Steep Fall in Money Velocity

Continues Despite Fed’s Massive Monetary Stimulus

by The Curmudgeon

Money Stock Dropping Like a Rock

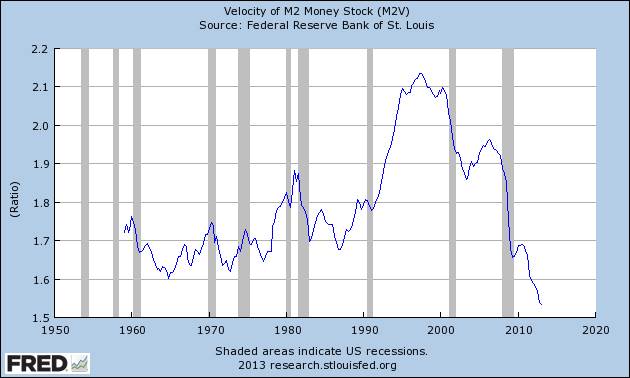

The eye opening Velocity of M2 Money Stock (M2V) is

shown below and in a previous Curmudgeon post titled, "U.S. Economy

Continues to Show Cracks While Fed Pushes on a String!"

[Note: Money velocity is a ratio of nominal GDP to a

measure of the money supply- in this case M2. It can be thought of as the rate

of turnover in the money supply--that is, the number of times one dollar is

used to purchase final goods and services included in GDP.]

The M2V ratio was down again in the latest quarter (1Q2013) and has made yet another all-time low since the ratio was first created in 1958. Each of the last five quarters has seen successively lower lows as shown below:

Table 1. M2V Ratios for Last Five

Quarters in the U.S.

2013:Q1: 1.533

2012:Q4: 1.538

2012:Q3: 1.568

2012:Q2: 1.579

2012:Q1: 1.588

The key point is that despite the Fed's massive monetary stimulus and zero interest rates, money is not turning over in the real economy. In effect, the interval between money transactions is getting longer, which acts to suppress economic growth. Until money velocity reverses course, it is highly unlikely that the U.S. will start a new period of sustained economic growth and prosperity.

Many investment "professionals" are astonished there's no inflation, despite the ballooning money supply and Fed balance sheet. We submit that as long as money velocity continues to decline, acceleration in the underlying rate of inflation is highly unlikely, regardless of the rate of expansion of the money stock or the Fed's debt monetization programs.

We strongly re-iterate that

the Fed's continued QE programs are NOT stimulating the real economy and (once

again) are causing a speculative bubble in almost all financial assets.

Trader Vic on the Effects of Fed's Easy Money:

Victor Sperandeo (legendary

trader Vic is also a commodity index inventor and CTA) wrote the Curmudgeon

that "the Fed is printing an estimated 18 % of "Total [Stated]

Debt" at the end of 2012, and an estimated 26% of "Public [Stated]

debt." The Fed's Balance sheet is

extremely large and (with zero interest rates) is a new high of fiat

money creation in 237 years! These

numbers will be estimated 33% Public Debt and 24% of Total [STATED] debt."

Continuing, Sperandeo wrote in

an email, "Almost all observers [certainly those in the press] see the

Fed's monetary stimulus as a harmless fix. They think it's good as it keeps the

financial markets (e.g. stocks and junk bonds) going up and is creating wealth

and is thereby helping the economy. But it is actually counterfeiting of the

highest order that will someday cause a crash of the US Capitalist system and

freedom as we know it."

"The problem today is the investment equity business

is an estimated $17 trillion+ and it is the business of RIA's and most vanilla

money managers to be long. These managers ignore and forget risks as they don't

suffer while the market is going up. However the issue is always "risk vs.

reward” for Professionals managers ... When something goes wrong, and it always

does, the S&P 500 will decline very sharply in five trading days (withholding

Victor's estimate so as not to scare readers)." [Editor’s note: readers

should be scared.]

Other Professional Money Managers

& NY Times Columnist Weigh In

Think Sperandeo is a lone wolf or voice in the wilderness? Think again! The NY Times reports that many big name investment managers, e.g. Stanley Druckenmiller, Paul Singer, J. Kyle Bass and David Einhorn have warned against the Bernanke's monetary stimulus. Mr. Druckenmiller said that Mr. Bernanke was “running the most inappropriate monetary policy in history.” These and other hedge fund managers have expressed no confidence in the Federal Reserve or the economics profession.

In recent NY Times titled, Why

Fund Managers May Be Right About the Fed columnist

Jesse Eisenberger wrote:

The Fed’s track record is out-and-out abysmal. Fund

managers remember only too well how Alan Greenspan encouraged the stock bubble

of the late 1990s, convincing investors that he would bail them out if the

stock market dropped severely. Worse, Mr. Greenspan urged people in 2004 to buy

homes by taking out adjustable rate mortgages. Then the central bank did

nothing to curtail the housing bubble.

The Fed has explicitly welcomed rising asset prices

as a sign that its monetary policies are working, as lower rates push investors

to put their money to work. But something is wrong. Companies are sitting on

their profits. Businesses aren’t investing and hiring enough."

In fact, the Fed may be inadvertently making things

worse. What if it succeeds in bringing average people back into the markets

right at the top? Is the Fed setting these poor suckers up to come in to buy

from the hedge fund managers?"

“The people you are trying to help don’t get the

message till the end of move,” said hedge fund manager James Chanos. “You keep impoverishing them,” he added.

Hedge fund managers can read markets, and they can

see that the Fed isn’t engineering the hiring, inflation and recovery it would

like. Instead of dismissing the critiques, the Fed and economists would do well

to pay heed.

On that note, the Curmudgeon hopes all readers realize that there is a risk vs. reward decision that investors should make when deciding to invest or speculate in the markets.

Till next time.....................................

The Curmudgeon

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.