these loans can be as

short as overnight.

..

Many were surprised when the rate on repos surged in

mid-September to well above the target range for short-term borrowing set by

the Fed (the Fed Funds rate). Fed

chairman Jerome Powell acknowledged that these markets experienced

"unexpectedly intense volatility."

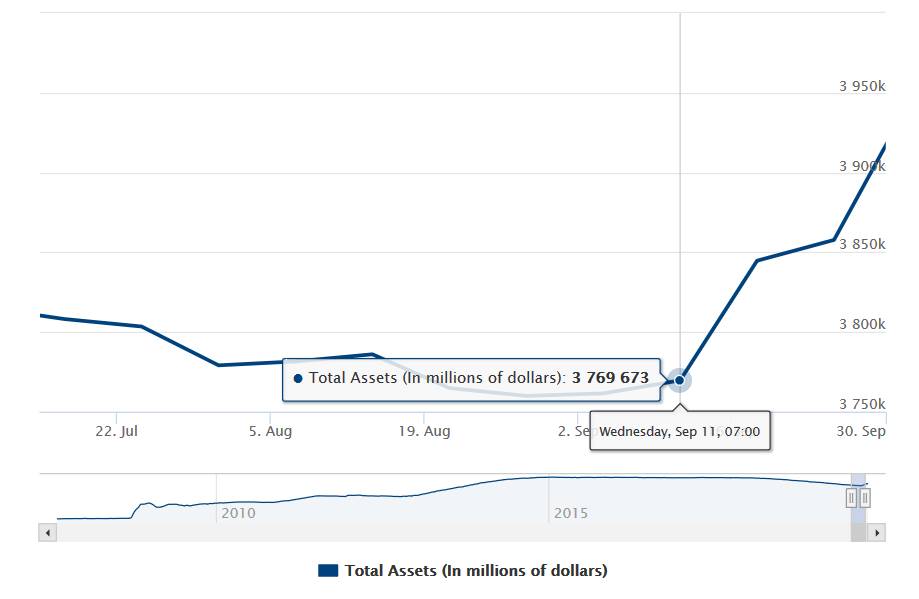

On Thursday, The New York Federal added $88.1 billion to the

financial system, using the market for repos to relieve funding pressure in

money markets. That type of buying has

greatly increased the Feds Balance Sheet by $176 Billion from September 11 to

30, 2019 as per this graph:

(Source: Federal Reserve

Board)

The most recent balance sheet expansion is due to the Fed

making hundreds of billions of dollars a week in revolving loans to Wall Street

securities firms (primary dealers) by intervening in the repo market.

.

The Fed will continue to intervene in the market for repos, something the New

York Fed branch began to do last month as rates climbed. The Fed will keep

those operations going at least through January of next year, according to

the press release, to ensure that the supply of reserves remains ample even

during periods of sharp increases in non-reserve liabilities.

Significance of the

Feds Move:

While the amount could change, buying $60 billion in Treasury

bills over a month is substantial, even by the Feds standards. For context,

the Fed bought about $85 billion in bonds each month during its final round of

quantitative easing, which started in 2012.

The Fed posted a Frequently Asked Questions press release on

Friday that sought to draw a bright line between the moves and what happened

during the crisis.

"These operations have no material implications for the

stance of monetary policy," the statement said, adding that there should

be "little if any effect" on household and business spending nor the

overall level of economic activity.

Instead, the Fed just wants to make sure there is enough cash

sloshing around the financial system, because lately there hasn't been. This volatility (in the repo market) can

impede the effective implementation of monetary policy, and we are addressing

it, Powell said.

Comments from Economists:

The size of the package surprised some onlookers, including

Priya Misra, head of global rates strategy at TD Securities. This is building a buffer, and its doing it

faster than I thought, Ms. Misra said.

Some onlookers were skeptical that the Fed would manage to

convince investors that this was not an attempt to bolster the economy, given

the size of the purchases.

When it swims like a duck and quacks like a duck, its hard

to prove your intentions arent fowl, Paul Ashworth, chief economist at Capital Economics, wrote in research

note.

They want to keep Q.E. as something special, said Laura

Rosner, a co-founder of MacroPolicy Perspectives. I dont think they want

to send a signal that things are bad.

The Fed is telling investors that their bond purchases do not

stimulate the economy, yet they will probably need investors to believe that

Fed bond buying will be stimulative if genuine QE is

invoked during the next recession. I

see some tensions there, Ms. Rosner said.

"You don't want to have funding shocks add to the

worsening outlook. We don't need this problem on top of our other

problems," said Ralph Axel, senior US rates strategist at Bank of America

Merrill Lynch. "They are winging it, absolutely," Axel added.

UBS has warned that U.S. GDP growth will tumble to near-zero

next year, forcing the Fed to slash interest rates by another percentage point

between now and the first half of 2020. "We've got a pretty massive

slowdown in our forecasts," said Rob Martin, US economist at UBS.

ShadowStats

John Williams Analysis:

Mr. Williams was not surprised by Fridays Fed

announcement. John wrote in his latest

commentary (subscribers only):

Powell had suggested in an earlier October 8th speech that

such a move was coming, but he emphasized ... that growth of our balance sheet

for reserve management purposes should in no way be confused with the

large-scale asset purchase programs [a.k.a. Quantitative Easing] that we

deployed after the financial crisis.

The New York Fed effectively has been forced to provide QE in

recent weeks, in order to maintain adequate overnight systemic liquidity,

recently announcing continuing overnight funding through November 4th, post

FOMC October 29-30, 2019 meeting.

Adding Liquidity to the

System Tends to Boost the Economy, Irrespective of Intent.

Cash is fungible, and cash in the system tends to increase

with added liquidity. Such tends to support and expand economic activity,

irrespective of how much the FOMC would like the world to think that the U.S.

economic activity is just fine and dandy.

(Its not!)

Williams Recommendation

to the Fed:

The ShadowStats broad economic outlook remains unchanged,

other than as exacerbated by fast-moving and potentially extreme domestic and

global political instabilities and other systemic stresses. A rapidly intensifying U.S. economic downturn

is foreseen.

Accordingly, it is time now for the Fed to ease aggressively,

not only cutting its targeted Federal Funds Rate by 0.50%, but also by

re-expanding Quantitative Easing (QE) at the upcoming October 29th to 30th FOMC

meeting.

Good luck and till next time

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since 1971) to profit in

the ever changing and arcane world of markets, economies and government

policies. Victor started his Wall Street

career in 1966 and began trading for a living in 1968. As President and CEO of

Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and

development platform, which is used to create innovative solutions for

different futures markets, risk parameters and other factors.

Copyright © 2019 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).