China

Economy Expands but Debt and New Loans Soar; Trade Deal Revisited

By the

Curmudgeon

Introduction:

This is a follow up to our recent post analyzing the U.S.-China trade

agreement (Victor insists I note it is NOT a treaty or a law nor related to

the U.S. constitution).

2019 China Economic

Growth:

China’s

economy grew by 6.1% last year, slower than 6.6% the previous year and its

slowest rate in 29 years. But it was

well within Beijing’s target range so financial markets weren’t shocked.

The world’s second-largest

economy grew 6% in the 4th quarter of 2019, despite fears that the domestic

struggle with bad debt and the trade war with the U.S. would result in further

deceleration. Instead, investment picked

up for the first time since June 2019.

Industrial production growth in December perked up to 6.9%, retail sales

rose 8% and fixed-asset investment in the 12 months expanded 5.4%. The surveyed unemployment rate ticked up to

5.2% in December from 5.1% in November, signaling that the manufacturing-led

slowdown in 2019 may be filtering through to the labor market.

“2019 was the year when the Chinese economy’s transition

toward a less credit-intensive model was tested by downward pressure,” said Cui

Li, head of macro research at CCB International Holdings Ltd. in Hong

Kong. “The new growth model implies more

investment discipline, an increase in return to capital, and better control of

risks,” Li added.

A Goldman Sachs

analysis of China’s policy stance found that easing in the past two years was

only about half that of 2015 and 2016, despite growth slowdowns of similar

magnitudes. In 2008 and in the years after the global financial crisis, China

unleashed a stimulus binge that led to one of the fastest buildups of debt in

history.

China Bank Lending and

the Debt Buildup:

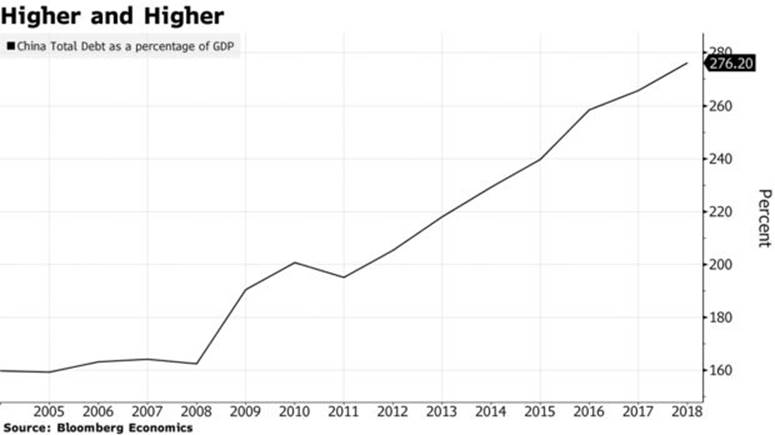

Official China bank lending consistently expanded at more

than double digits last year on top of an enormous base (see graph and further

details below), outpacing nominal GDP growth by more than it used to, said

Derek Scissors, chief economist at the China Beige Book International.

While restrained stimulus slowed the buildup of debt last

year, Bloomberg Economics says it’s still

on track to reach more than 300% of

gross domestic product by 2022, from 276% at the end of 2018.

Note: Reuters said last July China debt was already > 300% of

its GDP.

Reuters

reports that new bank lending in China hit a record of 16.81 trillion yuan

($2.44 trillion) in 2019 as the central bank eased policy to support the

domestic economy.

Chinese banks extended 1.14 trillion yuan in new yuan loans

in December, down from 1.39 trillion yuan in November and falling slightly

short of analyst expectations, data from the PBOC showed on Thursday. Outstanding yuan loans grew 12.3% from a year

earlier, a notch below 12.4% growth forecast by analysts and November’s pace,

which was also 12.4%.

There’s also a lot of off-balance-sheet debt, otherwise known

as shadow debt, which the Chinese

government has been cracking down on over the last three years.

China’s central bank has cut borrowing costs to shore up

business activity and more monetary easing and fiscal stimulus is expected this

year to spur growth, analysts say.

“Growth in outstanding broad credit was unchanged last month

as a slowdown in bank loans outstanding was offset by an easing contraction in

shadow credit,” Capital Economics said in a report.

With recent easing measures having little impact so far on

credit growth, that could strengthen the case for additional rate cuts, the

research firm said.

……………………………………………………………………………………………

Trade Deal Optimism

Misplaced?

Though optimism over the U.S. – China trade deal prompted

some economists to revise up forecasts for 2020 recently, expansion is still

expected to decelerate again this year to 5.9%, according to a Bloomberg

survey.

Despite the U.S. – China phase 1 trade agreement, Chinese

manufacturers still labor under U.S. President Donald Trump’s higher tariffs on

about $360 billion of their goods, which are an unprecedented assault on

China’s dominance of the global supply chain.

Bloomberg Economists Chang Shu and David Qu had this to say about the trade deal:

The signing of the

‘phase-one’ trade deal takes China out of the most turbulent waters, but it

will hardly be smooth sailing ahead -- sizable U.S. tariffs will continue to

weigh on the external sector, and sentiment is weak. Fiscal and monetary policy

still need to provide cyclical support. However, we think the authorities will

start to look beyond the cycle, with a view to maintaining robust growth over

the medium term.

In an email to this author, a Bloomberg reporter wrote “It

doesn’t add-up”:

The Trump administration’s

“monster” trade deal with China helped drive global stocks to records and push

currency volatility to all-time lows. But the accord excludes $50 billion of

U.S. exports and there are doubts China can buy the required $95 billion extra

in commodities. And trade is only a small part in the competition with China

that Secretary of State Mike Pompeo warned will require “every fiber” of

America’s “innovative spirit.”

“Rhetoric became reality last year,” said Andrew Batson, head

of research at research firm Gavekal Dragonomics in Beijing. “We had a deepening slowdown in the

domestic economy last year and unprecedented pressures on the external front

from the trade war with the U.S. In the face of all that, the Chinese

leadership actually did very little.”

Here’s Politico’s opinion - The

U.S.-China Trade Deal Was Not Even a Modest Win:

At best, the Phase I

agreement modestly revises the status quo before Trump came into office.

Nothing that China has agreed to departs markedly from

what it agreed to during the Obama administration.

That was not at all sufficient for many China hawks, both Republican and

Democrat. Trump, with his conviction that trade deficits were a sign of

weakness and of the United States being ripped off, helped those voices, which

were in danger of being marginalized as the two countries continued to

negotiate and increase the amount of reciprocal trade, rise to the fore.

After two years of

tariffs and mounting hostility, however, the agreement struck has cost the

United States more than $30 billion to subsidize American farmers to compensate

for Beijing’s retaliatory refusal to buy American agricultural goods. It has cost

American consumers tens of billions in tariffs. It has forced U.S. companies to

diversify their supply chains out of China at an additional cost of many

billions. Many of those companies were beginning to consider China alternatives

before 2017—China is no longer the lowest-cost producer—but having to shift

those supply chains under duress added vast unnecessary expenses.

The Phase I agreement

barely restores China’s agricultural purchases to where they were before 2017,

even as that is presented as a victory. If one of your main customers boycotts

you and then agrees to start buying again but buying less, it would be

disingenuous to announce that they had promised to buy more. Similarly, China

agreed to do what it had already agreed to do in 2015 on intellectual property,

except now in 2020, it is spending far more money domestically on its own

intellectual property, on 5G telecommunications, artificial intelligence and

cybersecurity. Agreeing to honor U.S. intellectual property in 2015 meant some

real trade-offs for Chinese companies; in 2020 that’s like agreeing to stop

manufacturing biplanes in a jet engine age. Chinese companies, fueled by

government priorities, are plunging ahead with their own innovation in order

not to be as linked or dependent on the United States going forward. China

conceded on intellectual property because it now cares far more about

developing its own than stealing from the United States.

And that gets to the

core failure: The United States has fundamentally misread the relative

strengths of both itself and China. It has acted as if Chinese exports to the

United States are the key driver of the Chinese economy and hence tariffs are a

potent weapon. As underscored by a recent McKinsey study, in fact, China has

been aggressively, purposefully and successfully shifting from an export-driven

economy to a consumer-driven one. Much of the gain of exports accrues to the

multinational companies that source in China and not to the domestic Chinese

economy, and more and more Chinese manufacturing activity is geared toward its

own vast internal ecosystem. Tariffs certainly stung, but their greatest impact

was not economic but rather as a signal to Beijing that the United States was

no longer a reliable economic partner.

The trade war and the

paper-thin truce codify a new order that will see ever less American leverage

going forward. By focusing on the abuses of the past, the United States has

failed to meet the challenges of China going forward. It has declared victory

in a war that it started over issues that matter less and less. It is not just

a hollow victory—it’s no victory.

……………………………………………………………………………………………..

China Demographic and

Geopolitical Issues:

In other China news that may affect the global economy, or

world markets:

1. Chinese births

hit their lowest level in 58 years in 2019, dropping 580,000 from 2018.

Longer term, such demographic trends will drag on China’s potential economic growth rate. That’s certainly happened in Japan during the

last two “lost decades” as the population aged.

The number of births per 1,000 people in China declined to

10.48, the lowest level on record according to National Bureau of Statistics

data going back to 1949 when the Communist Party took power. China’s

working-age population -- those aged 15 to 59 -- declined 890,000, the figures

showed. The number of newborns in 2019 fell to 14.65 million, a decrease of

580,000 from the year before.

2. The U.S. has

sailed another guided-missile destroyer, the USS Shiloh, through the Taiwan

Strait, prompting the

Chinese Foreign Ministry to send a warning statement regarding respect of its

territorial integrity.

Guided-missile

cruiser the USS Shiloh (CG-67) conducted a “routine Taiwan Strait transit” on

Thursday. Photo: Reuters

……………………………………………………………………………………………….

“The issue of Taiwan is about China’s territorial integrity, and

the most important and sensitive issue for China-US relations,” Geng said, adding the US should abide by the one China

principle.

Joe Keiley, a spokesman for the US 7th

Fleet, on Friday said the USS Shiloh conducted a “routine Taiwan Strait

transit” in a demonstration of “the US commitment to a free and open

Indo-Pacific.” “The US Navy will continue to fly, sail and operate anywhere

international law allows,” Keiley added.

Taiwan’s defense ministry said in a statement that the US

warship was on a general navigation mission when it sailed north, from the

southwest of the island, through the strategic waterway separating Taiwan from

mainland China.

The US has increased the frequency of its Taiwan Strait transits

in recent years despite Beijing’s protestations, with at least nine passages

through the waterway last year. One of the most recent included the

guided-missile cruiser USS Chancellorsville sailing through the strait in

November, in what the US Navy said was a demonstration of “the US commitment to

a free and open Indo-Pacific.”

………………………………………………………………………………….

Conclusion and

End Quote:

Ayhan

Kose, the World Bank’s lead economic forecaster,

warned in a report forecasting weak

global growth in 2020: “Such large waves of debt borrowing tend to

have unhappy endings and that low interest rates may not be enough to offset

another financial meltdown.”

“Low global interest rates provide only a precarious protection

against financial crises. In a fragile

global environment, policy improvements are critical to minimize the risks

associated with the current debt wave.”

……………………………………………………………………………………………

Good luck and till next time….

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been

involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since 1971) to profit in

the ever changing and arcane world of markets, economies and government

policies. Victor started his Wall Street

career in 1966 and began trading for a living in 1968. As President and CEO of

Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and

development platform, which is used to create innovative solutions for

different futures markets, risk parameters and other factors.

Copyright © 2020 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).