S&P 500

Earnings Recession Continues; Severe Decline in Core Earnings Explained

By the

Curmudgeon

In our last post - Curmudgeon:

S&P 500 Earnings Beat Estimates Which Continue to Fall; ShadowStats

Financial Forecast (11/11), we noted that S&P

500 companies had reported what looked to be three consecutive quarters of negative earnings growth. That was confirmed last Thursday, November 21st

by FactSet,

which stated that the S&P 500 (combined average of 500 companies) reported

a decline in earnings of (-2.2%) for the third straight quarter. That was the largest earnings decline so far

this year. Note also, that 85 S&P 500 companies issued negative EPS guidance for Q3 tied for third highest number since

2006. But thats old news!

What about 2019 Q4 earnings for the S&P 500?

Lipper (owned by Reuters) reported on Friday November 22nd

that there have been 61 negative EPS pre-announcements issued by S&P 500

corporations for 2019 Q4 compared to 29 positives, which results in a Negative/Positive ratio of 2.1 for the

S&P 500 Index. Sanguinely, Lipper estimates earnings growth rate for the

S&P 500 for 2019 Q4 to be flat (0.0% growth). FactSet disagrees.

Earnings for the S&P 500 companies are now projected to decline 1.51% in the fourth quarter

from the year before, according to a FactSet

compilation of analysts average forecasts for individual companies making

up the S&P 500. The last time

S&P 500 corporate earnings decreased for four quarters in a row was in the

period beginning with the third quarter of 2015, according to FactSets senior

earnings analyst John Butters.

An earnings recession

is defined as two quarters or more of consecutive year-over-year declines. Weve now experienced three such negative

quarters with the Q4 forecast to be flat to down 1.51% depending on the

forecast.

Heres an interesting chart from Refinitiv:

S&P 500 Y/Y Growth

Rates:

You can clearly see that S&P 500 revenues, net income and

earnings peaked in 2018 Q3, began declining through 2019 Q3 (this past

quarter). The numbers starting with 2019

Q4 are forecasts, which are subject to drastic revisions. For example, 2019 Q4 earnings are now

estimated to have grown 0.0% (Lipper) vs the 3.9% (Refinitiv)

shown in the above table. That

discrepancy is because the chart and table forecasts have not yet been revised

downward!

Earnings Recessions vs.

Economic Recessions:

Three-fourths of earnings recessions since World War II have

morphed into economic recessions, according to CFRA Chief Investment Strategist

Sam Stovall, who has been scratching his head trying to reconcile analyst

pessimism around earnings with continued stock-market rallies. The S&P 500 has hit 10 new all-time highs

since Oct. 28th, but during that entire time, earnings forecasts have been

coming down, Stovall noted. While third-quarter earnings did fall, the decline

wasnt as steep as what analysts had originally projected, marking the 31st straight quarter when actual profits

exceeded end-of-quarter estimates.

Of course, that is the managed

earnings game corporate CFOs play with stock market analysts. The result is that a YoY earnings decline

becomes an earnings beat, (due to fake lower earnings guidance) which sparks

a rally in the stock price. What a sham!

Core Earnings Distortion

Missed by Most Investors/Speculators:

Heres an illuminating Q&A and chart from MarketWatch:

The S&P 500 index has been on a tear this year, up nearly

25% and currently around an all-time high.

How do stocks rise when the underlying fundamentals fall?

Answer: Most investors

are not aware of the more severe decline in core earnings.

Why are they not aware?

Answer: Because too few people read the footnotes.

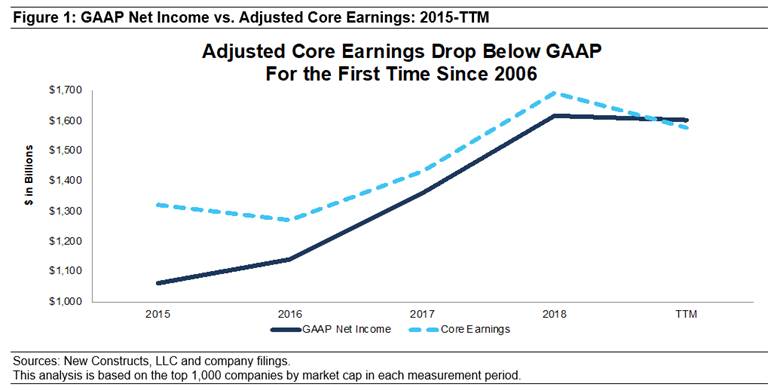

Adjusted core earnings drop below GAAP earnings for the first

time since 2006: Over the trailing 12

months, GAAP earnings fell 1% while adjusted

core earnings fell 6% for the largest 1,000 companies by market

capitalization in each period. Most investors know that GAAP earnings are prone

to distortion because they include lots of non-recurring or unusual items.

Most investors are not

aware that core earnings (from CompuStat

or Wall Street analysts) are also distorted by unusual items. In fact, earnings for the S&P 500 were distorted

by 22% on average in 2018.

The chart below highlights the more severe drop in core

earnings when accounting for these hidden gains or losses.

Earnings distortion from hidden gains is on a rapid rise, and

core earnings from traditional sources have not been this overstated since

2000. The rapid rise in earnings

distortion since 2015 means that an increasing amount of corporate income is

coming from unusual or one-time gains, which is not apparent to investors

analyzing news releases or income statements. Corporate managers hide the

one-time nature of these gain by only disclosing them in the fine print. In

other words, managers are dressing up the numbers in an increasingly aggressive

manner over the last few years.

In Stovalls view, trade fears have analysts feeling cautious

about profits even as the market seems to be anticipating that things could get

better. Until details of the deal are

revealed, along with the prospects for continued conversations, EPS estimates

are likely to undershoot potential, he wrote in a recent note to CFRA clients.

Some of the downward earnings forecasts are huge. Amazon, typically a big winner in holiday

sales and the undisputed cloud computing leader, is expected to post an

earnings decline of 31.3% in the fourth quarter, after earlier projections

called for an 8.3% advance. The e-commerce and cloud computing giant increased

spending this year to cut its delivery times to Amazon Prime customers in half

(to one day), and all retailers face a shortened shopping season this year with

Thanksgiving falling later in the calendar.

That does not augur well for corporate profits in the retail sector.

Because the S&P

500 is market-cap weighted, profit declines at large companies have an

outsize impact on overall earnings for the index. A handful of large companies

that have been big contributors to the earnings decline thus far in 2019 are

expected to deliver sizable drops in

profits for the fourth quarter. In addition to Amazon, others include

Boeing, Exxon Mobil and Micron Technology.

FactSets Butters notes that 2019 Q4 estimates call for larger earnings declines among

companies with greater international exposure. Thats because of the very

weak global economy and the high value of the US dollar vs. foreign

currencies. For S&P 500 components

that generate more than half of their revenue internationally, the average

projection is for a 3.9% drop in profits as of November 20th. Earnings are

expected to be flat for those companies that derive more than half of their

revenue domestically.

CFRAs Stovall said that a U.S. China trade deal would

offer some relief to multinational sectors, including industrials, materials,

and technology, which also happen to be cyclical industries. But of course, that depends on the nature of

the deal and how much is genuine vs PR fluff.

There must be a lot of hopes pinned on relaxation of tariffs

from a trade agreement as the stock market rallies on ANY keywords indicating theres

a positive outlook for such a trade deal.

Weve been surprised that these rallies have been going on unabated

(including last Friday, November 22nd) without any trade resolution

accomplished or even scheduled. Evidently, thats the nature of the Alice

in Wonderland markets we live in today.

End Quote:

For those who think stock market bull/bear cycles have been

repealed and we are in a never ending bull market with no recessions for the

next 10 years, heres a quote for you:

You get recessions, you have stock market declines. If you

don't understand that's going to happen, then you're not ready, you won't do

well in the markets.

By Peter Lynch, former manager of Fidelity Magellan fund.

.

Good luck and till

next time

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since 1971) to profit in the

ever changing and arcane world of markets, economies and government

policies. Victor started his Wall Street

career in 1966 and began trading for a living in 1968. As President and CEO of

Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and

development platform, which is used to create innovative solutions for

different futures markets, risk parameters and other factors.

Copyright © 2019 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating,

copying, or reproducing article(s) written by The

Curmudgeon and Victor Sperandeo without providing the URL of the original

posted article(s).