Why Stocks

Have Moved Up Despite Lower Profits and a Weakening Global Economy

By Victor

Sperandeo with the Curmudgeon

Introduction

(Curmudgeon):

Once upon a time, stock prices were mostly driven by future

corporate profits and to some extent by the level of interest rates. As weve explained in numerous Curmudgeon

posts, that is no longer true. Double

digit U.S. and global stock gains this year have occurred while the global

economic outlook has grown progressively dimmer. The global growth slowdown coupled with the

waning boost from 2017s U.S. tax cuts have reduced corporate profits. S&P 500 companies are expected to post

their first year-over-year decline in earnings since 2016. There is also the

uncertainty of trade and tariff wars, China economic weakness, and BREXIT

uncertainty. Apparently, stock investors

dont care about any of the above!

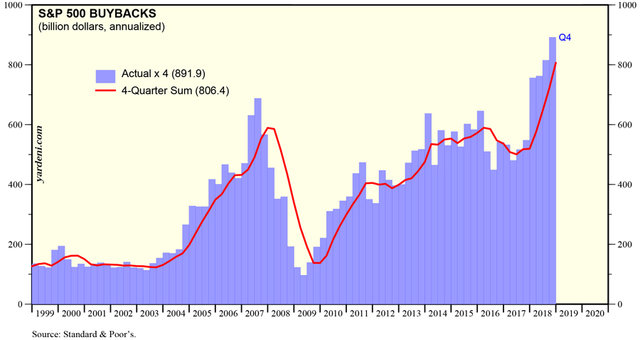

Weve repeatedly pointed to record stock buybacks as

the primary fuel for ever rising equity prices, but weve so often wondered where

that money was coming from and why were corporations buying back their own

stock at near record high valuations, rather than invest in their future

growth.

Victor explains, in what I perceive to be a merry go round

con game, that to date has gone unchecked by financial regulators.

Victors Analysis:

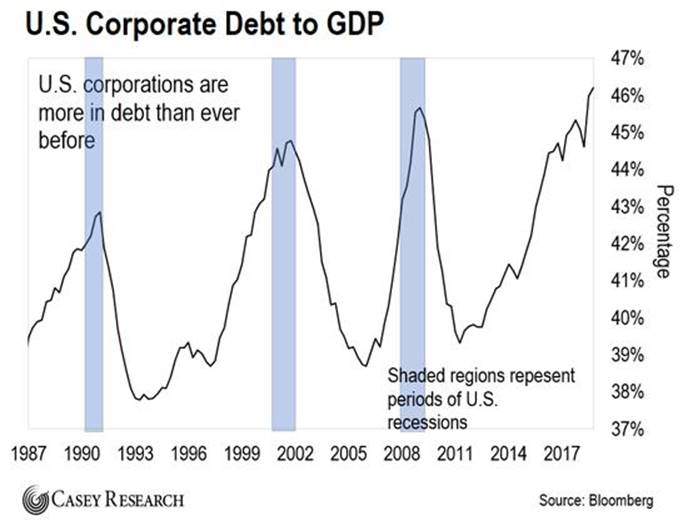

The answer is in part pictured by the below Corporate Bond

chart, courtesy of Casey Research. It

clearly illustrates an exponentially rising U.S. Corporate Debt to GDP ratio

which is now at an all-time high.

Brian

Reynolds [1], Chief Market Strategist of New Albion Partners, coined the

phrase a Daisy chain of financial engineering. It all starts with a Pension Funds mandate to

earn 7.5% in order to maintain the benefits they have promised retirees.

However, the trustees cannot prudently make that high a yield on investment

without taking on greater risks. They

are reluctant to overweight stocks, which are at or very near historic over

valuations with earnings declining.

Pension Funds, like most investors (especially this trader/

author) see the huge risks that are present and therefore dont want large

stock exposure.

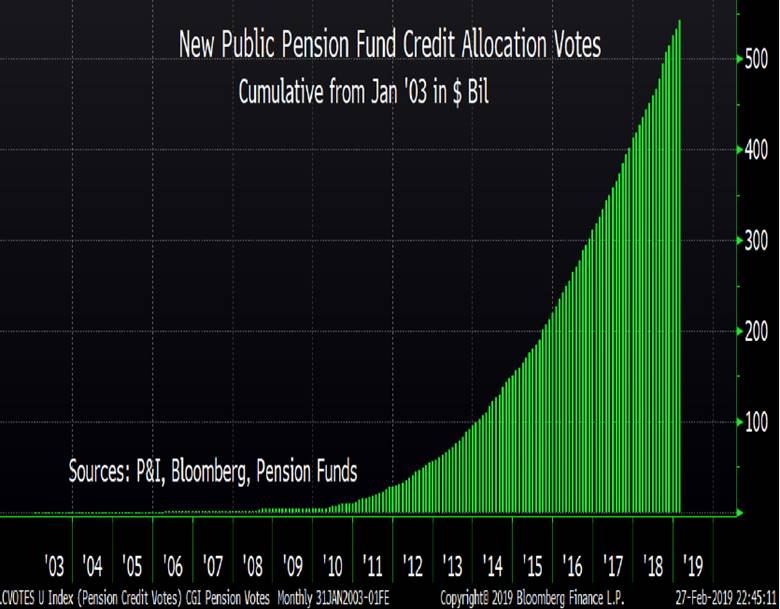

Both private and especially public Pensions Funds are

generally still way underfunded. ERISA regulates private pension funds, whereas

there is no oversight in public or state-run funds and

many go unaudited. So

no one really knows what their status truly is? What we do know is depicted in this rocket

like chart:

Pensions continue to boost credit with

record flows

As an example, Kentuckys Pension Fund is only 12% funded!

Illinois and New Jersey have equal unfunded liabilities.

Other public pension funds with sizeable recent allocations

to credit and related products include Nebraska's pension, the Chicago Public

School teachers' pension, the Illinois Municipal pension, and the Los Angeles

City Employees' pension.

Another Reference:

Goldman

Sachs view of Private Pension problems -

Goldman Sachs: Pensions Underfunded by $240 Billion

..

As a result, many pension funds have been drawn to the

corporate credit markets in search of higher yields. To this end pension funds find investment

grade BBB credits that can prudently (?) satisfy their goals without using

leverage. Corporate America will always comply in supplying the demands of

Pension investors by issuing more credit for them to buy. Thats clearly depicted in the above chart.

The problem is liquidity,

because when interest rates rise you cant sell this debt as everyone heads for

the same exits. In other words, they all

want to sell but there are no buyers!

NOTE [1.]: Readers are encouraged to watch this video: Financial

Engineering, Unfunded Pensions and Potential Disaster - Real Vision. A 14-day free trial subscription is

available. [Brian Reynolds, former chief

market strategist at Rosenblatt, sits down with Real Vision's Tyler Neville to

discuss how unfunded pension liabilities are the real engine for the U.S.

credit boom and how this leads to corporate stock buybacks.]

Curmudgeon Notes and

Warnings:

1. High-yield

securities and long-term corporates are leading the across-the-board gains for

bonds this year by wide margins. SPDR Bloomberg Barclays High Yield Bond (JNK) ETF is the bond markets top

year-to-date performer with a strong 9.0% YTD total return (as of April 12th).

Using recent history as a guide, the ETFs bull-run this year remains red hot!

2. Liz McCormick and

Katherine Greifeld of Bloomberg suggests that a possible $2

Trillion Corporate Bond Wipeout is coming.

Ultra-low bond yields and reduced liquidity could blindside investors

and exacerbate losses once the market turns.

One problem is the sheer amount of ultra-low yielding debt,

which means investors have almost no buffer in the event prices drop (check

your bond or bond fund duration to determine its price sensitivity to a rise of

1% in interest rates for comparable dated maturities).

A much bigger worry is that liquidity will suddenly evaporate in a selloff and leave bond

holders stuck with losses on positions they cant get out of quickly or at all

for some thinly traded (or not daily traded) high yield bonds.

The risk of getting left behind when everyone heads for the

exits is something Elaine Stokes takes to heart. The Loomis Sayles money

manager says when she screens for securities to buy, the ability to get out of

the trade is a key factor. That concern was underscored by JPMorgan Chases CEO

Jamie Dimon, who wrote in his annual shareholder

letter that investors face a new normal of reduced liquidity and heightened

volatility because of tighter regulations.

The issue is whether there will be enough liquidity in asset

markets when everybody wants to redeem funds at the same time, says Nellie

Liang, a former Fed staff economist, whos now a researcher at the Brookings

Institution. She sees the biggest risks

in funds and ETFs for less liquid assets, like certain corporate bonds,

leveraged loans and emerging-market debt.

This is an element of hidden leverage that is not

appreciated, says Jeffrey Snider, global head of research at Alhambra

Investments. We are eventually going to have a shock.

3. Since 2010, thanks to the policies of ultra-low (or

negative) interest rates by the Central Banks of the most industrialized

countries (Federal Reserve in the U.S., European Central Bank (ECB), Bank of

England, Bank of Japan, Swiss National Bank, among others), big

corporations have become massively more indebted. In the U.S. for example,

corporate debt increased by $7,800 billion between 2010 and mid-2017 and has

risen substantially since then (see first chart above). What have the companies done with the

proceeds of the debt offerings? Have

they invested in research and development, in production, in the ecological

transition, in creating descent jobs, warding off climate change? Not at all!

The money has been used principally to buy back their own

issued shares (also to pay increased dividends).

4. Its very well

known that stock buybacks have been

the largest source of share demand in the last decade. David

Kostin of Goldman Sachs wrote:

"Eliminating buybacks would immediately force firms to

shift corporate cash spending priorities, impact stock market fundamentals, and

alter the supply/demand balance for shares... The potential restriction on

buybacks would likely have five implications for the US equity market: (1) slow

EPS growth; (2) boost cash spending on dividends, M&A, and debt paydown;

(3) widen trading ranges; (4) reduce demand for shares; and (5) lower company

valuations."

Senator Marco Rubio (R-Florida) released a plan that would

curb buyback incentives while Senator Chris Van Hollen

(D-Maryland) said he plans to propose legislation curbing executive share sales

after repurchase announcements. The U.S. Senate is

starting a hearing aimed at introducing legislation to prohibit public

companies from repurchasing their shares on the open market. In the previously referenced post, Doug Kass says he wants to make share buybacks illegal.

Victor

previously wrote that companies that buy back their own shares should have

a lower P/E multiple. They should also issue a buy back

disclosure document thats approved by the SEC (just like they do when they

issue new shares).

5. Less Money

Available for future Buy Backs?

Many companies were able to issue debt cheaply under QE and

ZIRP for the sole purpose of being able to fund stock buybacks. But as the economy has started running into

some formidable headwinds, many companies are going to have to allocate billions

of dollars to pay down debt over the

next three to four years. Thats exactly

what AT&T has been doing recently.

Companies may be reluctant to issue more debt if they already have a

high debt to equity ratio. If so, that

will leave much less money available to fund stock buybacks!

ΰAt the risk of being

called the boy who cried wolf, the Curmudgeon urges readers to note the above

risk warnings.

.

Victors Analysis

(Continued):

The Daisy Chain

Sequence, espoused by Reynolds is as follows:

1.

Pension funds need and want 7.5% returns with

lower risk (?) then equities.

2.

Corporations sell high yield

bonds to Pension funds.

3.

They take the proceeds of the

debt offering and use it to buy

back their own common stock [2].

NOTE [2.]: Curmudgeon and I have tried to find documentation on the

percent and/or dollar volume of stock buybacks that were funded from the

proceeds of newly issued corporate debt. Unfortunately, neither of us could

find any credible data, so we are relying on Brian Reynolds assertion for this

claim. On the other hand, the Curmudgeon

in Note 5. suggests that there may be LESS money available for stock buybacks

due to corporations forced to pay down their very high debt.

.

Remember (former junk bond king) Michael Milken using company

earnings to take over companies and created what became known as high yield -

Junk Bonds in the 1980s?

Today, companies dont care about growing net earnings, or

the company, per se, because their stock price goes up via stock buybacks which

reduces the outstanding shares and thereby increases the P/E- even if earnings

dont increase or even decline! When

the stock price rises, so does the value of insider stock options and warrants!

It seems like this game

of charades causes almost everyone to win in the short run? However, if interest

rates rise, and/or yields invert the game ends.

Thats what happened last October-through December 24, 2018.

The Fed (who knows the risk quite well) has

to come in and rescue the markets from what they had caused by raising

short term interest rates at their December 2018 meeting.

The U.S., and world are now trapped in their own Pandoras Box of low to negative interest

rates, and monstrous growing of never to be repaid debt. This problem is also

present in the private equity market, according to Reynolds.

Victors Conclusions:

Corporations buying back their own stock with the proceeds of

bond sales to Pension funds (in order to fund their Pension mandated returns to

retirees) causes stock prices to increase, even when earnings are set to

decline (and possibly enter an earnings recession).

Weve puzzled over this for many years and at long last have

found a plausible answer why earnings growth doesnt really matter much anymore

to stock market participants.

The markets also know the Fed can talk tough, but (with a

close to $4 trillion balance sheet and very low or negative real rates) the Fed

has no ammo to fight the end game of panic selling. The only option was for the Fed to reverse

its interest rate policy, which it did on January 4th as Victor so

eloquently described here.

The Fed had to change course else risk a loss of liquidity driven crash. This madness can only end, when reality and

its consequences causes it to stop.

The Keynesian policy

(distorted to the 10th power) of government spending and creating debt, while

lowering interest rates, added to raising of taxes (whose sole purpose is to

lower middle-class spending power) to keep inflation low and to allow this

insane policy to continue. This is the

true execution of serving the rich and enslaving the poor.

The repression of the

middle class/savers is illustrated below via the real interest rate on T-bills from 12/31/08 to 12/31/18:

CPI =1.8% and one-month T-bills = 0.32% net (-1.48% in real

terms) compounded.

Compare that to the time period from 12/31/1925 to 12/31/08:

CPI =3.01% and one-month T-bills =3.71%.

The real (pre-tax) interest rate during the multi-decade long

latter period was +70bps vs. a -1.48% real loss during the latest 10-year time

period (through 12/31/18)!

The bottom line: The markets dont care about the economy anymore. They only care if interest rates are rising

or falling. According to Reynolds, the record amount of stock buybacks this

year are being fueled, aided and abetted by corporations using the proceeds of

newly issued debt to buy back stock in record numbers.

End Quote (Victor):

It appears to me that the GOAL of corporations buying back

their own stock (aided by an accommodative Fed) is to take money from the

people and transfer it to the elites (i.e. thats been the effect of zero

interest rates and QE for the last decade).

Thereby, that turns the people into serfs.

Genghis

Kahn put it differently, but the end result is

similar:

The greatest happiness is to vanquish your enemies, (the

people) to chase them before you, to ROB THEM OF THEIR WEALTH, to see those

dear to them bathed in tears, to clasp to your bosom their wives and

daughters.

― Genghis

Khan

Good luck and till next time

..

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since 1971) to profit in

the ever changing and arcane world of markets, economies and government

policies. Victor started his Wall Street

career in 1966 and began trading for a living in 1968. As President and CEO of

Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and

development platform, which is used to create innovative solutions for

different futures markets, risk parameters and other factors.

Copyright © 2019 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).