Ready, Set, Go: Global Debt Implosion, Deleveraging

& Quantitative Tightening

by the Curmudgeon

The Background: Bubbles

Everywhere Thanks to Global Central Banks:

10 years after Lehman

Brother’s bankruptcy, global central banks have created monster bubbles in

bonds, stocks (especially big tech names), private equity and residential real

estate on a scale never before seen. By adopting quantitative easing—enormous central

bank purchases of securities with money created out of thin air—the Federal

Reserve, the European Central Bank, and the Bank of Japan, plus other major

central banks, stupendously inflated the prices of financial assets.

Wilshire Associates says that

U.S. equity values have increased by $27.8 trillion, or 337%, since the stock

market’s low in March 2009. According to Yardeni Research, the rise in the

combined balance sheets of the Fed, ECB, and BOJ, from roughly $4 trillion in

2008 to a peak of $15 trillion in early 2018, was closely paralleled by the

rise in the S&P 500.

Victor and I have written

about this theme extensively, so we’ll stop here.

Will the Global Debt Bomb

Implode?

As central banks greatly

inflated their balance sheets and pumped up financial assets, global debt has

surged. That, in turn, is fueling fears

of a new financial crisis that could spread far beyond the disruption sweeping

Turkey. Total debt is now somewhere

between $234 and $247 trillion (depending

on the estimate), up from $97 trillion on the eve of the Great Recession,

according to the McKinsey Global Institute.

Over the last 10 years, global debt has grown stupendously and is

currently about 2 1/2 times the size of the global economy.

Foreign investors,

particularly European banks, lent freely to developing countries (like Turkey)

in search of the higher returns those markets offered at a time when the U.S.

Federal Reserve and European Central Bank were keeping interest rates

artificially low (zero or negative).

"We were supposed to

correct a debt bubble," said David Rosenberg, chief economist at Gluskin Sheff, a wealth-management firm. "What we did

instead was create more debt."

The bill for all that debt

must eventually be paid and that’s much harder to do when U.S. interest rates

are rising, the dollar is strong, and emerging market currencies (e.g. Turkey,

Argentina, South Africa, etc.) are extremely weak. The situation could grow even more perilous.

Money is fleeing Turkey and similar markets precisely when many of the loans

their companies took out in recent years are coming due. Globally, a record

total of up to $10 trillion in corporate bonds must be refinanced over the next

five years, according to McKinsey.

Susan Lund, co-author of the

McKinsey study said, "We've depended on emerging markets to bring up

global growth, some of it due to a credit boom.

This is going to take a bite out of growth, which will affect the US,

Europe and the entire world economy."

For emerging market countries

that borrowed in dollars, rising interest rates will make it more expensive to

borrow new money or refinance existing debt. That could trigger a wave of

defaults by corporate borrowers, with problems spreading far beyond Turkey and

ultimately into the United States, Rosenberg said. The rising U.S. dollar also will erode the

sales that major US companies book overseas, which amount to roughly 40 per

cent of revenue for members of the S&P 500-stock index, according to

Rosenberg.

In a new report, the Institute

of International Finance (IIF), an industry research and advocacy group,

says the debts of some “emerging market” countries (Turkey, South Africa,

Brazil, Argentina) seem vulnerable to rollover risk: the inability to replace

expiring loans. In 2018 and 2019, about $1 trillion of dollar-denominated emerging-market

debt is maturing, the IIF says.

Debt can either stimulate or

retard economic growth, depending on the circumstances. Now we’re approaching a

turning point, according to Hung Tran, the IIF’s executive managing director.

If debt growth is not sustainable, as Tran believes, new lending will slow or

stop. Borrowers will have to devote more of their cash flow to servicing

existing debts.

Tran described the change this

way: “[We had] a Goldilocks economy, with decent economic growth. Inflation was

nowhere to be seen, allowing central banks [the Federal Reserve, the European

Central Bank] to be more accommodative [i.e., keeping interest rates

artificially low]. You could always roll over your debt. However, the

probability of this continuing is much less now. . . .

Trade tensions are on the rise, and this has already impacted [business

confidence] and the willingness to invest.”

Tran seems to be suggesting

is a global shift away from debt-financed economic growth. The meaning of the

$247 trillion debt overhang is that many countries (including China, India and

other emerging-market countries) will be dealing with the consequences of high

or unsustainable debts — whether borne by consumers, businesses or governments.

There will be a collective drag on the global economy.

“If you are in a high-debt

situation, you need to bring the debt down, either absolutely or as a share of

GDP,” Tran said at the briefing. “[Either] will result in slower economic

growth. You don’t have the borrowing needed to maintain strong investment and

consumption spending.”

Free Money Party Has

Ended!

"The free money is going

away," said economist Tim Lee of Pi Economics, who has been warning of a

potential Turkish crisis since 2011.

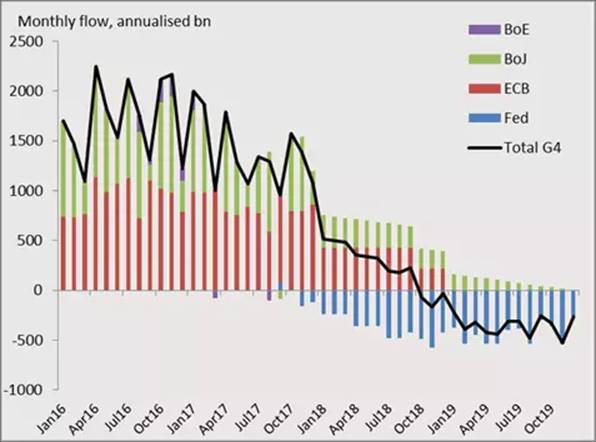

Since last October, the Fed

has proceeded as promised in shrinking its balance sheet, reducing its assets

by $252 billion. And as Peter Boockvar, chief

investment officer at Bleakley Advisory Group, points

out, the net purchases of the Fed, ECB, and BOJ will go from the equivalent of

$100 billion a month in the fourth quarter of 2017 to zero starting in this

year’s fourth quarter. That’s depicted

in this chart:

Chart courtesy of the

Financial Times

..................................................…........................................................................................................…

Boockvar says the biggest bubble inflated by the central banks

has been in supposedly safe government and corporate bonds. Indeed, real interest rates on U.S. Treasury

notes have been negative for most of the last 10 years, while the 30-year U.S.

government bond real yield (after inflation) has averaged just 0.7% since

Lehman failed, according to Greg Ipp of the Wall

Street Journal. Compare that to more

than a 3% real yield in the prior three decades.

“A crisis usually begins when

money gets tight,” Felix Zulauf of Zulauf Asset Management told Barron’s. “While the Fed’s

balance sheet inflation since 2009 has inflated all sorts of asset prices, the

serious reduction of its balance sheet should have just the opposite effect,

namely to deflate asset prices.”

Ominous Warning Flags are

Flying:

Mr. Boockvar

asserts that the damage will become apparent in the next 12 to 24 months as

central banks move from QE to QT, or quantitative tightening. That loss of

liquidity will damage an overly indebted world economy. It may also cause havoc in both stock and

bond markets. Let’s examine why that

might happen.

The bond bubble has helped to

inflate the stock market, writes former Dallas Fed advisor Danielle DiMartino

Booth in her Money Strong weekly note. In the last five years, U.S.

corporations have taken advantage of low yields to sell $9.2 trillion of bonds,

which have helped fund $3.5 trillion in repurchases, and are on pace for a

record $850 billion in stock buybacks in 2018.

Bank of America Merrill Lynch

(BoAML) chief investment strategist Michael Hartnett notes the tremendous

leverage in the financial system and economy: “share buybacks with borrowed

money is leverage, private equity is leveraged equity portfolios, tax cuts

financed with Treasury borrowing is leverage.”

Please see BoAML bullet points at the end of this article.

Hartnett adds: “End of excess

liquidity…end of excess returns; Central Banks bought $1.6tn assets in 2016,

$2.3tn 2017, $0.3tn 2018, will sell $0.2tn in 2019; liquidity growth turns

negative in January 2019 for 1st time since global financial crisis.

Jason DeSena

Trennert of Strategas

Research Partners, says that private equity is the sector that has been

inflated the most. Public retirement funds’ average assumed return is 7.6%, far

above what a balanced portfolio of bonds and stocks is likely to provide, so

these funds and endowments have flocked to private equity to try to reach that

probably unattainable bogey. As a result, there are billions of dollars looking

for the next Uber or other unicorns.

Pensions are at the top of

the worry list of Stephanie Pomboy of MacroMavens. She was

farsighted in seeing housing triggering the last crisis and regularly tweets interesting

factoids related to rising risks. The $4 trillion in unfunded public pension

liabilities dwarfs the $500 billion in underwater housing that helped set off

the great financial crisis. A hit to risk assets would only deepen the

pensions’ hole and could necessitate a bailout that could make QE “look like

rounding error,” she says.

“When the repricing begins,

the rise of ‘quants,’ as well as passive strategies and ETF vehicles, will

amplify the downturn many times over,” she adds. That view was echoed last week

by JPMorgan quantitative strategist Marko Kolanovic.

BoAML: Has there ever been

an investment acronym that didn't end in a bubble?

…..and all bubbles eventually burst! BoA

Merrill Lynch notes:

·

4 of 8 FAANG

(Facebook, Amazon, Apple, Netflix, Google) + BAT (Baidu, Alibaba, Tencent)

stocks are in bear market (-20%) territory.

·

Shockers: Global

stocks x-U.S. tech = -6.2% YTD; 809 Emerging Market stocks in bear market;

worst losses in U.S. Investment Grade - BBB bonds since 2008 (annualized 3.2%

loss is second worst since 1988).

·

Tech stock

inflows are peaking and rolling over.

·

Credit spreads

are widening: watch credit spreads in excessively indebted Europe (credit/GDP

258%), China (credit/GDP 256% = record), Emerging Markets (record credit/GDP

194%), U.S. Investment Grade - BBB bonds ($4.93tn outstanding, up from $1.08tn

'08).

·

True global

contagion in 2018 ends with investors selling what they own and love (e.g. big

tech stocks), jump in systemic risk and the Fed blinking.

……………………………………………………………………………………………………………………….

Good luck and till next time…

The Curmudgeon

ajwdct@gmail.com

Follow the

Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2018 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).