Bear Markets, Corrections and Recession Lead Times

by Victor Sperandeo with the Curmudgeon

Introduction:

Watching financial news TV reporters suggest the

economy is strong yet the declining stock market isnt relevant seemed very

strange and puzzling to me. Those empty talking heads stimulated me to do a

study of the timing of U.S. economic recessions and bear markets/ intermediate

term corrections that preceded them. The results of my study are depicted in

the table below. It clearly shows a

discounting lead time of the stock market versus downturns in the real

economy.

Bear Mkt[1] Recession[2]--

Lead Time

4/4/1899 Jun-1899

2

9/19/1902 Sep-1902 0 (Coincident=same time)

1/19/06 May-07 17

11/19/09 Jan-10 2

9/30/12 Jan-13 4

11/21/16 Aug-18 21

11/3/19 Jan-20 2

10/14/22 May-23 7

N/B 2/11/26 Oct-26 8

9/3/29 [3] Aug-29 0 (5 days apart)

3/10/37 May-37 2

N/B 9/ 44

Feb-45 5

5/46 [4] ? ?

6/15/48 Nov-48 5

N/B 1/5/53 Jul-53 6

N/B 2/12/57 Aug-57 6

8/3/59 Apr-60

8

12/3/68 Dec-69 12

5/26/72 Nov-73 6

N/B 11/79 Jan-80

2

4/27/81 Jul-81 3

N/B 1/90 Jul-90 6

3/2000 Mar

2001 12

10/2007 Dec-2007 2

Average Lead Time = 6.08

months

Notes:

- Bear

market according to Dow Theory. Bear

market start date is the date of the previous bull market top.

- Recession

start date as per: NBER: US Business Cycle Expansions

and Contractions. Note that NBER economists do not give

reasons for their classifications, so no one knows what economic

statistics or metrics they weighted to identify recessions? Curmudgeon:

Many investors believe a recession requires at least two straight quarters

of declining gross domestic product (GDP). Thats not true. In 2001, there

was just one quarter when GDP declined.

- THE CRASH:

Stock prices began to decline after September 3, 1929 and the selling

continued into October 1929. On

October 24th ("Black Thursday"), the market lost 11%

of its value at the opening bell on very heavy trading. Panic set in, and on October 29th

(Black Tuesday) the Dow lost an additional 30 points, or 12 percent. The

volume of stocks traded on October 29, 1929, was a record that was not

broken for nearly 40 years. Economic

historians say the 1929 stock market crash was a pivotal factor in the

emergence of the Great Depression.

- NBC

News: Less than a year after

the end of World War II, stock prices peaked and began a long slide. As

the postwar surge in demand tapered off and Americans poured their money

into savings, the economy tipped into a sharp "inventory

recession" in 1948. The

S&P 500 lost 29.6% during that 37-month bear.

According to the St.

Louis Fed, The bear market of 1946-49

actually encompassed two major periods of declining prices with rather sizable

fluctuations between the two large downward movements. Prices declined sharply

from June through November of 1946, then fluctuated within a range of 10%

through February 1948. From February to June 1948 prices rose 19%. This major

rebound was followed by a 16% decline between July 1948 and June 1949. Thus it appears that the major bear market of 1946-49 can be

divided into two subcycles the period from June to

November of 1946 and the period from July 1948 to June 1949.

N/B- No

Bear market was declared by Dow Theory, but an intermediate decline/correction

occurred instead.

.

..

Exceptions and Explanations:

Some exceptions have occurred over the 120-year study

period.

For example, in the 1950s the NBER declared

there were two very short recessions, but Dow Theory saw them as one long bull

market with intermediate term corrections preceding the recessions. Dow Theory

did not classify those stock market declines as bear markets. Perhaps, the market

knew those so-called recessions would be minor and of no significance?

It was the same situation in 1926...

WW II had some confusion due to war related U.S.

government spending that was slowing as the war ended in July 1945. Those

spending cuts caused the NBER to classify the Feb-Oct 1945 as a recession.

In every occurrence the market sold off, but if the

Fed changed its mind on interest rates the recession was very moderate or

rather short in duration.

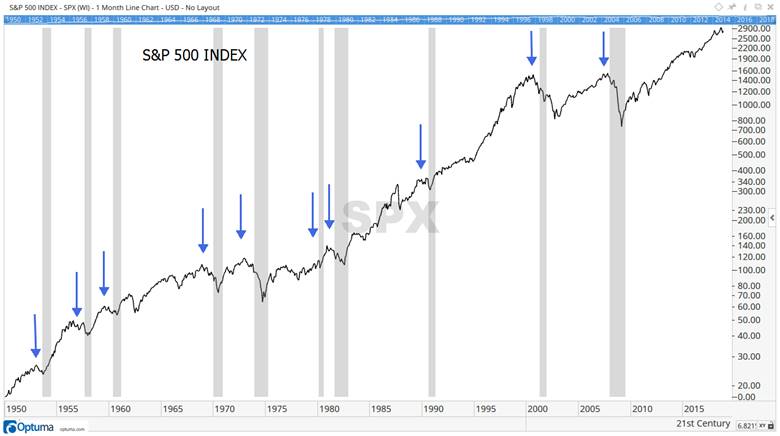

S&P 500 vs Recessions since 1950 (Curmudgeon):

The chart below shows the S&P 500 Index peaked

before each of the 10 recessions since 1950. Grey bars highlight recessions.

Lead time varied from one month to 13. On average, the S&P 500 peaked seven

months before the recession began.

SOURCE: Banyan

Hill

..

..

.

.

.

.

Does Knowing GDP

6 Months in Advance Aid Stock Traders?

The Curmudgeon spotted an interesting observation in

a Barrons interview (on line or

print subscription required) with Winton Capital founder David Harding: that knowing GDP % change six months in

advance didn't help trading stocks.

Heres the quote from this weeks Barrons:

Winton researchers

once analyzed whether traders could make money by knowing six months in advance

the figure for gross domestic product. While Winton did find that traders could

profit if they knew the GDP figure a day in advance, essentially trading on

inside information, it also discovered that knowing six months ahead wasnt much help. The firm did not use the

results of the study to build a trading system.

If you cant make any money out of knowing it, how can it be so

fundamental? Harding asked.

My response is that knowing the GDP number and/or %

change six months in advance has no meaning, because it only views one economic

statistic. In contrast, the market quantifies all factors (many are not known

or quantifiable) that will determine stock prices.

Todays example is very apropos! GDP growth for the

4th quarter of 2018 was well known to be in a range of 2.7% to 3% five months

ago. While such economic growth is very

good on its own, rising interest rates and quantitative tightening (QT) are far

more powerful factors for the market.

For a reference, please read Curmudgeon:

Ready, Set, Go: Global Debt Implosion, Deleveraging, and Quantitative

Tightening

To know what the Fed will do with its balance sheet,

Fed Funds and credit availability would be far more important, especially if

you were the only one to know! But

that would be trading on inside information.

..

Another Study of

Bear Markets and Recessions: (written by the Curmudgeon)

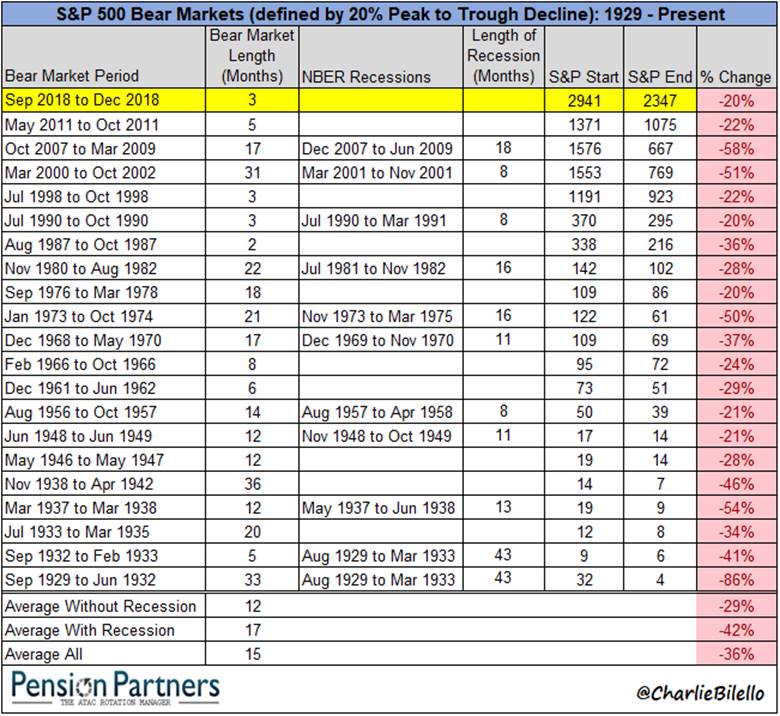

Charlie Bilello of Pension

Partners recently completed a similar study of U.S.

bear markets and recessions. He says that the current market swoon is the

21st Bear Market since 1929. Of the previous 20, only 11 were associated with a

recession (=55% of the time).

Looking at the

data, the U.S. economy does not yet appear to be in a recession, but that fact

is hardly an all-clear. After the March 2000 stock market peak, a recession did

not begin until a year later: March 2001. No one can say for sure that in

September 2019 (a year from the September 2018 S&P 500 peak) there wont be

a recession.

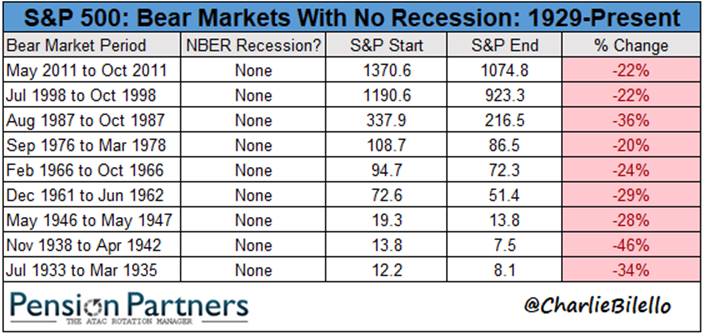

Here are Charlie Bilellos

tables for S&P 500 Bear Markets

(from 1929) with and without recessions that followed the start of the Bear:

Bilello

thinks that most investors likely assume the 50%+ recessionary bear markets of

2000-2002 and 2007-2009 are the norm.

The Curmudgeon

believes a 60%+ stock market decline is more likely, especially for the NASDAQ

and Russell 2000 stock indexes.

.

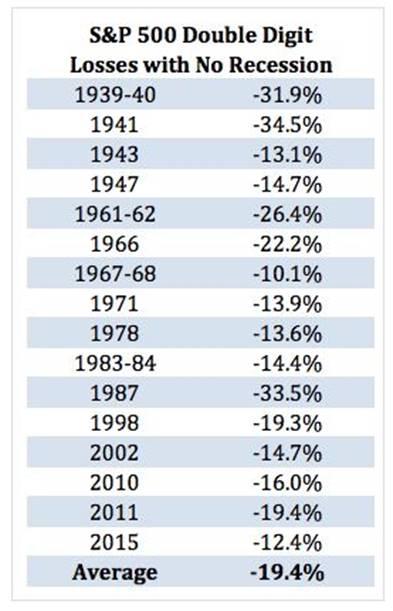

Courtesy of the

now defunct Dow Theory Letters is this table:

The Aden Forecast, which took over Dow Theory Letters, wrote in last Thursdays hotline:

The bear remains in the drivers seat. This was

confirmed by Dow Theory on December 10th and its been spot on. That is, the primary

trend remains down and stocks are set to decline

further.

Reference:

Dow Theory Sell Signal Triggered YesterdayYet No One

Noticed! (12/11/18)

..

Current Quotes

on the Market and Economy [Source: Washington Post, Dec 30, 2018 edition]:

Theres a lot of pressure on the market right now,

most of it to the downside, that will carry forward into the new year. You have international chaos, seeming instability

in the White House and a Fed that wants to raise rates, all of which is causing

incredible turmoil in the markets, said Lindsey Piegza, chief economist at

Stifel Fixed Income.

We arent in a good spot, and there arent many

cushions left if we fall further, said Joseph LaVorgna,

chief U.S. economist at Natixis. The Fed cant cut interest rates as much as

it did in past slowdowns. We just passed a tax cut, so we arent going to do

that again. And we wont pass any new legislation in this political

environment.

Individuals are scared to death. They are not

cautious, they are scared to death, said Jeffrey Saut,

chief investment strategist at Raymond James.

Financial markets have finally awoken to the fact

that Donald Trump is U.S. president, Nouriel

Roubini, an economist widely credited with predicting the 2007 financial

crisis, wrote this week. Many trusted that, at the end of the day, the adults

in the room would restrain Trump . . .

things changed radically in 2018.

The [Trump] administration has spent a lot of time

hurting the business outlook, and now investors are trying to figure out just

how badly, said Doug Holtz-Eakin, president of the American Action Forum and

an adviser to GOP presidential candidates.

2018 was a strong year for the U.S. economy. There

are no ifs, ands or buts about that, said Roger Altman, founder of the

investment banking firm Evercore and a former Treasury official in the Clinton

administration. 2019 will be slower, but not recessionary.

People will get their year-end statement showing a

market down 20 percent from its peak and 10 or 12 percent for the year, said

Ivan Feinseth, chief investment officer of Tigress

Financial Partners. At the same time, they are going to get their credit card

bills for the holiday season. Imagine a double whammy.

You should put blinders on and not pay attention to

it, said Saut, the chief strategist at Raymond

James.

Curmudgeon: Do you also believe in the tooth fairy?

..

Good luck and till next time

.

The Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been

involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor

Sperandeo is a historian, economist and financial innovator who

has re-invented himself and the companies he's owned (since 1971) to profit in

the ever changing and arcane world of markets, economies and government

policies. Victor started his Wall Street

career in 1966 and began trading for a living in 1968. As President and CEO of

Alpha Financial Technologies LLC, Sperandeo oversees the firm's research and

development platform, which is used to create innovative solutions for

different futures markets, risk parameters and other factors.

Copyright © 2018 by the Curmudgeon and

Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).