S&P

500 Forecasts Bullish but Prices Bolstered by Buybacks and ETFs, Not Earnings

By the

Curmudgeon

Introduction:

2020 stock market forecasts issued by the big investment banks and

brokerage houses are out and, as expected, they are mostly bullish. Only four of 14 firms forecast a negative

return for the S&P 500 next year as shown in the following table:

We caution readers not to put too much faith in these forecasts. Why? Because they have a dismal track record. The main reason is that stock market

forecasts are typically based on earnings growth for the coming year. In fact, CFA Institute (and other) students

are taught that earnings are the number one driver of stock prices. Based on 2019 stock market performance, that

no longer seems to be true.

Do

Earnings Still Drive Stock Prices?

In this new era of never-ending financial bull markets, we wonder if the

stock market even cares about earnings anymore.

Thats in light of S&P 500 3Q-2019 YoY

earnings decline of -2.3% with the index +24% YTD.

Recent stock market performance seems to be driven by valuation swings,

corporate stock buybacks, central bank ultra-easy money policies, negative

nominal (and real) interest rates. The

old tool kit, consisting of fundamentals, technical analysis, cycles,

sentiment, etc. seems to be a thing of the past. Only monetary policy remains as a classical

market metric. Hence, stock prices have become impossible to forecast

accurately.

Lets look at P/E ratio, which has become greatly distorted by share

buybacks which reduce the number of outstanding shares of stock. The S&P

500 is currently at a relatively high 23x earnings (without buybacks it would

be much higher). Historically, investors have been willing to pay anywhere

between 5x and 40x earnings for the U.S. market. That valuation swing

translates in anything from a 70% gain in stocks to a 70% decline. With interest rates so low and monetary

policy so easy, it is highly unlikely that the P/E ratio will decline to single

digits, which makes a major stock market decline unlikely in 2020- an election

year in the U.S.

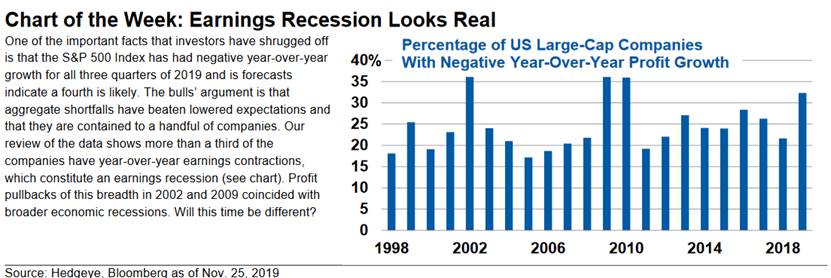

However, we have been in an earnings recession for quite some time as

documented in previous Curmudgeon posts and elsewhere, like this piece

from Morgan Stanley Wealth Management:

Morgan Stanley found that more than a third of S&P 500 companies have

posted a year-over-year decline in earnings in 2019. The last times the share

of companies posting contracting earnings was that high: 2009, 2008 and 2002,

all periods when the broader economy, plus the stock market, were in

decline. The investment bank forecasts

that the S&P 500 will end 2020 at 3000 and will be at 2750 by Dec 31, 2019

(vs 3146 as of Dec 6, 2019).

.

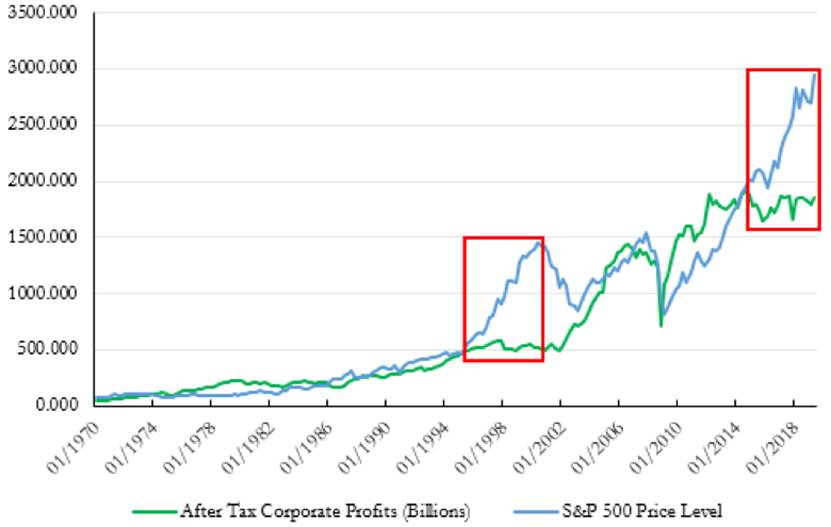

Heres a terrific chart showing S&P 500 Price Level vs. After Tax

Corporate Profits (1970- Present):

Source:

St. Louis Fed, Yahoo Finance

The red box on the right shows that S&P 500 after tax profits (not EPS which

is distorted by buybacks) peaked five years ago in 2014 and have been basically

flat since then. JULEX Capital reflected on this dichotomy in a December 6th blog post:

Although the stock market

continues reaching record highs, companies are making less than they did five

years ago, so this performance is largely driven by P/E expansion.

There is good reason to

believe that the current environment represents a fundamental mispricing in the

stock market. For instance, applying a linear model to the most recently

available earnings data would yield a predicted S&P 500 price level of

below 2566 with 97.5% probability, quite the far cry from the current levels of

over 3100.

Corporate

Stock Buybacks:

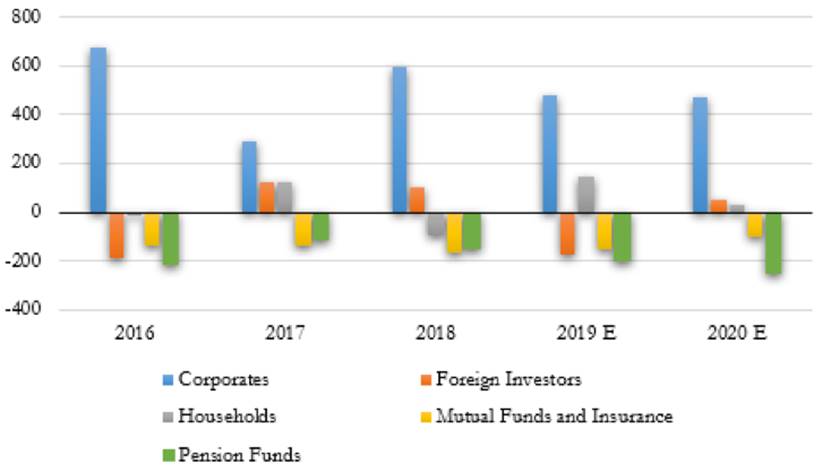

A large part of this P/E expansion can be attributed to aggressive

corporate buybacks. According to Goldman Sachs Research Team, only

corporations and households have been net buyers of equities since 2015, with

buybacks accounting for a large majority of the demand (see chart below). If

the market loses this key piece of support going forward, either through

government regulation or from natural causes (e.g. difficult to do buybacks

without a significant increase in after tax earnings), then one would expect

equities to come back down to more reasonable valuations. But dont bet on it!

Net Equity Demand by Category (Billions)

..

.

..

..

..

.

..

..

Bearish Analysts Comments:

Morgan Stanleys Michael Wilson is one of the more bearish analysts on Wall

Street. Easier monetary policy and trade stabilization will help global growth

accelerate, but only stabilize GDP growth in the US at 1.8%, leaving pressure

on corporate margins from tight labor markets, he wrote in a note to clients.

Wilson argued that central bank stimulus may keep stock prices elevated in

the near term, but by April, the liquidity tailwind will fade

and the market will focus more on fundamentals, where uncertainty is higher

than normal.

He believes that profit margin headwinds and sluggish U.S. economic growth

will keep earnings gains nearly non-existent, as has been the case in 2019,

while international trade and policy uncertainty will keep a lid on equity

valuations.

UBS Francois Trahan also has a target of 3,000 on the S&P 500 for the

coming year, driven by what he predicts will be an earnings recession or two

or more consecutive quarters of declines in S&P 500 earnings.

Directly in front of us, we see S&P 500 forward earnings falling and

expect them to remain under pressure for several quarters, Trahan wrote in a

recent 2020 outlook note. He said that earnings declines

in small cap stocks are presaging what will happen to large caps as a slowing

of economic growth, which began in 2019, continues next year.

Tim

Quast on ETFs Influence on the Market:

Our long-time colleague Tim Quast, principal of ModernIR

[1.] has several cogent comments on how ETFs are artificially propping up stock

prices.

Note 1. ModernIR is the No.1 Market Structure Analytics firm in the

Investor Relations (IR) profession, serving a rapidly growing client base in

excess of $1.5 trillion in market capitalization.

..

ETFs are fostering inflation in stocks precisely the same way issuing

excess currency beyond the markets requirements diminishes purchasing

power. ETF shares continue to expand at

an eye-popping pace even as investors exit U.S. equities via net redemptions

(the WSJ said over the weekend that investors have pulled a net $135 billion

this year from equity mutual funds).

How is

it possible to create more ETF shares as money leaves U.S. equities? Very easy:

Create them WITHOUT accumulating the underlying stocks (academics refer

to this as operational shorting, Professor Rich Evans from UVA in Charlottesville

VA wrote a paper on it, and I moderated a panel with him in June this year to

discuss it). Selling ETF shares that

have no associated underlying collateral inflates prices, because arbitragers

trade the ETF shares up in line with the benchmarks they track which in turn

pulls stock prices up too.

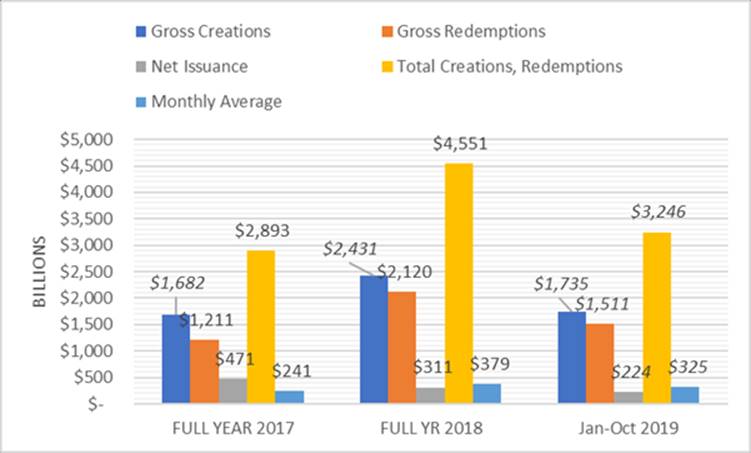

We track the ETF data from the Investment

Company Institute every month.

Thereve been $3.2 TRILLION of ETF creations and redemptions this year,

with creations outstripping redemptions

by $224 billion (monthly average of $325 billion total create/redemptions

per month in 2019 through October, the most recent data available). From ICIs November 26th report:

Assets of all exchange-traded funds rose in October 2019 by $105.36

billion, or 2.6 percent, to $4.13 trillion. Over the past 12 months, ETF assets

increased $653.77 billion, or 18.8 percent. Assets in domestic equity ETFs

increased $323.81 billion since October 2018, and global equity ETF assets rose

$93.84 billion during this period. At the end of October 2019, assets of bond

funds were $793.89 billion and hybrid funds were $29.23 billion and commodity

funds were $85.47 billion.

During October 2019, the value of all ETF shares issued exceeded that of

shares redeemed by $28.61 billion. In October 2018, the value of all ETF shares

issued exceeded that of shares redeemed by $7.93 billion.

ETF Data from Investment Company Institute

.

End Quote (courtesy of Victor):

Just because something isn't a lie does not mean

that it isn't deceptive. A liar knows that he is a liar, but one who speaks

mere portions of truth in order to deceive is a craftsman of destruction.

ΰThe Fed does not understand this!

― Criss Jami

..

.

Good luck and till

next time

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since 1971) to profit in

the ever changing and arcane world of markets, economies and government

policies. Victor started his Wall Street

career in 1966 and began trading for a living in 1968. As President and CEO of

Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and

development platform, which is used to create innovative solutions for

different futures markets, risk parameters and other factors.

Copyright © 2019 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the original

posted article(s).