Year Low in Ten-Year Treasury Signals Trouble Ahead For

Economy and Stocks

by The Curmudgeon

The CURMUDGEON has previously called attention to something that has NEVER happened in ANY U.S. economic "recovery." The 10 Year Treasury Note yield, rather than increasing during the current "economic expansion," is actually substantially lower than it was at the recession bottom in June, 2009.

In fact, the 10Y yield, which closed at 1.66% on Friday

April 26th, is now less than half of what it was during June 2009 when it

ranged from 3.49% to 3.94%. A decline of over 50% in the yield is remarkable over any

time period, but especially during an economic recovery. Check

out this 5 year chart of the yield on ^TNX and see for yourself!

[Courtesy Yahoo.com; for an interactive link click here]

Here's what the CURMUDGEON previously wrote on

this topic:

"In a healthy economic recovery, intermediate term

interest rates rise as there is more demand for credit and inflation premium

rises. Why isn't this happening now?

Answer: the U.S. has an artificial economic recovery, aided and abetted

by a Federal Reserve that has kept short term rates at zero, while buying

longer term government and mortgage debt. The yield on the 10 year T-Note is

well below the headline inflation rate, which means the real yield is

negative."

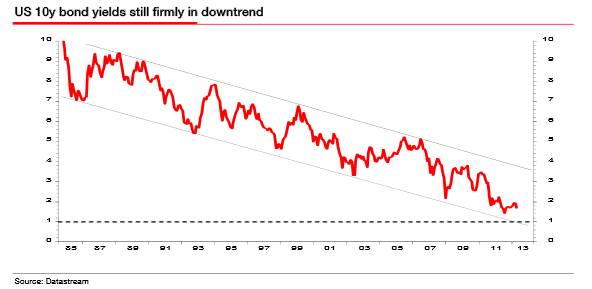

SocGen Investment Bank's Albert Edwards goes one step further

and continues to forecast sub 1% 10 Yr. T-Note yields (as well as 450 on the

S&P 500!). His view is that "US 10y will break below 1% as global

recession beckons."

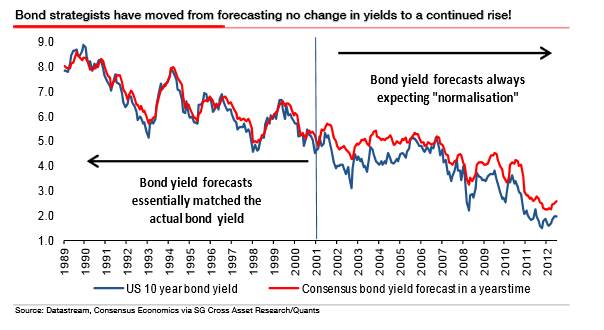

Here are several charts

from his latest Global Strategy Weekly (only available to clients and the trade

press):

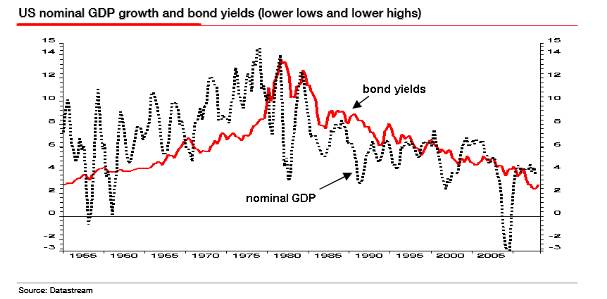

In reference to the third chart above, Mr. Edwards wrote,

"We may have

seen the peak of nominal US GDP growth for this cycle. An unfolding recession

should see 10y bond yields dragged ever lower and the Fed moving to QE infinity

(squared)."

But the CURMUDGEON has repeatedly stated

that the Fed has run out of silver bullets to fight any new recession. I

don't think Congress or the foreign exchange markets would permit an expansion

of the Fed's QE Ponzi scheme to continue indefinitely. At some

point, the U.S. $ would collapse under the heavy burden of debt monetization

and new money "created out of thin air."

On another note, Mr. Edwards has NOT

given up on Gold as a source of real value. He writes:

"Gold corrected

47% from 1974-1976 before rising more than 8x to US$887/oz. in 1980. A steep correction is normal before the

parabolic move. As Dylan Grace said in his note of Sept. 2011, “The market for honesty: is $10,000 gold fair

value?”, holding gold is a

bet against central banks competency and given their track record that’s

certainly a bet I’d be happy to still take."

And in that we are firm believers!

Till next time.....................................

The Curmudgeon

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.