U.S. Economy Continues to Show Cracks While Fed Pushes

on a String!

by The Curmudgeon

The U.S.

economic weakness described in previous CURMUDGEON posts has continued, as per

these recent news releases:

·

The

University of Michigan-Thomson Reuters consumer-sentiment gauge dropped

to a preliminary April reading of 72.3 — the lowest result since July 2013 —

from a final March reading of 78.6.

Economists polled by MarketWatch had expected a preliminary April

reading of 79.3.

·

U.S.

Commerce Dept. reported Friday that sales at U.S. retailers fell 0.4 percent

last month, indicating that higher payroll taxes and weak hiring likely

made some consumers more cautious about spending. With increase in the payroll tax (on January

1st), rising health and food costs, sequestration (automatic federal government

spending cuts, as of March 1st), and an uncertain employment picture, consumers

are not likely to increase spending.

·

Restocking

of goods slowed last month, according to the Commerce Dept. which said

that business inventories edged up 0.1% in February to a seasonally adjusted

$1.64 trillion. That came in below the

0.4% forecast in a MarketWatch-compiled economist poll. Meanwhile, January's growth was revised to

0.9% from an initially estimated 1%.

·

The March

NFIB Index of Small Business Optimism ended its slow climb, declining

1.3 points to 89.5. In the 44 months of economic expansion

since the beginning of the recovery in July 2009, the Index has averaged 90.7,

putting the March reading below the mean for this period.

·

Institute

for Supply Management™ Manufacturing Index (PMI) registered 51.3 percent, a decrease

of 2.9 percentage points from February's reading of 54.2 percent,

indicating expansion in manufacturing sector is slowing.

·

Institute

for Supply Management™ Non-Manufacturing Index (NMI) registered 54.4 percent in

March, 1.6 percentage points lower than the 56 percent registered in

February.

·

Index

of Manufacturers' New Orders: Nondefense Capital Goods Excluding Aircraft decreased

to 67593 in February (latest month reported) from 65405 in January. By excluding military/government spending,

it's a good indicator of the private sector economy.

But the U.S.

economy is actually in worse shape than the above indicators suggest! Here's why:

1.

The

effects of the federal government’s budget sequestration — $85 billion in

automatic spending cuts — are just beginning to be felt on consumer and capital

spending, economic growth or unemployment.

For sure, sequestration is not going to help the economy grow or add

jobs.

2.

Another

disturbing trend during this "economic recovery" is the precipitous

decline in the velocity of money (which measures how fast money changes

hands or turns over). The faster that

happens, the more positive effect on economic activity. But when money velocity declines sharply,

even as supply (e.g. M1, M2) is soaring, it means that the added liquidity is

not stimulating economic activity.

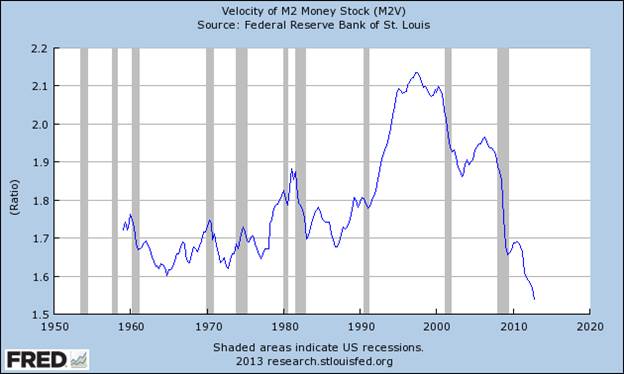

The graph

below of Velocity of M2 Money Stock (M2V) below is as scary as it gets.

Combined with the exponential growth in M2, the Fed's Balance Sheet, and the

Monetary Base (shown in a previous CURMUDGEON post) it

proves that the Fed has been "pushing on a string" with its zero

interest rate policy and QE programs- at least as far as the real economy is

concerned.

3.

It

appears the Fed's newly created money seems to be finding its way into

financial markets, especially the U.S. stocks market. Yet, there is absolutely no evidence to

support the assertion that higher stock prices meaningfully support economic

expansion. "Historically, a 1.0% increase in the S&P 500 index has

been accompanied by GDP growth of approximately 0.04%n during the same year,

0.04% growth during the next year, and it has a negative correlation during

subsequent years," writes

Erik McCurdy, senior market technician for Prometheus Market Insight.

The final two

charts below paint a picture of a deteriorating U.S. economy. The 1st chart

shows the steady drop in new orders since the "economic

recovery" began in June 2009. The

index has dropped from 63.8 in April 2011 to its most recent March 2013 reading

of 51.4 (down from 57.8 in February).

Without new

orders, production won't increase and the economy won't grow. Some say, it's a "service economy."

But services depend on real things

that must be ordered and produced before they can be serviced!

The steep downtrend

in the DJ-UBS Industrial Metals sub-index is shown in the chart below.

It indicates reduced demand for industrial metals used in manufacturing of real

things!

Conclusions:

With all these

negative economic indicators and sharp drop in money velocity, the real economy

will be lucky to limp along at a 1.5% growth rate with unemployment staying

high and more people quitting the labor force.

Summing up,

Joseph Carson director of global economic research at AllianceBernstein

recently said. “Prices of financial assets have been rising rapidly. Wages have

not. Job creation has not. People in less exalted income brackets are still

struggling."

And that cold

reality makes the "great disconnect" between sharply rising stock

prices and the stagnant real economy even more striking!

Till next time.....................................

The Curmudgeon

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.