End

of Decade Review of U.S. Economy and Financial Markets

By the

Curmudgeon

Preface:

This is the first of a two-part series examining the U.S. economy and

financial markets for the last 10+ years.

The second article will be published next weekend, with Victor joining

me to provide his usual no holds barred comments and incisive on target

analysis.

Introduction:

Investors never had it so good!

Since March 2009, U.S. stocks have compounded at a 14.4% annual rate,

twice the rate of the last century. U.S. bonds have returned more than 9% a

year, triple the historic pace. Adjusted for risk, as measured by annual

volatility of returns, the past 10 years have been the best in the past 100

years (Source: Morgan Stanley Wealth Management).

U.S. Stock Market vs the

Economy:

As of the Friday, December 20th close, the S&P 500 Index YTD

total return is 31.05%, according to y.charts.com. At Fridays close of 8,924.96, the NASDAQ

composite has a YTD gain of 34.51%.

Curmudgeon Comment:

It seems like the S&P and

NASDAQ continue to make new all-time highs almost every day even on days

where there is very bad political and/or economic news. Instead, we hear never ending tales of a goldilocks

economy and an unstoppable, never ending bull market that is immune to the

diminishing power of bad news.

To be sure, the stupendous gains in stocks are NOT the result of a strong

economy. To the contrary, while the U.S. has a 3.5% unemployment rate, the

lowest in 50 years, GDP growth has averaged 2.1% a year over the last decade,

versus a long-term average of 3.3%.

United States GDP Growth Rate

Because of demographics and the growing share of older workers that have

given up looking for a job, the labor-participation rate (63.2% as of November

2019) remains four percentage points below the post-World War II average. Real wage growth (i.e. after inflation) has

been modest, averaging only 1.6% a year.

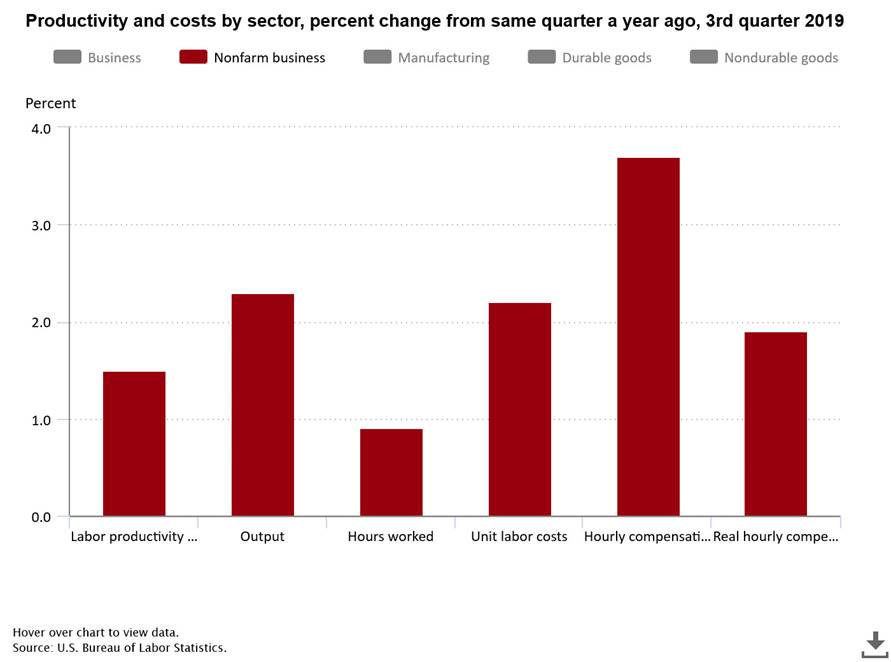

Productivity for the 2010s has been lackluster, which is likely due to

anemic capital investment (aka CAPEX) which has offset companies using more

efficient and cost-effective technologies.

U.S. labor productivity decreased 0.2% in the nonfarm business sector in

the third quarter of 2019 and dropped

by 0.82 % YoY in Sep 2019, the last month for which figures are available.

Note: U.S. Labor Productivity Growth data is updated quarterly by the US BLS. It is a measure of economic performance that

compares the amount of goods and services produced (output) with the number of

hours worked to produce those goods and services.

..

Disconnect Widens to

Unimaginable Levels:

When we started writing the Curmudgeon, 15 years ago (after the market

recovered from the dot.com bust/telecom crash and started a new bull move), we

noted the huge disconnect between the

economy and stock prices. We never

imagined it could get much wider, let alone reach the stupendous disparity of

recent years. The past year has been

most improbable, with three consecutive quarters of YoY negative earnings

growth even though profit margins and profits as a percent of GDP are and have

been all-time highs. Yet the stock market didnt seem to care or

even celebrated the earnings recession with popular averages up over 30%!

What accounts for this great disconnect and stupendous increase in P/E

ratios, which would be even higher without share buybacks?

We think its a combination of: the Fed and other central banks ultra-easy

monetary policies which provides stupendous liquidity for financial assets,

negative overseas interest rates (and negative real interest rates in the

U.S.), corporate stock buy backs, huge short liquidity trades, computerized

trading based on key words in social media and the news, ETFs being used as

highly leveraged derivatives [as per Tim Quasts comments in Curmudgeon: S&P 500

Forecasts Bullish but Prices Bolstered by Buybacks and ETFs, Not Earnings

(12/08)], and other factors that we dont understand.

Sayings which were once ridiculed,

but may now be true:

The four most dangerous words in investing: this time its different,

by Sir John Templeton (founder of the Templeton mutual funds).

"The old rules no longer apply."

"Risk is off the table. Count

on it."

Buy the dip. [See below for counter-argument]

Every dip is a blip in a never ending bull market.

Prudent sayings which may now

be invalid:

Buy into fear, sell into greed

Always sell too soon, by Baron Rothschild (then many others repeated this

saying).

Take profit when your stocks % gain hits your target.

Do not buy into a steep correction, because it could likely be the

beginning of a bear market

It would be wonderful if we could

avoid the common setbacks with timely exits, Peter Lynch, Fidelity Magellan

fund manager.

And finally

.

Markets get old too.

[Quintessential Victor Sperandeo interview with Jack Schwager published in New

Market Wizards starting on page 293.]

..

.

Good luck and till

next time

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since 1971) to profit in

the ever changing and arcane world of markets, economies and government

policies. Victor started his Wall Street

career in 1966 and began trading for a living in 1968. As President and CEO of

Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and

development platform, which is used to create innovative solutions for

different futures markets, risk parameters and other factors.

Copyright © 2019 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).