Post Midterms Stock Market Outlook: History vs.

Fundamentals in Conflict

by the Curmudgeon with Victor Sperandeo

Introduction:

What's the outlook for the U.S.

stock market now that the November 2018 midterm elections are over? That depends if you value history as a guide

or prefer to look at current fundamentals and interest rate trends.

History suggests the U.S.

stock market should move higher, especially in 2019, but less so till the end

of 2018. The fundamentals augur for

caution as there are many economic uncertainties along with a Fed that is

intent on continuing to raise short term interest rates.

Historical Post Midterm Stock

Market Results:

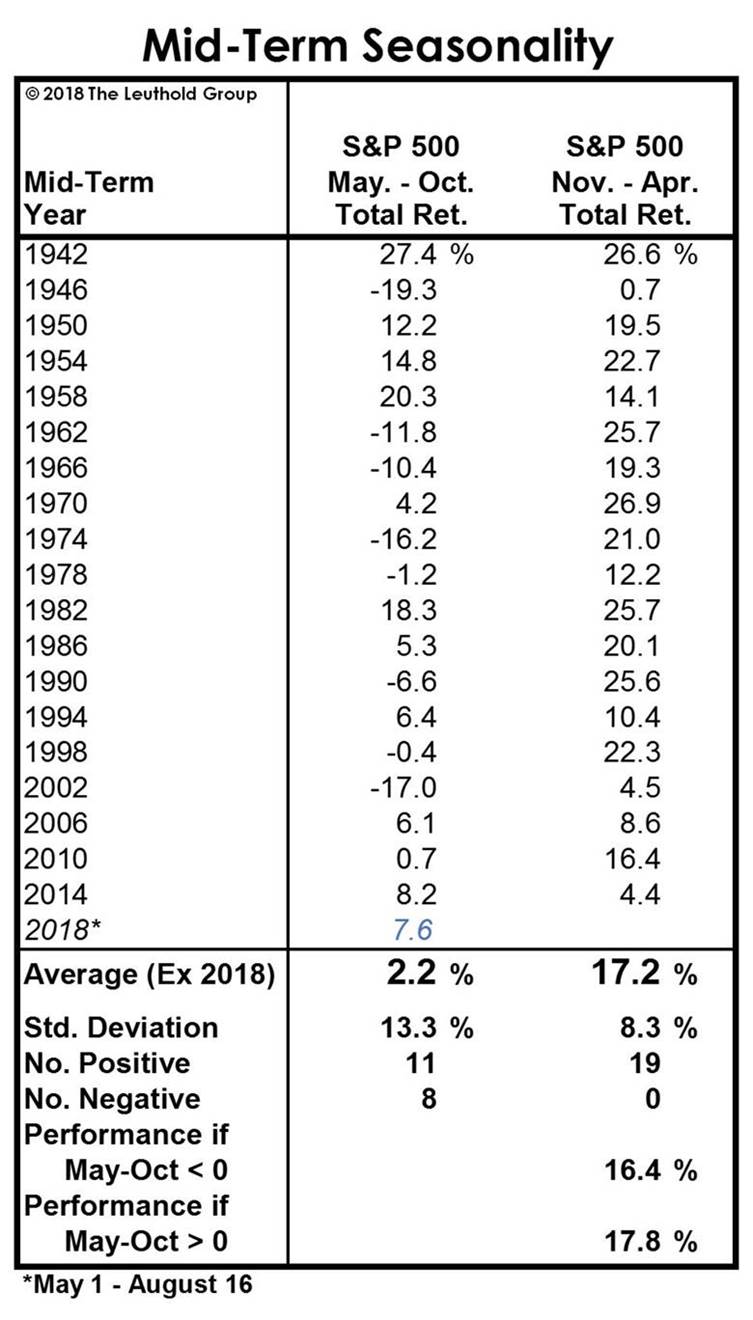

From a recent Curmudgeon post,

Leuthold Group found

that since 1942, the mid-term election years six-month window,

beginning in November of the mid-term year and extending through April of the

pre-election year, has seen an average un-annualized S&P 500 total return

of +17.2%. Indeed, none of the 19 six-month windows in this study saw a total

return LOSS. Thats impressive!

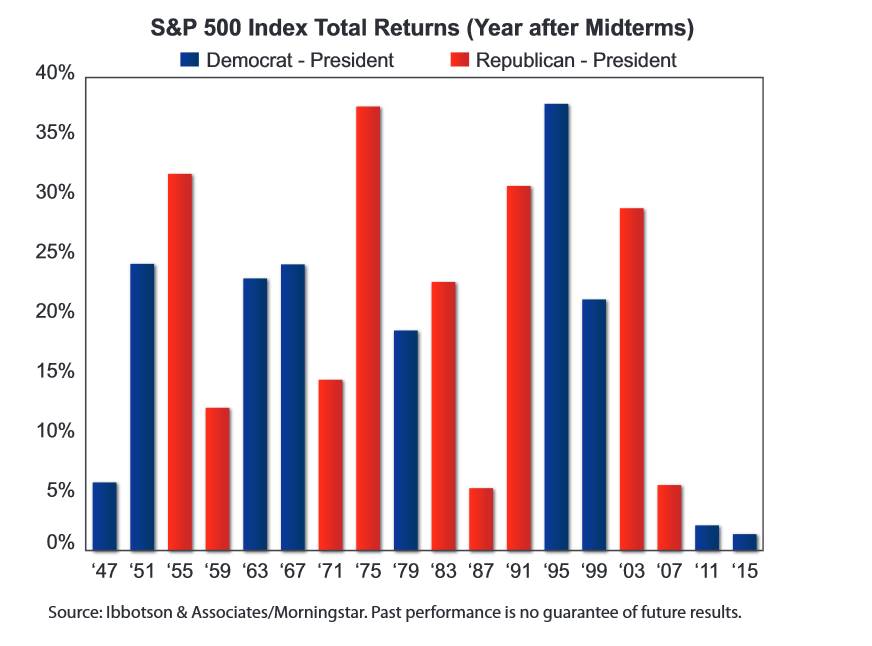

First Trust found

that the S&P 500 Index posted a positive total return in each of the

calendar years following the previous 18 midterm elections since 1945. The total returns have ranged from 1.38%

(2015) to 37.43% (1995). The average gain was 19.13%

NOTE: CALENDAR YEAR

is from January 1 to December 31 of the FOLLOWING YEAR - NOT 52 weeks or YoY

from November midterm elections till 1 year later!

..

..

..

..

..

..

..

..

..

..

.

.

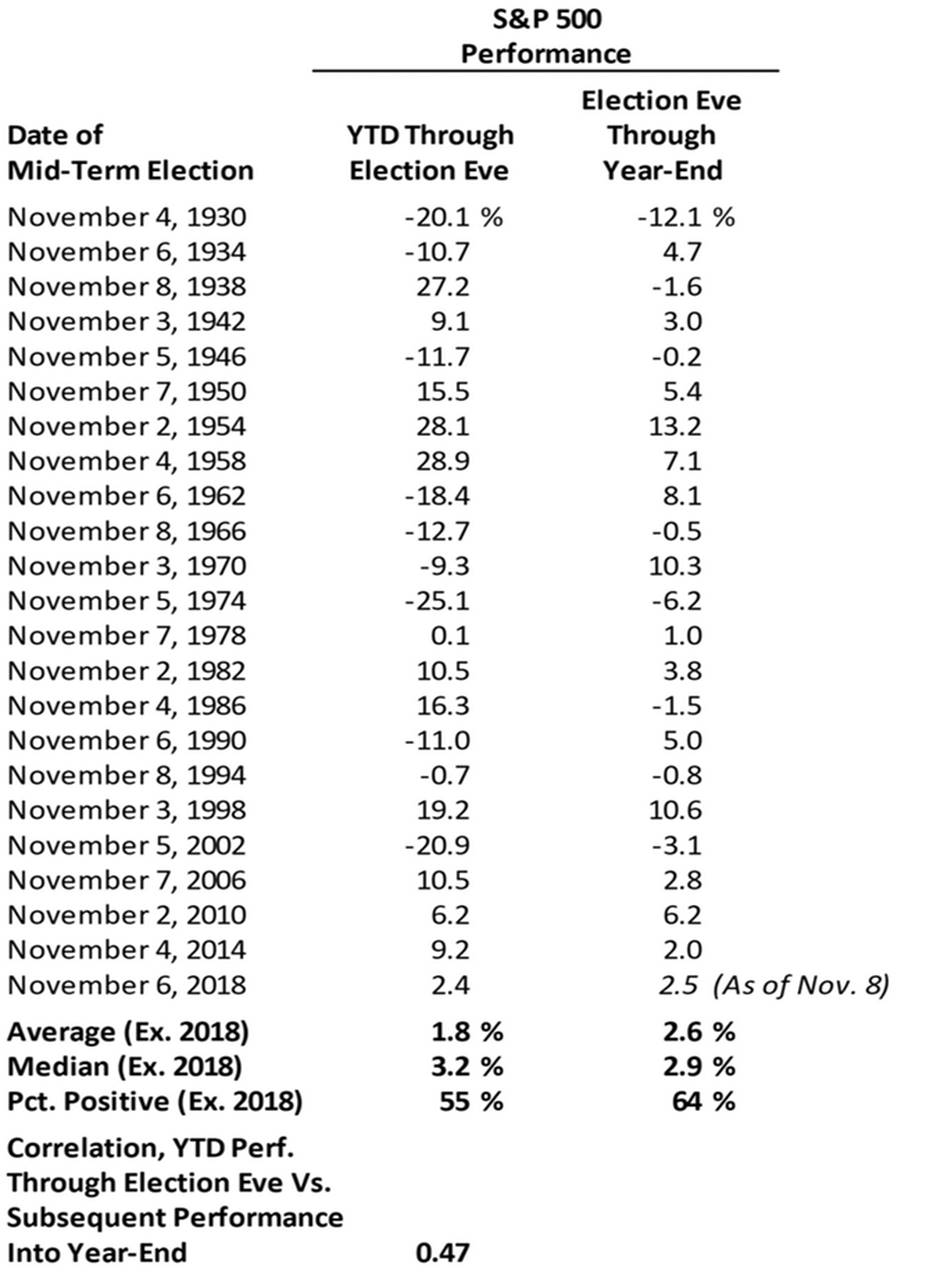

This past week, Leuthold

reported to institutional clients that the average S&P 500 gain from

election eve through year end was essentially the same (+2.6%) as for

non-election years as per this table:

Leuthold Group also found that

when BAA yields

have fallen over the six months leading up to election eve, the S&P 500 has

rallied into year-end 82% of the time, for an average gain of 4.6%. On the

other hand, rising yield environments (like the current one) have been

followed by rallies less than half the time, with an average gain of just 0.6%.

In summary, Leuthold says that year-end rallies during mid-term

years havent tended to be any larger than during other years, and this years

S&P 500 post-election gain through November 8th has already reached the

historical average. Finally, hostile bond market (i.e., monetary) conditions

should temper any hopes for a year-end melt-up.

Fundamentals are

BEARISH & Don't Fight the Fed:

As we've pointed

out in previous Curmudgeon posts, the fundamental factors driving corporate

profits and stock prices are negative.

These include: China trade war, escalating tariffs, rising inflation,

humongous budget deficits (that must be financed by ever more US Treasury debt)

and the Federal Reserve continuing to raise short term interest rates.

The Federal

Reserve Board (the Fed) is expected to raise its benchmark rate Ό point in

December and forecasts three more rate hikes next year. Some market

professionals worry that the economy may slow down toward the end of next year,

or that the Fed's tightening will slow growth and that could force the Fed to

slow down its rate hiking.

At its meeting

this past week, the Fed said the economy remained in good health. It cited

strong growth and the continued decline of the unemployment rate. The Fed expects "further gradual

increases" in the target range for the federal funds rate, but that will

depend on continued economic expansion, strong labor conditions and inflation

near its 2% target.

The Fed is

currently raising its benchmark rate by a quarter of a percentage point every

quarter. At that pace, the rate will reach about 3 percent by the middle of

next year. That is roughly the level the Fed regards as neutral, meaning it

would neither stimulate nor discourage economic activity. Some Fed officials are already pressing for

the Fed to raise the rate into restrictive territory, arguing that inflation is

likely to rise if the central bank does not begin to step on the brakes. That will all play out in 2019.

From Moody's Credit

Outlook (November 8, 2018):

Global economic

growth in 2019-20 will likely decelerate amid tightening global liquidity and

elevated trade tensions.

Economic growth will decelerate across advanced and

emerging market economies. In the US, the ongoing removal of monetary

accommodation, waning fiscal stimulus, and restrictive trade policies will

start weighing on financial markets and economic activity. Other advanced

economies will also see cyclical moderation toward trend growth. Slowing global

trade will have an adverse impact on open economies including Japan, Korea and

Germany. We expect global growth to slow to under 3.0% in 2019 and 2020, from

an estimated 3.3% in 2017-18. Real growth in G-20 advanced economies will

decelerate from around 2.3% in 2018 to 1.9% in 2019 and 1.4% in 2020. Growth in

G-20 emerging markets will decline from an estimated 5% in 2018 to 4.6% in

2019, followed by a pick up to 4.9% in 2020. Contractions in Turkey and

Argentina, as well as slowing in China, will pull down aggregate G-20 emerging

markets growth in 2019.

..

..

..

..

..

..

..

..

..

..

..

.

Victor's

Comments:

The U.S. stock market

was trading on the historical statistics after the midterm elections this past

Tuesday as can be seen from Wednesday's huge rally. As the Curmudgeon notes above, the post WW II

stock market has been up 100% of the time in the year following the mid-

terms. But there is an important

difference between then and now.

In the past,

both political parties (Dem's+GOP) wanted to get

re-elected so they made deals that were good for the economy. However, the

Democrats are now weighted and run by Socialists - not Democratic centrist or

moderates. They will never make a deal that helps Trump. Also, Fed Chairman

Powell is strongly opposed to Trump who has criticized the Fed's rate rising

agenda.

Trump's agenda

is over and the Fed

continuing to raise rates will cause GDP to decline not only in

the U.S. but all over the world.

Therefore, all equity markets, especially Europe (DAX, CAC and Italy)

are shorts! The equity bull market is

over.

I recommend

buying 2-year T-Notes at 3% and staying long the U.S. dollar.

..

..

..

..

..

..

..

.

..

..

.

..

..

..

..

..

..

..

..

..

..

.

Closing Quote:

Why U.S. fiscal policy will be on hold and the economy will decline

From The Road to Serfdom, by Friedrich A Hayek

"To weld

together a closely coherent body of supporters, the leader must appeal to a

common human weakness. It seems to be easier for people to agree on a negative

program -on hatred of an enemy, on envy of the better off- than on any positive

task. "

Good luck and till next time

The Curmudgeon

ajwdct@gmail.com

Follow

the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been

involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2018 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).