Employment, Treasuries, and Junk Bonds Indicate

Trouble for Economy and Markets

by The Curmudgeon

Friday's Labor Dept. unemployment report

for March was said to be a big disappointment, because only 88,000 net new jobs

were created that month. But a much more

disturbing fact was that about 500,000 Americans dropped out of the labor force

— meaning they stopped working or looking for work. The labor force

participation rate or the share of Americans ages 16 and over in the labor

force, fell from 63.5% to 63.3%, a 34-year low.

That's certainly

not a healthy sign for an economy that supposedly is in a recovery. In sharp contrast, the labor participation

rate was approximately 65 in June 2009 when NBER said the "great recession"

ended.

Labor Force

Participation Rate for 2001 to 2013. Source: Bureau of Labor Statistics

Meanwhile, the 10

year T Note yield closed

at its low for this year on Friday at 1.69%.

That yield ranged

from 3.49% to 3.94% during June 2009.

In a healthy

economic recovery, intermediate term interest rates rise as there is more

demand for credit and inflation premium rises.

Why isn't this happening now?

Answer: the U.S. has an

artificial economic recovery, aided and abetted by a Federal Reserve that has

kept short term rates at zero, while buying longer term government and mortgage

debt. The yield on the 10 year T-Note is

well below the headline inflation rate, which means the real yield is negative.

With negative

real yields on short and intermediate Treasuries, investors and savers have

been forced into much riskier debt investments, especially junk bonds. Junk bonds are those rated below investment

grade by the bond rating agencies, and their current popularity reflects the

search for yield by many investors, whose alternatives include savings accounts

that pay almost nothing.

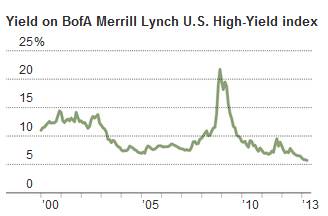

Junk bond

yields have fallen to the lowest level on record. The Bank of America Merrill

Lynch U.S. High Yield index yielded 5.7 % at the end of the quarter, as can be

seen in the graph below. That was down from 6.1% at the end of the year, and

from 8.3% at the end of 2011.

Source: Bank of America Merrill Lynch via Bloomberg

In the past,

these bonds were more politely referred to as "high yield" bonds, but

not anymore when they're only yielding 5%!

For example, the junk bond ETF SPDR Barclays High Yield Bond (JNK) now

has a 5.04% 30-day SEC yield.

“Global

investors have found themselves in a situation where first cash rates were

unattractive, then government bonds, then investment-grade bonds and now

high-yield bonds,” Tom Becket, chief investment officer at Psigma

Investment Management, said in a Financial Times article.

“People talk

about opportunities in high yield because on a relative basis it looks good. At

the moment the world is enjoying low inflation and we have very low interest

rates, but at some point those things will change and that poses a risk.”

There have been

warnings about a potential bubble in the bond market for a while. Fund managers

are now warning investors that quantitative easing policies have artificially

pushed up demand and prices on high-yield bonds, which have in turn put

downward pressure on yields. While investors have been rewarded for taking on

riskier junk bonds in the past, the current yields at around 5% no longer

support the risks of default or price declines.

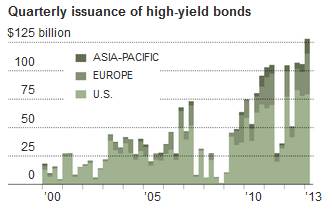

During the

first quarter, investors poured $133 billion into junk bonds around the world,

reports Floyd Norris for the New York Times.

Quarterly issuance of junk bonds hit a record in the last quarter as

companies sold bonds to eager buyers:

Source: Investment Company Institute

The Curmudgeon

suggests that investors should keep an eye on speculative-grade corporate debt for

warning signs in the credit markets that investors are losing their tolerance

for risk. That would have a very

negative impact on U.S. equities. It

could be like the canary in the coal mine.

Till next time.....................................

The Curmudgeon

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.