Longest S&P Bull Market with Many

Bear Markets; Seasonality Fails in New Era

by the Curmudgeon

Acknowledgement: Many thanks to BoAML Global Research and Doug Ramsey

of Leuthold Group for much of the

research and analysis presented in this article. Also

to John Williams of ShadowStats for his closing comments.

Longest Bull Market in History:

The current bull market will

become the longest in history this Wednesday, August 22, 2018. Bull markets last an average of approximately

97 months each and gain an average of 440 S&P 500 points. At the last bear market bottom of March 9,

2009, the S&P 500 closed at 676.53.

Fridays close was 2,850.13 for a total price gain (not including

dividends) of 1,173.6 S&P 500 points, i.e. the price more than quadrupled

during this bull-run!

|

Table 1: The history of US

equity bull markets |

|||

|

Start |

End |

Price return |

Duration (months) |

|

6/1/1932 |

3/5/1937 |

323% |

57 |

|

4/29/1942 |

5/29/1946 |

153% |

49 |

|

6/14/1949 |

8/2/1956 |

265% |

86 |

|

10/22/1957 |

12/12/1961 |

86% |

50 |

|

6/27/1962 |

2/9/1966 |

79% |

44 |

|

10/7/1966 |

11/29/1968 |

48% |

25 |

|

5/26/1970 |

1/11/1973 |

74% |

32 |

|

10/3/1974 |

11/28/1980 |

126% |

73 |

|

8/12/1982 |

8/25/1987 |

229% |

60 |

|

12/4/1987 |

7/16/1990 |

65% |

31 |

|

10/11/1990 |

3/24/2000 |

417% |

113 |

|

10/9/2002 |

10/9/2007 |

101% |

60 |

|

3/9/2009 |

8/15/2018 |

321% |

112 |

|

Average |

|

176% |

61 |

|

Source: BofA Merrill Lynch Global Investment Strategy, Bloomberg |

|||

|

.. |

|||

By comparison bear markets

since the 1930s have an average duration of only 18 months and an average loss

in value of about 40%. At the latest

bear market bottom, the S&P 500 (which reached a high of 1565.15 on Oct. 9,

2007) lost 57%.

Longest S&P 500 Bull Market

yet Bear Markets

Abound:

Despite this being the

S&P 500 bull market becoming the longest of all-time on Wednesday, BoAML Global Research notes that

there are many grizzly bond, commodity and equity market returns this year:

· Global bonds annualizing worst price

return (-3.5% local currency) since 1999;

· 11 of 21 commodity markets have

experienced "bear" markets;

· 1254 ACWI constituents out of a universe

of 2273 are in bear markets (i.e. down >20%). [iShares MSCI ACWI ETF seeks to track the

investment results of an index composed of large and mid-capitalization

developed and emerging market equities.]

BoAML notes that its almost

10 years since Lehman Brothers bankruptcy, yet many assets currently remain

below their Sept 14th 2008 level. Those include: oil, industrial metals, equity

markets in Italy, Spain, Russia, Brazil, Turkey, global equity sectors such as

energy and utilities, and most glaring of all, European and Japanese

banks. The central banks prevented debt

deflation, but they did not inflate indebted assets, BoAML wrote.

In light of the recent strength of the U.S. equity market

(dominated by a few stocks), global stocks are down -14% since January

2018.

BoAML states that the U.S.

Treasury yield curve is now <25bps from inversion (which has signaled 7 out

of past 7 recessions). They suspect the

weak U.S. housing market portends a shift in the US macro narrative to peak US

GDP, yields and U.S. dollar in the next 3-6 months. Also, monetary policy stimulus has also

peaked: Central bank asset purchases

were $1.60tn in 2016, but only $2.30tn in 2017 and are just $0.16tn thus far in

2018. By year-end global liquidity will

be contracting, according to BoAML.

Also, corporations have reached peak profitability for this economic

cycle.

BoAML Position:

Until the Fed blinks (likely

December at the earliest) and until KOSPI and copper indicate that Chinese

policy makers have eased big to stimulate Asian growth, we believe the

double-whammy of Peak Profits and Peak Policy stimulus will overwhelm Bearish

Positioning; we retain defensive, bearish recommendations.

..

Sell in May and Go Away is NOT Working this Year!

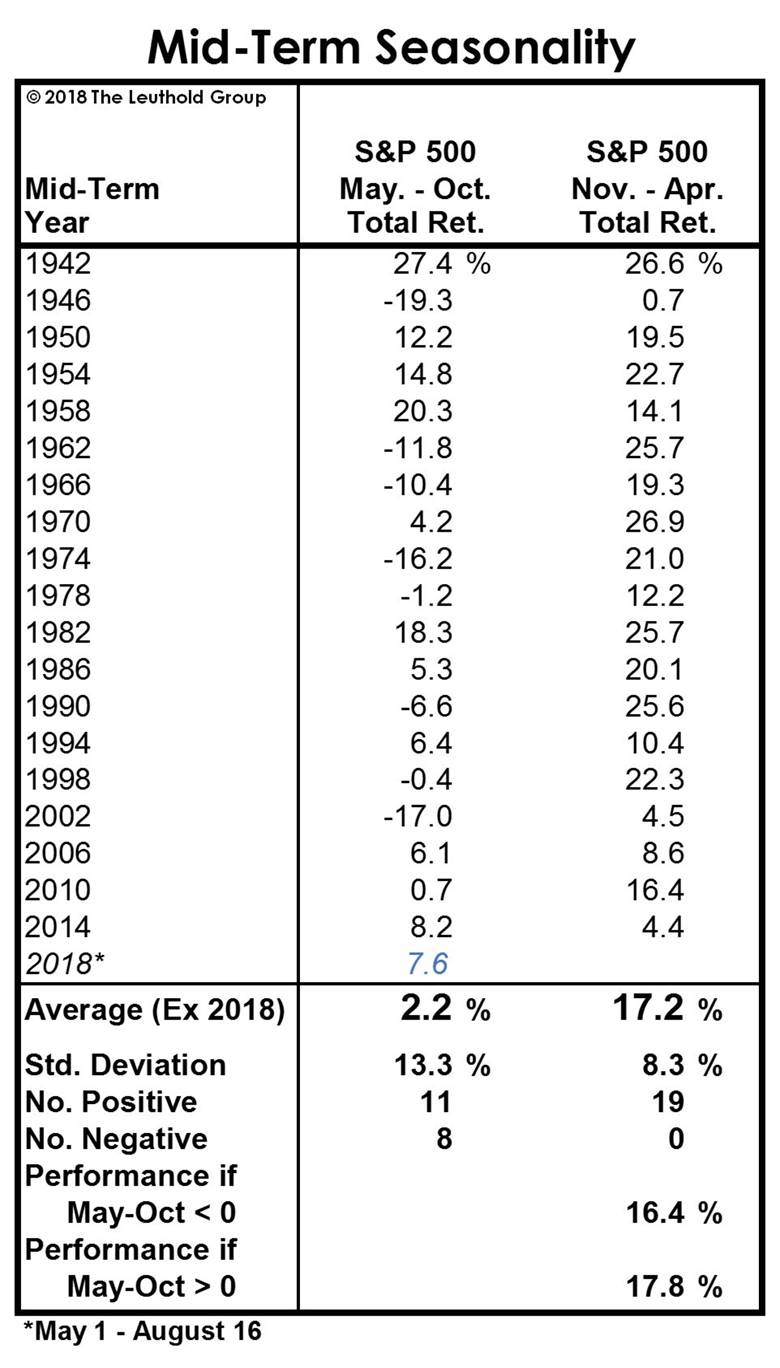

Market seasonality dictates

that the months of May through October, especially in mid-term election years,

have statistically been the weakest six-month window for stocks during the

four-year presidential cycle, with an average S&P 500 total return of just

+2.2% (Chart 1). But so far during 2018, the S&P 500s total return is

+7.6%. And thats with the statistically

best six months of the presidential cycle now lay only 2 1/2 months away.

Or as Victor and I have said

previously, the 4-year presidential

cycle is dead. It evidently no

longer applies (like so many other time-tested rules, metrics and gauges) in

this new era for financial markets.

Leuthold Group found that

since 1942, the mid-term years six-month window, beginning in November of the

mid-term year and extending through April of the pre-election year, has seen an

average un-annualized S&P 500 total return of +17.2%. Indeed, none of the 19 six-month windows in

this study saw a total return LOSS.

Thats impressive!

To Leuthold Groups surprise,

returns in the six-month periods beginning with the mid-term election were

lower when majority power changes. [In this mid-term election year, it would be

the Democrats regaining control of Congress from the Republicans.] The average

November-April S&P 500 total return in those cases has been +10.2%, compared

with an average +21.3% return when theres no shift in Congressional

power.

Doug Ramsey of Leuthold

concludes this research piece by stating: But plenty can happen before this

bullish window opens around election time.

Leuthold tactical funds (the

Curmudgeon has a long-term position in Leuthold Core- LCORX) are still

positioned with net equity exposure of 43-44%.

..

ShadowStats

John Williams Outlook for the Economy and Financial Markets:

U.S. Dollar and

Financial-Market Turmoil Remain at Intensified High Risk, Amidst Mounting

Fiscal Concerns, Consumer Liquidity Issues and Non-Expanding, Real-World

Economic Activity. In the context of

weakening consumer-liquidity trends, the headline economic outlook should

continue to dim rapidly, despite the big initial headline jump in

second-quarter GDP.

Indeed, the dollar and

financial markets remain at extraordinarily-high

risk of intense, panicked declines, possible at any time. Holdings of

physical gold and silver remain the ultimate hedgesstores of wealthfor

preserving the purchasing power of ones U.S. dollar assets, during times of

high inflation and currency debasement, and/or political- and financial-system

upheaval.

.

Good luck and till next time

The Curmudgeon

ajwdct@gmail.com

Follow the

Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2018 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).